Michigan Employee Stock Ownership Plan of Franklin Savings Bank - Detailed

Description

How to fill out Employee Stock Ownership Plan Of Franklin Savings Bank - Detailed?

Are you currently in the situation that you need documents for both business or specific reasons virtually every day time? There are a lot of lawful document templates available on the Internet, but discovering kinds you can rely is not simple. US Legal Forms offers a huge number of form templates, such as the Michigan Employee Stock Ownership Plan of Franklin Savings Bank - Detailed, that are written in order to meet state and federal demands.

If you are presently acquainted with US Legal Forms website and get your account, merely log in. Afterward, you are able to obtain the Michigan Employee Stock Ownership Plan of Franklin Savings Bank - Detailed format.

Unless you provide an accounts and wish to start using US Legal Forms, abide by these steps:

- Find the form you require and make sure it is for your appropriate metropolis/region.

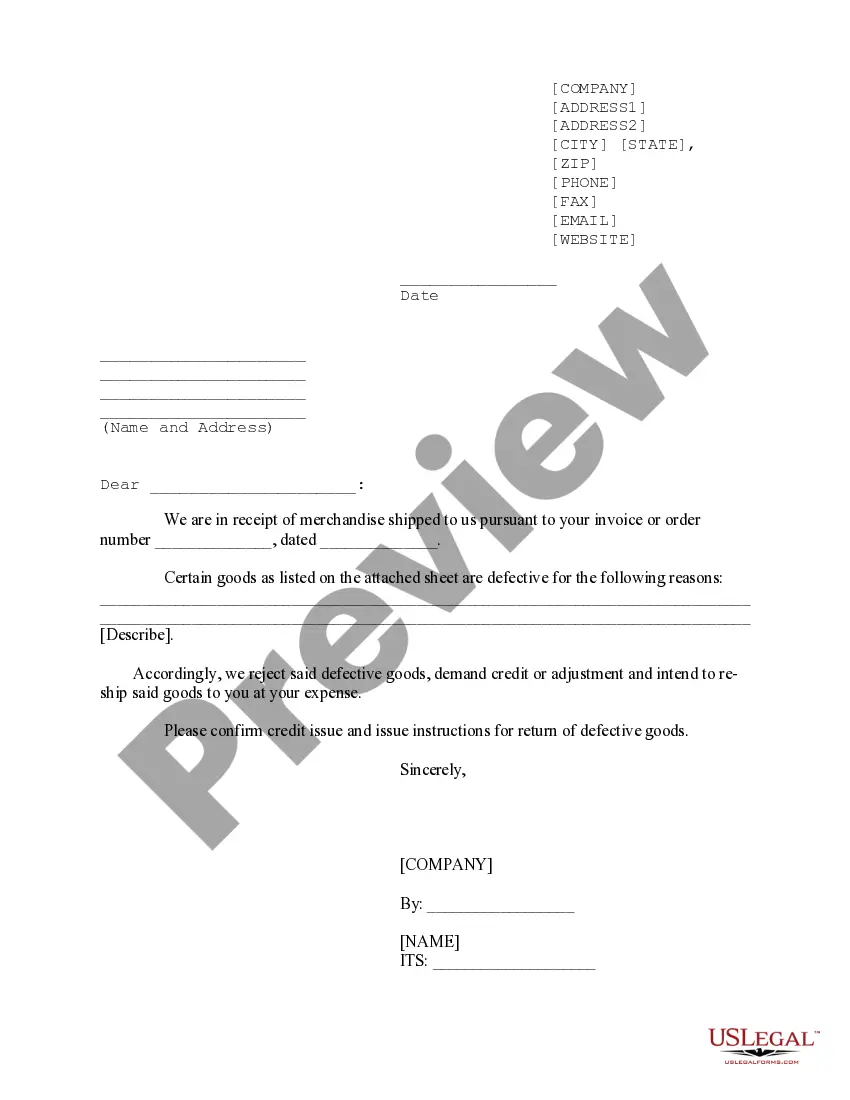

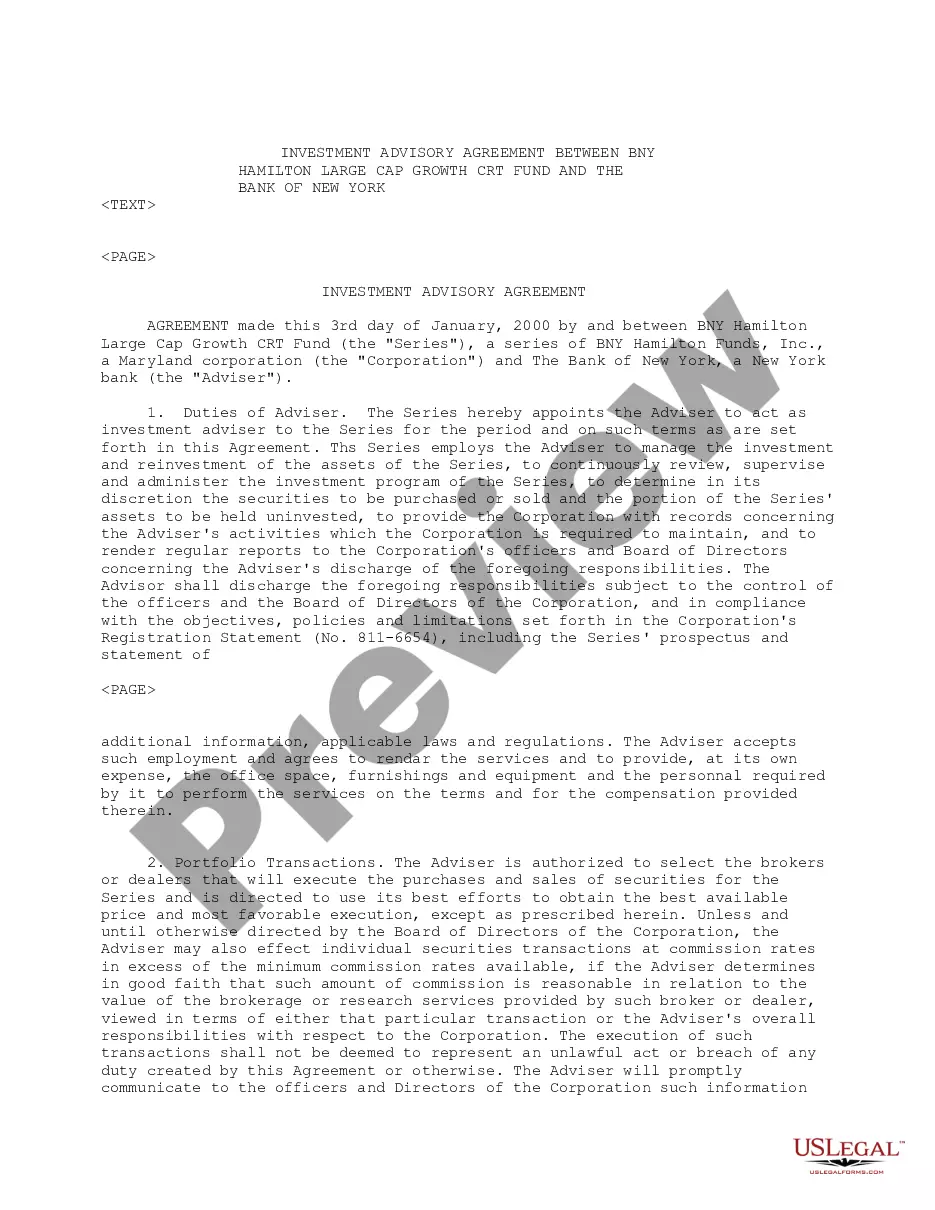

- Utilize the Review switch to check the shape.

- Browse the description to ensure that you have chosen the proper form.

- If the form is not what you`re seeking, use the Search field to find the form that suits you and demands.

- When you obtain the appropriate form, click on Acquire now.

- Choose the pricing strategy you need, complete the necessary details to create your account, and purchase the transaction making use of your PayPal or Visa or Mastercard.

- Select a practical document structure and obtain your version.

Get all of the document templates you possess purchased in the My Forms menus. You can aquire a additional version of Michigan Employee Stock Ownership Plan of Franklin Savings Bank - Detailed anytime, if necessary. Just go through the essential form to obtain or print the document format.

Use US Legal Forms, the most extensive collection of lawful varieties, in order to save efforts and stay away from mistakes. The support offers skillfully manufactured lawful document templates that can be used for a variety of reasons. Create your account on US Legal Forms and initiate creating your daily life a little easier.

Form popularity

FAQ

ESOP rules set a limit of 25% of salary as the maximum amount that can be contributed to a participant's account annually, though most companies contribute between 6-10% of salary annually. The 25% is a combined limit that includes ESOPs, 401(k)s, profit sharing, and stock bonus plans offered by the company.

An ESOP Valuation is the process by which the Fair Market Value (FMV) of a company's ESOP shares is determined by an independent appraiser and confirmed by the company's ESOP trustee. Ultimately, under the recommendation of the appraiser, the fiduciary (trustee) makes the final ESOP valuation.

1.Exit without exercising stock options Employees who leave the organization before completing the vesting period forfeit the right to own any stock. Even if the contract offers a partial vesting option, and they do not complete any of the conditions, they still forfeit the rights to own the stock.

An ESOP grants company stock to employees, often based on the duration of their employment. Typically, it is part of a compensation package, where shares will vest over a period of time. ESOPs are designed so that employees' motivations and interests are aligned with those of the company's shareholders.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. at fair market value (unless there's a public market for the shares). So, the employee receives the value of his or her shares from the trust, usually in the form of cash.

Benefits of an ESOP Over 401K ESOPs offer far more benefits than 401ks. For this reason, satisfaction?both from employees and employers?with ESOPs tends to be far higher than that of 401ks. ESOPs most-effectively reward workers both for their increased productivity but also for their continued employment.

Key Takeaways. An employee stock ownership plan (ESOP) is an employee benefit plan that gives workers ownership interest in the company in the form of shares of stock. ESOPs encourage employees to give their all as the company's success translates into financial rewards.

An ESOP is an employee benefit plan that enables employees to own part or all of the company they work for. ESOPs are most commonly used to facilitate succession planning, allowing a company owner to sell his or her. shares and transition flexibly out of the business.