Michigan MHA Request for Short Sale

Description

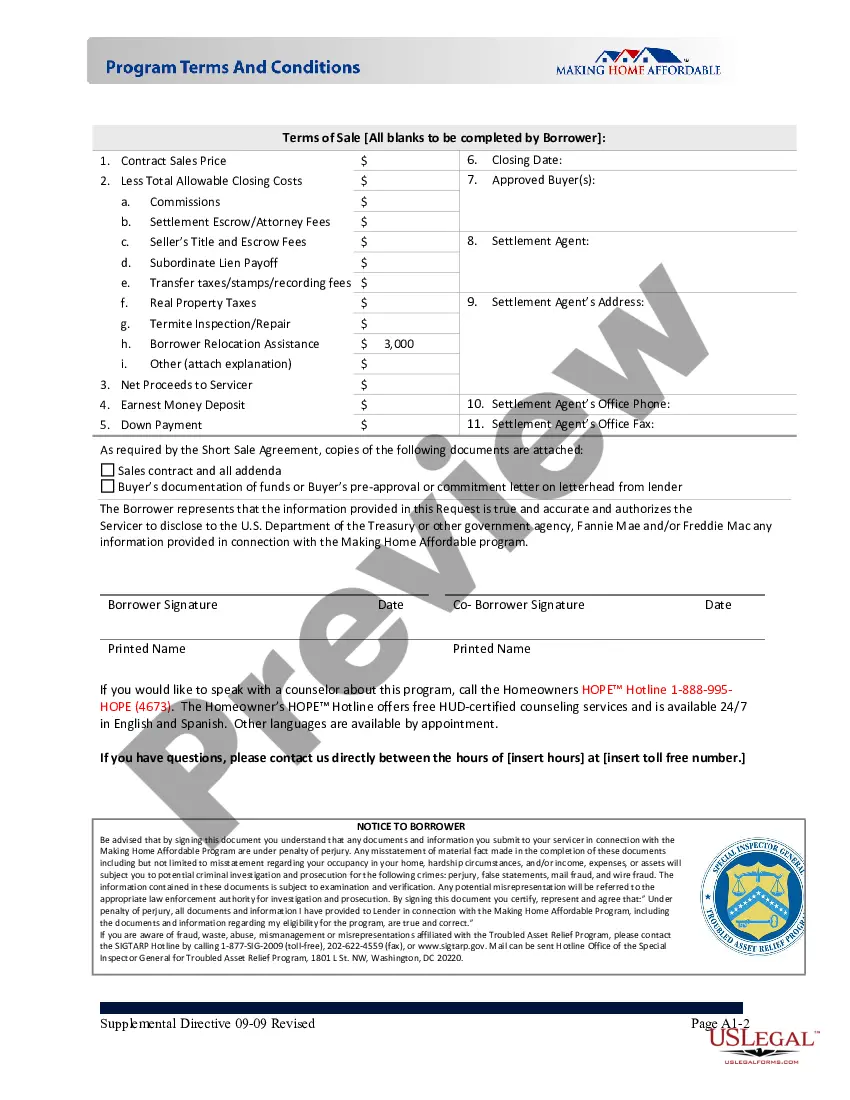

How to fill out MHA Request For Short Sale?

If you need to finalize, acquire, or print official document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site's straightforward and user-friendly search feature to obtain the documents you require.

Various templates for business and personal purposes are categorized by groups and states, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Select your preferred pricing option and enter your details to create an account.

Step 5. Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the payment.

- Utilize US Legal Forms to retrieve the Michigan MHA Request for Short Sale with just a couple of clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to get the Michigan MHA Request for Short Sale.

- You can also access forms you previously saved in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have selected the form for the correct region/state.

- Step 2. Use the Review function to examine the form's details. Don’t forget to read the overview.

- Step 3. If you are not satisfied with the form, utilize the Search section at the top of the screen to find other forms from the legal template collection.

Form popularity

FAQ

The amount a bank will accept on a short sale varies but is typically less than the outstanding mortgage balance. Generally, banks evaluate the market conditions, the home’s value, and your financial situation. The Michigan MHA Request for Short Sale may provide additional insights and support during your negotiations. Engaging with a knowledgeable real estate agent can also help you navigate this process effectively.

Requesting a short sale involves contacting your lender and expressing your situation clearly. Provide them with documentation that supports your financial hardship, including proof of income and expenses. It's beneficial to mention the Michigan MHA Request for Short Sale, as this program can assist in facilitating your request. Lenders prefer to work with you directly, so being organized will aid in getting your request approved.

While a short sale can have an impact on your credit, it often results in less damage compared to foreclosure. The Michigan MHA Request for Short Sale can provide alternatives that reduce the stigma typically associated with a short sale. Many factors contribute to credit scores, but taking responsible steps may allow for faster credit recovery. Understanding your options provides peace of mind during this process.

The rules for short sales in Michigan involve specific lender guidelines and state regulations. Homeowners must provide proof of financial hardship and submit a formal request to their lender for approval. Moreover, all parties involved, including real estate agents and attorneys, should be well-informed about these regulations to ensure a smooth process. Utilizing resources like the Michigan MHA Request for Short Sale can guide you through compliance with these important rules.

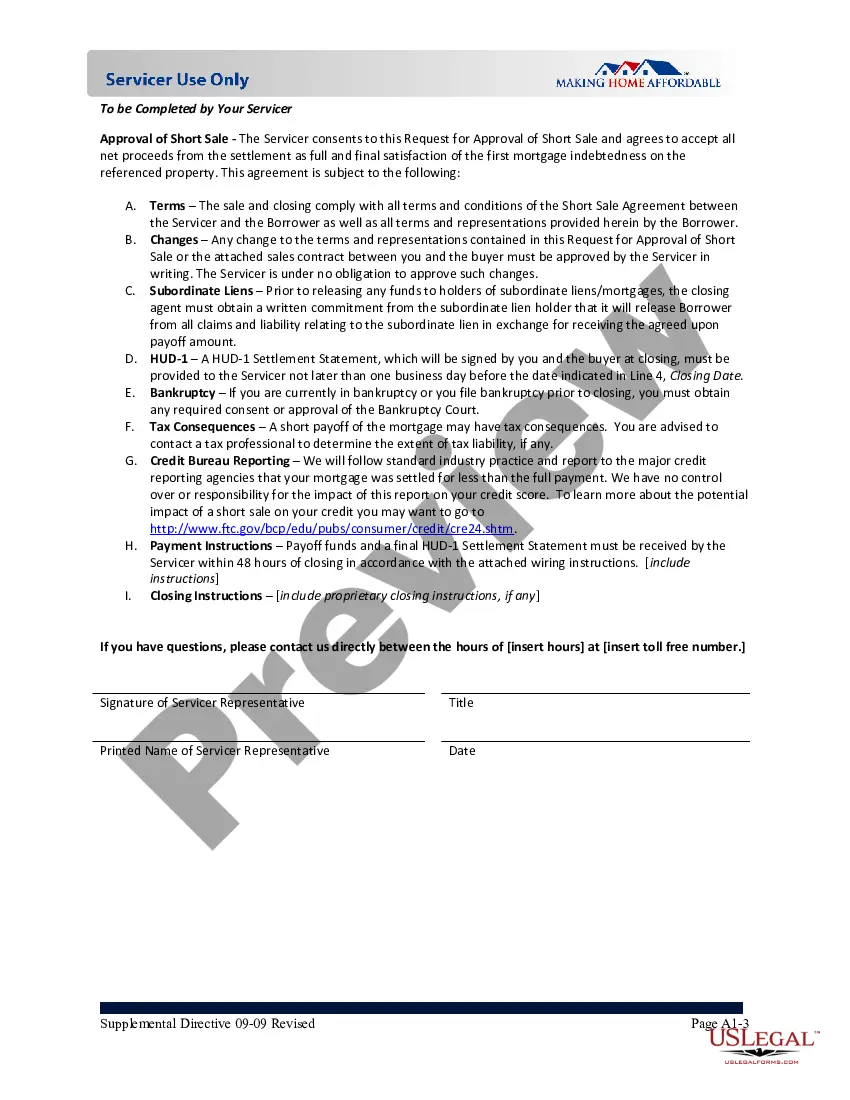

Step 5: If the contract is approved, the short sale property closes and the home is transferred to the new buyer. The lender receives all proceeds from the sale of the property and releases the original homeowner from their mortgage loaneven though the full mortgage balance was not paid off by the proceeds.

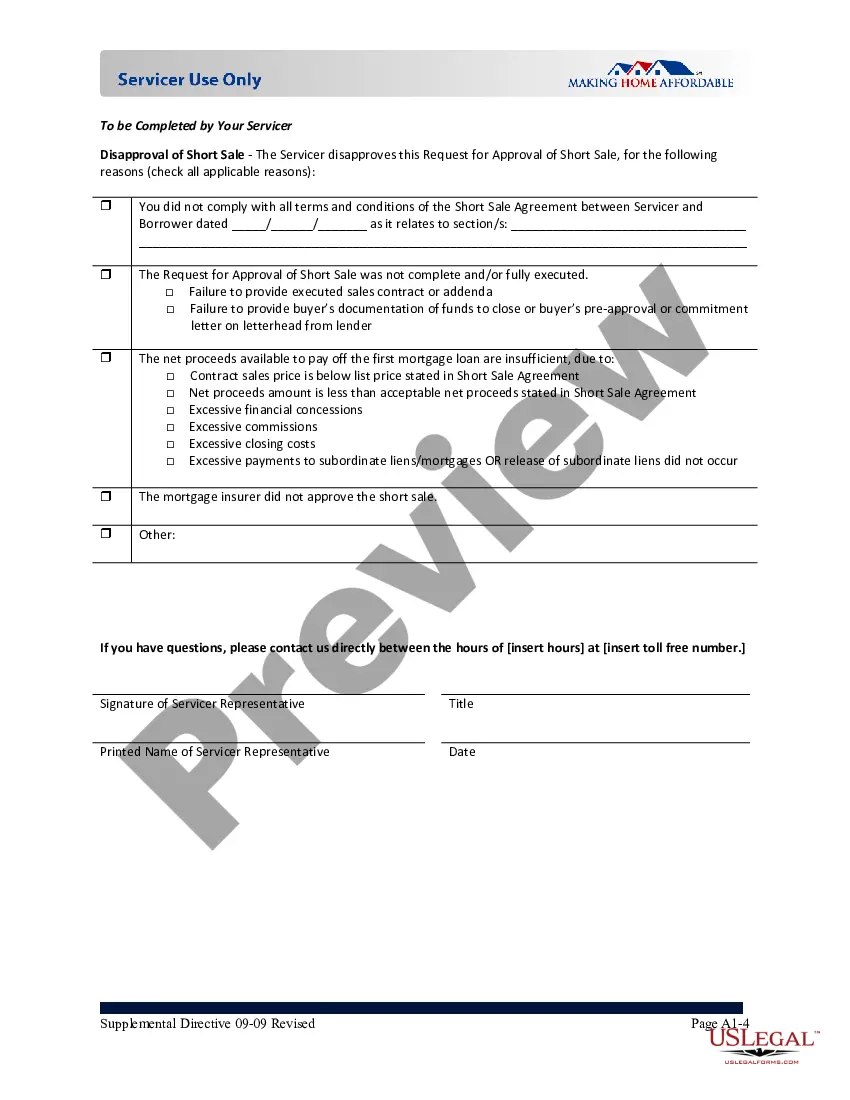

After accepting an offer, the homeowner or his realtor must forward the offer to the lender for review. If the lender approves the offer, the short sale moves forward. If the lender does not accept the offer, the buyer may counteroffer or end the process.

Learn seven risks of a short sale so you can plan properly and decide if it could be the right investment for you.Long Process.Subject to the Mortgage Lender's Approval.Lender Could Counter, Reject or Not Respond.Opportunity Cost.Property 'As Is'Is the Seller Approved?Lenders Prefer All Cash or Large Down Payments.

A listing broker always needs to perform a comparative market analysis (CMA) to estimate the probable sales price of the property in order to advise the seller on an appropriate listing price. This is also an essential step in identifying a potential short sale situation.

Disadvantages. Shorting only makes money if the stock price goes down. If you're wrong, and the price rises, you are out the difference. The real risk is your loss is potentially limitless.

Be aware the short sale process could take much longer than a traditional home purchase. Even with a qualified agent, it's not uncommon for short sale transactions to take six months or more to close.