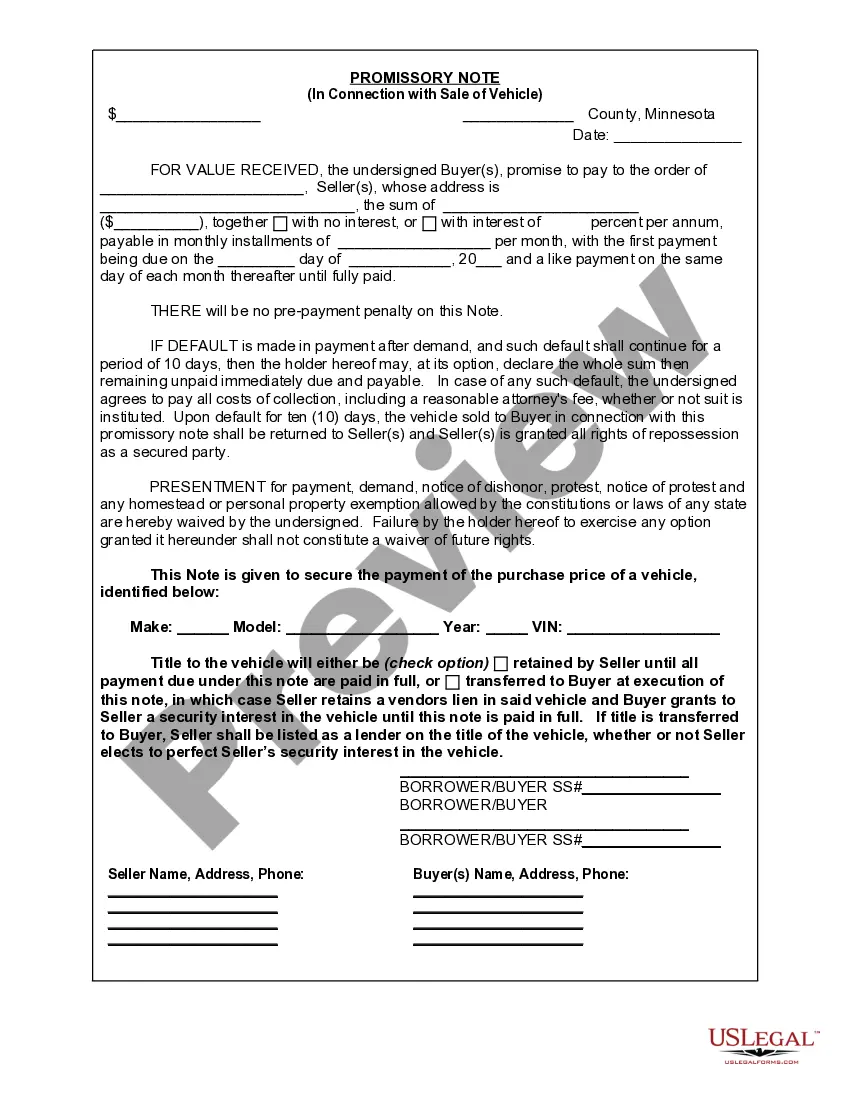

Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile

Description

How to fill out Minnesota Promissory Note In Connection With Sale Of Vehicle Or Automobile?

Acquire any type from 85,000 legal records like Minnesota Promissory Note in Relation to Sale of Vehicle or Automobile online with US Legal Forms. Each template is composed and revised by state-certified attorneys.

If you possess a subscription already, sign in. Once you're on the form's webpage, hit the Download button and navigate to My documents to access it.

If you have not subscribed yet, follow the instructions below.

With US Legal Forms, you will consistently have instant access to the appropriate downloadable template. The platform provides you with access to documents and categorizes them to streamline your search. Utilize US Legal Forms to obtain your Minnesota Promissory Note in Relation to Sale of Vehicle or Automobile efficiently and swiftly.

- Verify the state-specific criteria for the Minnesota Promissory Note in Relation to Sale of Vehicle or Automobile you wish to use.

- Examine the description and view the template.

- Once you're sure the template meets your needs, click on Buy Now.

- Select a subscription plan that fits your financial situation.

- Establish a personal account.

- Make payment in one of two convenient methods: by credit card or through PayPal.

- Choose a format to download the document in; there are two options available (PDF or Word).

- Download the file to the My documents section.

- After your reusable template is downloaded, print it or save it to your device.

Form popularity

FAQ

When writing a promissory note for a car, begin with the date and the names of the borrower and lender. Clearly outline the amount being borrowed, the repayment schedule, and the interest rate, if any. Include specific terms about what happens in case of a default. Using a template from a trusted source like uslegalforms can simplify this process, ensuring your Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile is comprehensive and legally sound.

In Minnesota, a promissory note does not necessarily need to be notarized to be enforceable. However, having the document notarized can provide additional legal protection for both the lender and borrower. It serves as proof that both parties agreed to the terms outlined in the Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile. Always consider consulting legal advice to ensure compliance with state laws.

You can obtain a promissory note form from various sources, including online legal service providers. US Legal Forms offers customizable templates specifically designed for Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile. These forms ensure that your agreement complies with state laws and meets your specific needs.

In Minnesota, the statute of limitations for enforcing a promissory note is typically six years. This means that if a borrower fails to repay the note, the lender has six years from the date of the default to take legal action. Understanding this timeframe is crucial when dealing with a Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile, as it can affect your rights.

Yes, you can create your own promissory note in Minnesota. However, it is essential to ensure that your document includes all necessary elements, such as the terms of repayment and the interest rate, if applicable. Using a reliable platform like US Legal Forms can help you draft an accurate Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile, ensuring it meets legal requirements.

In Minnesota, a promissory note does not necessarily need to be notarized to be considered legal. However, notarization can provide an added layer of protection and verification for both parties involved in the transaction. When dealing with a Minnesota Promissory Note in Connection with Sale of Vehicle or Automobile, it is advisable to have the document notarized to avoid potential disputes in the future.

A promissory note is often included in a mortgage, student loan, car loan, business loan, or personal loan agreement. If you're loaning someone a large sum of money, you'll likely want a legal record of it. Therefore, promissory notes can be used in personal transactions as well.

Writing the Promissory Note Terms You can use a template or create a promissory note online. But before you begin, you'll need to gather some information and make decisions about the way the loan will be structured. First, you'll need the names and addresses of both the lender (or "payee") and the borrower.

A simple promissory note might be for a lump sum repayment on a certain date. For example, you lend your friend $1,000 and he agrees to repay you by December 1. The full amount is due on that date, and there is no payment schedule involved.

A promissory note basically includes the name of both parties (lender and borrower), date of the loan, the amount, the date the loan will be repaid in full, frequency of loan payments, the interest rate charged on the loan payments, and any security agreement.