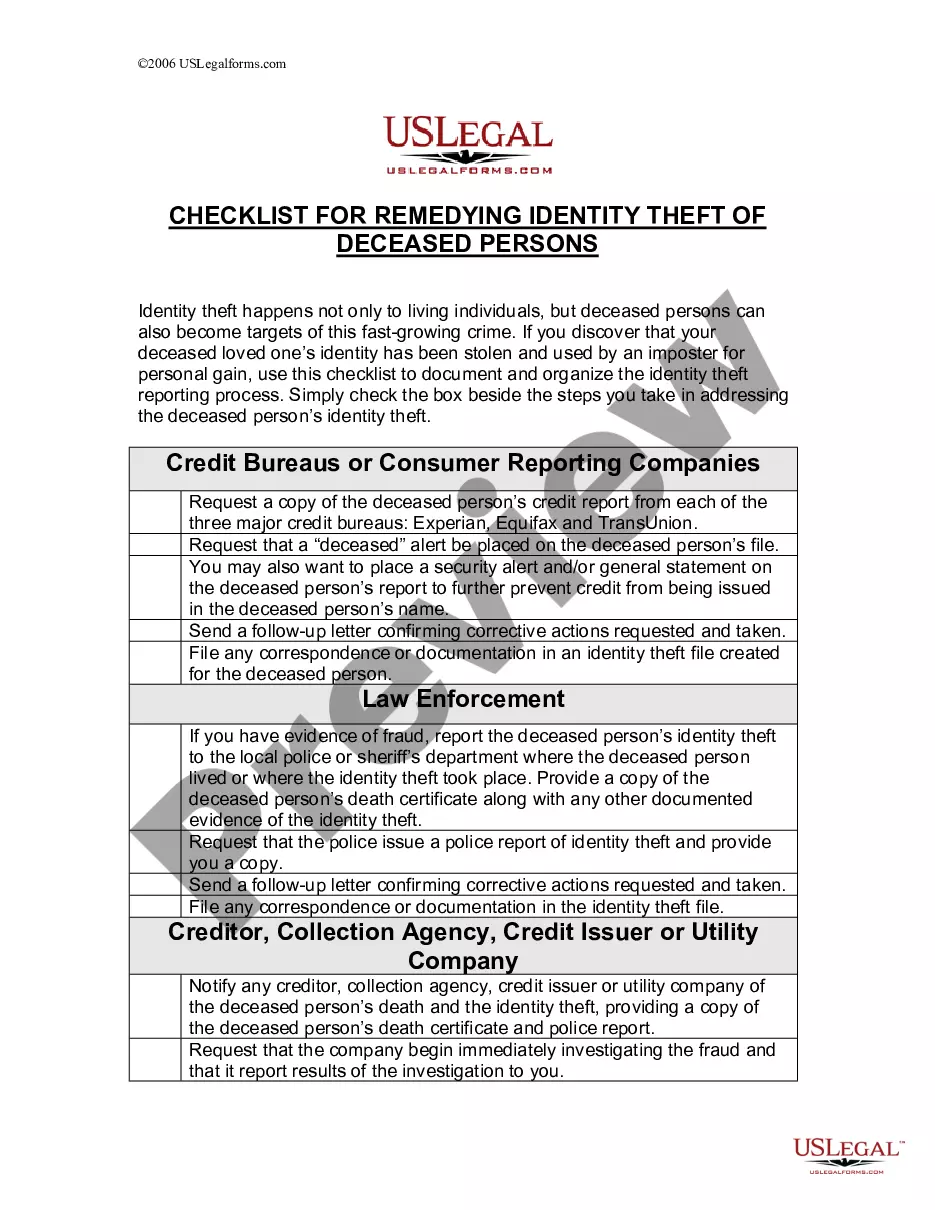

Minnesota Checklist for Remedying Identity Theft of Deceased Persons

Description

How to fill out Checklist For Remedying Identity Theft Of Deceased Persons?

Are you presently in a scenario where you require documentation for potentially business or personal purposes almost every day.

There is an assortment of legal document templates accessible online, but locating forms you can rely on is challenging.

US Legal Forms offers a multitude of form templates, including the Minnesota Checklist for Addressing Identity Theft of Deceased Individuals, which can be customized to satisfy state and federal requirements.

Once you locate the appropriate form, click Get now.

Choose the pricing plan you desire, provide the necessary information to create your account, and complete the transaction with your PayPal or credit card. Select a preferred document format and download your copy. Access all of the document templates you have purchased in the My documents list. You can download an additional copy of the Minnesota Checklist for Addressing Identity Theft of Deceased Individuals anytime, if needed. Click on the required form to download or print the document template. Use US Legal Forms, one of the most extensive collections of legal forms, to save time and prevent errors. The service provides accurately crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already acquainted with the US Legal Forms website and possess an account, simply sign in.

- Then, you can download the Minnesota Checklist for Addressing Identity Theft of Deceased Individuals template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/county.

- Utilize the Preview option to review the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you’re looking for, use the Search section to find the form that suits your needs and requirements.

Form popularity

FAQ

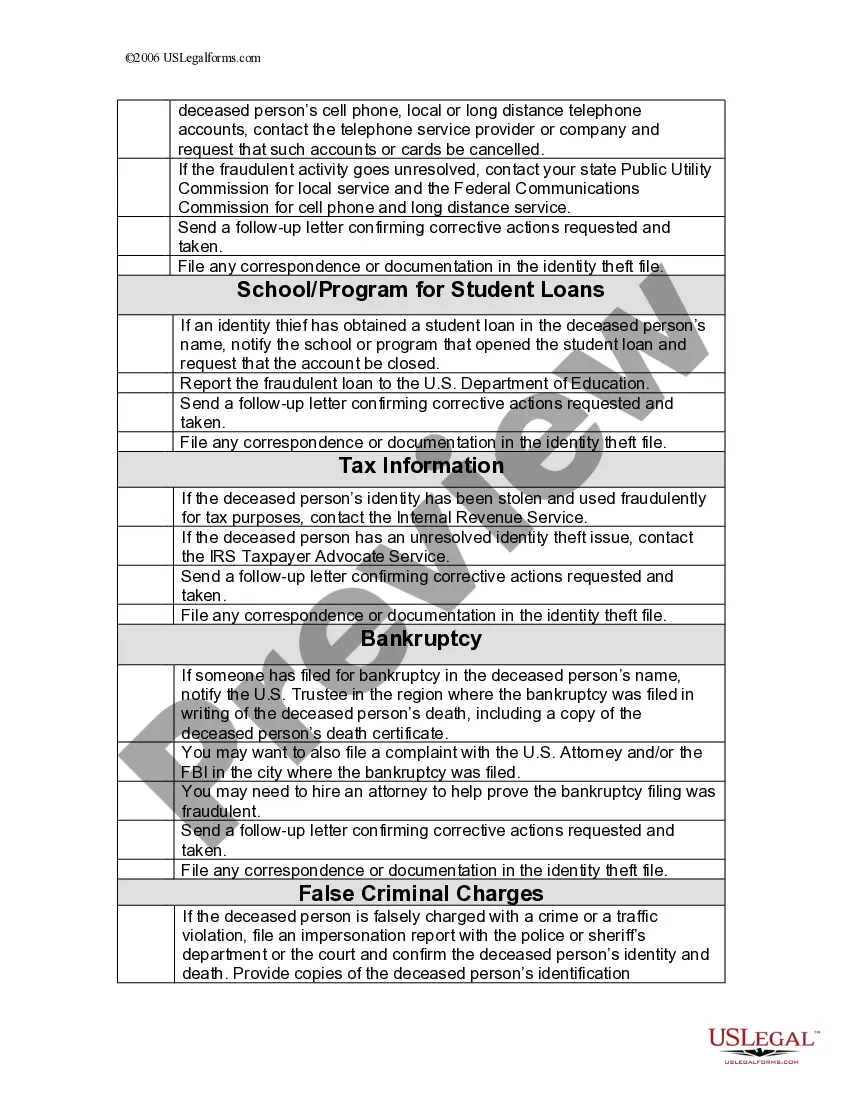

Police reports play an important role when identity theft occurs. They can play a crucial role in disputing incorrect information your credit report, or in filing a complaint with a regulatory agency (like the Consumer Protection Financial Bureau or the Federal Trade Commission), or completing a fraud affidavit.

Consumers can report identity theft at IdentityTheft.gov, the federal government's one-stop resource to help people report and recover from identity theft. The site provides step-by-step advice and helpful resources like easy-to-print checklists and sample letters.

The penalties for identity theft range from a misdemeanor to a 20-year felony. The offense level correlates with the amount of loss incurred, the number of direct victims involved, or the related offense. Loss is defined as the value obtained and the expenses incurred as a result of the crime.

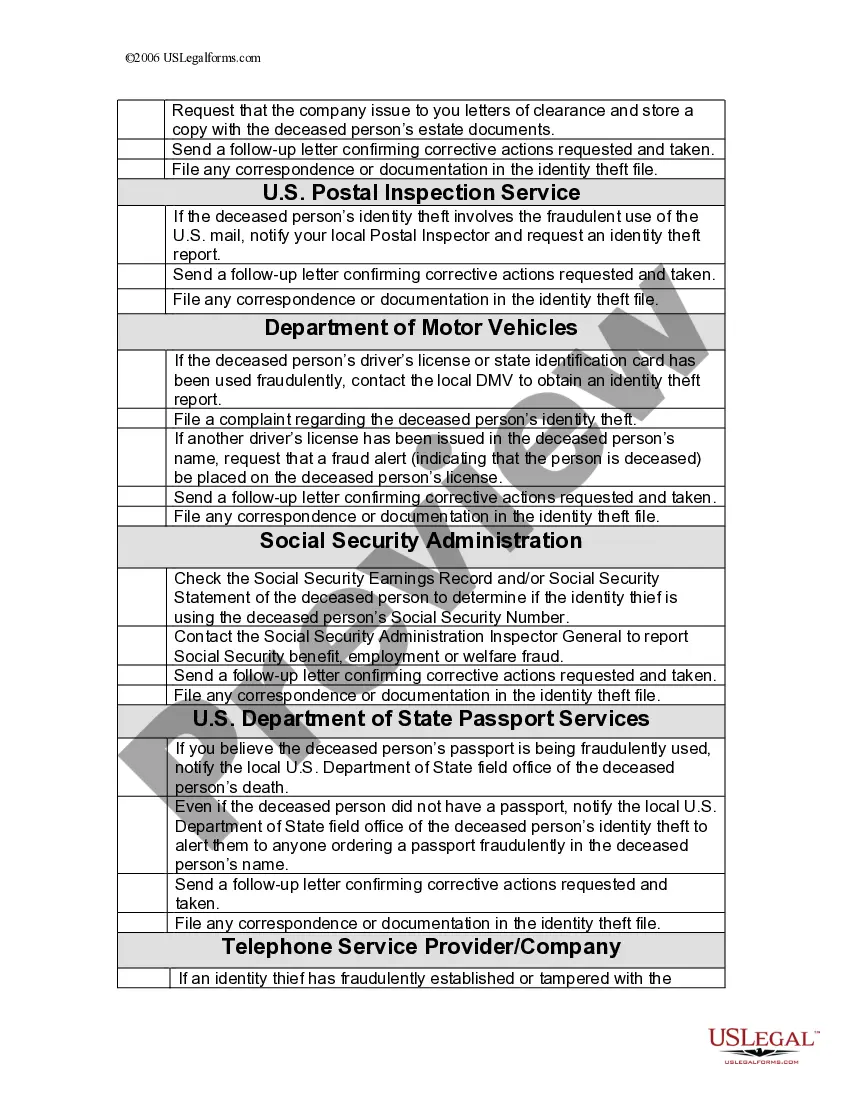

Send a written notice to all financial institutions where the deceased had an account instructing them to close all individual accounts and remove the deceased's name from joint accounts: As soon as you receive the certified copies of the death certificate, send a letter and a certified copy to each of the financial ...

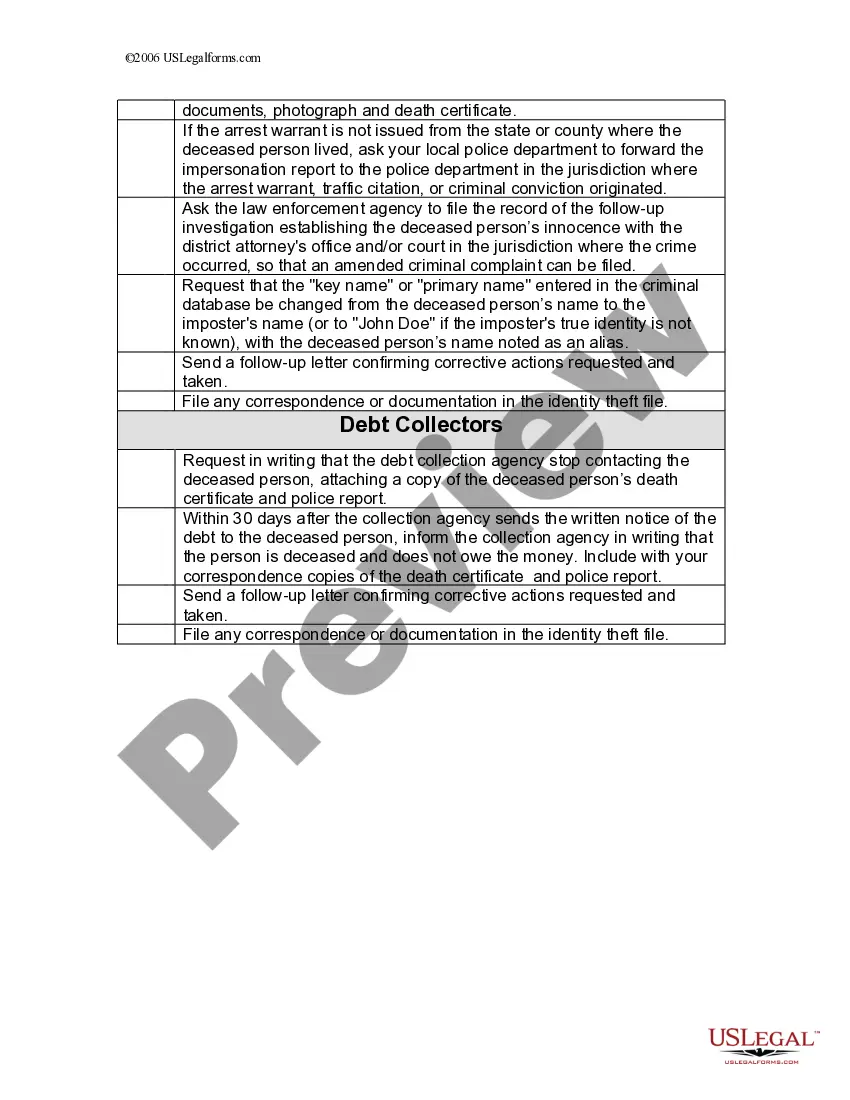

File a report with your local police department. Place a fraud alert on your credit report. ... Consumer Reporting Agencies (CRA's) Close the accounts that you know or believe have been tampered with or opened fraudulently. ... Report the theft to the Federal Trade Commission. ... File a police report.

Explain that someone stole your identity and ask them to close or freeze the compromised account. Contact any of the three credit reporting agencies and ask that a free fraud alert be placed on your credit report. Also ask for a free credit report.

Identity theft has profound consequences for its victims. They can have their bank accounts wiped out, credit histories ruined, and jobs and valuable possessions taken away. Some victims have even been arrested for crimes they did not commit.

Contact the Internal Revenue Service (IRS) at 1-800-908-4490 or visit them online, if you believe someone is using your SSN to work, get your tax refund, or other abuses involving taxes. Order free credit reports annually from the three major credit bureaus (Equifax, Experian, and TransUnion).