Michigan Statement to Add to Credit Report

Description

How to fill out Statement To Add To Credit Report?

Have you ever found yourself in a situation where you need to have documents for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, including the Michigan Statement to Add to Credit Report, which can be customized to meet state and federal requirements.

Select a convenient document format and download your copy.

Access all the document templates you have purchased in the My documents menu. You can obtain another copy of the Michigan Statement to Add to Credit Report at any time, if needed. Click the desired form to download or print the document template. Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a little easier.

- If you are already acquainted with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Michigan Statement to Add to Credit Report template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

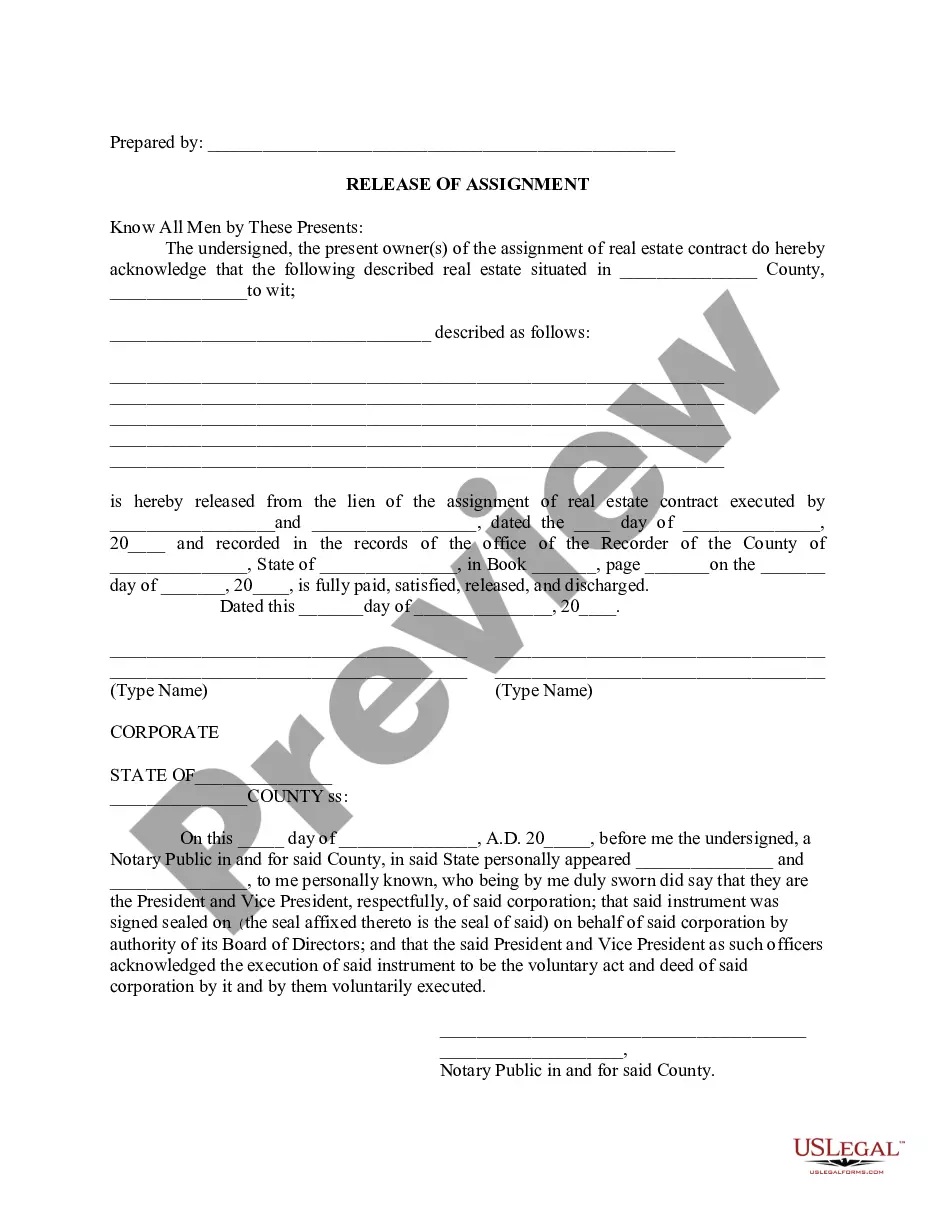

- Use the Review button to check the document.

- Read the description to ensure you have selected the right form.

- If the form is not what you are looking for, utilize the Lookup field to find the form that suits your needs and requirements.

- If you find the correct form, click on Buy now.

- Choose the payment plan you prefer, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

Increasing your credit score by 100 points in 30 days is ambitious but possible with the right strategies. Start by paying down high credit card balances and ensuring all payments are made on time. Adding a Michigan Statement to Add to Credit Report can also help clarify your financial situation. For tailored guidance and resources, consider using UsLegalForms to access helpful tools that can support your credit-building efforts.

You can absolutely add a statement to your credit report. If you have a Michigan Statement to Add to Credit Report, it can help you explain any discrepancies or negative items that may affect your creditworthiness. This process involves submitting your statement to the credit reporting agency of your choice. Platforms like UsLegalForms provide the necessary resources to help you navigate this process smoothly.

Yes, you can include a 100-word statement on your credit report, provided it adheres to the guidelines set by the credit bureaus. This statement acts as your opportunity to explain any negative information on your report. A Michigan Statement to Add to Credit Report can be a great way to clarify your situation to potential lenders. Using UsLegalForms can assist you in crafting a suitable statement that meets the requirements.

Building your credit from 500 to 700 can take several months to a few years, depending on your financial behavior. Consistently making on-time payments, reducing your credit utilization, and adding a Michigan Statement to Add to Credit Report can positively impact your credit score. Each individual's journey varies, but demonstrating responsible credit use is key. Using tools available on UsLegalForms can help you track your progress and stay motivated.

To add a Michigan Statement to Add to Credit Report, you need to contact the credit reporting agency directly. You can submit your statement either online or via mail, depending on the agency's process. Ensure that your statement is clear and concise, as this will help in effectively communicating your situation. Utilizing platforms like UsLegalForms can simplify this process by providing templates and guidance.

Achieving an 800 credit score in 45 days requires a strategic approach. Start by paying down existing debts, ensuring your credit utilization is below 30%. Additionally, make all your payments on time and consider adding a Michigan Statement to Add to Credit Report if there are any inaccuracies affecting your score. Resources like uslegalforms can provide templates and guidance to help you manage your credit effectively.

To add a statement to your credit report, you can contact the credit reporting agencies directly and request the addition of a Michigan Statement to Add to Credit Report. It's essential to provide a clear explanation of the circumstances that led to the need for the statement. You may also want to include any supporting documents that can help validate your request. Utilizing resources like uslegalforms can guide you through the process effectively.

If you do not file your annual statement report in Michigan, you may face various penalties, including fines or loss of business privileges. It is essential to remain compliant with state requirements to avoid these consequences. Using US Legal Forms can help you prepare and submit your Michigan Statement to Add to Credit Report on time, ensuring you meet all necessary deadlines and maintain good standing.

To add something to your credit report, you should first gather the necessary documentation that supports your claim. You can then contact the credit reporting agencies directly or use a service like US Legal Forms, which simplifies the process. They provide templates and guidance for filing a Michigan Statement to Add to Credit Report. This ensures your information is accurately reported and can improve your credit standing.