Michigan Renunciation of Legacy in Favor of Other Family Members

Description

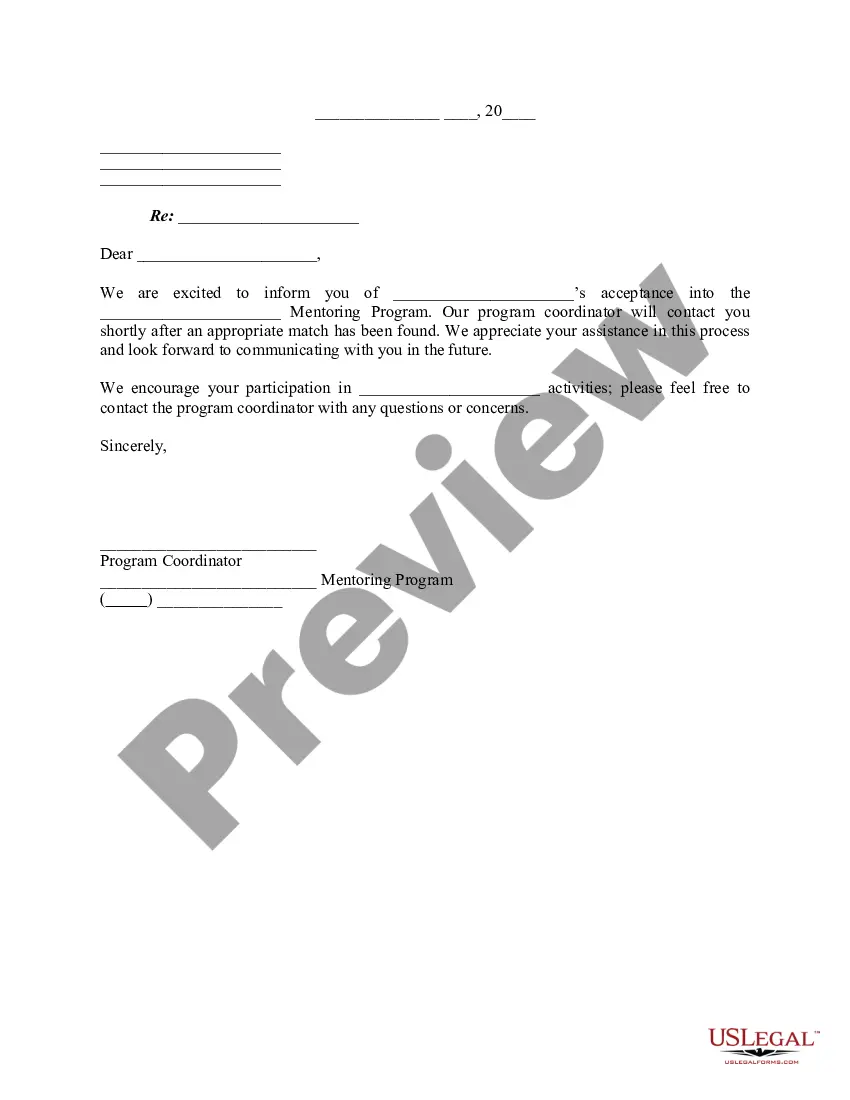

How to fill out Renunciation Of Legacy In Favor Of Other Family Members?

You can invest hrs on the web trying to find the legitimate papers web template which fits the federal and state needs you will need. US Legal Forms gives a huge number of legitimate types that are evaluated by specialists. You can easily download or printing the Michigan Renunciation of Legacy in Favor of Other Family Members from my services.

If you already possess a US Legal Forms accounts, you are able to log in and click the Acquire key. After that, you are able to total, modify, printing, or indication the Michigan Renunciation of Legacy in Favor of Other Family Members. Every single legitimate papers web template you purchase is your own property permanently. To get an additional copy of the obtained kind, go to the My Forms tab and click the corresponding key.

If you use the US Legal Forms web site the first time, follow the basic recommendations under:

- Initially, make sure that you have selected the proper papers web template for that region/metropolis that you pick. Browse the kind information to make sure you have picked out the right kind. If offered, utilize the Review key to search from the papers web template also.

- If you wish to discover an additional version of your kind, utilize the Lookup field to find the web template that meets your needs and needs.

- Once you have discovered the web template you would like, just click Get now to continue.

- Choose the prices plan you would like, key in your accreditations, and register for an account on US Legal Forms.

- Total the transaction. You may use your bank card or PayPal accounts to pay for the legitimate kind.

- Choose the formatting of your papers and download it to your system.

- Make modifications to your papers if possible. You can total, modify and indication and printing Michigan Renunciation of Legacy in Favor of Other Family Members.

Acquire and printing a huge number of papers layouts making use of the US Legal Forms Internet site, which offers the largest collection of legitimate types. Use expert and status-particular layouts to tackle your organization or person requirements.

Form popularity

FAQ

Here are a few common instances where assets do not require probate in the State of Michigan: Assets owned under ?joint tenancy.? Beneficiary designation assets (i.e. retirement accounts with a listed beneficiary) When the decedent has assets named within a trust.

In the absence of a surviving spouse, the person who is next of kin inherits the estate. The line of inheritance begins with direct offspring, starting with their children, then their grandchildren, followed by any great-grandchildren, and so on.

AN ACT to codify, revise, consolidate, and classify aspects of the law relating to wills and intestacy, relating to the administration and distribution of estates of certain individuals, relating to trusts, and relating to the affairs of certain individuals under legal incapacity; to provide for the powers and ...

The Estates and Protected Individuals Code (EPIC) governs matters pertaining to the administration of estates of deceased and protected persons. The Probate Court has exclusive jurisdiction over these matters.

Under Internal Revenue Service (IRS) rules, to refuse an inheritance, you must execute a written disclaimer that clearly expresses your "irrevocable and unqualified" intent to refuse the bequest.

If the personal representative holds a mortgage, pledge, or other lien upon another person's property, the personal representative may, in lieu of foreclosure, accept a conveyance or transfer of encumbered property from the property's owner in satisfaction of the indebtedness secured by lien.