Minnesota Nonresidential Simple Lease

Description

How to fill out Nonresidential Simple Lease?

If you require to sum up, download, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents available online.

Employ the site’s straightforward and efficient search feature to locate the documents you need. Numerous templates for commercial and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to acquire the Minnesota Nonresidential Simple Lease in just a few clicks.

Every legal document template you acquire is yours forever. You have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, and print the Minnesota Nonresidential Simple Lease with US Legal Forms. There are thousands of professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to find the Minnesota Nonresidential Simple Lease.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, please follow the steps below.

- Step 1. Ensure you have selected the form for the correct city/state.

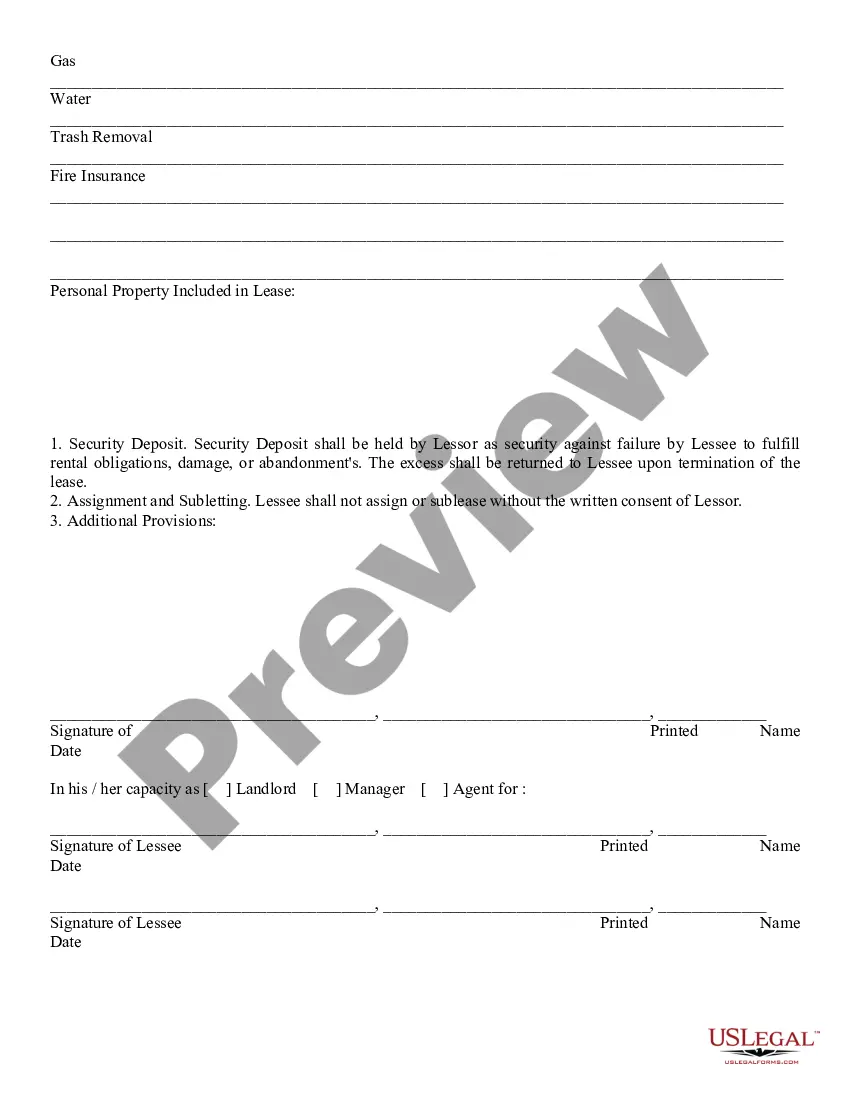

- Step 2. Use the Preview option to review the contents of the form. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you want, click on the Get now button. Choose your preferred pricing option and input your credentials to sign up for an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of the legal document and download it to your device.

- Step 7. Fill out, edit, and print or sign the Minnesota Nonresidential Simple Lease.

Form popularity

FAQ

Filing a non-resident tax return begins with gathering all necessary income documentation from the state sources. You will complete a nonresident tax form and report earnings, including those from a Minnesota Nonresidential Simple Lease. Consider using an online tax service that supports non-resident filings to facilitate your submission.

Absolutely, you can file a nonresident state tax return on TurboTax. The platform offers guidance tailored for non-residents, allowing you to input your income details, including those from a Minnesota Nonresidential Simple Lease. Utilizing TurboTax simplifies the process and helps you identify any deductions you may qualify for.

Yes, TurboTax can be a useful tool for non-residents filing taxes. TurboTax provides specific options for non-resident state tax returns, making it easy to report income from Minnesota. By effectively navigating the software, users can ensure they accurately address income derived from a Minnesota Nonresidential Simple Lease.

Anyone who earns income from Minnesota sources while living elsewhere must file a Minnesota nonresident tax return. This includes income from jobs, investments, or rentals, like those obtained through a Minnesota Nonresidential Simple Lease. If your income exceeds the state's minimum threshold, filing becomes necessary.

Filing taxes for a different state involves reporting your income earned from that state, such as Minnesota in this case. You will need to complete a nonresident tax return and include any specific sources of income related to your Minnesota Nonresidential Simple Lease. Consider using tax software that accommodates non-resident filings to streamline the process.

To submit the Conservation Reserve Program (CRP) in Minnesota, you must complete the necessary forms and submit them to your local USDA office. It is vital to ensure that you provide accurate details regarding your land and its management. As a non-resident, if you have leased land through a Minnesota Nonresidential Simple Lease, this program may benefit your income strategy.

You certainly can create your own lease agreement, but it's vital to ensure that it complies with state laws. For a Minnesota Nonresidential Simple Lease, including critical components such as rental terms, payments, and maintenance responsibilities is essential. To avoid pitfalls, consider using templates from reputable services like uslegalforms, which can help ensure your custom agreement is comprehensive and legally sound.

Filling out a condition form for an apartment involves noting the state of the property's key features accurately. Generally, you will assess appliances, plumbing, and walls to report any wear or damage. For ease, utilize templates available through platforms like uslegalforms to ensure compliance with specific requirements, particularly for a Minnesota Nonresidential Simple Lease. This can safeguard both your rights and obligations as a tenant.

residential property refers to any location utilized for commercial purposes rather than living accommodations. This includes offices, retail spaces, and industrial sites. Familiarizing yourself with the characteristics of nonresidential properties can aid in making informed decisions. A wellconstructed Minnesota Nonresidential Simple Lease can protect your interests in these types of spaces.

While living in a place without being on the lease is not inherently illegal, it can lead to potential issues. Landlords may view this as a violation of the lease agreement, which could expose you to eviction. If you are considering a Minnesota Nonresidential Simple Lease, understanding the terms regarding additional occupants is crucial. Always check with the leaseholder for clear guidelines.