Minnesota Letter to Report False Submission of Deceased Person's Information

Description

How to fill out Letter To Report False Submission Of Deceased Person's Information?

Are you within a situation that you will need papers for sometimes business or individual purposes just about every day? There are a lot of legal papers layouts available on the net, but discovering ones you can trust is not straightforward. US Legal Forms provides a large number of form layouts, such as the Minnesota Letter to Report False Submission of Deceased Person's Information, that are published in order to meet federal and state demands.

If you are already informed about US Legal Forms internet site and possess a free account, merely log in. Afterward, you are able to acquire the Minnesota Letter to Report False Submission of Deceased Person's Information template.

If you do not provide an profile and need to start using US Legal Forms, follow these steps:

- Discover the form you will need and make sure it is for that correct city/region.

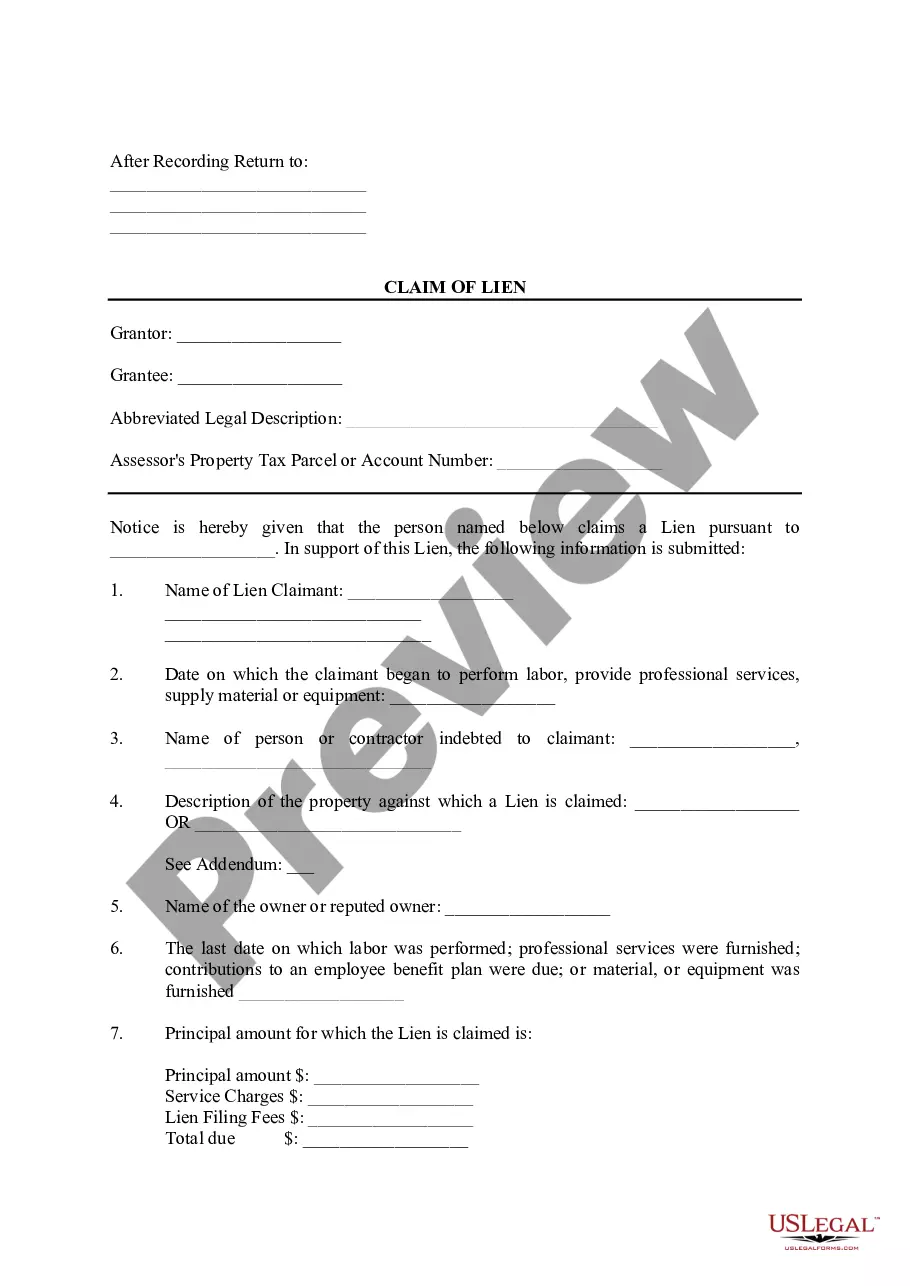

- Utilize the Preview option to check the form.

- See the description to actually have selected the appropriate form.

- In case the form is not what you are searching for, use the Lookup field to find the form that fits your needs and demands.

- Whenever you find the correct form, click on Buy now.

- Pick the costs prepare you desire, fill out the required info to produce your account, and purchase the transaction with your PayPal or charge card.

- Select a hassle-free file file format and acquire your duplicate.

Locate every one of the papers layouts you may have bought in the My Forms menus. You may get a further duplicate of Minnesota Letter to Report False Submission of Deceased Person's Information at any time, if required. Just select the required form to acquire or printing the papers template.

Use US Legal Forms, by far the most comprehensive selection of legal forms, to save time and steer clear of errors. The services provides expertly manufactured legal papers layouts which can be used for a range of purposes. Create a free account on US Legal Forms and initiate creating your lifestyle a little easier.

Form popularity

FAQ

The personal representative of an estate is an executor, administrator, or anyone else in charge of the decedent's property. The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due.

A taxpayer can't claim a dependent if they are a dependent themselves, if the dependent files a joint tax return with a spouse (except in certain cases), or is claimed as a dependent on someone else's tax return.

The administrator, executor, or beneficiary must: File a final tax return. File any past due returns. Pay any tax due.

If you are filing taxes on behalf of a deceased person who was also your dependent, you'll be able to claim the dependent on your tax return during the year of their death, even if they died early in the year.

In general, file and prepare the final individual income tax return of a deceased person the same way you would if the person were alive. Report all income up to the date of death and claim all eligible credits and deductions.

Yes. If the deceased dependent was a qualifying child or relative during the year, then claiming a deceased child on your return is allowed. You must meet all of the dependency requirements.

(Form M1PR) If the decedent died before filing their Form M1PR or died after filing but before receiv- ing the refund check, only the decedent's surviving spouse or dependent can claim the refund. No one else, including the per- sonal representative of the estate, can apply for the decedent's refund.

Form 1310 is filed by the primary beneficiary of the estate of the deceased. This may be the spouse, a child, or another family member of the deceased. If the person did not leave a will, a probate court will name an executor. That person is then responsible for Form 1310.