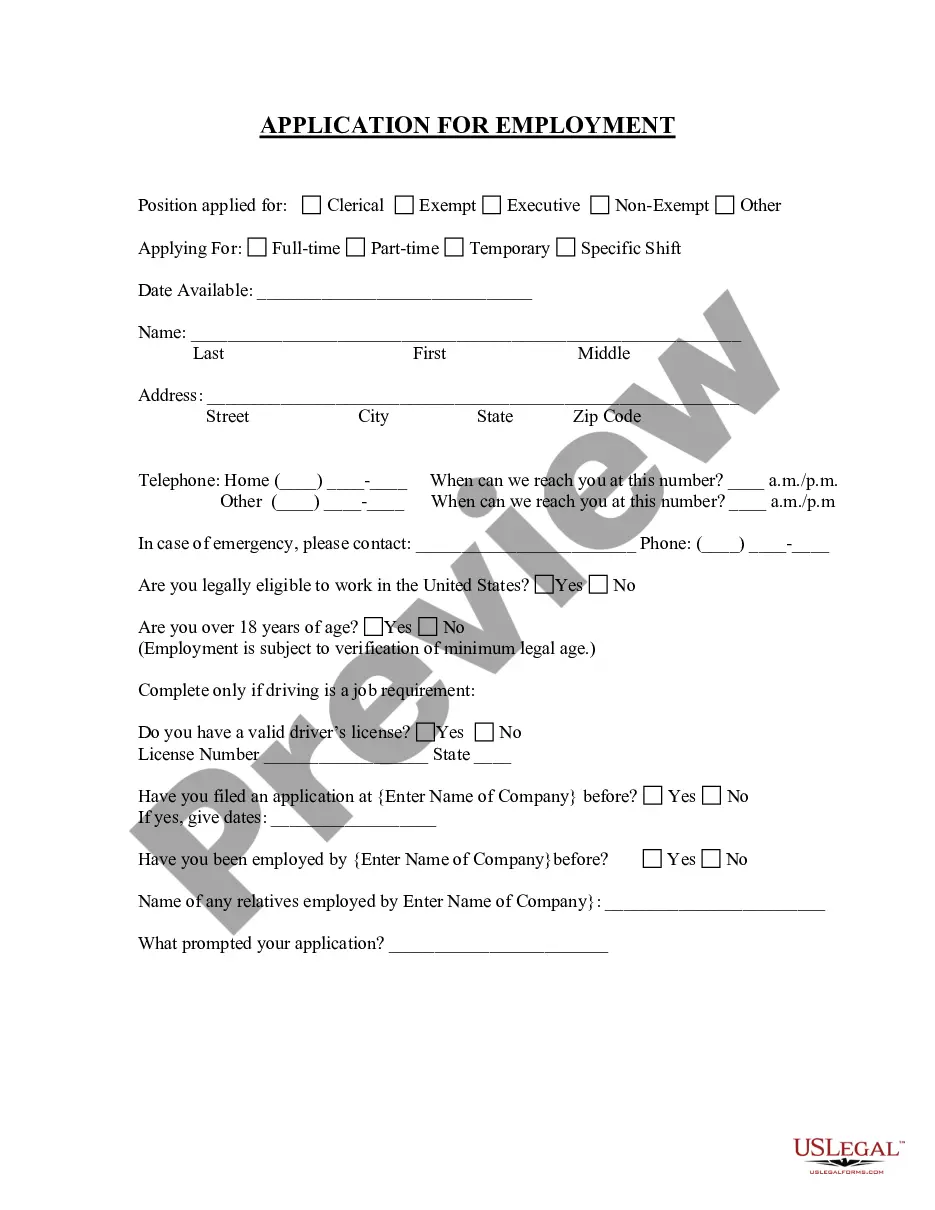

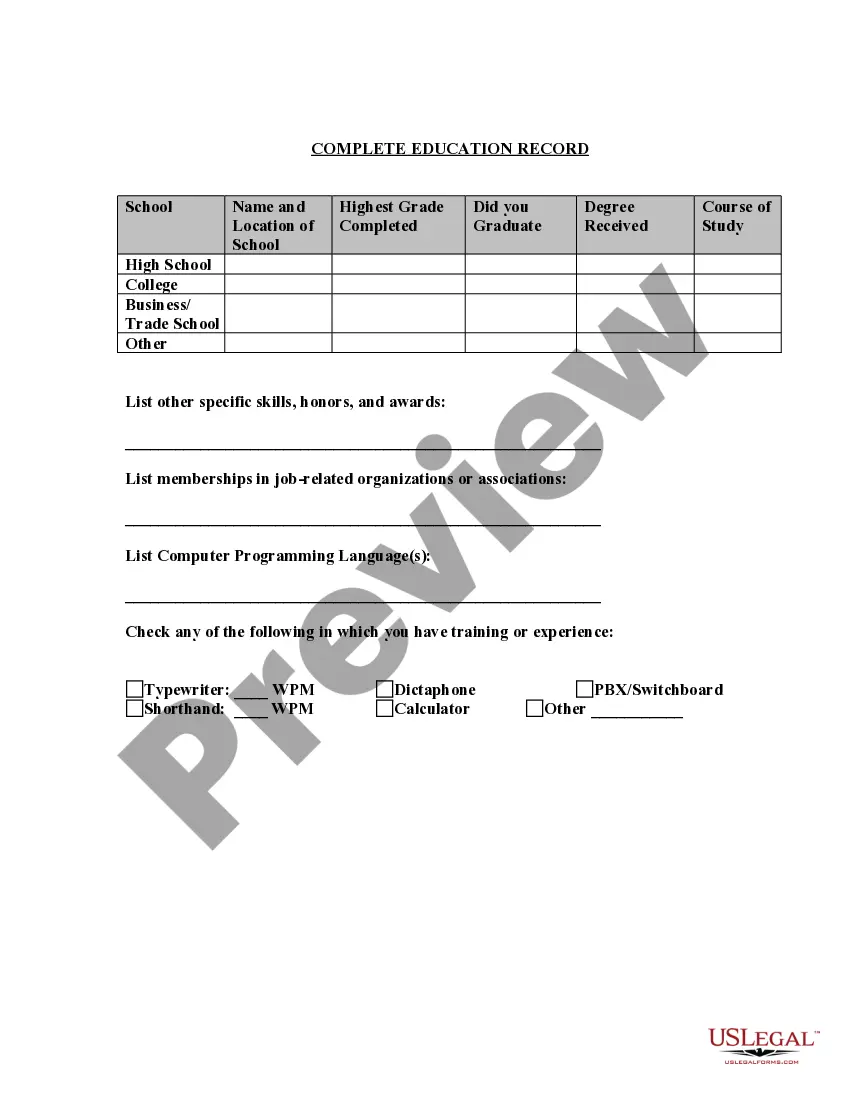

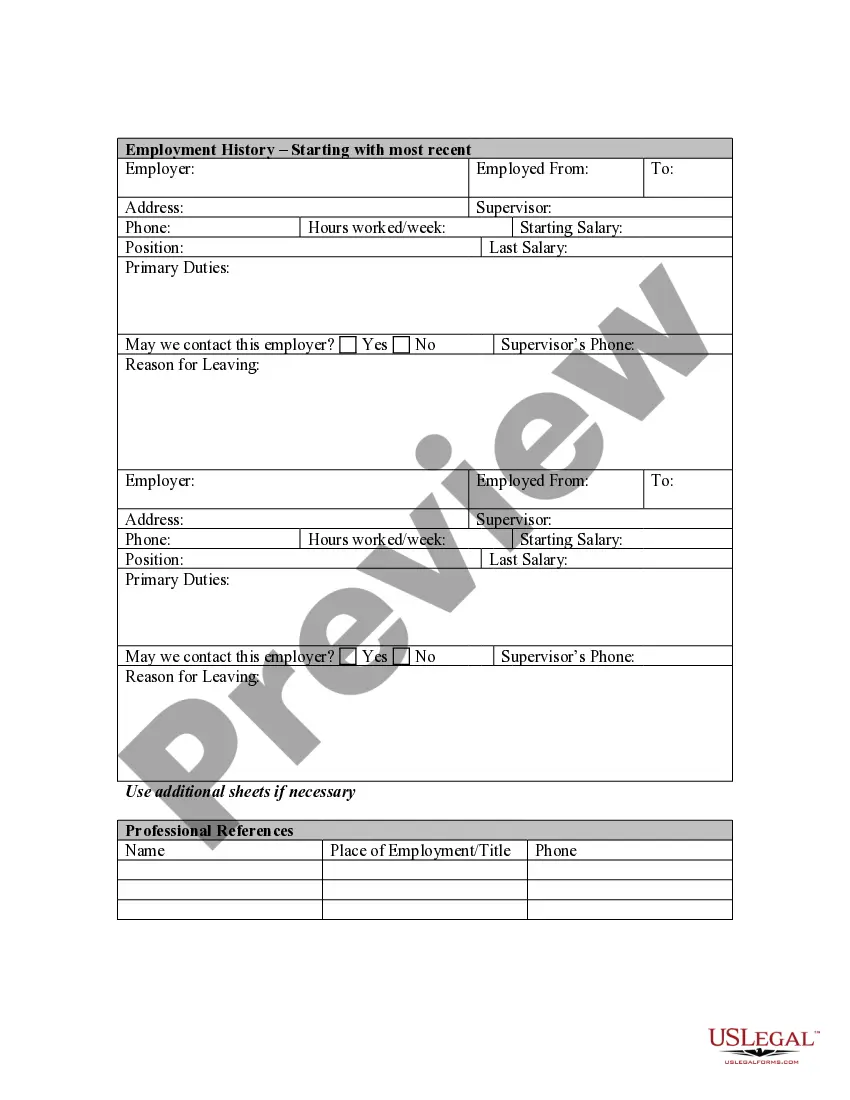

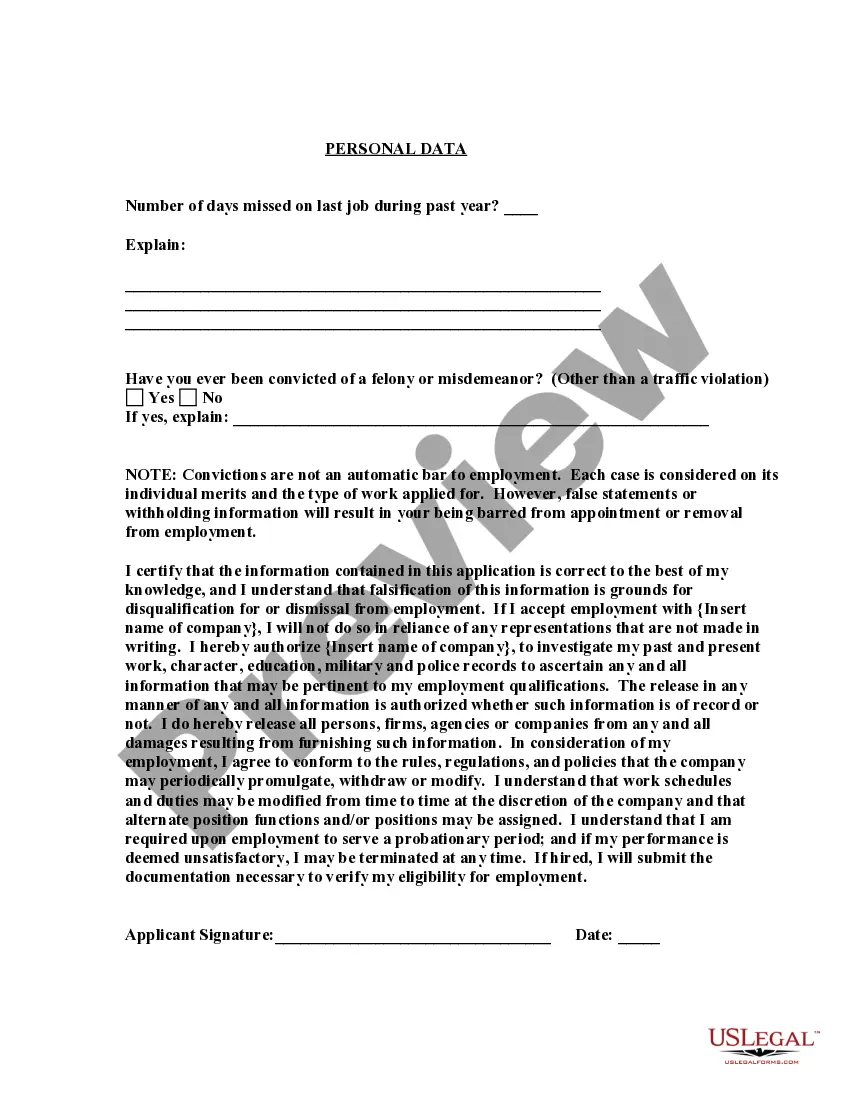

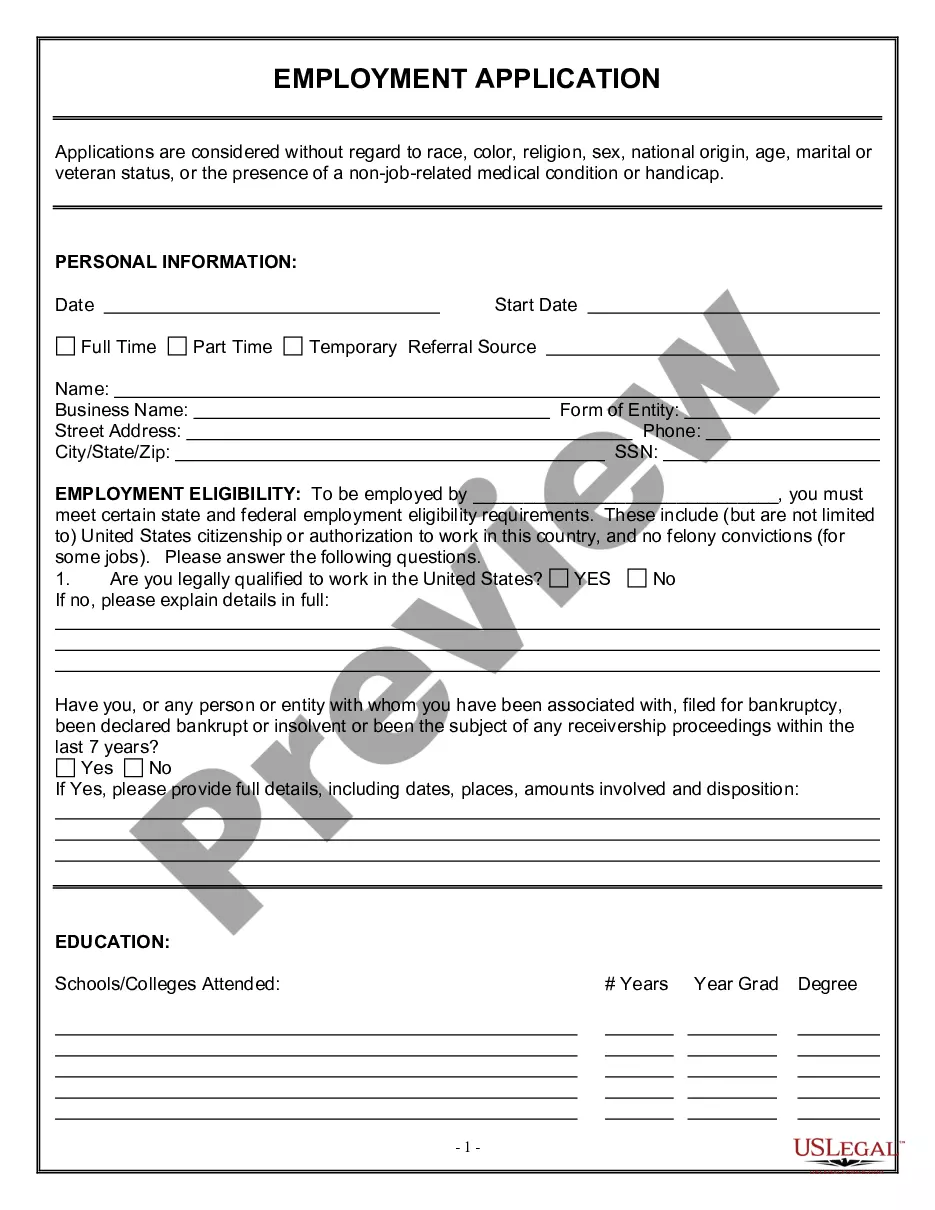

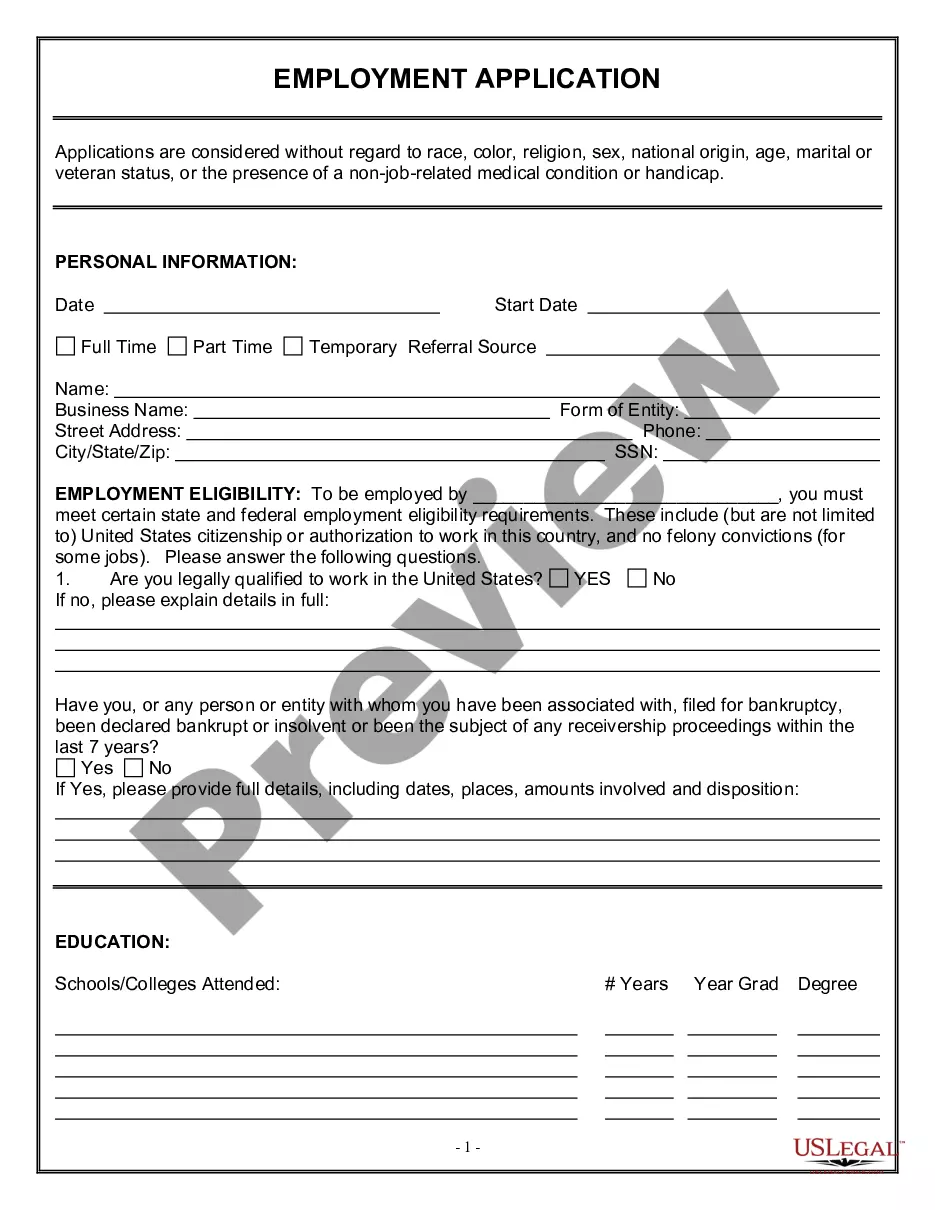

Michigan Application for Work or Employment - Clerical, Exempt, Executive, or Nonexempt Position

Description

How to fill out Application For Work Or Employment - Clerical, Exempt, Executive, Or Nonexempt Position?

Locating the appropriate sanctioned document template can be a struggle.

Indeed, there are numerous formats available on the internet, but how do you obtain the legal document you require? Utilize the US Legal Forms website.

The platform provides thousands of templates, including the Michigan Application for Employment - Clerical, Exempt, Executive, or Nonexempt Position, which can be utilized for both business and personal purposes.

- All of the documents are reviewed by experts and comply with federal and state regulations.

- If you are currently registered, sign in to your account and click on the Download button to obtain the Michigan Application for Employment - Clerical, Exempt, Executive, or Nonexempt Position.

- Use your account to browse the legal documents you have purchased previously.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are some straightforward instructions for you to follow.

- First, ensure you have selected the correct form for your region/state. You can review the form using the Preview option and read the form description to verify it is suitable for you.

Form popularity

FAQ

Michigan exempts executive employees from its overtime requirements. MI Laws 408.934a(4)(a) Employees qualify as executive employees if they: are compensated at least $455 per week on a salary basis; have primary duties that consist of management; and.

An exempt employee is not entitled overtime pay by the Fair Labor Standards Act (FLSA). These salaried employees receive the same amount of pay per pay period, even if they put in overtime hours. A nonexempt employee is eligible to be paid overtime for work in excess of 40 hours per week, per federal guidelines.

An exempt position is not eligible for overtime pay. A non-exempt position is eligible and must receive overtime pay at time-and-one-half for any hours worked above 40 hours in one workweek. (Note: Staff represented by a collective bargaining unit should consult their agreements concerning overtime.)

Farm and agricultural workers, elected officials, seasonal camp workers, and under-18 childcare providers are all exempt from overtime completely, as are most white collar workers and anyone who is already exempted from Michigan's minimum wage law.

Nonexempt: An individual who is not exempt from the overtime provisions of the FLSA and is therefore entitled to overtime pay for all hours worked beyond 40 in a workweek (as well as any state overtime provisions). Nonexempt employees may be paid on a salary, hourly or other basis.

Michigan law exempts anyone employed in a bona fide executive, administrative, or professional capacity from state overtime pay requirements. When an employer is choosing to apply either state or federal law, the employer must apply the law that is most beneficial to the employee.

Future Michigan Minimum Wage Increases In the years subsequent to 2022, the state minimum wage is scheduled to increase annually as long as the unemployment rate for Michigan for that year is 8.5 percent or greater. The scheduled increases are: January 1, 2023: $10.10. January 1, 2024: $10.33.

An exempt position is not eligible for overtime pay. A non-exempt position is eligible and must receive overtime pay at time-and-one-half for any hours worked above 40 hours in one workweek. (Note: Staff represented by a collective bargaining unit should consult their agreements concerning overtime.)

Exempt employees refer to workers in the United States who are not entitled to overtime pay. This simply implies that employers of exempt employees are not bound by law to pay them for any extra hours of work. The federal standard for work hours in the United States is 40 hours per workweek.

July 11, 2019. LIKE SAVE PRINT EMAIL. The designation of an employee as "salaried, nonexempt" means that the employer has designated an employee as nonexempt from the federal Fair Labor Standards Act (FLSA), and chooses to pay a weekly salary that equates to at least minimum wage for all hours worked.