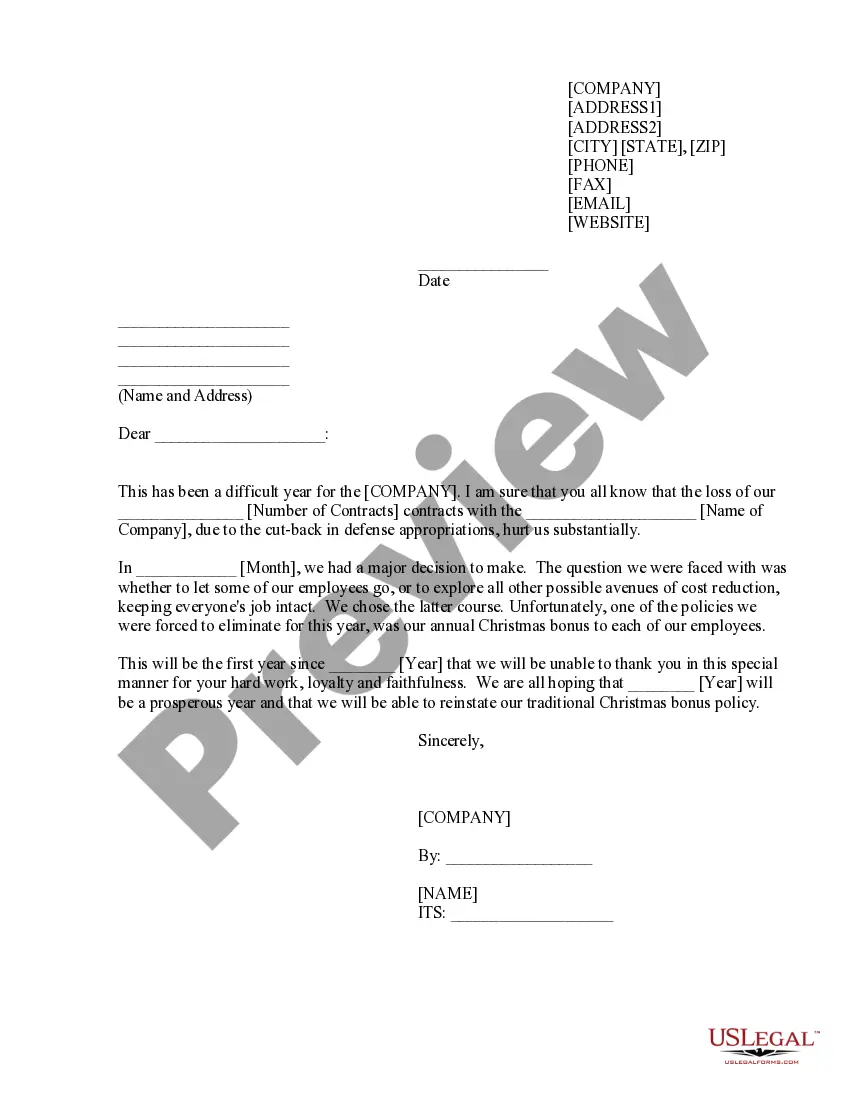

Minnesota Sample Letter for Bonus Cancellation

Description

How to fill out Sample Letter For Bonus Cancellation?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal form templates that you can download or create.

Through the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent versions of forms like the Minnesota Sample Letter for Bonus Cancellation within moments.

Check the form details to ensure you have selected the correct document.

If the form does not meet your requirements, utilize the Search bar at the top of the page to find the one that does.

- If you already have a subscription, Log In to download the Minnesota Sample Letter for Bonus Cancellation from the US Legal Forms library.

- The Download button will appear on each form you view.

- You can access all previously downloaded forms in the My documents section of your account.

- If you wish to use US Legal Forms for the first time, here are simple steps to get started.

- Ensure you have selected the appropriate form for your region/county

- Click the Preview button to review the content of the form.

Form popularity

FAQ

If you need to address not getting a bonus, focus on understanding the reasons behind the decision. Request a meeting with your manager or HR for clarification and feedback on your performance. This proactive approach shows your interest in growth and sets the stage for future opportunities.

Writing a discretionary bonus letter involves clearly stating the reasons for awarding the bonus while discussing the employee's performance positively. Ensure that you express appreciation for their contributions and specify when they can expect to see the bonus reflected in their paycheck. A sample format can be found in a Minnesota sample letter for bonus cancellation for an effective structure.

When telling employees there are no bonuses, use a transparent and compassionate approach. Explain the rationale behind the decision and acknowledge the effort employees put into their work. It’s essential to reaffirm your commitment to their growth and highlight potential future rewards whenever possible.

An example of a bonus letter often includes a greeting, an introduction expressing gratitude, and a clear statement about the bonus. Additionally, it should outline the criteria for the bonus and specify any related conditions. Consider using a Minnesota sample letter for bonus cancellation as a guide to ensure clarity and professionalism.

To inform an employee they aren't receiving a bonus, choose a private setting for the conversation. Be direct yet compassionate, explaining the factors that led to this decision. Offer to discuss their performance and set goals for the future to help them feel valued and motivated despite the news.

Communicating to employees about not receiving a bonus requires transparency and empathy. It's important to clearly outline the reasons, such as company performance or budget constraints, before delivering the news. Acknowledge their hard work and assure them of your commitment to recognize their efforts in future evaluations.

When writing a letter to HR for a bonus request, start by clearly stating your request and the reasons behind it. Emphasize your accomplishments and contributions to the company. Keep the tone professional and polite to ensure a positive reception. A well-structured letter often makes a compelling case.

To communicate that an employee is not receiving a promotion, approach the conversation with sensitivity and clarity. Begin by acknowledging their efforts and contributions. Then, explain the reasons for the decision, while suggesting areas where they can improve. Providing constructive feedback helps maintain their motivation for future opportunities.

In Minnesota, bonus depreciation is treated differently than at the federal level. While the federal government allows for bonus depreciation, Minnesota may require adjustments. When dealing with such complexities, a Minnesota Sample Letter for Bonus Cancellation can help articulate your position regarding bonus depreciation effectively.

Yes, Minnesota does allow NOL carryforward, permitting businesses to use past losses to offset future taxable income. This carryforward can be a beneficial tax strategy for many Minnesota taxpayers. When drafting a Minnesota Sample Letter for Bonus Cancellation, you may want to indicate how your NOL situation plays into your overall financial planning.