Michigan Subscription Agreement

Description

How to fill out Subscription Agreement?

US Legal Forms - one of many largest libraries of legitimate varieties in the United States - delivers a wide range of legitimate file themes you can acquire or printing. While using site, you can get a huge number of varieties for enterprise and personal reasons, categorized by groups, says, or search phrases.You will discover the newest models of varieties such as the Michigan Subscription Agreement in seconds.

If you already have a registration, log in and acquire Michigan Subscription Agreement from the US Legal Forms collection. The Obtain switch can look on each and every type you perspective. You get access to all earlier delivered electronically varieties inside the My Forms tab of the bank account.

If you wish to use US Legal Forms for the first time, listed here are simple directions to obtain started out:

- Be sure to have picked out the correct type for your personal metropolis/county. Click the Review switch to review the form`s content material. Browse the type description to actually have chosen the right type.

- When the type does not match your demands, use the Look for field towards the top of the display to find the one that does.

- In case you are pleased with the form, verify your decision by clicking the Purchase now switch. Then, choose the costs plan you prefer and give your references to sign up on an bank account.

- Process the transaction. Make use of charge card or PayPal bank account to perform the transaction.

- Pick the structure and acquire the form on your own product.

- Make adjustments. Complete, revise and printing and indication the delivered electronically Michigan Subscription Agreement.

Each format you included in your bank account lacks an expiration date which is your own eternally. So, if you want to acquire or printing yet another version, just go to the My Forms area and click on around the type you will need.

Obtain access to the Michigan Subscription Agreement with US Legal Forms, one of the most extensive collection of legitimate file themes. Use a huge number of professional and state-specific themes that fulfill your business or personal requirements and demands.

Form popularity

FAQ

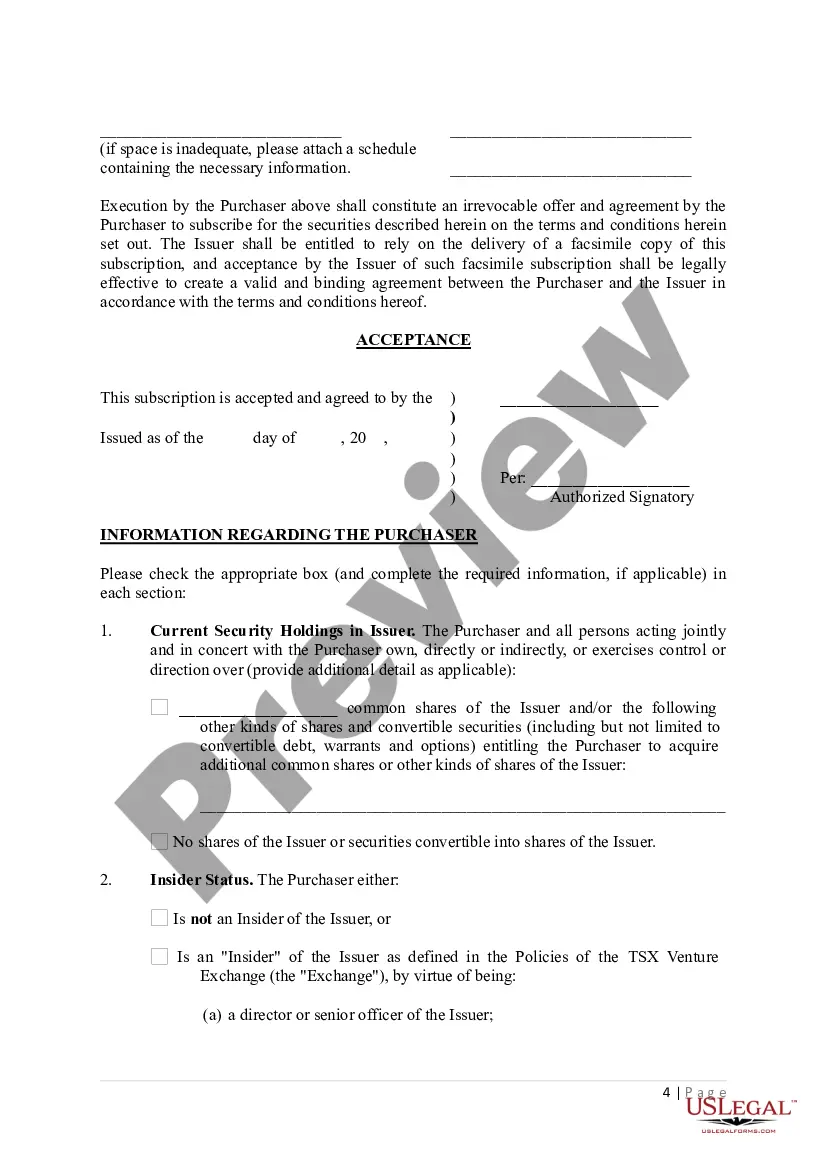

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

There are two key documents that set out the terms and the structure of an LLC, the Operating Agreement and the Subscription Agreement. Note that investors do not buy shares in an LLC ? they buy an interest, which determines their percentage ownership and is documented in the Subscription Agreement.

The Operating Agreement outlines how the governing body will operate. The Subscription Agreement is the legally binding agreement between the investor and the Issuer.

Summary. A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

A subscription agreement is a formal agreement between a company and an investor to buy shares of a company at an agreed-upon price. It contains all the details of such an agreement, including Outstanding Shares, Shares Ownership, and Payouts.

A Share Subscription Agreement is a legally binding contract between a company and an investor or subscriber. It outlines the terms and conditions under which the investor agrees to purchase newly issued company shares.

1.1 The Agreement provides for the sale of ________ [insert number and type of shares] to the Buyer by the Seller at a price of ______ [insert price per share], par value per share (the ?Shares?). 1.2 Purchase and Sale. The Seller agrees to sell and the Buyer agrees to buy the Shares. 1.3 Delivery of Shares.