Oregon Call and Notice of Organizational Meeting of Incorporators

Description

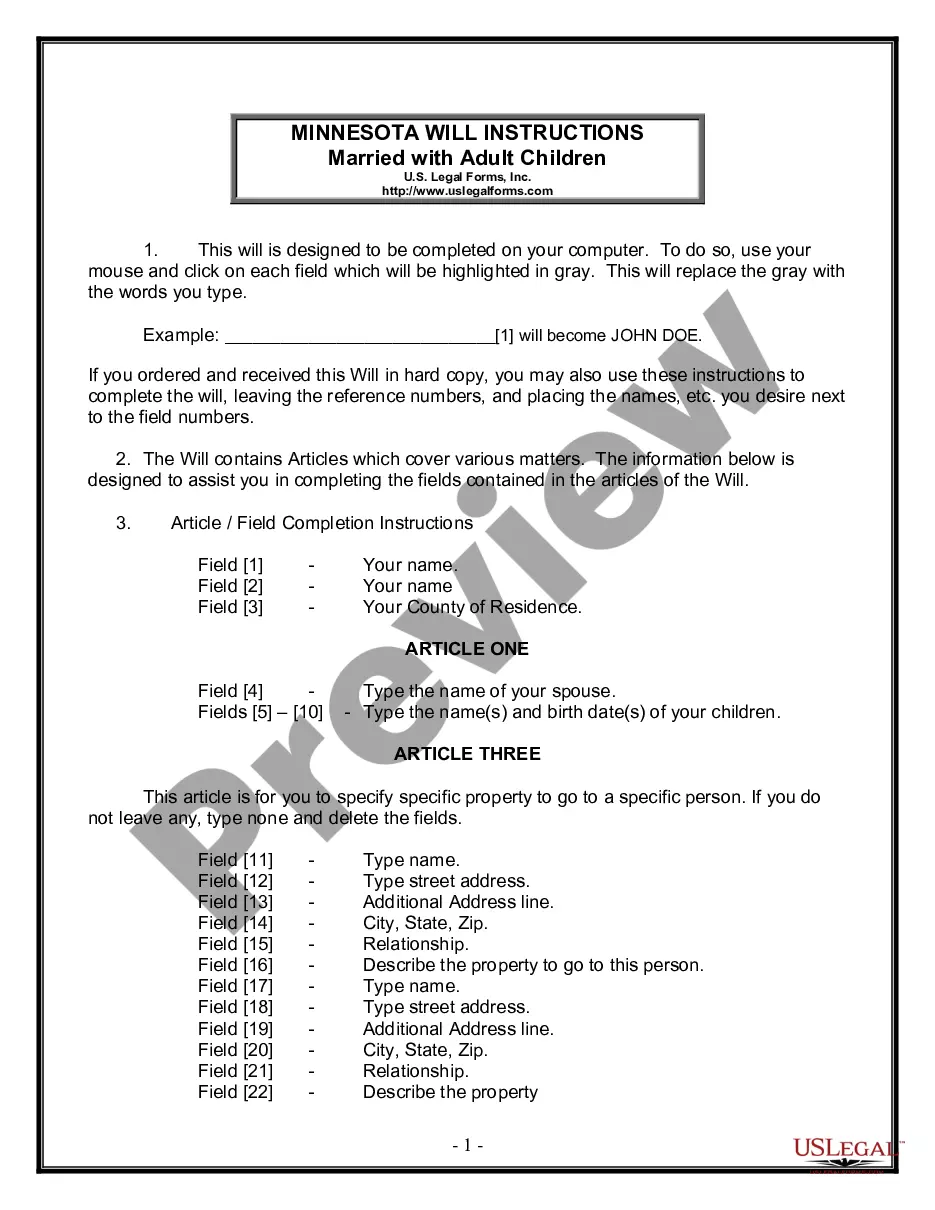

How to fill out Call And Notice Of Organizational Meeting Of Incorporators?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal form templates that you can obtain or create.

By utilizing the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Oregon Call and Notice of Organizational Meeting of Incorporators in just a few minutes.

If you already have an account, Log In to download the Oregon Call and Notice of Organizational Meeting of Incorporators from the US Legal Forms collection. The Download button will appear on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Process the payment. Use your credit card or PayPal account to complete the transaction.

Select the format and download the form to your device. Make edits. Complete, modify, print, and sign the downloaded Oregon Call and Notice of Organizational Meeting of Incorporators. Each template you added to your account has no expiration date and belongs to you permanently. So, to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Oregon Call and Notice of Organizational Meeting of Incorporators with US Legal Forms, one of the most extensive collections of legal document templates. Utilize a myriad of professional and state-specific templates that satisfy your business or personal needs and requirements.

- Ensure you have selected the correct form for your locality/state.

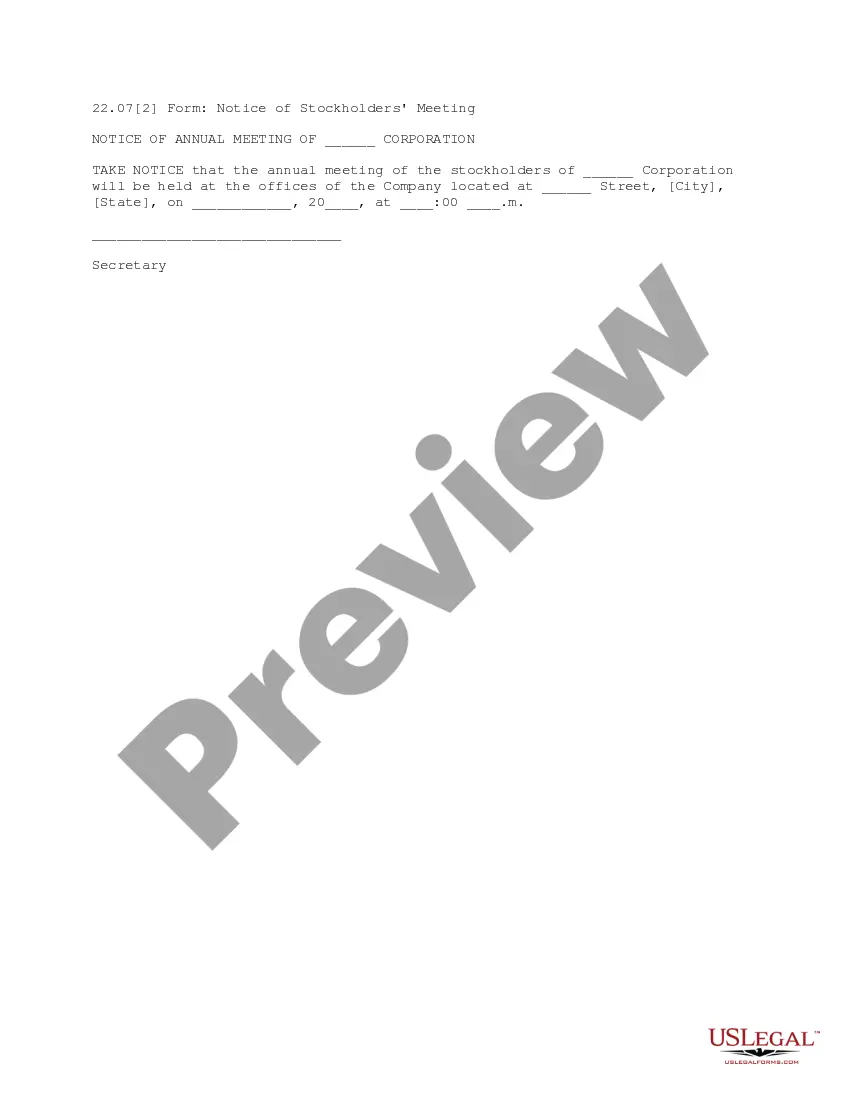

- Click the Review button to examine the content of the form.

- Check the form description to confirm you have chosen the right form.

- If the form does not meet your requirements, utilize the Search field at the top of the screen to find one that does.

- When you are satisfied with the form, verify your choice by clicking the Get now button.

- Next, select the pricing plan you prefer and provide your credentials to enter into an account.

Form popularity

FAQ

An LLC, or Limited Liability Company, is not considered a corporation in Oregon. While both entities offer liability protection to their owners, they differ in structure and taxation. If you are looking for guidance on forming either an LLC or a corporation, consider using the USLegalForms platform to streamline the process.

Yes, you need a business license to operate an LLC in Oregon, depending on specific city or county regulations. While your LLC provides liability protection, local rules may require additional permits or licenses. Be proactive in checking local requirements to avoid any compliance issues.

The minimum tax for a C Corporation in Oregon is $150. This tax applies regardless of whether the corporation generates any income. After establishing your corporation, ensure you properly document your financial activities to comply with Oregon tax regulations and maintain good standing.

To start a C Corporation, you need a unique business name, Articles of Incorporation, and a registered agent. After submitting the necessary documents to the Oregon Secretary of State, you should hold an Oregon Call and Notice of Organizational Meeting of Incorporators for key decisions regarding the corporation's structure and governance.

To start an S Corporation in Oregon, you must first incorporate your business as a C Corporation and then elect S Corporation status by filing IRS Form 2553. Make sure to prepare for your Oregon Call and Notice of Organizational Meeting of Incorporators, where you will appoint directors and adopt bylaws to govern your business operations.

Becoming incorporated in Oregon involves several steps. Start by choosing a unique business name and then file your Articles of Incorporation with the Secretary of State. Additionally, you should schedule an Oregon Call and Notice of Organizational Meeting of Incorporators to finalize your corporation's initial decisions.

To fill out corporate bylaws, carefully consider the specific needs of your business while adhering to legal requirements. Begin with the basics, such as the corporation's name and purpose, then detail the governance structure, including directors and officers. Don't forget to incorporate relevant elements like the Oregon Call and Notice of Organizational Meeting of Incorporators, so all stakeholders know when and how meetings are conducted. Uslegalforms can help you navigate this process, ensuring completeness and compliance.

Writing corporate bylaws involves outlining the structure and rules that govern your organization. Start by defining the corporation's purpose, followed by the roles and powers of directors and officers. Make sure to include procedures for meetings, such as the Oregon Call and Notice of Organizational Meeting of Incorporators, ensuring that all members are appropriately informed. Utilizing platforms like uslegalforms can streamline this process by providing templates and guidance.

Bylaws are essential documents that define how your corporation operates and governs itself. They typically cover the roles of directors, meeting procedures, and voting rights. For instance, a corporation may include provisions about the Oregon Call and Notice of Organizational Meeting of Incorporators, detailing how these meetings should be conducted. Examples of bylaws include rules on board member elections or the process for amending the bylaws themselves.

When drafting your corporate bylaws, avoid including overly specific operational procedures or irrelevant details that can change often. Bylaws should cover fundamental governance aspects without becoming cluttered. For example, don't specify how often to hold meetings, as these can change in response to circumstances such as the Oregon Call and Notice of Organizational Meeting of Incorporators. Instead, outline the general structure and rules for meetings.