Michigan Personal Property - Schedule B - Form 6B - Post 2005

Description

How to fill out Personal Property - Schedule B - Form 6B - Post 2005?

Finding the right lawful document design could be a struggle. Of course, there are a lot of themes available on the net, but how can you discover the lawful kind you will need? Utilize the US Legal Forms site. The service delivers 1000s of themes, like the Michigan Personal Property - Schedule B - Form 6B - Post 2005, which you can use for enterprise and personal requires. Each of the forms are examined by experts and meet up with state and federal requirements.

In case you are currently authorized, log in in your accounts and click the Obtain option to get the Michigan Personal Property - Schedule B - Form 6B - Post 2005. Make use of accounts to appear from the lawful forms you possess bought formerly. Check out the My Forms tab of your own accounts and get an additional copy from the document you will need.

In case you are a whole new consumer of US Legal Forms, listed below are easy guidelines that you should comply with:

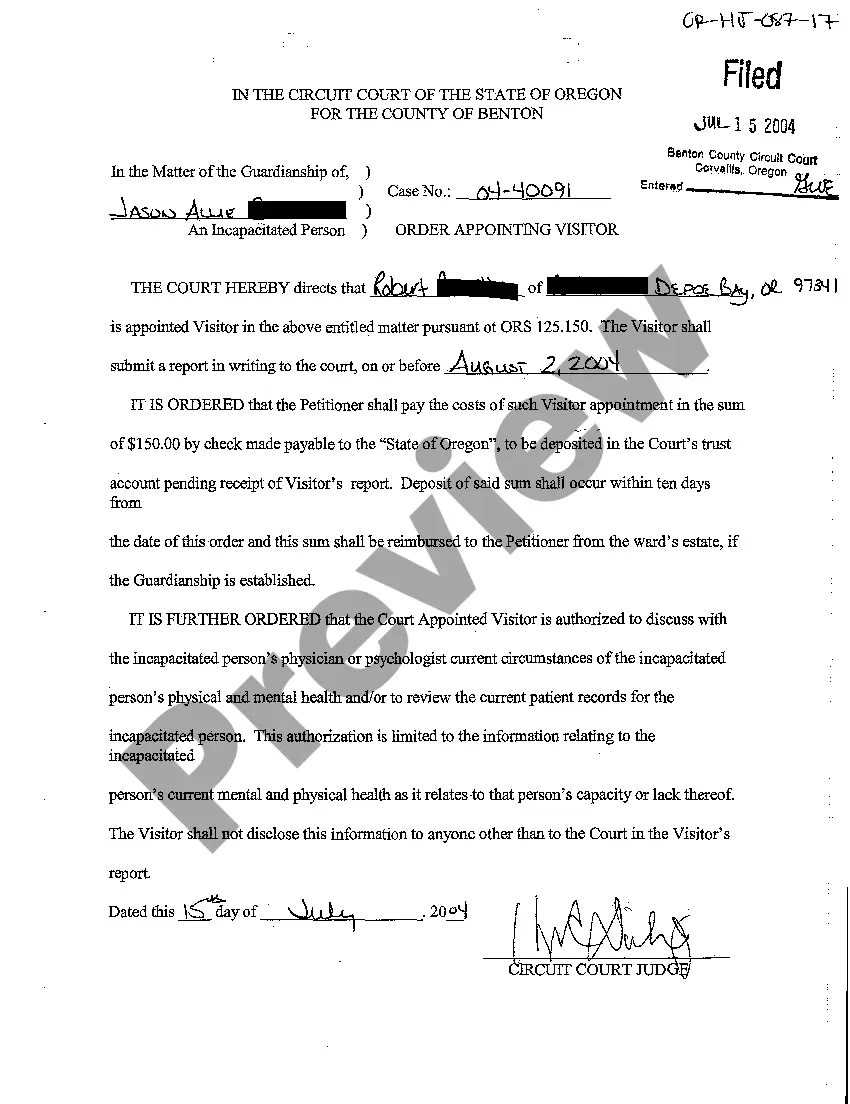

- Very first, ensure you have selected the correct kind to your city/county. You may examine the form while using Review option and look at the form description to ensure this is basically the right one for you.

- In the event the kind fails to meet up with your needs, take advantage of the Seach area to get the proper kind.

- Once you are positive that the form is acceptable, click on the Buy now option to get the kind.

- Choose the pricing plan you desire and enter the essential information and facts. Make your accounts and pay money for the transaction making use of your PayPal accounts or charge card.

- Choose the data file file format and acquire the lawful document design in your device.

- Full, revise and printing and sign the obtained Michigan Personal Property - Schedule B - Form 6B - Post 2005.

US Legal Forms will be the largest catalogue of lawful forms where you can find a variety of document themes. Utilize the company to acquire professionally-made paperwork that comply with express requirements.

Form popularity

FAQ

Yes. Inventory tax is a ?taxpayer active? tax. That the taxpayer (business owner) must calculate it. Business owners can count and value unsold inventory based on one of the three accepted valuation methods: cost, retail, or lower of cost or retail.

The small business taxpayer personal property exemption provides a complete exemption from personal property tax for industrial or commercial personal property when the combined true cash value of all industrial personal property and commercial personal property owned by, leased by or in the possession of the owner or ...

Vehicles pay an annual registration fee in lieu of state and local property taxes. Vehicles that have not paid the fee or are not registered are taxable.

Personal property is defined as property that is not real property (i.e., is not land, buildings, etc.). Examples of personal property include, but are not limited to: computers. display racks.

Inventory is exempt from property taxation. "Inventory" means (1) the stock of goods held for resale in the regular course of trade of a retail or wholesale business, (2) a manufacturing business's finished goods, goods in process, and raw materials, and (3) materials and supplies, including fuel and repair parts.

Sign and date the quitclaim deed in a notary's presence, then file it with the County Register of Deeds Office in the property's county, not the county where you live. Once the deed is filed and recorded, the transfer is deemed legal.

Michigan Tax Rates A mill is equal to $1 of tax for every $1,000 of taxable value. For example, if your total tax rate is 20 mills and your taxable value is $50,000, your taxes owed would be $1,000 annually. Homeowners living in their principal residence in Michigan are eligible for the Principal Residence Exemption.

Michigan has no inventory tax. Additional property tax abatements available to Michigan businesses include: Locally-negotiated abatements, including 100% new real property exemptions available in specified communities.