Michigan Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust

Description

How to fill out Termination Of Grantor Retained Annuity Trust In Favor Of Existing Life Insurance Trust?

Selecting the finest sanctioned document template may be a challenge.

Indeed, there is a multitude of templates accessible online, but how can you find the legal document you require.

Utilize the US Legal Forms platform. This service offers thousands of templates, including the Michigan Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust, suitable for both business and personal purposes.

If the document does not satisfy your requirements, use the Search box to find the correct form. Once you are confident that the document is suitable, click the Buy now button to purchase the document. Choose the pricing plan you desire and enter the necessary details. Create your account and complete the payment using your PayPal account or credit card. Select the file format and download the legal document template for your device. Fill out, modify, print, and sign the received Michigan Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust. US Legal Forms is the largest collection of legal templates where you can find a variety of document templates. Use the service to obtain professionally crafted documents that meet state requirements.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Obtain button to download the Michigan Termination of Grantor Retained Annuity Trust in Favor of Existing Life Insurance Trust.

- Use your account to browse the legal forms you have previously purchased.

- Visit the My documents section of your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions to follow.

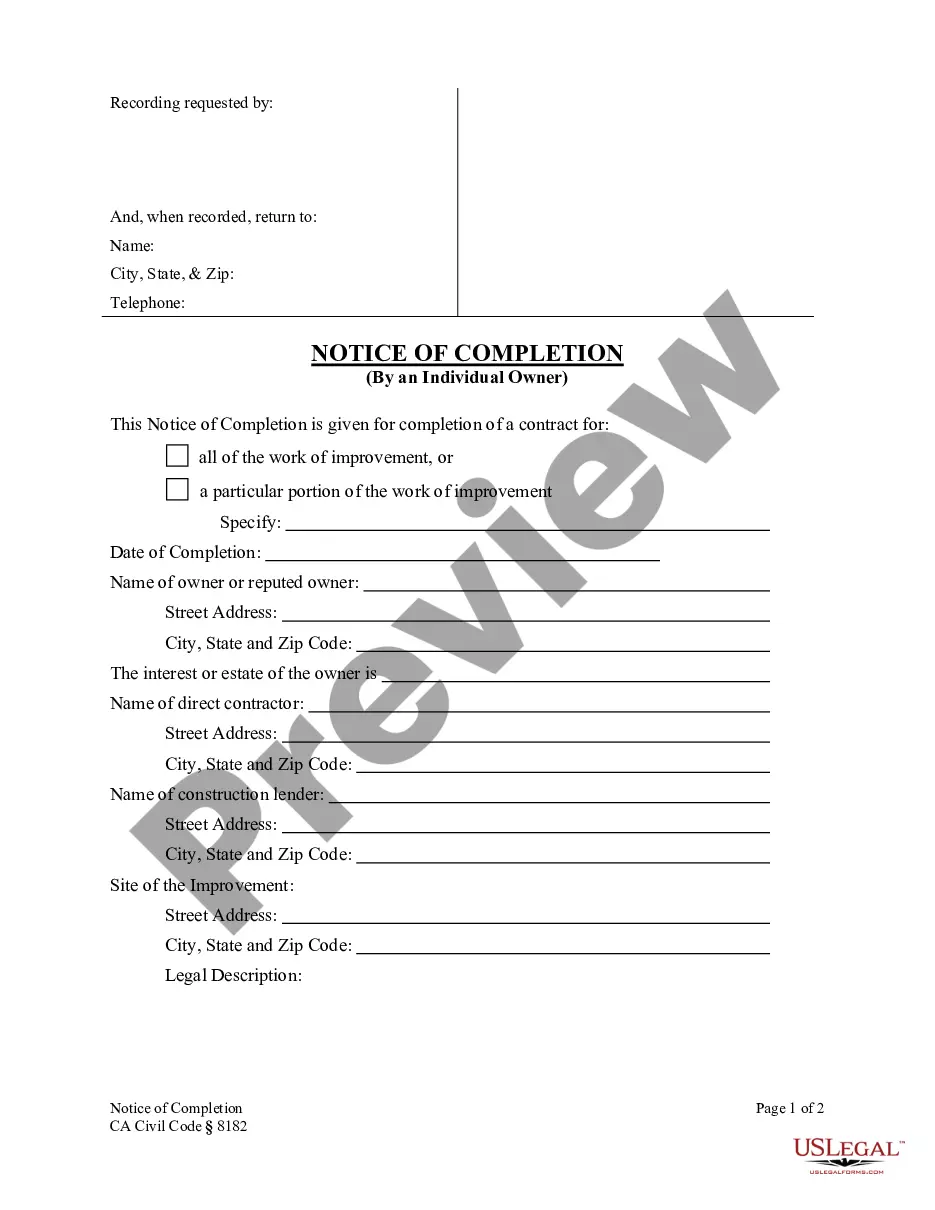

- First, make sure you have selected the appropriate document for your city/state. You can review the document using the Review button and examine the document details to confirm it's the right one for you.

Form popularity

FAQ

A grantor retained annuity trust is a type of irrevocable gifting trust that allows a grantor or trustmaker to potentially pass a significant amount of wealth to the next generation with little or no gift tax cost. GRATs are established for a specific number of years.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

If the grantor does not survive the term, the GRAT will fail, but again no assets are lostthey will simply be included in the grantor's taxable estate.

GRATs may provide payments for a term of years or for the life of the Grantor.

To implement this strategy, you zero out the grantor retained annuity trust by accepting combined payments that are equal to the entire value of the trust, including the anticipated appreciation. In theory, there would be nothing left for the beneficiary if the trust is really zeroed out.

The annuity amount is paid to the grantor during the term of the GRAT, and any property remaining in the trust at the end of the GRAT term passes to the beneficiaries with no further gift tax consequences.

When a GRAT is created, you also set the term, or lifetime, of the trust. Once the term expires, the remaining assets transfer to your beneficiaries. However, if you pass away before the term expires, then all assets in the trust revert back to you and are included in your taxable estate.

The minimum duration for a GRAT is two years, and that is a very popular choice for many clients. But longer GRATs are also common, and some clients decide to establish GRATs that last 3, 5 or 10 years. The choice of an optimal GRAT term is driven by several factors.

Thus, the trustee cannot terminate the GRAT before expiration of the term of the grantor's qualified interest by distributing to the grantor and the remainder beneficiaries the actuarial value of their term and remainder interests, respectively.