Michigan Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp

Description

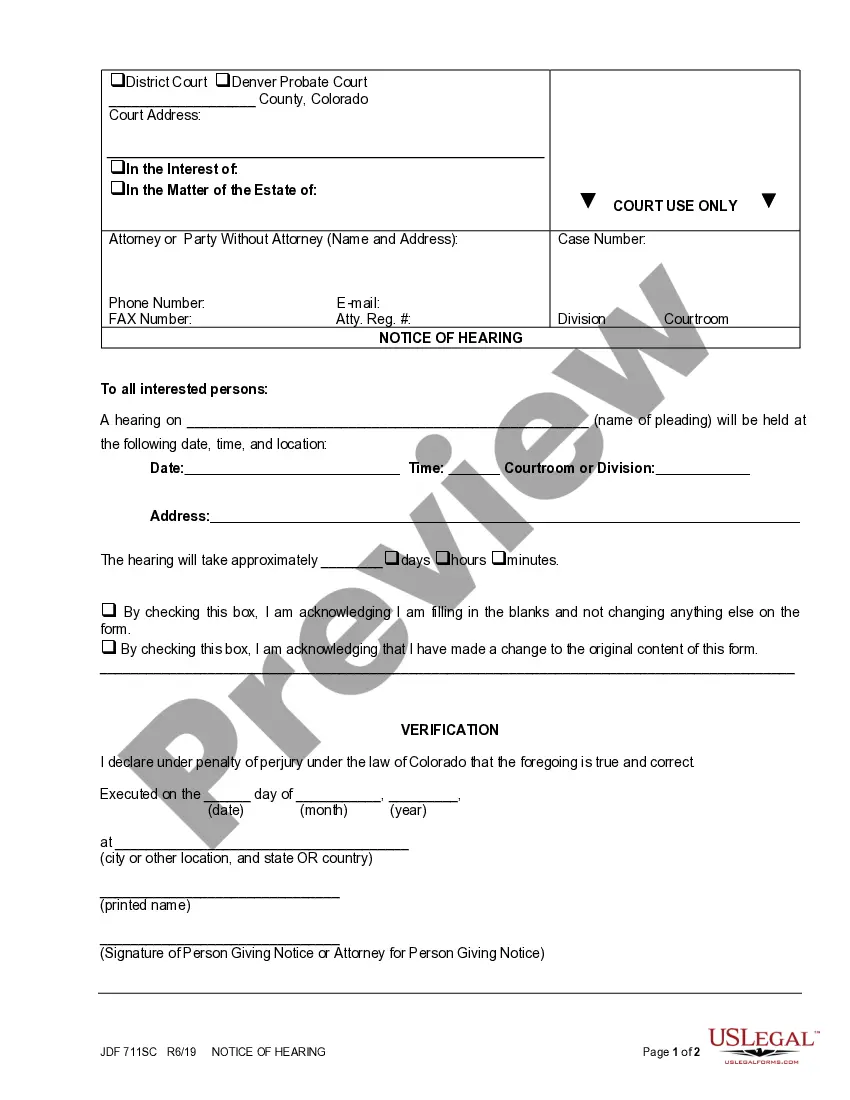

How to fill out Credit Agreement Between Unilab Corp, Various Lending Institutions, Bankers Trust Co And Merrill Lynch Capital Corp?

Have you been in the placement the place you require paperwork for either enterprise or person functions virtually every working day? There are plenty of lawful document web templates accessible on the Internet, but finding types you can rely is not easy. US Legal Forms offers thousands of develop web templates, like the Michigan Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp, which can be published to meet state and federal needs.

Should you be already acquainted with US Legal Forms website and possess your account, simply log in. Afterward, you are able to download the Michigan Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp design.

Should you not have an accounts and want to begin using US Legal Forms, abide by these steps:

- Obtain the develop you want and make sure it is to the correct area/county.

- Take advantage of the Preview key to review the shape.

- Read the explanation to actually have selected the appropriate develop.

- If the develop is not what you are looking for, use the Look for industry to obtain the develop that meets your requirements and needs.

- Whenever you get the correct develop, click Acquire now.

- Select the costs program you would like, fill out the required info to make your bank account, and pay money for the transaction making use of your PayPal or Visa or Mastercard.

- Select a handy paper format and download your duplicate.

Discover all of the document web templates you have bought in the My Forms menus. You may get a additional duplicate of Michigan Credit Agreement between Unilab Corp, Various Lending Institutions, Bankers Trust Co and Merrill Lynch Capital Corp any time, if required. Just click the essential develop to download or print the document design.

Use US Legal Forms, one of the most considerable collection of lawful types, to save lots of efforts and prevent faults. The services offers expertly created lawful document web templates that you can use for a selection of functions. Generate your account on US Legal Forms and start generating your life a little easier.