Michigan Proposed merger with the Grossman Corporation

Description

How to fill out Proposed Merger With The Grossman Corporation?

Have you been within a situation that you need to have paperwork for either company or specific reasons nearly every day time? There are plenty of authorized record themes available online, but finding kinds you can rely on isn`t easy. US Legal Forms provides a huge number of type themes, such as the Michigan Proposed merger with the Grossman Corporation, that are composed in order to meet state and federal specifications.

In case you are currently informed about US Legal Forms web site and possess your account, merely log in. Next, you may download the Michigan Proposed merger with the Grossman Corporation web template.

If you do not offer an account and would like to start using US Legal Forms, abide by these steps:

- Obtain the type you require and make sure it is for the proper town/region.

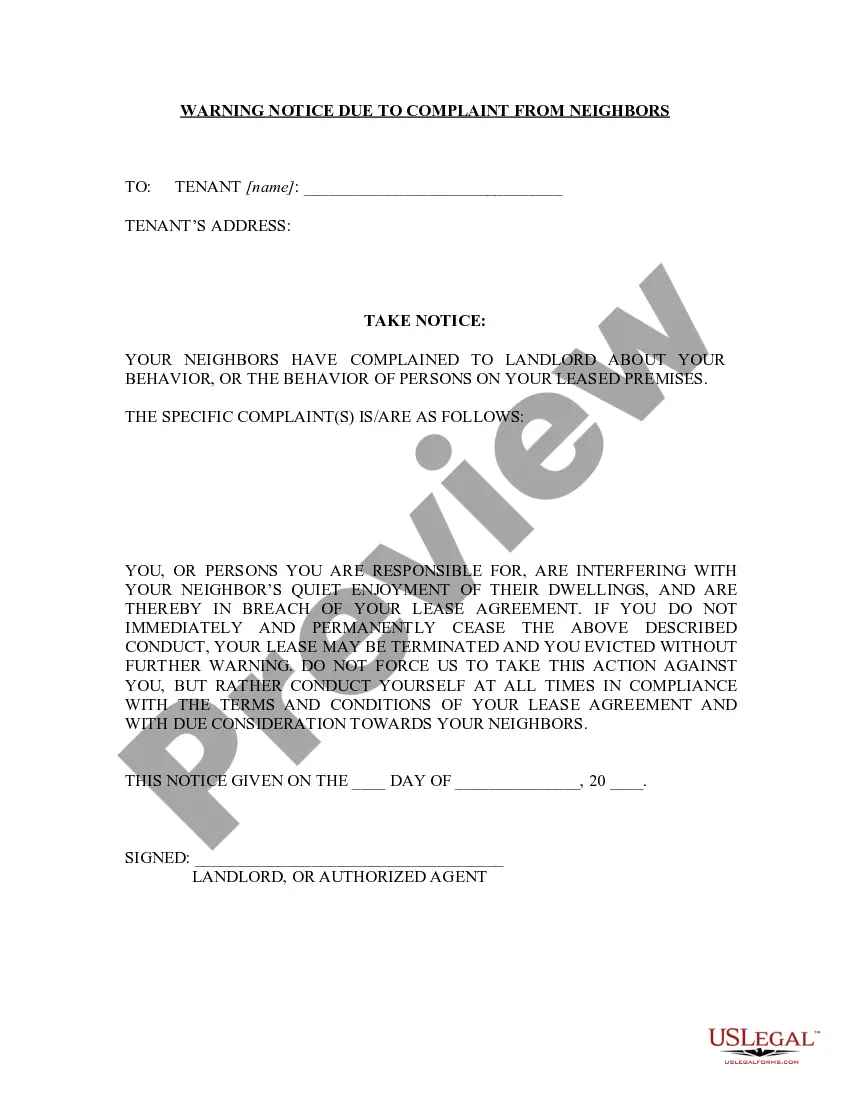

- Take advantage of the Review option to analyze the form.

- Read the information to actually have chosen the right type.

- When the type isn`t what you`re looking for, utilize the Look for industry to get the type that fits your needs and specifications.

- Once you find the proper type, click Buy now.

- Select the costs program you want, submit the required info to create your money, and purchase an order making use of your PayPal or bank card.

- Pick a hassle-free file file format and download your duplicate.

Discover every one of the record themes you might have purchased in the My Forms food list. You can obtain a extra duplicate of Michigan Proposed merger with the Grossman Corporation whenever, if necessary. Just click on the necessary type to download or print the record web template.

Use US Legal Forms, probably the most comprehensive selection of authorized varieties, to save time and prevent mistakes. The services provides expertly created authorized record themes that can be used for a variety of reasons. Generate your account on US Legal Forms and commence producing your daily life easier.

Form popularity

FAQ

To start a corporation in Michigan, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Department of Licensing and Regulatory Affairs (LARA). You can file this document online, by mail or in person.

If you're looking to incorporate in Michigan, you're in the right place. This guide will help you file formation documents, get tax identification numbers, and set up your company records. Incorporation: ~5-7 business days with returned documents in ~4 weeks when filing by mail or in-person.

Initial Michigan Corporation Filing Fee State FeeState Filing TimeExpedited Filing Time$604 Weeks1 Business Days *State Fee$60State Filing Time4 WeeksExpedited Filing Time1 Business Days *

An LLC is easier and less expensive to start and maintain than a corporation. An LLC's members can choose for the business to be taxed as a pass-through entity or corporation. Michigan LLC formation fees are lower than average. Michigan doesn't charge an annual LLC tax.

Starting a business corporation in Michigan Choose the business entity type. ... Choose a name for the company. ... Create folders to hold corporate records and documents. ... Obtain a Federal Employer Identification Number (FEIN). ... Obtain an Unemployment Insurance Account (UIA) number.

To start a corporation in Michigan, you'll need to do three things: appoint a registered agent, choose a name for your business, and file Articles of Incorporation with the Department of Licensing and Regulatory Affairs (LARA). You can file this document online, by mail or in person.