Minnesota Owner's and Contractor Affidavit of Completion and Payment to Subcontractors

Description

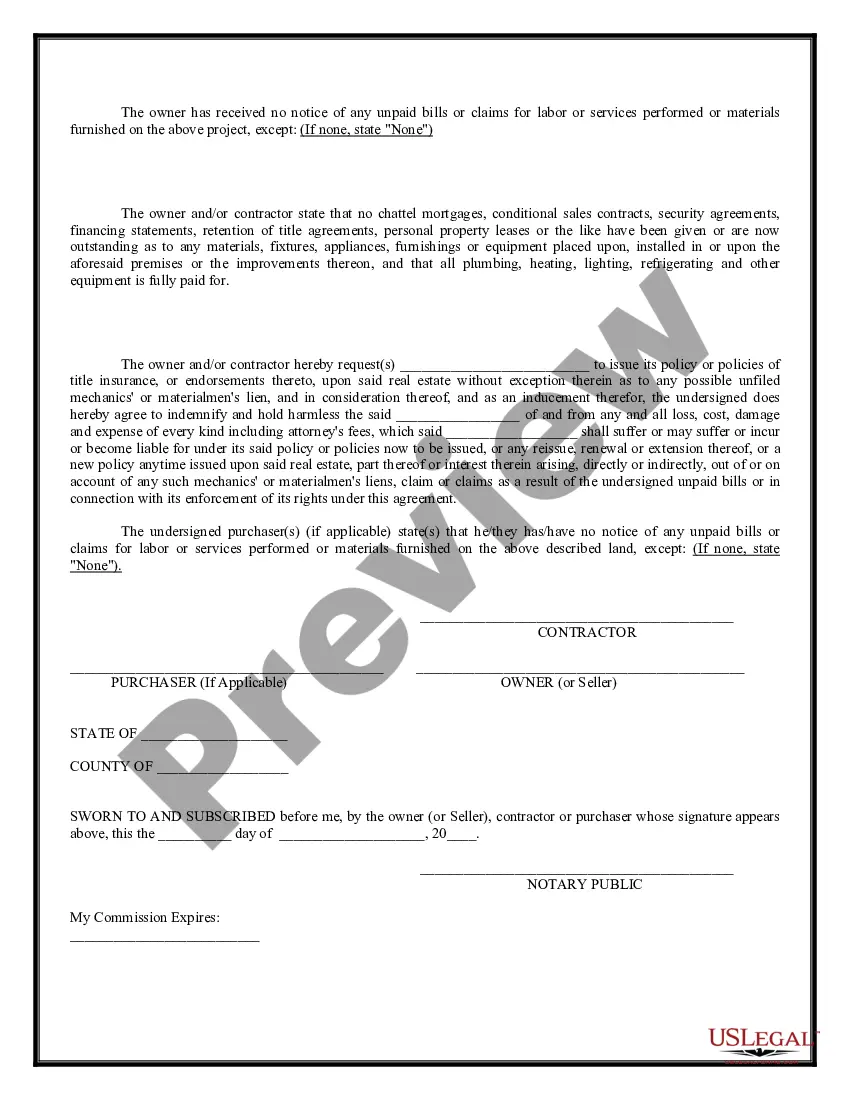

How to fill out Owner's And Contractor Affidavit Of Completion And Payment To Subcontractors?

You can invest multiple hours online attempting to locate the authentic document template that complies with the state and federal requirements you desire.

US Legal Forms offers thousands of valid forms that are reviewed by experts.

You can download or print the Minnesota Owner's and Contractor Affidavit of Completion and Payment to Subcontractors from the service.

Initially, ensure that you have selected the appropriate document template for the specific area of your choice. Review the form description to confirm you have chosen the correct document. If available, use the Review feature to examine the document template as well.

- If you possess a US Legal Forms account, you can Log In and select the Download option.

- After that, you can complete, modify, print, or sign the Minnesota Owner's and Contractor Affidavit of Completion and Payment to Subcontractors.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of a purchased form, navigate to the My documents section and click the relevant option.

- If you're using the US Legal Forms website for the first time, follow the simple instructions below.

Form popularity

FAQ

The MN IC134 form is used in Minnesota for the purpose of withholding taxes on payments made to independent contractors and subcontractors. This form helps ensure compliance with state laws regarding tax withholdings and is often required in conjunction with other documents. If you are involved in construction, keeping track of forms like the MN IC134 can be essential, especially when preparing the Minnesota Owner's and Contractor Affidavit of Completion and Payment to Subcontractors.

A contractor's final payment affidavit in Florida is a document that states all financial obligations related to a construction project have been settled. This affidavit serves as a protective measure for homeowners and general contractors against unpaid subcontractors or suppliers. While it's specific to Florida, similarities exist with the Minnesota Owner's and Contractor Affidavit of Completion and Payment to Subcontractors, which provides similar protections in Minnesota.

In Minnesota, certain goods and services may be exempt from sales tax, including specific construction materials and equipment used in projects. Exemptions can apply to items directly related to construction for nonprofit organizations or government projects. Understanding these exemptions can aid contractors in complying with tax laws, especially when filling out the Minnesota Owner's and Contractor Affidavit of Completion and Payment to Subcontractors.

A MN tax ID number is a unique identifier assigned by the Minnesota Department of Revenue to businesses for tax purposes. This number is crucial for filing state taxes, collecting sales tax, and making accurate payments. If you are a contractor, having a MN tax ID can help you complete documents, including the Minnesota Owner's and Contractor Affidavit of Completion and Payment to Subcontractors.

An affidavit in construction is a formal written statement made under oath, which serves as a declaration of facts related to a construction project. It is commonly used to verify completion and payment to subcontractors. This legally binding document can also provide assurance to the property owner and general contractor regarding obligations. The Minnesota Owner's and Contractor Affidavit of Completion and Payment to Subcontractors is an essential tool for this purpose.