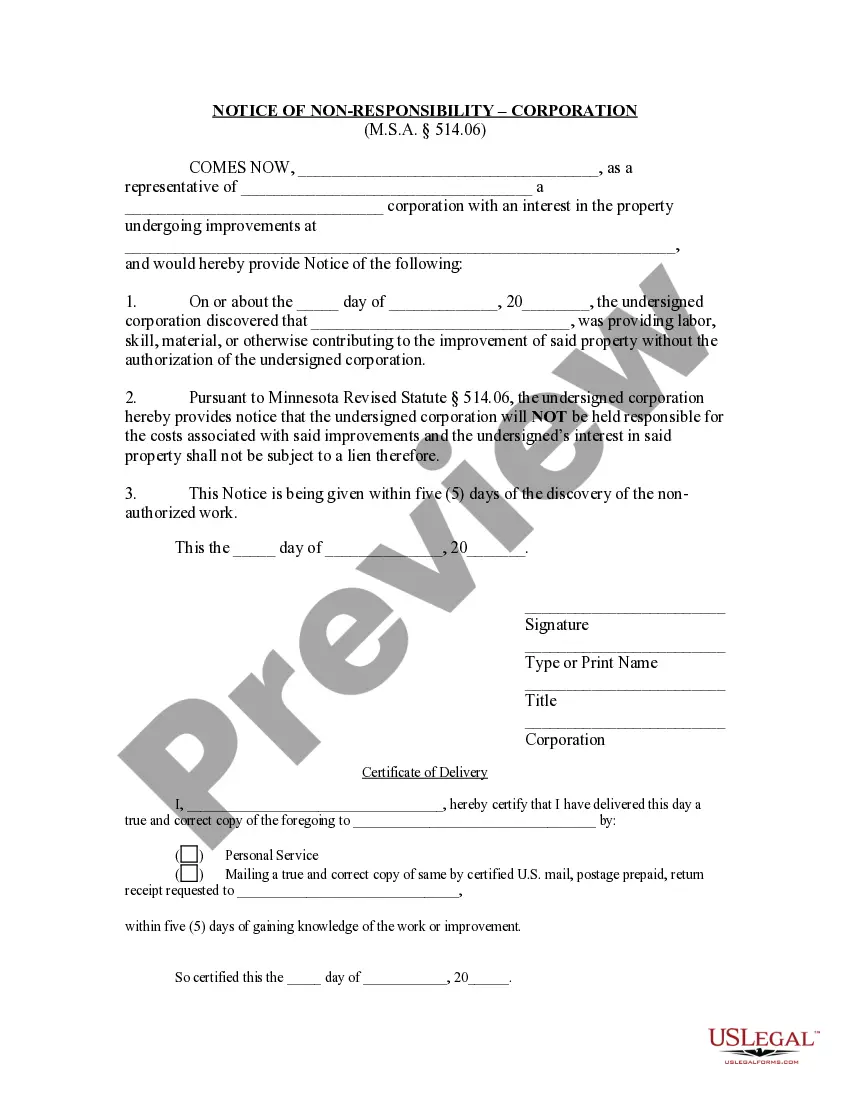

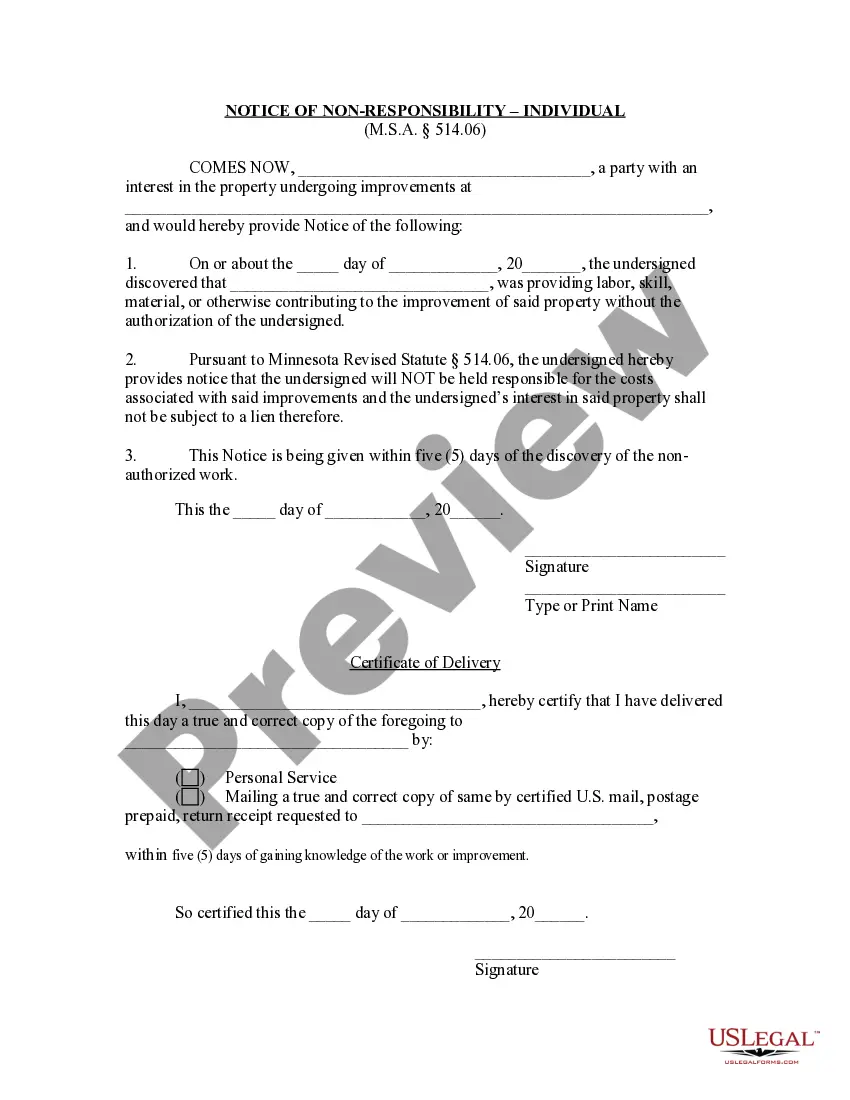

Minnesota Notice of Nonresponsibility - Corporation or LLC

Description

How to fill out Minnesota Notice Of Nonresponsibility - Corporation Or LLC?

Obtain any template from 85,000 legal documents including Minnesota Notice of Nonresponsibility - Corporation or LLC online with US Legal Forms. Each template is crafted and refreshed by state-authorized legal experts.

If you already possess a subscription, sign in. Once you are on the form’s page, click the Download button and navigate to My documents to retrieve it.

If you haven't subscribed yet, adhere to the following guidelines: Check the state-specific criteria for the Minnesota Notice of Nonresponsibility - Corporation or LLC you wish to utilize. Review the description and preview the template. When you are confident that the template meets your needs, click on Buy Now. Choose a subscription plan that fits your financial situation. Establish a personal account. Make payment via one of the two suitable methods: by credit card or through PayPal. Select a format to download the document in; two options are available (PDF or Word). Save the file to the My documents tab. Once your reusable form is prepared, print it out or save it to your device.

- With US Legal Forms, you will always have immediate access to the appropriate downloadable template.

- The service will provide you with access to forms and organizes them into categories to make your search easier.

- Utilize US Legal Forms to acquire your Minnesota Notice of Nonresponsibility - Corporation or LLC quickly and effortlessly.

Form popularity

FAQ

An operating agreement is not legally required for an LLC in Minnesota, but it is highly recommended. This document serves as a foundational framework for your business, detailing management structures and operational procedures. Establishing an operating agreement can significantly aid in protecting your interests, especially when submitting a Minnesota Notice of Nonresponsibility - Corporation or LLC. You can create a comprehensive operating agreement easily using the resources available on the US Legal Forms platform.

In Minnesota, a public notice must include specific information such as the name of the entity, its registered office address, and the nature of the business. The notice must be published in a qualified newspaper within the county where your LLC operates. This is crucial for compliance and transparency, especially when filing a Minnesota Notice of Nonresponsibility - Corporation or LLC. US Legal Forms provides templates and guidance to help ensure your notice meets all legal requirements.

Yes, an LLC can exist without an operating agreement in Minnesota; however, it's not advisable. Without this agreement, your LLC will be governed by state default rules, which may not align with your intentions. Establishing an operating agreement helps you maintain control over your business operations and is particularly important when filing a Minnesota Notice of Nonresponsibility - Corporation or LLC. Utilizing US Legal Forms can simplify this process for you.

Even if you are the sole owner of your LLC, having an operating agreement is beneficial. This document outlines your business's structure and defines your rights and responsibilities. It can also help you separate personal and business liabilities, which is crucial for the Minnesota Notice of Nonresponsibility - Corporation or LLC. By using the US Legal Forms platform, you can easily create a customized operating agreement tailored to your needs.

Yes, you can have both an LLC and a nonprofit organization. Many entrepreneurs choose to operate a for-profit business alongside a nonprofit to serve different goals. However, it is important to maintain clarity in operations and accounting for each entity. US Legal Forms can help you set up both structures correctly to ensure compliance with Minnesota laws.

Yes, an LLC can operate as a nonprofit organization in Minnesota, but it must meet specific requirements. This includes focusing on charitable purposes and adhering to state regulations for nonprofits. Understanding these requirements is vital for compliance, and US Legal Forms can assist you in navigating the legal landscape effectively.

While Minnesota does not legally require an operating agreement for LLCs, it is highly recommended to have one. An operating agreement outlines the management structure and operating procedures of your LLC, which can help prevent disputes among members. If you're unsure how to draft one, US Legal Forms offers templates that can guide you through this essential document.

Yes, a single member LLC can operate as a nonprofit in Minnesota. While the structure may differ, the essential principle remains that the organization must serve a charitable purpose. Understanding the legal framework around this can be complex, so utilizing resources from US Legal Forms can help simplify the process and ensure compliance.

Yes, you can convert your LLC into a nonprofit organization in Minnesota. This process involves filing specific documents and meeting certain requirements set by the state. It is crucial to understand the implications of this change, especially regarding taxes and governance. US Legal Forms can provide guidance and necessary forms to facilitate this transition.

Yes, in Minnesota, you must file an annual report for your LLC. The report is due on December 31 each year, and it keeps your business in good standing with the state. Failing to file can result in penalties, so it's essential to stay on top of this requirement. For more assistance, consider using the resources available on the US Legal Forms platform.