Michigan Software Maintenance Agreement

Description

How to fill out Software Maintenance Agreement?

Have you found yourself in a situation where you require documents for either professional or personal purposes nearly every day.

There are many authentic document templates accessible online, but locating reliable ones can be challenging.

US Legal Forms provides thousands of document templates, including the Michigan Software Maintenance Agreement, specifically designed to comply with federal and state regulations.

Utilize US Legal Forms, one of the largest collections of authentic templates, to save time and avoid mistakes.

This service provides professionally crafted legal document templates that you can use for various purposes. Create an account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Subsequently, you can download the Michigan Software Maintenance Agreement template.

- If you do not have an account and wish to use US Legal Forms, follow these instructions.

- Retrieve the document you need and ensure it is for your correct region/area.

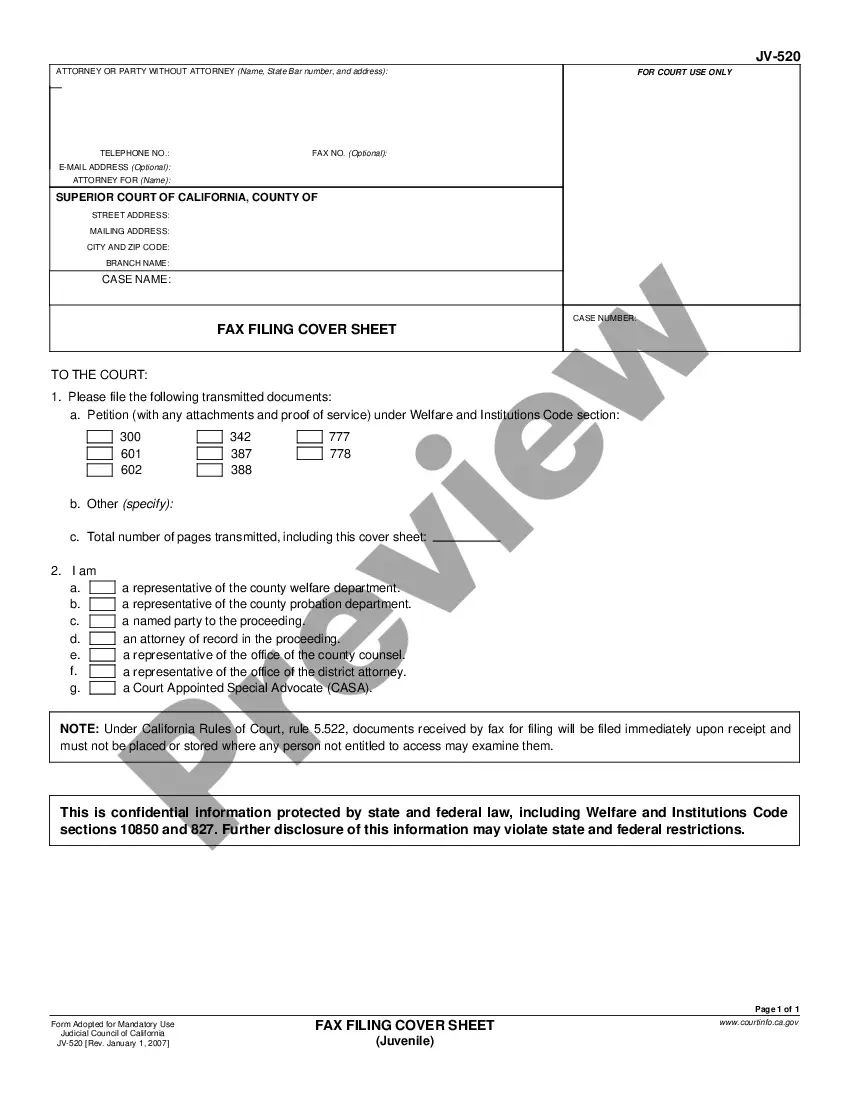

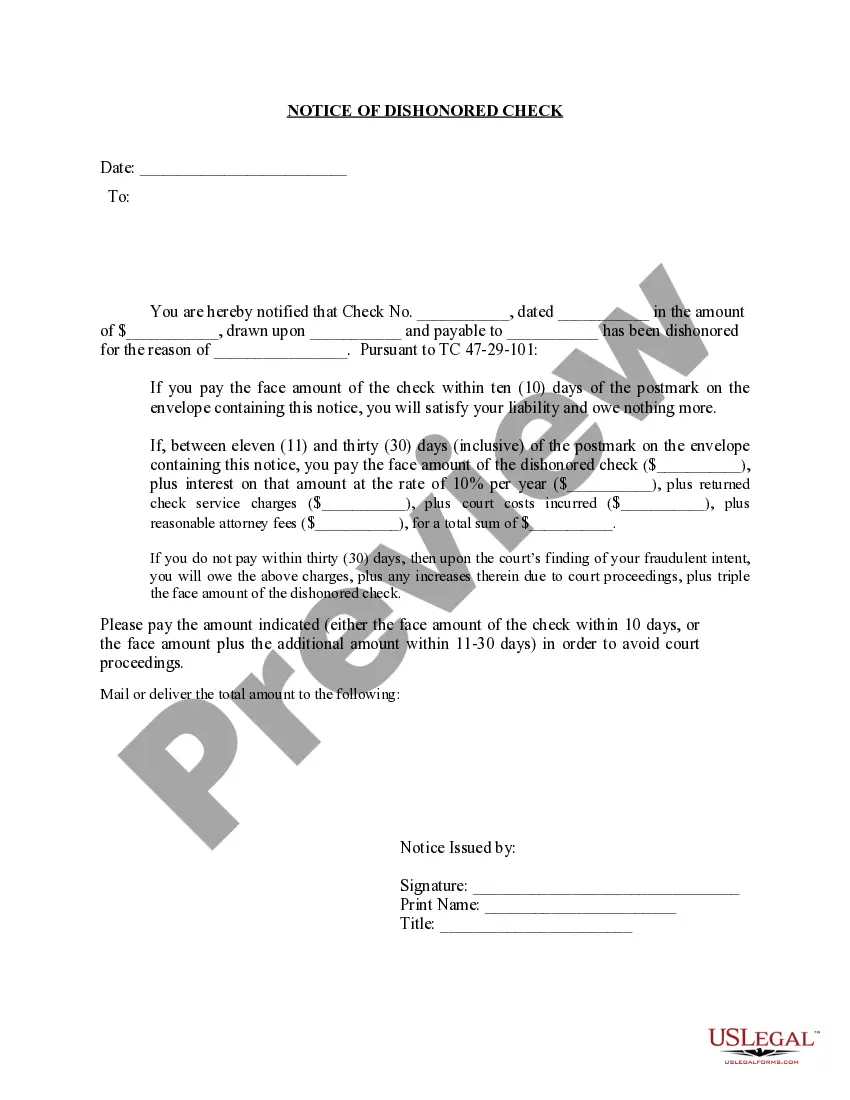

- Use the Preview button to review the document.

- Examine the information to confirm you have selected the accurate template.

- If the document does not meet your requirements, utilize the Lookup field to find the document that fits your needs.

- Once you identify the correct template, click on Purchase now.

- Select the pricing plan you prefer, complete the necessary details to create your account, and complete your purchase using Paypal or credit card.

- Choose a convenient document format and download your copy.

- Access all the document templates you have acquired in the My documents section. You can request an additional copy of the Michigan Software Maintenance Agreement at any time if needed. Simply click on the required document to download or print the template.

Form popularity

FAQ

Sales of custom software - delivered on tangible media are exempt from the sales tax in Michigan. Sales of custom software - downloaded are exempt from the sales tax in Michigan. In the state of Michigan, it is considered to be exempt if it was separately stated and separately identified.

Software maintenance is the process of changing, modifying, and updating software to keep up with customer needs. Software maintenance is done after the product has launched for several reasons including improving the software overall, correcting issues or bugs, to boost performance, and more.

A service maintenance contract is a legal agreement between a company and a maintenance service provider. It specifies the terms and conditions of the agreement between the two parties.

AMC is a maintenance contract or an insurance policy for your technological advancement. It is a software update service for which your company has to pay annually, to the software provider.

A software maintenance agreement, or SMA, is a legal contract that obligates the software vendor to provide technical support and updates for an existing software product for their customers. It may also extend the expiration date of certain features, such as new releases or upgrades.

If the contract is optional and separately itemized, it is not taxable upon sale to a customer. The servicer under the contract, however, must pay tax on any tangible personal property used to fulfill the maintenance contract. Michigan Letter Ruling 88-30.

Maintenance agreements provide routine maintenance, access to emergency repairs, and constant upgrades to software and your system's hardware. More importantly, the agreement make you a priority and allows you to build a relationship with your maintenance provider.

Groceries, prescription medicine, and gasoline are all tax-exempt. Some services in Michigan are subject to sales tax.

Sales of parts purchased for use in performing service under optional maintenance contracts are subject to sales tax in Michigan.

In the state of Michigan, services are not generally considered to be taxable.