Michigan Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest

Description

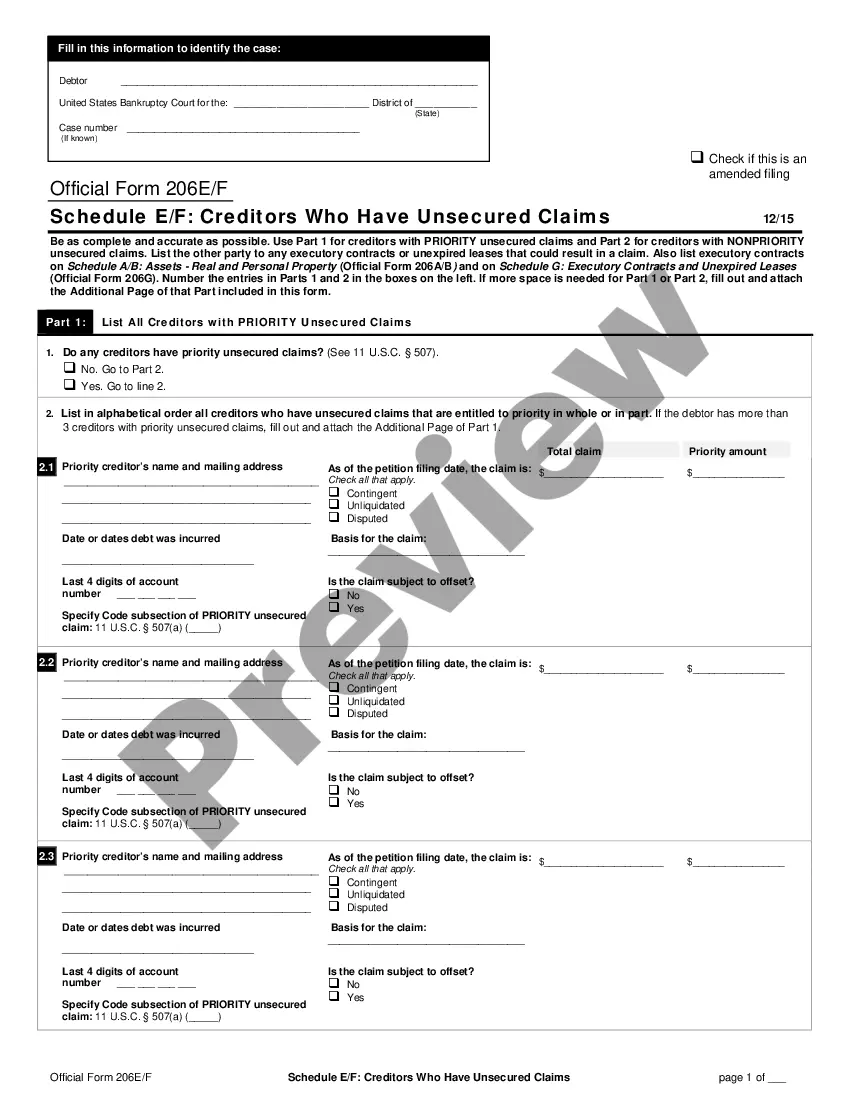

How to fill out Mineral Deed With Grantor Reserving Nonparticipating Royalty Interest?

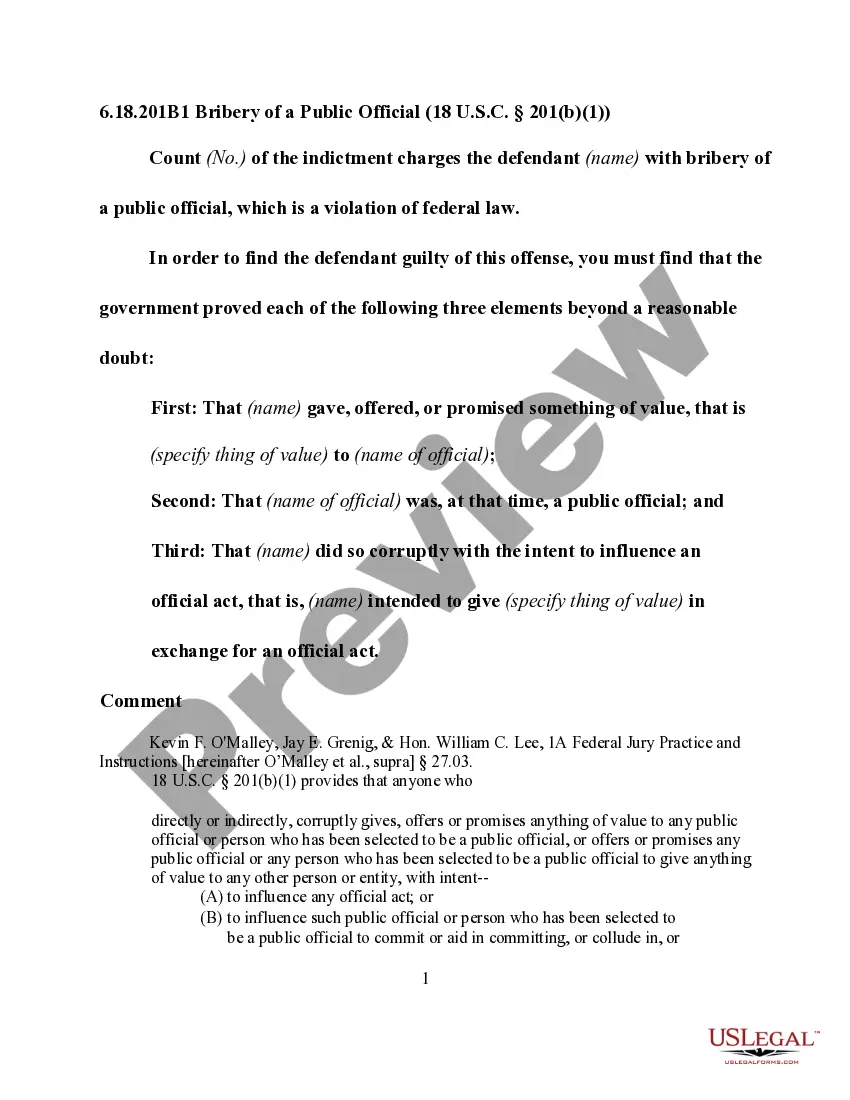

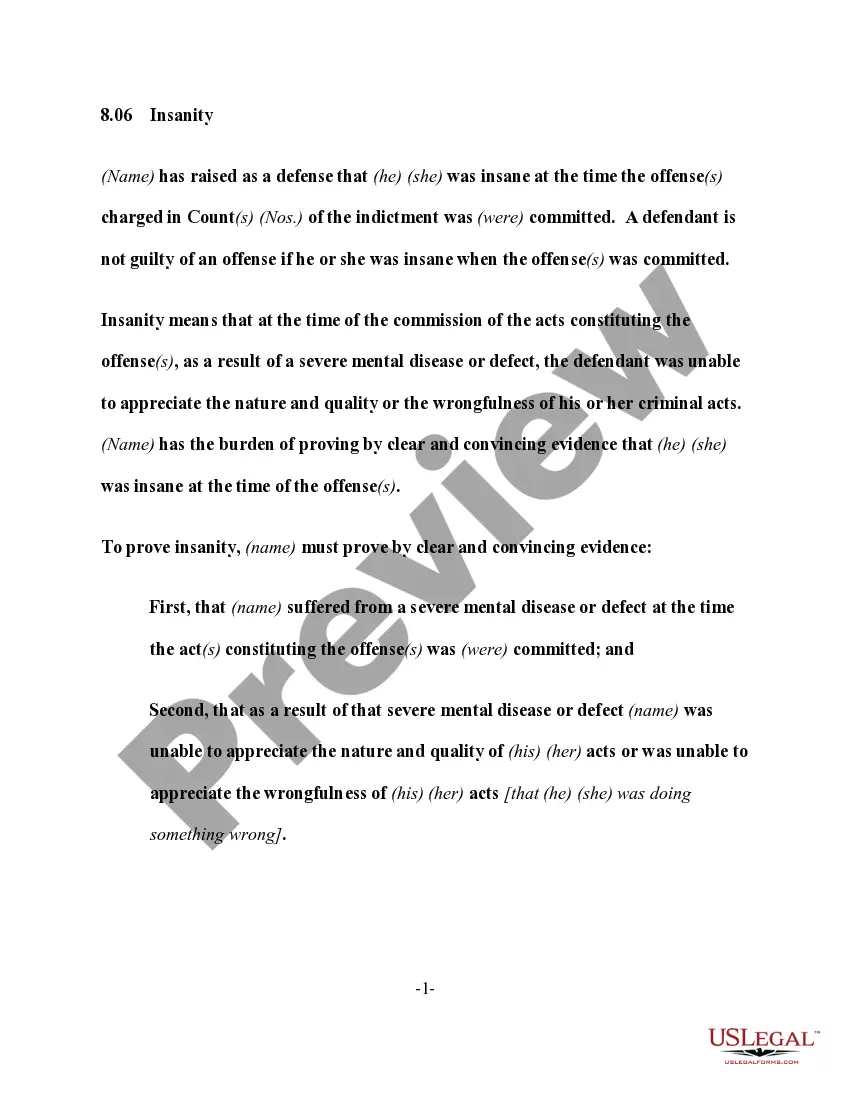

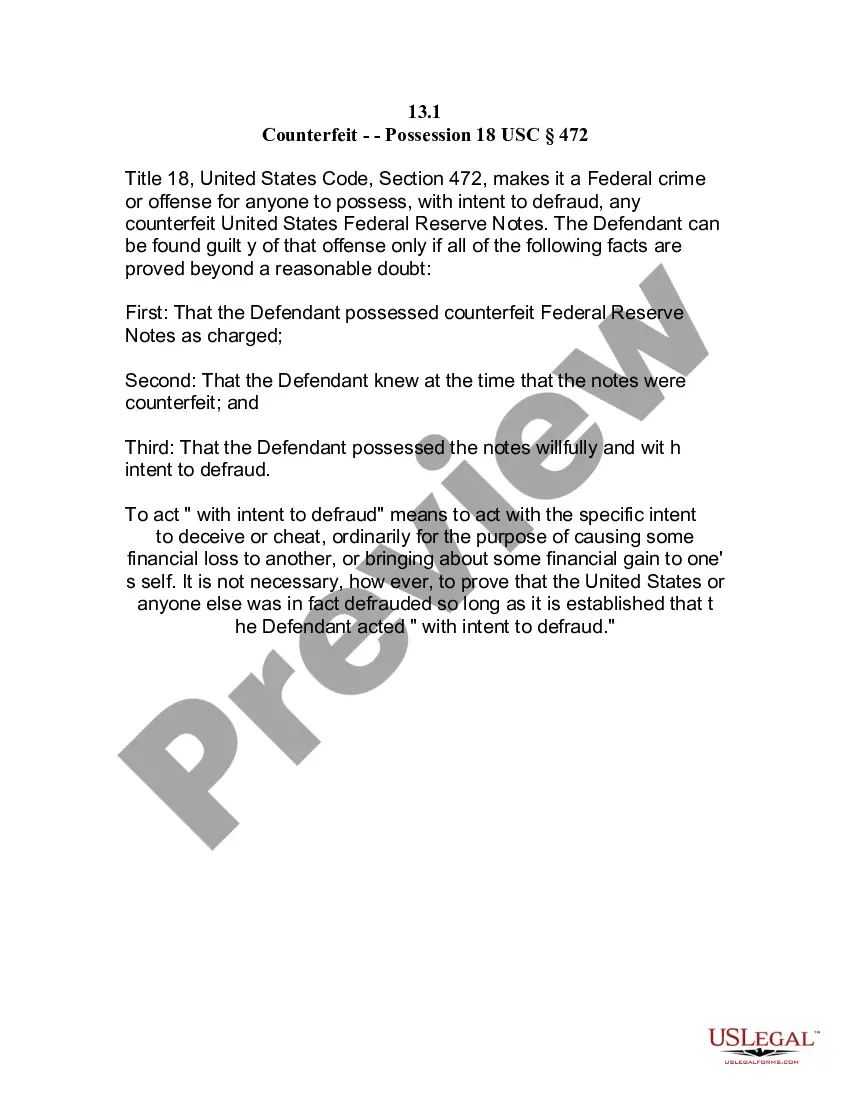

Are you within a place where you need to have documents for either business or personal uses just about every time? There are plenty of lawful record templates available online, but discovering types you can trust isn`t effortless. US Legal Forms delivers a large number of develop templates, just like the Michigan Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest, which can be created to meet state and federal specifications.

When you are already informed about US Legal Forms site and have a free account, simply log in. After that, you are able to download the Michigan Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest format.

Should you not come with an bank account and want to start using US Legal Forms, follow these steps:

- Find the develop you need and ensure it is for the appropriate metropolis/county.

- Use the Preview switch to analyze the shape.

- Look at the information to ensure that you have selected the proper develop.

- In the event the develop isn`t what you are trying to find, make use of the Look for field to discover the develop that fits your needs and specifications.

- Once you discover the appropriate develop, simply click Acquire now.

- Select the pricing strategy you would like, fill out the specified information and facts to create your money, and buy your order making use of your PayPal or credit card.

- Select a handy data file format and download your version.

Discover each of the record templates you may have purchased in the My Forms menu. You can aquire a extra version of Michigan Mineral Deed with Grantor Reserving Nonparticipating Royalty Interest any time, if possible. Just go through the needed develop to download or printing the record format.

Use US Legal Forms, the most extensive variety of lawful kinds, to save some time and steer clear of mistakes. The assistance delivers appropriately made lawful record templates which can be used for a selection of uses. Produce a free account on US Legal Forms and start making your daily life easier.

Form popularity

FAQ

An attorney can create a deed or assignment that conveys the mineral rights to the new owners. The original deed will need to be recorded in the county where the minerals are located. If there are producing wells on the property, each operator will need to be notified of the change in ownership.

Form H1242, Verification of Mineral Rights | Texas Health and Human Services.

The only way to determine mineral rights ownership in Oklahoma is to do a title search at the courthouse where the property is located. To do this, you must review all deeds and other legal conveyances pertaining to the subject tract back to 1907. Mineral ownership information is not available online from any website.

?To pay Lessor for gas (including casinghead gas) and all other substance covered hereby, a royalty of 3/16 of the proceeds realized by Lessee from the sale thereof.? This simply means the operator will pay a royalty of 3/16 of revenue generated from production on the property.

A mineral right is a property right and may be sold, transferred, or leased similar to other property rights. Mineral rights are distinct from ?surface rights,? or the right to the use of the surface of the land for residential, agricultural, recreational, commercial, or other purposes.

You will need to sign the mineral deed form in front of a notary to confirm its authenticity, have it notarized, and have it recorded. The recorder of the deed can send a copy back to us, and you will keep a copy. And you are done!

The record owner must: TITLE: Title the property "Transfer-on-death" by making a new deed. NAME: Name the person to get the land, home or mineral interest when the record owner dies on the new deed. This person is called the "beneficiary." SIGN: Sign the deed before two witnesses and a notary.

Effect of Property Taxes on Mineral Rights Oklahoma has no inheritance tax. Capital gains tax must be paid on any sale of mineral rights and income generated from royalty streams. However, if the mineral rights have not been severed from the property, the county may not charge taxes beyond property taxes.