Michigan Private Annuity Agreement

Description

How to fill out Private Annuity Agreement?

Have you ever been in a situation where you require documentation for either business or personal reasons almost every day.

There are numerous legal document templates available online, but finding reliable ones is not straightforward.

US Legal Forms provides a vast array of form templates, including the Michigan Private Annuity Agreement, designed to satisfy state and federal requirements.

Choose the pricing plan you prefer, provide the necessary information to create your account, and pay for your order using PayPal or a credit card.

Select a convenient document format and download your copy.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Michigan Private Annuity Agreement template.

- If you do not have an account and wish to use US Legal Forms, follow these directions.

- Find the form you need and ensure it is for the correct city/state.

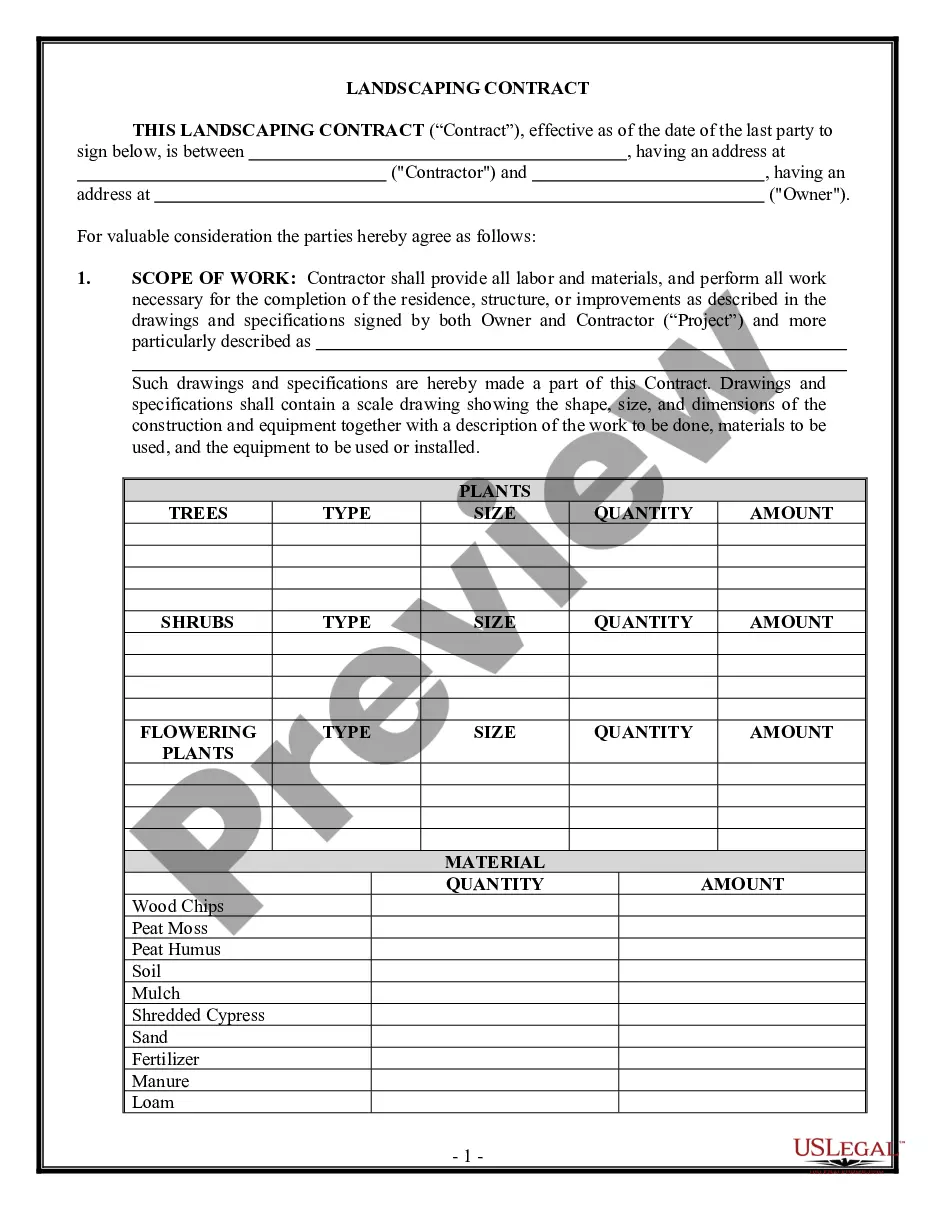

- Utilize the Preview option to review the document.

- Check the details to confirm that you have selected the correct form.

- If the form does not meet your requirements, use the Search area to find the form that suits you and your needs.

- Once you find the appropriate form, click on Buy now.

Form popularity

FAQ

Annuitization is a method of guaranteeing yourself a regular and set income over a specific period of time. When you annuitize, you are essentially turning your annuity into set payments that you will receive ensuring that you will never run out of money or not have income coming in.

Each annuity payment is treated as part tax-free return of basis, part capital gain, and part ordinary income until your entire basis is recovered. Once your basis is recovered, the entire annuity is treated as part capital gain and part ordinary income until you have surpassed your life expectancy.

If you have an annuity and are about to retire, you have an important decision to make. You can choose to annuitize your investments, creating a steady stream of income available to you throughout retirement. Or, you can cash out the annuity, and get money into your bank or taxable brokerage account.

You can create your own annuity with a carefully crafted mix of bonds that will immunize your income against market change, say experts at Asset Dedication financial consulting company.

If you purchase an immediate annuity or have annuitized a contract, your policy may not be terminated or changed in most scenarios.

A private annuity is a special agreement in which an individual (annuitant) transfers property to an obligor. The obligor agrees to make payments to the annuitant according to an agreed-upon schedule in exchange for the property transfer.