Michigan Department Time Report for Payroll

Description

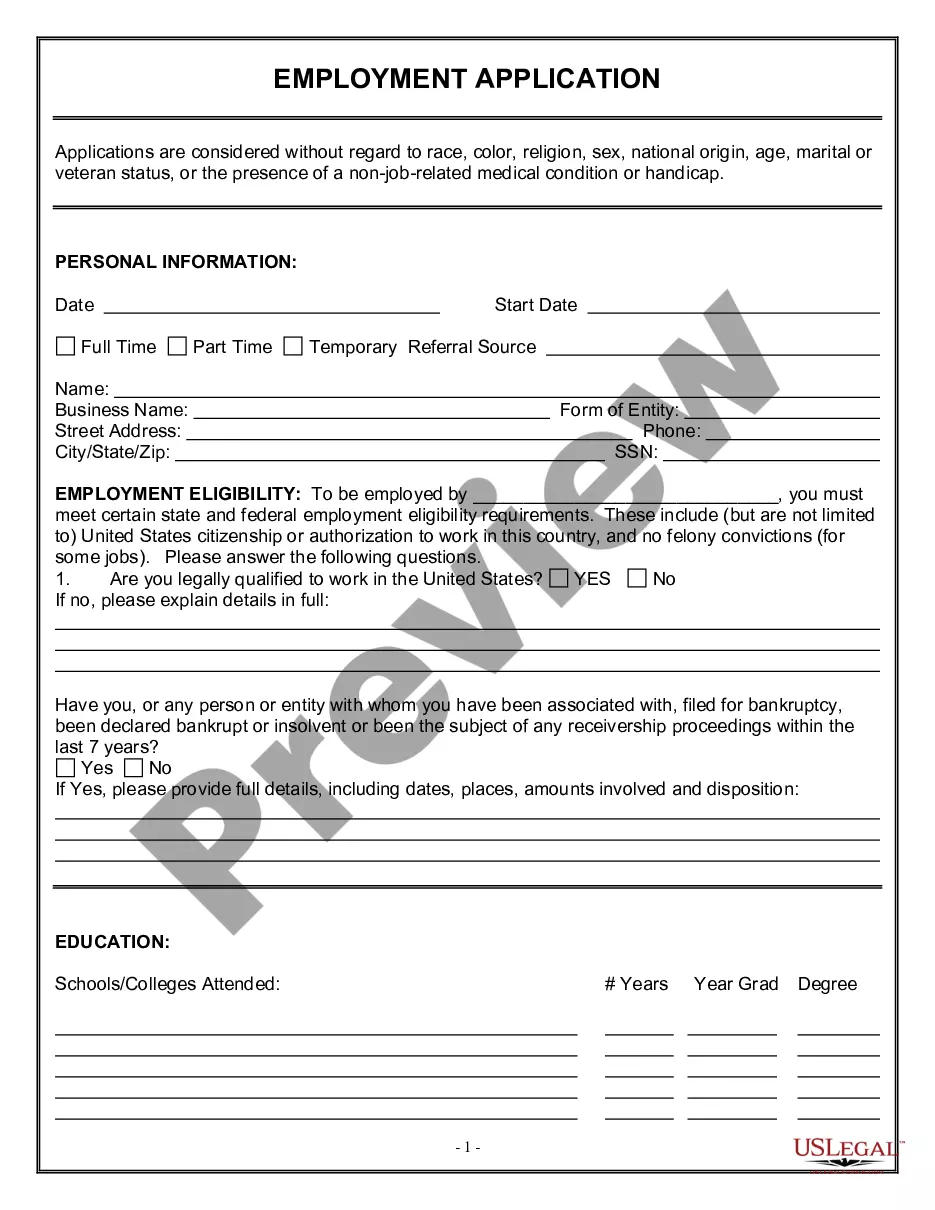

How to fill out Department Time Report For Payroll?

If you wish to sum up, obtain, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms, accessible online.

Employ the site’s straightforward and efficient search feature to locate the documents you need.

Various templates for business and personal purposes are organized by categories and states, or keywords.

Avoid altering or deleting any HTML tags. Only synonymize plain text outside of the HTML tags.

- Utilize US Legal Forms to find the Michigan Department Time Report for Payroll with just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and then click the Download button to get the Michigan Department Time Report for Payroll.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, adhere to the steps below.

- Step 1. Ensure you have chosen the form for the correct state/region.

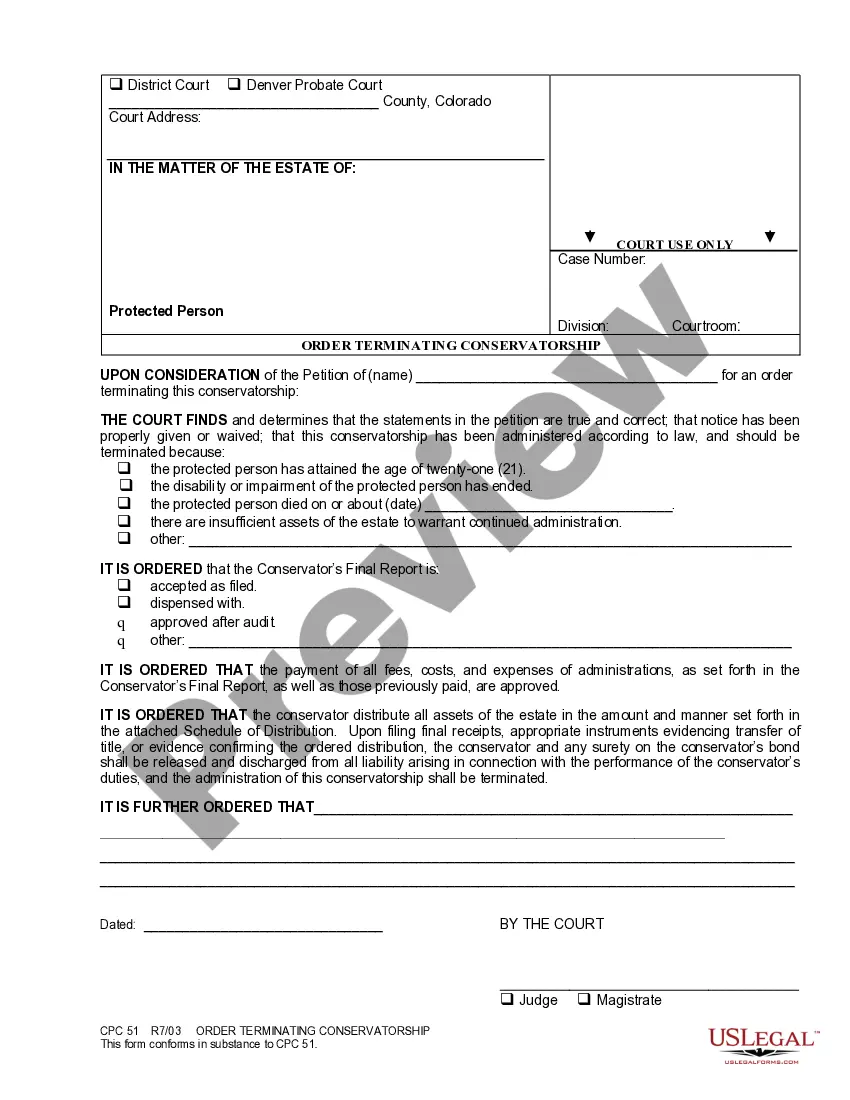

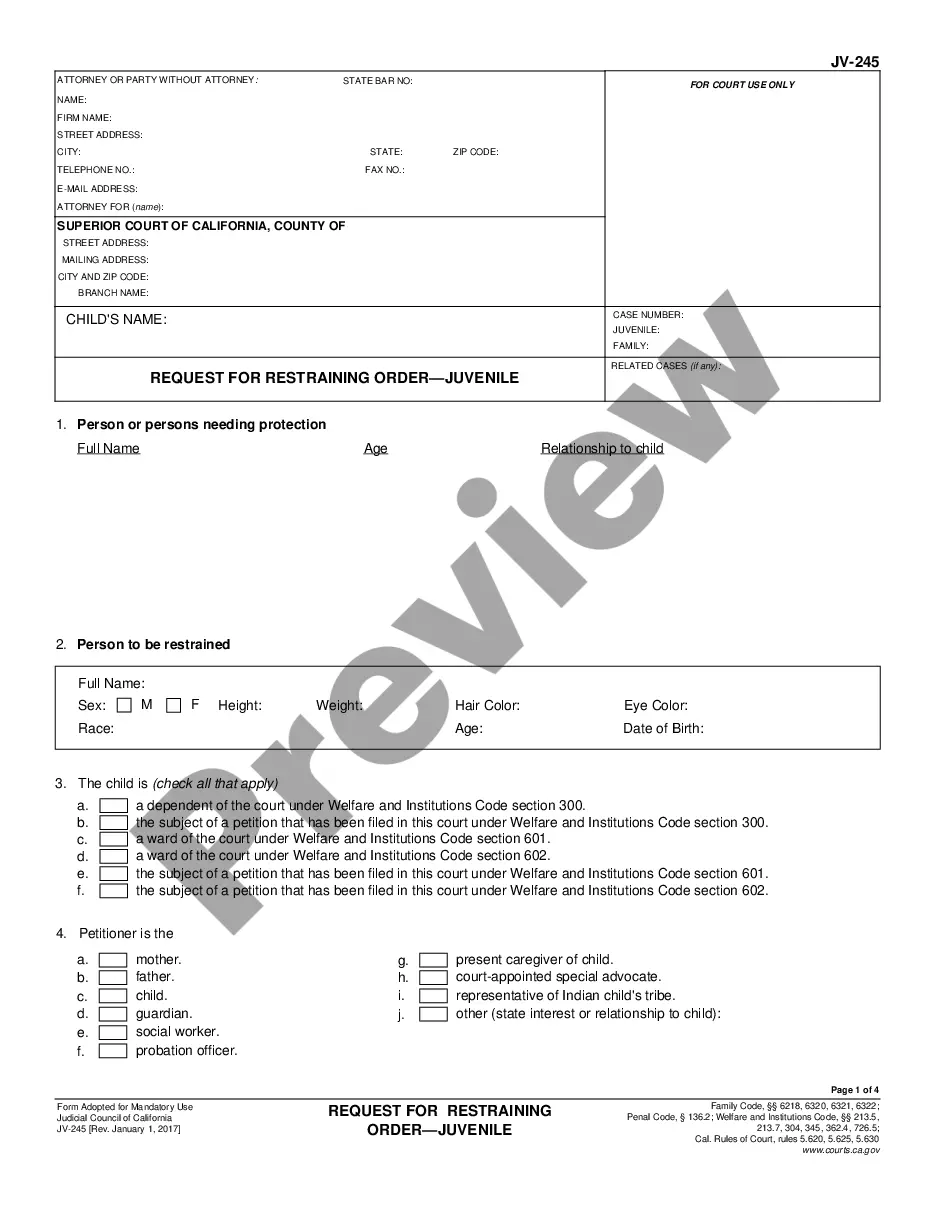

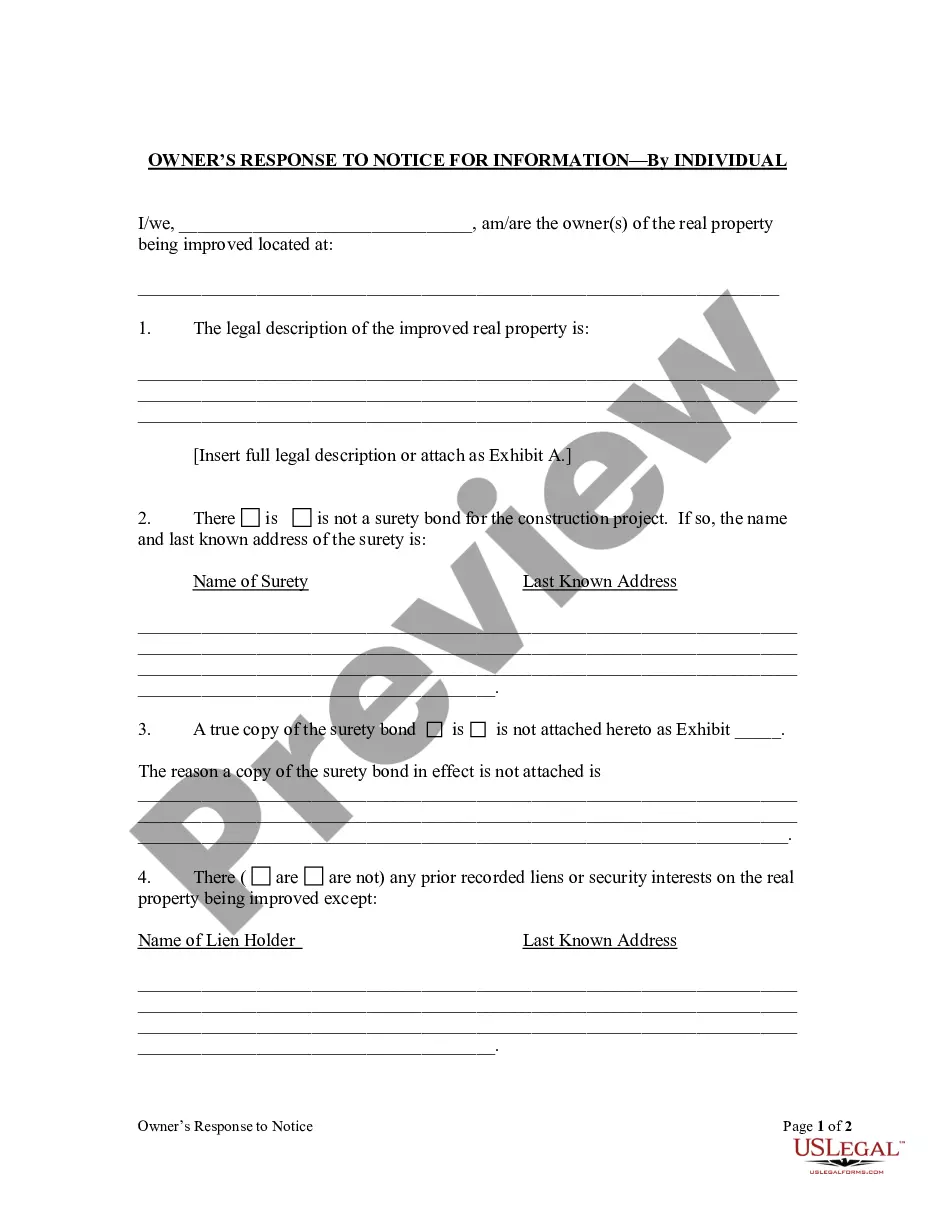

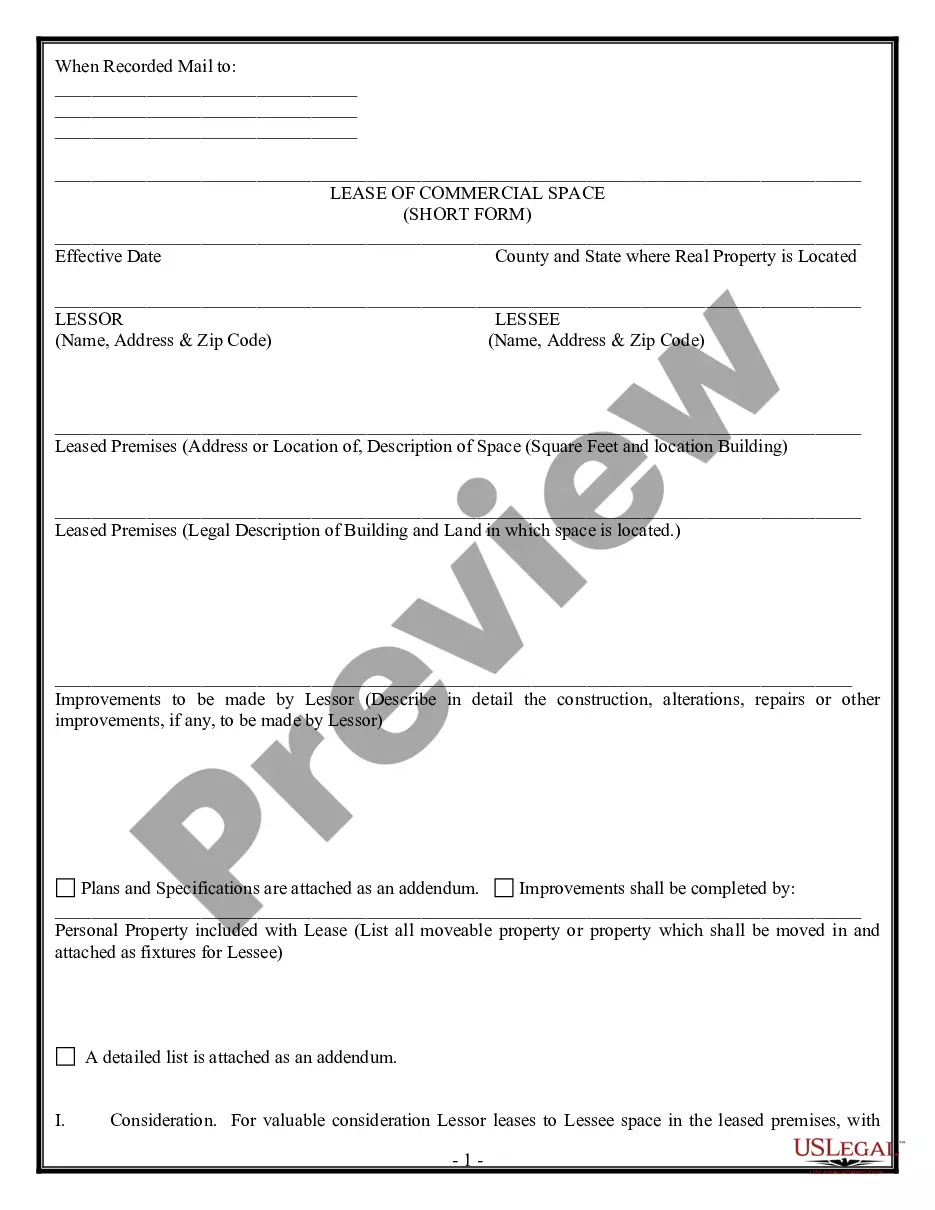

- Step 2. Use the Preview option to examine the content of the form. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. After you have found the form you need, click on the Purchase now button. Choose the payment plan you prefer and enter your details to register for the account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Michigan Department Time Report for Payroll.

- Every legal document template you buy is yours permanently.

- You have access to every form you downloaded in your account. Click the My documents section and select a form to print or download again.

- Stay competitive and obtain and print the Michigan Department Time Report for Payroll with US Legal Forms.

- There are millions of professional and state-specific forms available for your business or personal needs.

Form popularity

FAQ

What payroll reports do employers need to file?Wages paid to employees.Federal income tax withheld from employee wages.Medicare and Social Security taxes deducted from employee wages.Employer contributions to Medicare and Social Security taxes.

Form UIA 1028 can also be filed online by selecting the Operate a Business option from the Michigan Business One Stop web site and selecting the task File and Pay Quarterly Taxes. Selecting this task will link you to the online services offered by UIA through the Michigan Web Account Manager (MiWAM).

Four Steps In Setting Up Your Small Business Payroll SuccessUnderstanding the responsibilities of your managing your payroll.Choosing the right payroll system for your particular company.Ensuring that your employees are paid correctly.Paying payroll taxes and filing tax forms.

A state Employer Identification Number (EIN) or Employer Account Number (EAN) is a number assigned by a state government to an employer to track one of the following: Payroll tax liabilities and remittances. Unemployment insurance liability.

They are put in place to keep track of worked hours, calculating wages, withholding taxes and other deductions, printing and delivering checks and paying government employment taxes.

Employers are required to file Employer's Quarterly Wage/Tax Reports listing their employees and the wages earned for each quarter. A quarterly report must be filed even if you do not have any employees and/or wages to report for the quarter.

A payroll report is a document that includes specific financial and tax information, including pay rates, hours worked, federal and state income taxes withheld, vacation or sick days used, overtime incurred, tax withholdings, and benefit costs.

TLDR. A payroll report is a document that includes specific financial and tax information, including pay rates, hours worked, federal and state income taxes withheld, vacation or sick days used, overtime incurred, tax withholdings, and benefit costs.

You can find your employers FEIN on your W-2 form.

Private, for-profit employers, which includes most employers, are called contributing employers. Each calendar quarter, a contributing employer files a UIA 1028 with the UIA, called a Employer's Quarterly Wage/Tax Report. Employers use the report to compute and pay their unemployment insurance tax.