This handbook describes the Fair Debt Collection Practices Act (FDCPA) and discusses how to negotiate with debt collectors and creditors. The handbook is divided into 4 sections. Section 1 briefly describes how consumer credit got started. Section 2 describes how to deal with debt collectors. Section 3 provides a detailed overview of the FDCPA. Finally, Section 4 is a journal for you to use to document your communicatioins with debt collectors.

Michigan Fair Debt Collection Practices Act Handbook

Description

How to fill out Fair Debt Collection Practices Act Handbook?

Finding the appropriate legal document template can be a challenge.

Certainly, there are numerous templates available online, but how do you find the legal form you require.

Utilize the US Legal Forms website. The service offers thousands of templates, including the Michigan Fair Debt Collection Practices Act Handbook, that you can use for both business and personal purposes.

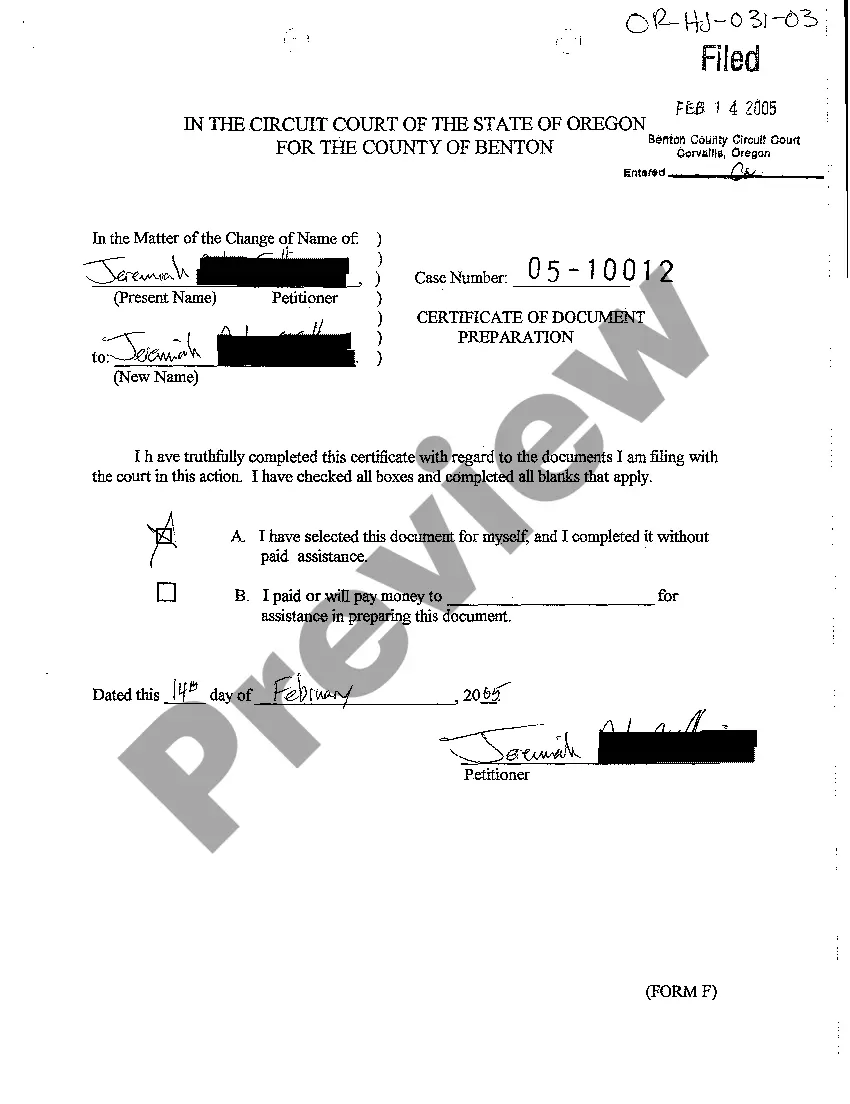

You can preview the form using the Preview button and review the form summary to confirm it is suitable for your needs.

- All templates are vetted by professionals and comply with both federal and state regulations.

- If you are already registered, sign in to your account and click on the Download button to retrieve the Michigan Fair Debt Collection Practices Act Handbook.

- Utilize your account to search for the legal forms you have previously purchased.

- Navigate to the My documents tab of your account and secure another copy of the document you need.

- If you are a first-time user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have chosen the correct form for your specific city/county.

Form popularity

FAQ

The most common violation of the Fair Debt Collection Practices Act involves harassment tactics, such as repeated phone calls or threatening messages. Collectors may also falsely claim legal action or misrepresent the amount owed. Staying informed with the Michigan Fair Debt Collection Practices Act Handbook can help consumers recognize these practices and take necessary action against violations.

For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts. If your home is repossessed and you still owe money on your mortgage, the time limit is 6 years for the interest on the mortgage and 12 years on the main amount.

According to Michigan law, your creditor has up to 6 years (from the date of your last payment) to collect on a debt, including obtaining a judgment on the debt. By getting a judgment, your creditor can pursue collections (likely a garnishment) almost indefinitely as long as they renew the judgment every 10 years.

Are debts really written off after six years? After six years have passed, your debt may be declared statute barred - this means that the debt still very much exists but a CCJ cannot be issued to retrieve the amount owed and the lender cannot go through the courts to chase you for the debt.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

What are the provisions of the FDCPA?Call Time Restrictions.Honoring Workplace Opt-Outs.Honoring Home Phone Opt-Outs.Restrictions Against Harassment.Restrictions Against Unfair Practices.Restrictions Against False Lawsuit Threats.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Michigan has a statute of limitations of six years, which applies to all types of debts. This means that if a debt is more than six years overdue or hasn't been paid in more than six years, creditors cannot take legal action.

Here are five ways the Fair Debt Collection Practices Act protects you and what to do if your rights are violated:You control communication with debt collectors.You're protected from harassing or abusive practices.Debt collectors must be truthful.Unfair practices are prohibited.Collectors must validate your debt.More items...