28 U.S.C.A. § 1961 provides in part that interest shall be allowed on any money judgment in a civil case recovered in a district court. Such interest would continue to accrue throughout an appeal that was later affirmed.

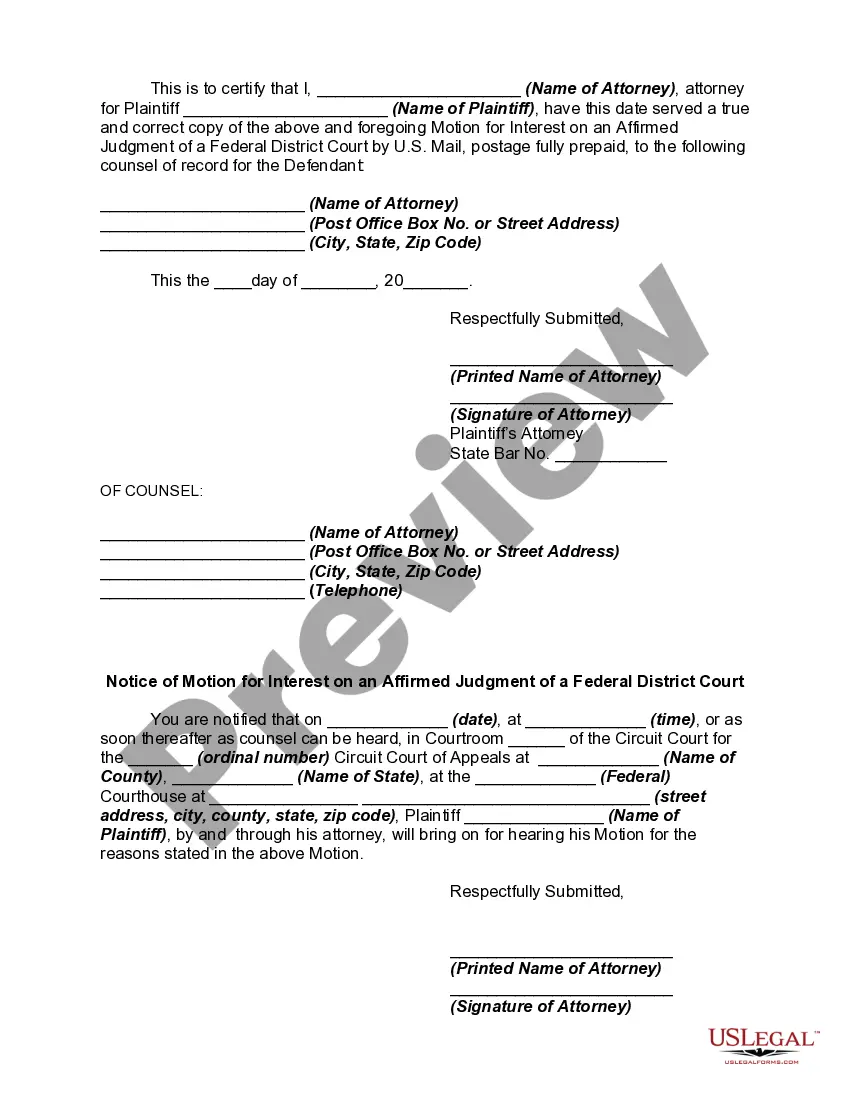

Michigan Motion for Interest on an Affirmed Judgment of a Federal District Court

Description

How to fill out Motion For Interest On An Affirmed Judgment Of A Federal District Court?

Have you been within a placement in which you require documents for both company or specific purposes virtually every day? There are a variety of lawful file layouts available on the Internet, but discovering ones you can rely on is not easy. US Legal Forms offers 1000s of form layouts, such as the Michigan Motion for Interest on an Affirmed Judgment of a Federal District Court, which are written to satisfy federal and state specifications.

If you are already knowledgeable about US Legal Forms website and also have an account, simply log in. Next, it is possible to down load the Michigan Motion for Interest on an Affirmed Judgment of a Federal District Court format.

If you do not come with an bank account and would like to begin using US Legal Forms, follow these steps:

- Obtain the form you need and make sure it is for the appropriate town/area.

- Utilize the Preview option to examine the shape.

- Browse the explanation to actually have chosen the proper form.

- In case the form is not what you`re looking for, make use of the Research discipline to get the form that meets your requirements and specifications.

- Once you obtain the appropriate form, click Purchase now.

- Choose the pricing prepare you need, fill in the desired information to produce your account, and pay money for the order making use of your PayPal or credit card.

- Decide on a hassle-free paper structure and down load your backup.

Locate all of the file layouts you might have purchased in the My Forms food selection. You may get a extra backup of Michigan Motion for Interest on an Affirmed Judgment of a Federal District Court anytime, if required. Just click on the essential form to down load or print out the file format.

Use US Legal Forms, probably the most extensive variety of lawful kinds, to save some time and stay away from errors. The service offers professionally made lawful file layouts which can be used for an array of purposes. Make an account on US Legal Forms and begin making your way of life a little easier.

Form popularity

FAQ

Example: Judgment of $2000; interest rate of 6% per year; 280 days since the date the small claims petition was filed. $2000 x .06 = $120 annual interest. $120/365 = $.329 per day. $. 329 x 280 days = $92.05 interest owed.

The interest of money shall be at the rate of $5.00 upon $100.00 for a year, and at the same rate for a greater or less sum, and for a longer or shorter time, except that in all cases it shall be lawful for the parties to stipulate in writing for the payment of any rate of interest, not exceeding 7% per annum.

Calculating interest owed You input the judgment amount, date, and payment history, and the program does all the calculations for you. The calculator has the interest rate set at 10%.

Interest is calculated from the date of filing the complaint to the date of satisfaction of the judgment at the rate of 12% per year compounded annually, unless the instrument has a higher rate of interest.

The money judgment interest rate as of July 1, 2023, for complaints filed in state court on or after Jan. 1, 1987, is 4.762%. This rate includes the statutory 1%. Listed below are the previous state-court money judgment interest rates since Jan.

When and at what rate do judgment debts attract interest? Judgment debts accrue simple interest at a rate of 8% a year until payment, unless rules of court provide otherwise, pursuant to section 17 of the Judgments Act 1838 (JA 1838) and the Judgment Debts (Rate of Interest) Order 1993, SI 1993/564.

Interest is calculated from the date of filing the complaint to the date of satisfaction of the judgment at the rate of 12% per year compounded annually, unless the instrument has a higher rate of interest.

When and at what rate do judgment debts attract interest? Judgment debts accrue simple interest at a rate of 8% a year until payment, unless rules of court provide otherwise, pursuant to section 17 of the Judgments Act 1838 (JA 1838) and the Judgment Debts (Rate of Interest) Order 1993, SI 1993/564.

The money judgment interest rate as of July 1, 2023, for complaints filed in state court on or after Jan. 1, 1987, is 4.762%.