Michigan Clerical Staff Agreement - Self-Employed Independent Contractor

Description

How to fill out Clerical Staff Agreement - Self-Employed Independent Contractor?

Are you presently in a situation where you frequently require documents for either business or personal reasons.

There are numerous legal document templates accessible online, yet finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Michigan Clerical Staff Agreement - Self-Employed Independent Contractor, designed to meet state and federal requirements.

If you find the correct form, click on Acquire now.

Choose your preferred payment plan, complete the necessary information to create your account, and finalize your order using PayPal or a Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Then, you can download the Michigan Clerical Staff Agreement - Self-Employed Independent Contractor template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Locate the document you need and confirm it is for the correct city/region.

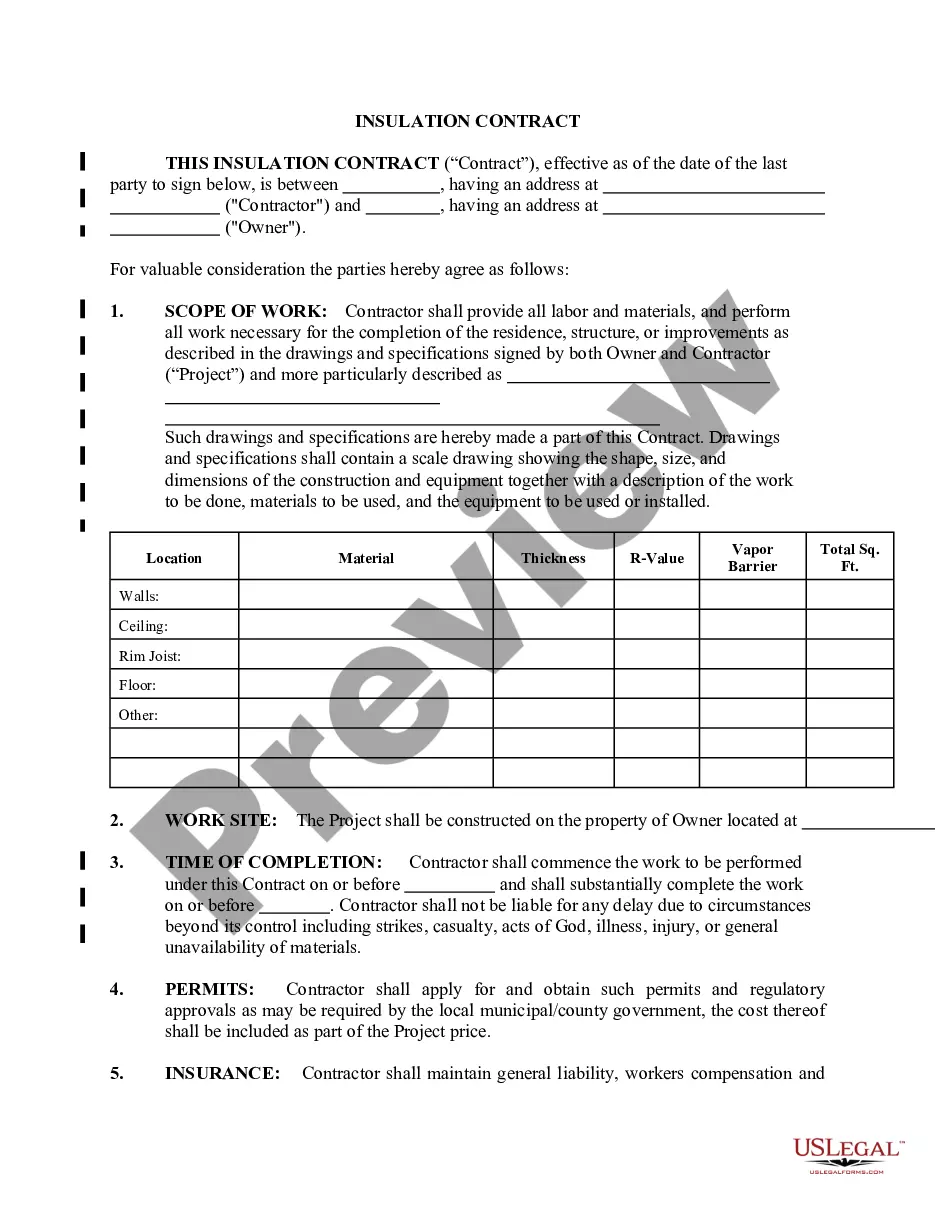

- Use the Review button to verify the form.

- Read the summary to ensure that you've selected the accurate document.

- If the form is not what you're looking for, use the Search field to find the document that meets your requirements.

Form popularity

FAQ

Yes, a 1099 employee can have a contract that outlines their work relationship with a client. This contract is integral for delineating responsibilities, payment terms, and project deadlines. Having a written contract helps prevent misunderstandings and protects both parties legally. Thus, incorporating a Michigan Clerical Staff Agreement - Self-Employed Independent Contractor is advisable to formalize these arrangements.

A basic independent contractor agreement outlines the working arrangement between a business and an independent contractor. It typically includes the scope of work, payment terms, deadlines, and any legal obligations. This type of agreement provides clarity and protects both parties' interests. Consider leveraging the Michigan Clerical Staff Agreement - Self-Employed Independent Contractor as a foundational template for your needs.

Writing an independent contractor agreement involves several key steps. Start by clearly defining the roles and responsibilities of each party, highlighting payment details, and establishing timelines. Additionally, include clauses regarding confidentiality and termination conditions. Using a template like the Michigan Clerical Staff Agreement - Self-Employed Independent Contractor from uslegalforms simplifies this process and ensures you cover all vital elements.

Yes, self-employed individuals can and should have a contract. A well-drafted agreement protects both parties and defines the nature of the working relationship. It clarifies expectations, deliverables, and payment terms. This is especially important in a Michigan Clerical Staff Agreement - Self-Employed Independent Contractor to ensure mutual understanding and compliance.

An independent contractor must earn at least $600 in a calendar year from a single client to receive a 1099 form. This amount is key for taxation purposes and ensures proper reporting to the IRS. As a self-employed individual, being aware of this threshold can help you manage your finances and obligations. When creating a Michigan Clerical Staff Agreement - Self-Employed Independent Contractor, ensure payment structures reflect these considerations.

The new federal rule on independent contractors clarifies the criteria used to classify workers. This rule emphasizes a more stringent test to determine independent contractor status. It aims to protect workers from misclassification and ensure they receive appropriate benefits. Understanding this rule is crucial for those drafting a Michigan Clerical Staff Agreement - Self-Employed Independent Contractor.

Filling out an independent contractor form starts with entering your basic information, like name and address. Then, provide details about the type of services you offer under the Michigan Clerical Staff Agreement - Self-Employed Independent Contractor. Follow up by ensuring that all sections related to payment and responsibilities are accurately filled. Consider using resources from USLegalForms to eliminate confusion.

To fill out a Michigan Clerical Staff Agreement - Self-Employed Independent Contractor, first enter your personal information and that of the hiring entity. Next, clearly detail the work to be performed and the compensation structure. Don't forget to specify the duration of the agreement and any termination conditions. Tools offered by USLegalForms can guide you through this process easily.

An independent contractor typically fills out a W-9 form to provide their taxpayer identification information. Additionally, they may need to complete contracts such as the Michigan Clerical Staff Agreement - Self-Employed Independent Contractor. Other paperwork might include invoices for payment and any relevant business licenses or permits. Familiarize yourself with these documents to ensure compliance.

To write a Michigan Clerical Staff Agreement - Self-Employed Independent Contractor, start by outlining the key terms. Include the scope of work, payment terms, and duration of the contract. Make sure the agreement defines both parties clearly, and consider adding clauses about confidentiality and dispute resolution. Using templates from platforms like USLegalForms can simplify this process.