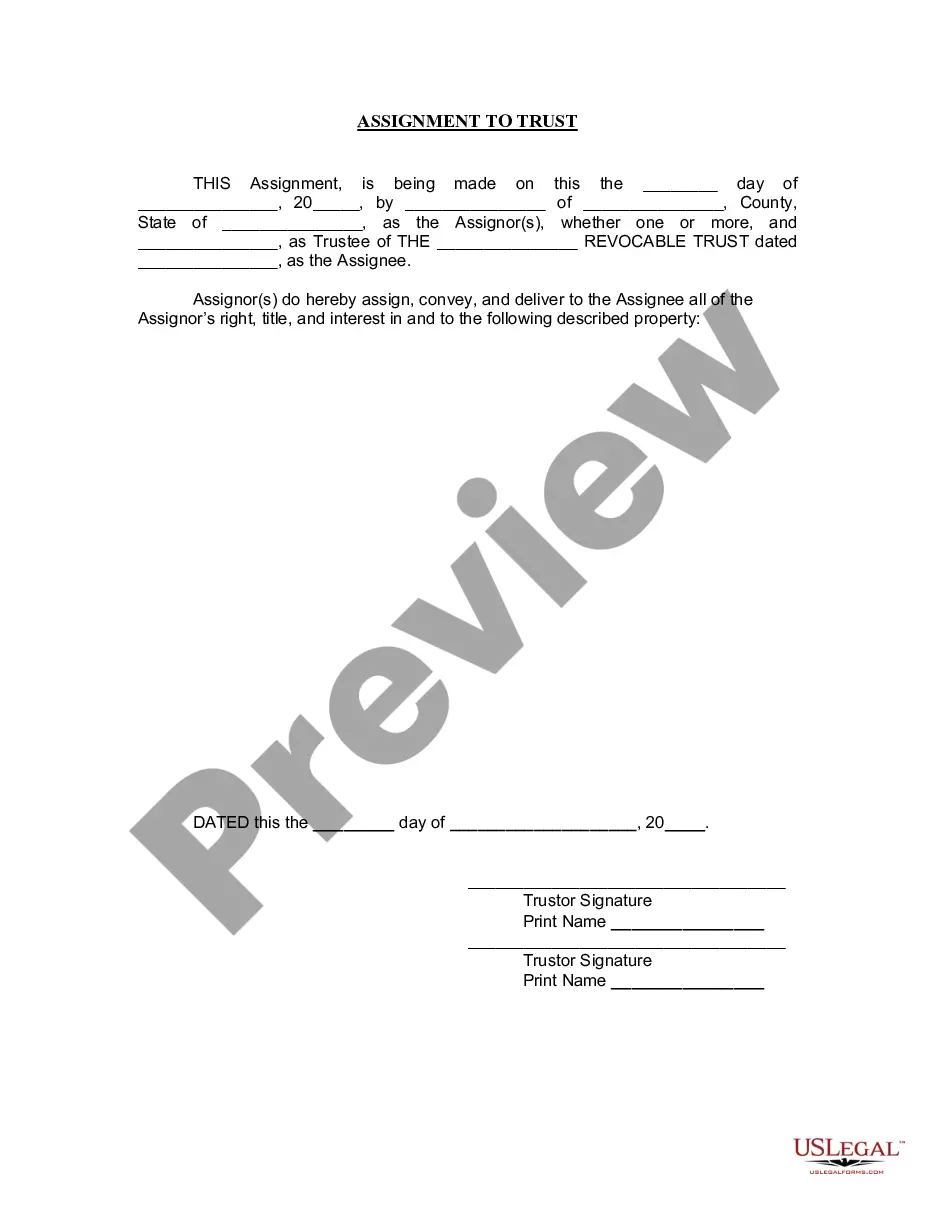

Minnesota Assignment to Living Trust

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

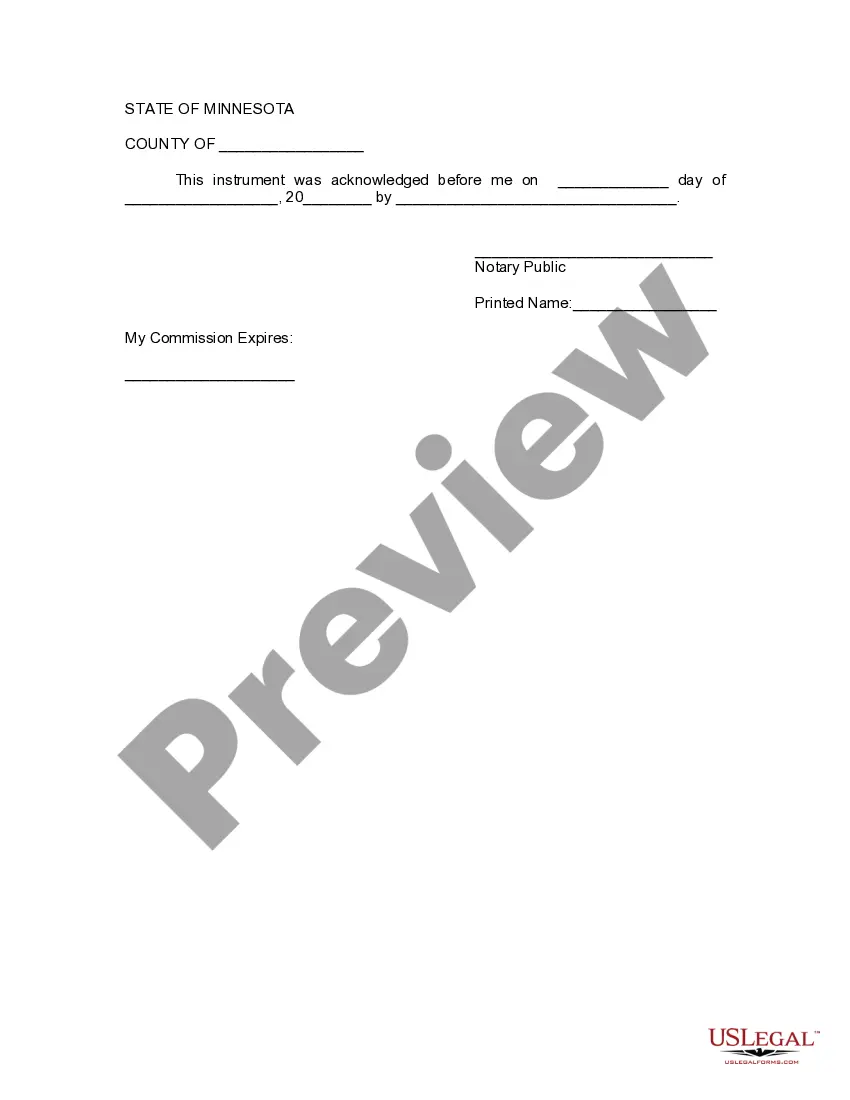

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Minnesota Assignment To Living Trust?

Access any type from 85,000 legitimate documents including Minnesota Assignment to Living Trust online with US Legal Forms. Every template is crafted and refreshed by state-authorized attorneys.

If you already possess a subscription, Log In. Once you reach the form’s page, click on the Download button and navigate to My documents to retrieve it.

If you haven’t subscribed yet, follow the steps below: Check the state-specific prerequisites for the Minnesota Assignment to Living Trust you wish to utilize. Browse the description and preview the template. Once you’re certain the sample meets your requirements, simply click Buy Now. Choose a subscription option that fits your budget. Set up a personal account. Pay in one of two convenient methods: by card or through PayPal. Select a format to download the file in; two options are available (PDF or Word). Download the document to the My documents tab. When your reusable form is downloaded, print it or save it to your device.

- With US Legal Forms, you’ll consistently have immediate access to the appropriate downloadable template.

- The service provides you with access to documents and categorizes them to simplify your search.

- Utilize US Legal Forms to obtain your Minnesota Assignment to Living Trust quickly and effortlessly.

Form popularity

FAQ

The downside of putting assets in a trust primarily involves the initial setup and maintenance costs. Additionally, some may find the process of transferring assets cumbersome. Despite these drawbacks, the benefits of a Minnesota Assignment to Living Trust, such as avoiding probate and gaining control over your assets, often outweigh the negatives. Platforms like US Legal Forms can help you navigate these challenges effectively.

You should consider putting significant assets into a living trust, such as real estate, investments, and bank accounts. These assets often benefit from the streamlined management and probate avoidance a Minnesota Assignment to Living Trust offers. However, it's crucial to evaluate each asset's value and your personal circumstances before making decisions.

Assigning assets to a living trust involves executing a few key steps. First, identify the assets you wish to include, such as real estate or bank accounts. Then, complete the necessary paperwork to transfer ownership, ensuring you comply with Minnesota Assignment to Living Trust regulations. US Legal Forms can help streamline this process by providing templates and instructions.

To put your assets in a living trust, you need to formally transfer ownership of each asset to the trust. This typically involves changing the title or deed of the assets to reflect the trust's name. Using a Minnesota Assignment to Living Trust can simplify this process, and resources like US Legal Forms can provide the necessary documents and guidance.

Yes, you can move your assets into a trust. This process involves transferring ownership of your assets to the trust, which allows the trust to manage them according to your wishes. If you're considering a Minnesota Assignment to Living Trust, you may want to consult a legal expert to ensure the process is done correctly and to maximize the benefits of your trust.

A house can remain in a trust indefinitely after death, as long as the trust is properly administered. This means that the property can be managed and passed on according to the terms of the Minnesota Assignment to Living Trust. Proper planning and management can ensure that the house serves your family's needs even after you are gone.

One disadvantage of putting your house in a trust is the potential loss of control over the property. Once you transfer your home into a Minnesota Assignment to Living Trust, you may face limitations on how you can sell or leverage the asset. Additionally, there can be ongoing costs and administrative duties associated with managing the trust.

The new IRS rule on trusts focuses on the taxation of trust income and distributions. This rule impacts how beneficiaries report income received from a trust, particularly regarding a Minnesota Assignment to Living Trust. Staying informed about these regulations can help you manage your trust effectively and avoid unexpected tax liabilities.

The 2 year rule after death involves the handling of assets left in a trust. In Minnesota, any transfers made to a living trust within two years prior to the owner's death may be scrutinized during probate proceedings. It’s essential to understand how this rule interacts with your Minnesota Assignment to Living Trust to ensure a smooth transition of assets.

The 2 year rule for trusts refers to a guideline that affects the transfer of assets into a trust. In Minnesota, if you transfer property into a trust within two years of applying for certain government benefits, that transfer could be considered a gift, impacting your eligibility for those benefits. Understanding the implications of this rule is crucial when considering a Minnesota Assignment to Living Trust.