Michigan Sample Letter to company Pension Administrator regarding Request for Plan Description

Description

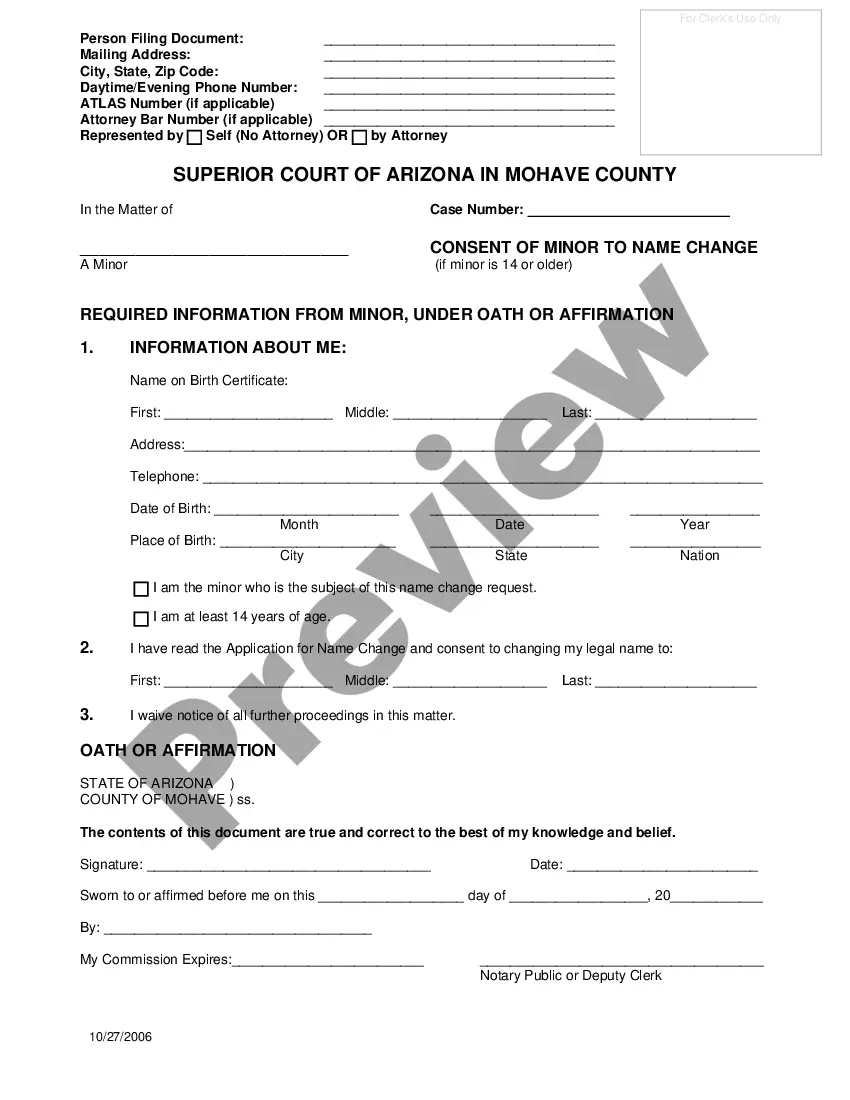

How to fill out Sample Letter To Company Pension Administrator Regarding Request For Plan Description?

Discovering the right legitimate file format could be a have a problem. Of course, there are tons of layouts available online, but how do you obtain the legitimate develop you want? Take advantage of the US Legal Forms website. The service gives thousands of layouts, for example the Michigan Sample Letter to company Pension Administrator regarding Request for Plan Description, which you can use for enterprise and personal requirements. Every one of the forms are inspected by specialists and meet up with state and federal requirements.

If you are presently registered, log in for your accounts and click on the Acquire switch to find the Michigan Sample Letter to company Pension Administrator regarding Request for Plan Description. Make use of your accounts to look with the legitimate forms you may have purchased earlier. Go to the My Forms tab of your respective accounts and get another duplicate in the file you want.

If you are a brand new customer of US Legal Forms, listed below are easy recommendations so that you can follow:

- Very first, be sure you have selected the proper develop to your city/area. You may check out the form utilizing the Preview switch and browse the form outline to guarantee this is basically the best for you.

- If the develop fails to meet up with your preferences, utilize the Seach field to obtain the proper develop.

- Once you are positive that the form is suitable, go through the Purchase now switch to find the develop.

- Pick the prices prepare you need and enter the needed info. Build your accounts and pay for the order making use of your PayPal accounts or Visa or Mastercard.

- Choose the data file structure and obtain the legitimate file format for your gadget.

- Total, revise and print and signal the acquired Michigan Sample Letter to company Pension Administrator regarding Request for Plan Description.

US Legal Forms will be the greatest catalogue of legitimate forms where you can find numerous file layouts. Take advantage of the service to obtain appropriately-created documents that follow status requirements.

Form popularity

FAQ

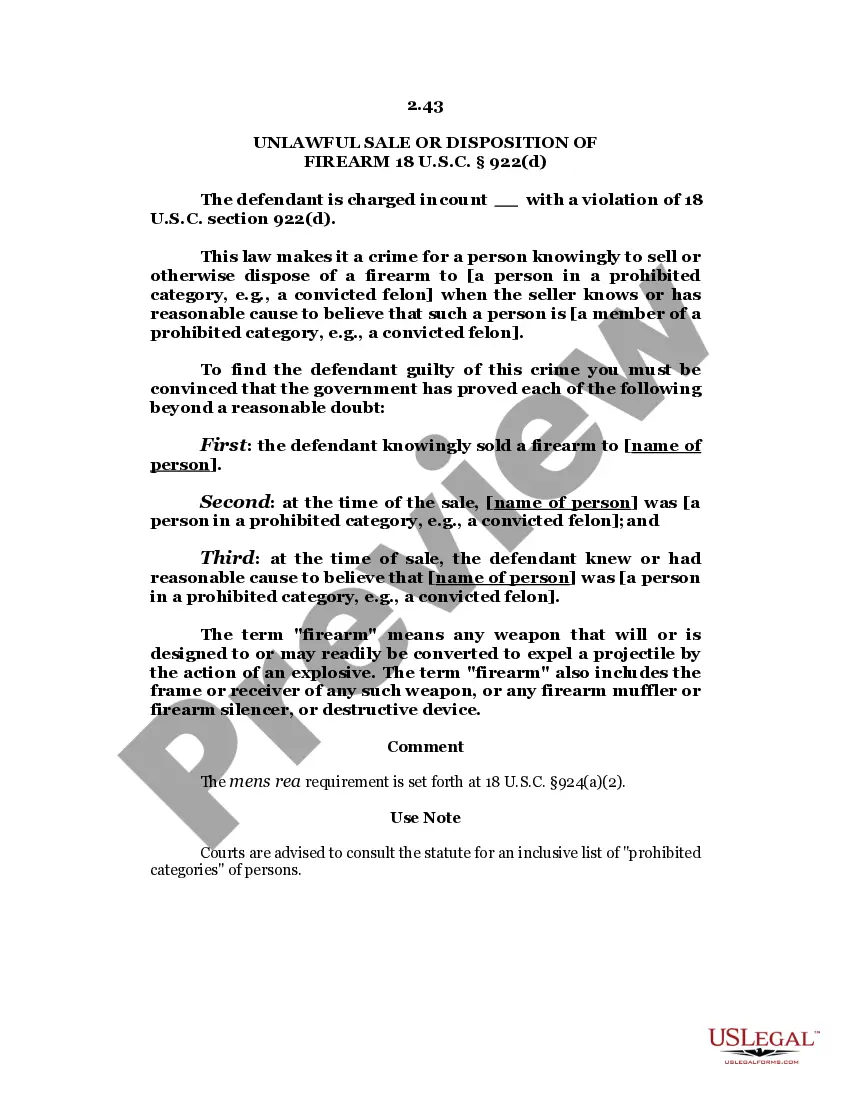

Pension plan administrators are fiduciaries responsible for prudently managing risks in their pension plans, making decisions in the best interest of pension plan beneficiaries, and administering the plan in ance with the filed plan documents and applicable laws, including the Pension Benefits Act.

The plan administrator is the person designated to enroll employees and their dependents in insurance plans. Employers can: Contract with a private company to handle enrollments. Have a benefits office within their company that handles enrollments.

Follow these steps to craft an effective retirement letter with all the essential details: Address the right people. ... Specify the date of your retirement. ... Express appreciation for your experience. ... Offer to assist with the transition. ... Discuss consulting if you're interested. ... Detail your needs regarding retirement.

A Pension Fund Administrator (PFA) is a company licensed by the National Pension Commission to manage and invest the pension funds in the employee's Retirement Savings Account (RSA).

Your 401(k) plan administrator is typically the employer that sponsors your retirement savings account. The name of this individual or organization will be listed on your retirement account statements.

Both the employer and employee usually contribute to the pension plan, though the employer is the pension plan administrator who manages the fund.

The Pension Tracing Service is a free government service. It searches a database of more than 200,000 workplace and personal pension schemes to try to find the contact details you need. You can phone the Pension Tracing Service on 0800 731 0193 or use the link below to search their online directory for contact details.

Defined benefit pension plans In a defined benefit pension plan, your employer promises to pay you a regular income after you retire. Usually both you and your employer contribute to the plan. Your contributions are pooled into a fund. Your employer or a pension plan administrator invests and manages the fund.