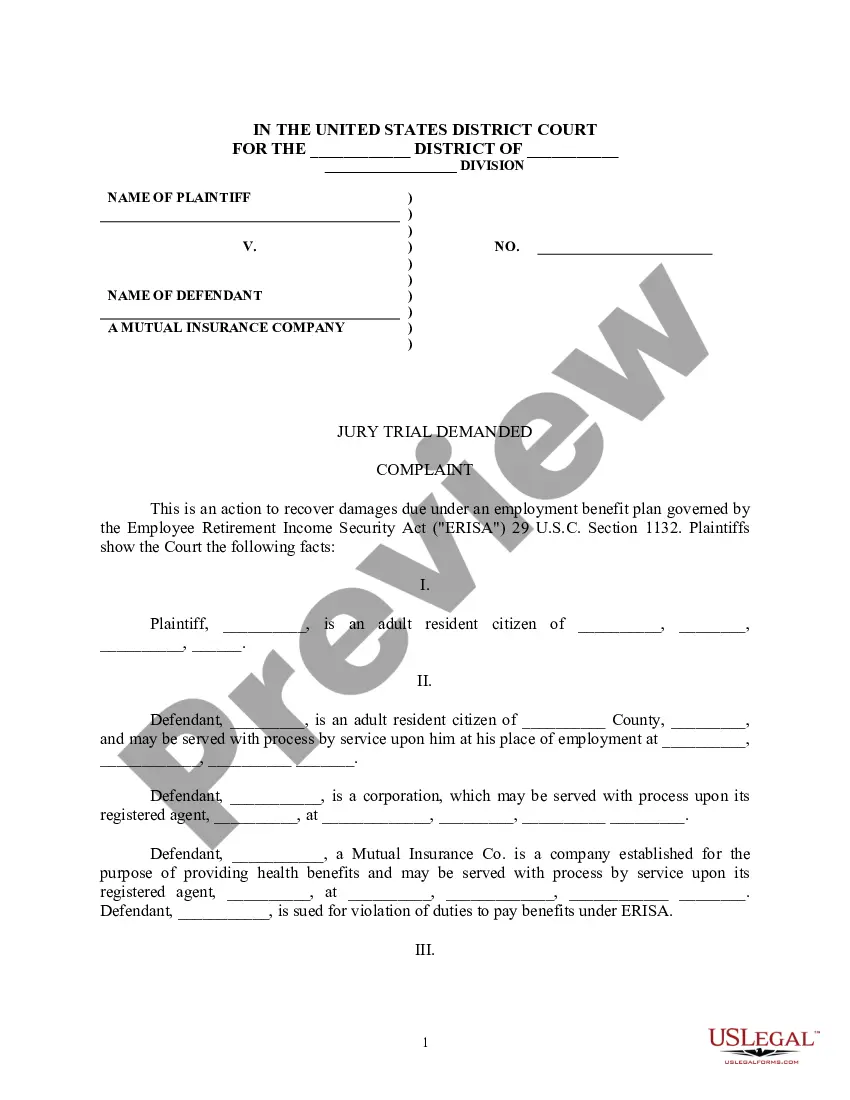

This form for use in litigation against an insurance company for bad faith breach of contract. Adapt this model form to fit your needs and specific law. Not recommended for use by non-attorney.

Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand

Description

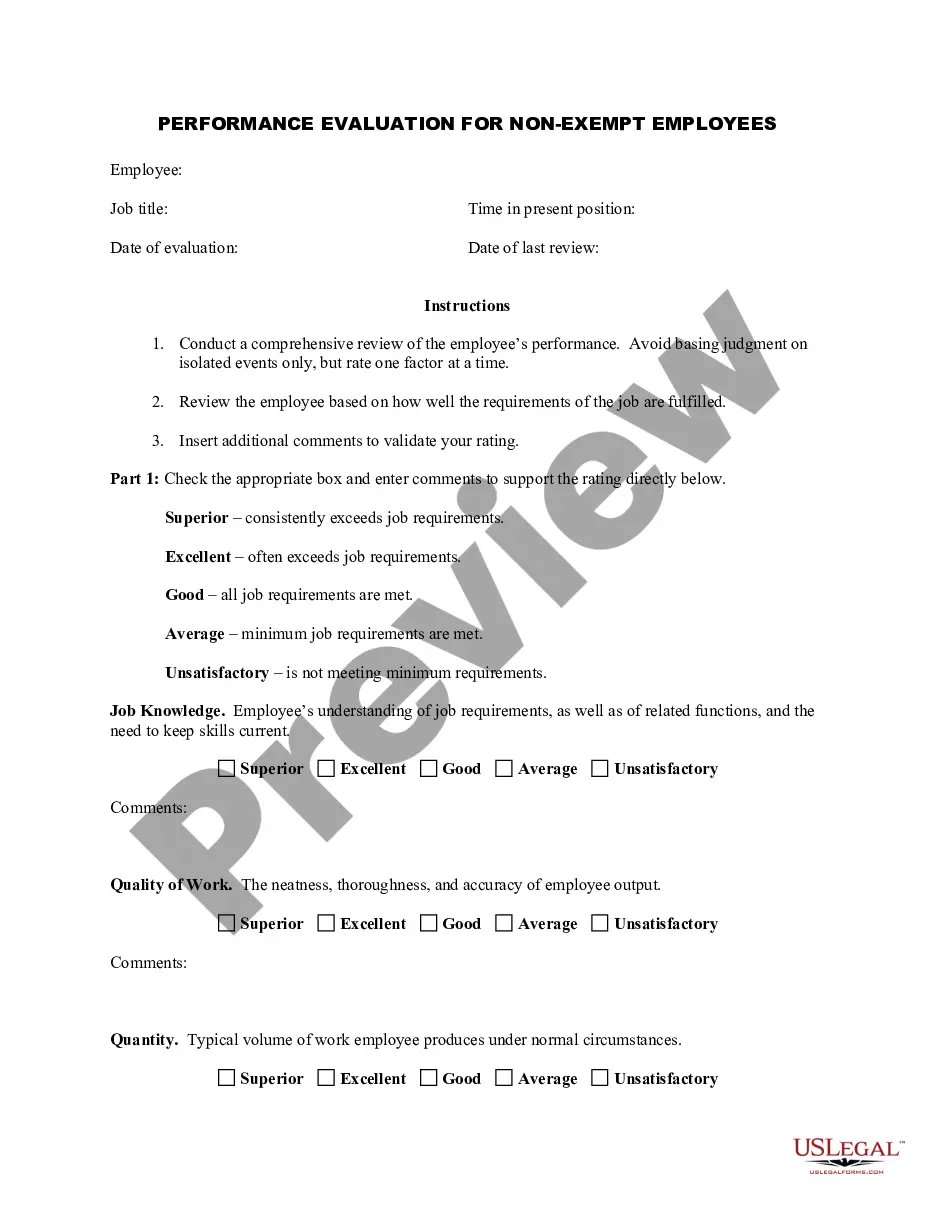

How to fill out Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand?

You can spend hours online looking for the legal document template that meets the federal and state requirements you need.

US Legal Forms offers a vast collection of legal forms that are reviewed by professionals.

You can easily download or print the Minnesota Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand from the service.

If available, use the Review option to look through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Download option.

- Then, you can complete, modify, print, or sign the Minnesota Complaint For Failure Of Insurer To Pay Benefits - Jury Trial Demand.

- Every legal document template you obtain is yours indefinitely.

- To get another copy of a purchased form, visit the My documents tab and click the relevant option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the county/city of your choice.

- Check the form description to ensure you have chosen the right form.

Form popularity

FAQ

The bad faith law in Minnesota allows policyholders to seek damages if an insurer fails to act in good faith while handling a claim. This includes situations where an insurance company unjustly denies benefits or delays payments without valid reasons. If you find yourself in such a situation, you may want to consider filing a Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand. USLegalForms can provide you with the necessary forms and information to support your case.

Statute 72A.20 in Minnesota addresses unfair practices by insurance companies. It prohibits insurers from engaging in misleading or deceptive behavior, which includes denying legitimate claims. Understanding this statute can be essential when you pursue a Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand. If you feel your rights have been violated, consider consulting USLegalForms for guidance.

To file a complaint against an insurance company in Minnesota, you should first gather all relevant documentation related to your claim. Next, you can submit your complaint to the Minnesota Department of Commerce, which oversees insurance practices. Additionally, if you believe the insurer has denied your benefits unjustly, you may need to prepare a Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand. USLegalForms can assist you in streamlining this process.

If you fail to show proof of insurance in Minnesota, you may face penalties such as fines or even license suspension. This could complicate your situation further, especially if you need to file a Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand. It's crucial to maintain proper documentation to protect your rights and interests. Consider using resources like USLegalForms to ensure that you have the necessary paperwork in place.

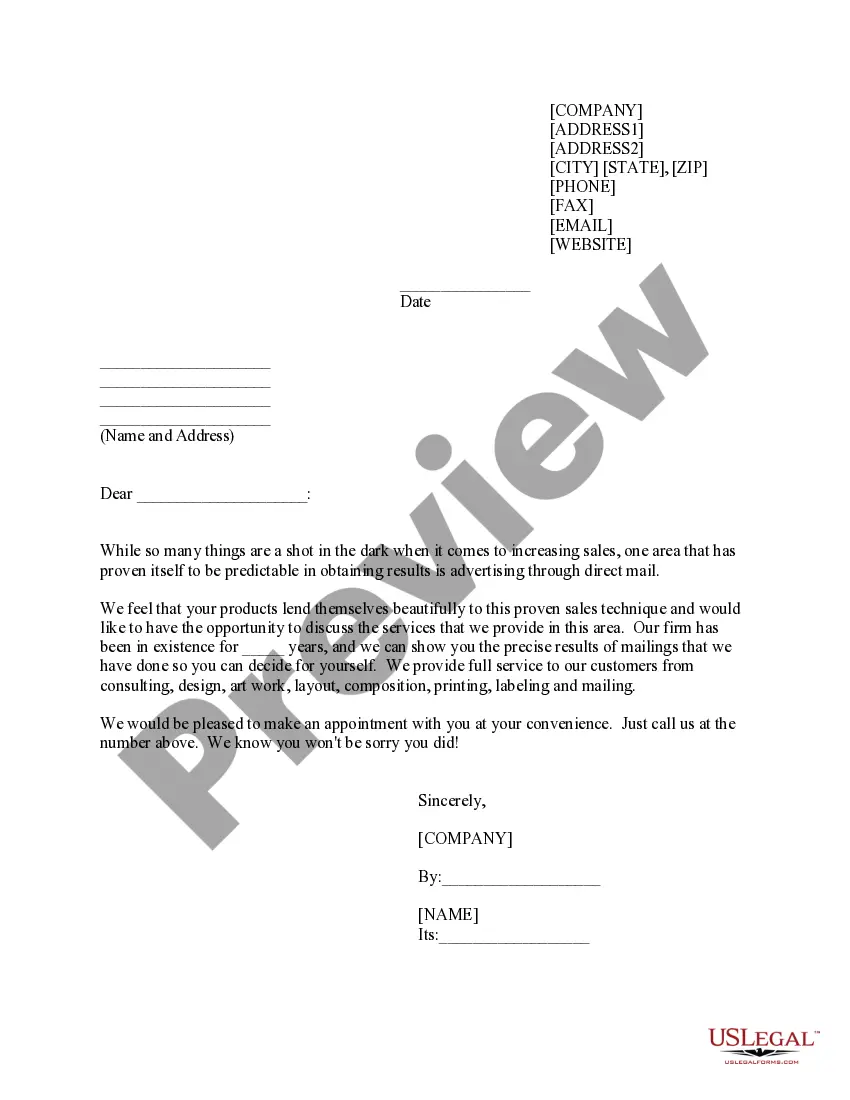

To craft a powerful complaint letter, be direct and concise. Clearly state the facts, express your dissatisfaction, and specify what resolution you seek. By articulating your concerns effectively, you can strengthen your case for a Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand, making your letter more impactful.

A dispute letter should clearly articulate the reasons for your disagreement with the insurer's decision. Start by referencing your policy number, summarize the issue, and include any relevant evidence. This letter can be a critical step before initiating a Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

When writing a complaint letter to your insurance company, start with your contact information and policy number. Clearly outline the issues, provide context, and state your desired outcome. A comprehensive approach can be beneficial, especially if you plan to escalate to a Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

Using strong, clear language in your complaint can emphasize your position. Words like 'failure,' 'breach,' and 'obligation' can convey the seriousness of your situation. These terms can be crucial when drafting a Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand, helping to underscore the inadequacies of the insurer's actions.

To write an effective complaint letter against your insurance company, start by clearly stating your policy details and the specific issues you've encountered. Include any supporting evidence, such as policy documents or correspondence. A well-structured letter can serve as a foundation for a Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.

After an insurer pays a loss, they may have the right to subrogation, which allows them to recover costs from third parties responsible for the loss. This process is important for insurers to manage their expenses and ensure that they can continue to provide coverage. If you are facing issues with your insurer, you may need to consider a Minnesota Complaint For Failure Of Insurer To pay Benefits - Jury Trial Demand.