Michigan Stock Participation Plan of Maynard Oil Co.

Description

How to fill out Stock Participation Plan Of Maynard Oil Co.?

Have you been in the place the place you require files for both organization or specific purposes just about every working day? There are plenty of legal papers web templates available on the Internet, but getting versions you can depend on is not simple. US Legal Forms gives thousands of develop web templates, much like the Michigan Stock Participation Plan of Maynard Oil Co., which are composed in order to meet federal and state needs.

When you are already informed about US Legal Forms website and have a merchant account, simply log in. Afterward, you may acquire the Michigan Stock Participation Plan of Maynard Oil Co. web template.

Should you not offer an profile and want to start using US Legal Forms, follow these steps:

- Get the develop you want and ensure it is for the right area/county.

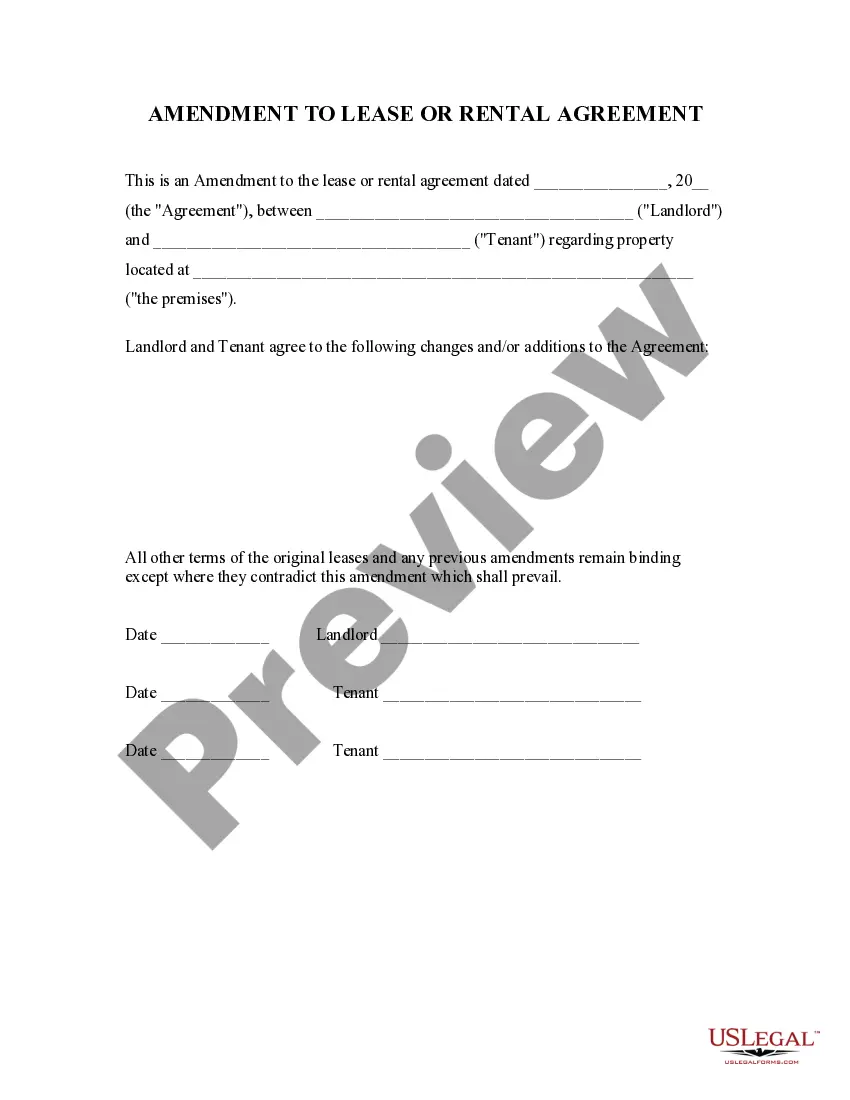

- Use the Review switch to analyze the shape.

- Browse the description to actually have selected the right develop.

- In case the develop is not what you`re trying to find, use the Look for field to find the develop that fits your needs and needs.

- When you obtain the right develop, click on Buy now.

- Opt for the prices prepare you want, submit the specified information to make your account, and purchase the transaction making use of your PayPal or bank card.

- Choose a handy data file formatting and acquire your version.

Discover each of the papers web templates you may have bought in the My Forms menu. You may get a extra version of Michigan Stock Participation Plan of Maynard Oil Co. anytime, if possible. Just click the necessary develop to acquire or produce the papers web template.

Use US Legal Forms, the most extensive variety of legal types, in order to save time as well as stay away from mistakes. The support gives professionally created legal papers web templates which can be used for a selection of purposes. Produce a merchant account on US Legal Forms and begin generating your way of life easier.

Form popularity

FAQ

The primary difference is that an ESO is a compensation plan and employee benefit, whereas an ESOP qualifies as a retirement plan, such as a 401(k). With an ESOP, employees don't purchase shares with their own money, while ESOs allow employees to use their money to buy company shares at a discounted rate.

Often, company shares are immediately repurchased by the ESOP, and the employee receives cash equivalent to fair market value as determined by the most recent annual valuation. In other cases, the company distributes the employee's shares directly to them.

Unlike an ESOP, an EOT doesn't allocate shares to employees ? and therefore, it's not obligated to repurchase shares when employees depart. That eliminates the financial obligation of stock repurchases, which an ESOP has to plan and account for.

Contributions may include new shares of stock, company cash to buy existing shares or borrowed money to buy stock. If you borrow from an ESOP, both principal and interest paid back are deductible.

Hence, you cannot transfer the ESOPS to any other person. The shares allotted to an employee under an ESOP are considered as a capital asset and any gain on the sale of such shares would attract capital gain tax. Here's a read on ESOPs Taxation on Sale of Shares.

ESOPs allocate shares to each eligible employee every year, giving employees an increasing ownership stake as they gain seniority. The ESOP plan distributes these shares to employees to fund their retirement.

A company can set up an ESOT to provide shares to employees. Shares can be retained in the trust for up to 20 years. To date, ESOTs have mainly been set up by State and semi-State bodies. An ESOT is normally set up in conjunction with an Approved Profit-Sharing Scheme (APSS).

The most common allocation formula is in proportion to compensation, years of service, or both. New employees usually join the plan and start receiving allocations after they've completed at least one year of service. The shares in an ESOP allocated to employees must vest before employees are entitled to receive them.

An Employee Stock Ownership Plan (ESOP) is an individual stock bonus plan designed specifically to invest in the stock of the employer corporation. An ESOP may be either nonleveraged or leveraged. An Employee Stock Ownership Trust (ESOT) is the entity responsible for administering the ESOP.

The most notable difference between an ESOP vs ESPP is in how the employee receives the stock and when they can sell the stock. ESOPs provide the stock or shares at no cost to employees. ESPPs require participants to contribute funds to purchase shares of stock, though at a discounted rate.