Michigan Escrow Check Receipt Form

Description

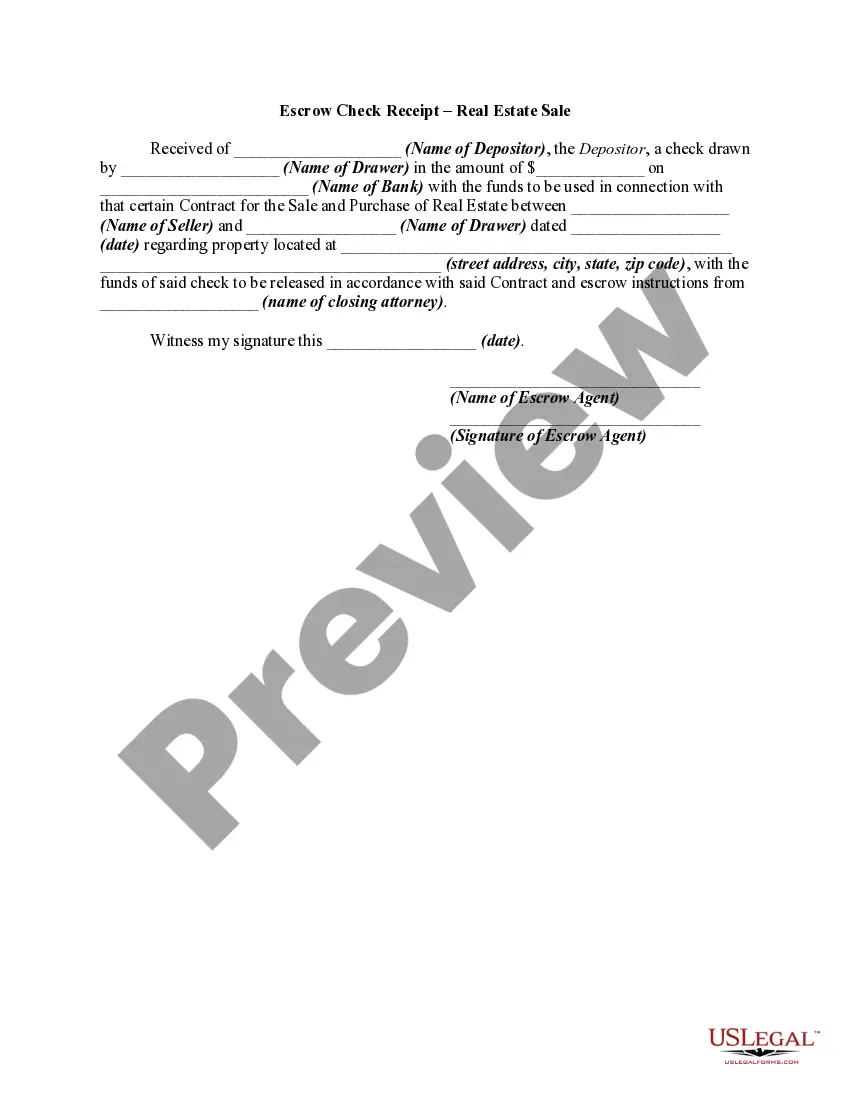

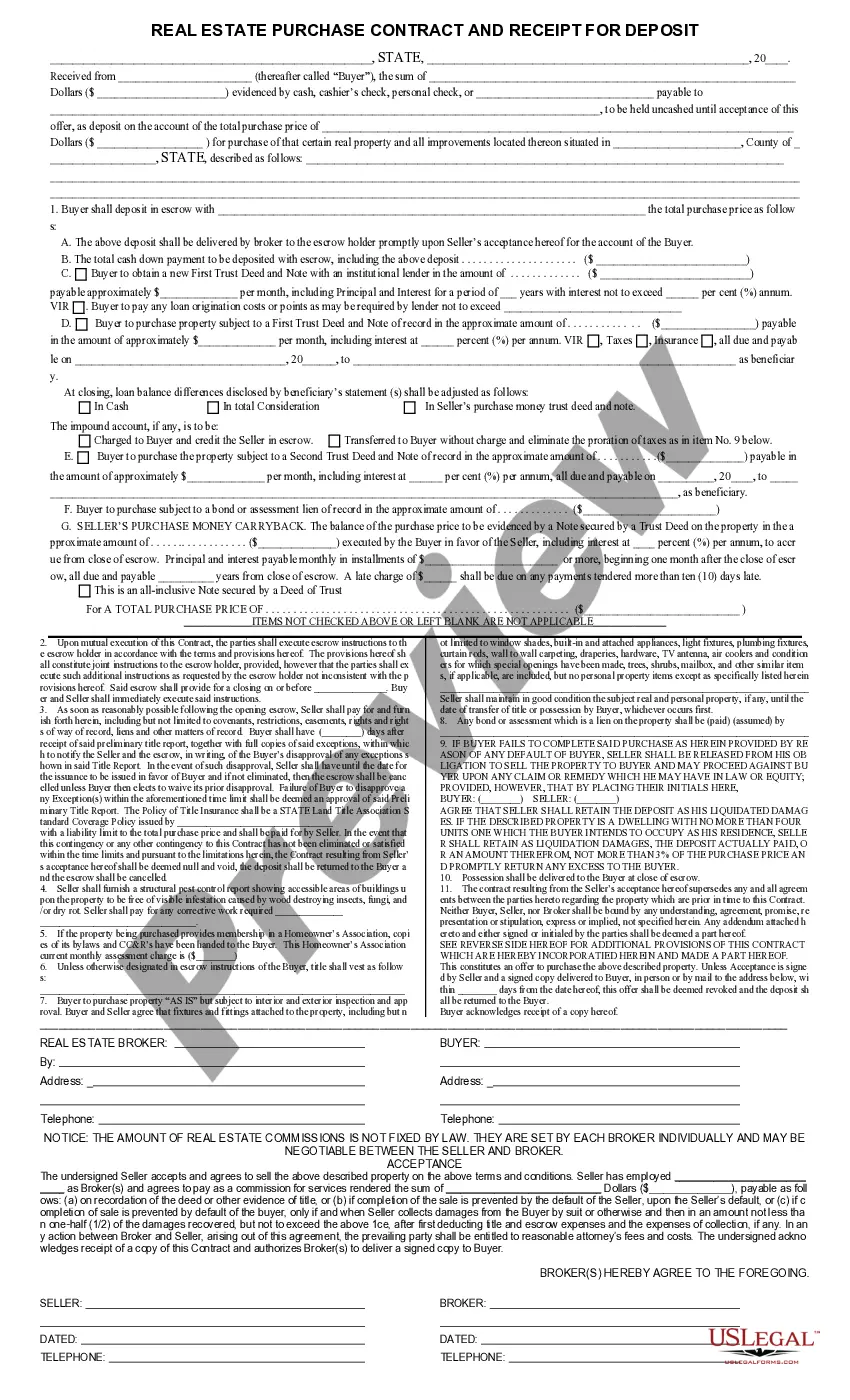

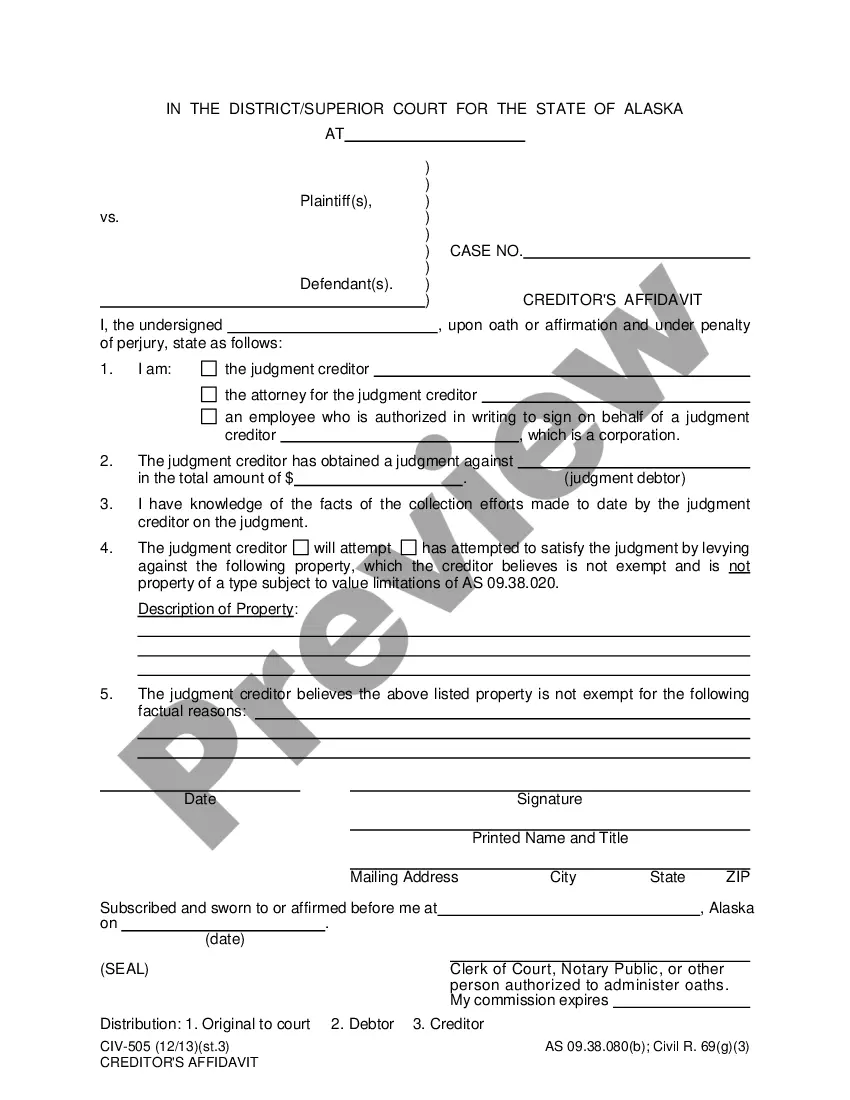

How to fill out Escrow Check Receipt Form?

Have you found yourself in circumstances where you require documentation for both business or personal purposes nearly every day.

There are numerous legitimate document formats available online, but finding trustworthy versions can be challenging.

US Legal Forms provides a multitude of template options, including the Michigan Escrow Check Receipt Form, which is designed to meet both federal and state requirements.

Once you find the appropriate form, click Get now.

Choose the pricing plan you prefer, fill in the necessary details to create your account, and complete your purchase with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Michigan Escrow Check Receipt Form template.

- If you do not have an account and would like to start using US Legal Forms, follow these steps.

- Select the form you need and make sure it is for the correct area/jurisdiction.

- Utilize the Preview button to review the form.

- Read the description to ensure that you have chosen the right form.

- If the form doesn't match what you are looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

In the memo of a tax check, you should include a clear description of the purpose of the payment. For instance, you might write 'Michigan Escrow Check Receipt Form' to specify what the check is for. Being specific in the memo helps ensure that your payment is processed correctly and linked to the right account. This practice can also assist in resolving any potential queries about your payment in the future.

You might receive a check from the Michigan Department of Treasury for various reasons, such as tax refunds, rebates, or overpayments. This could also include payments related to your Michigan Escrow Check Receipt Form if applicable. It's a good idea to review any correspondence from the department to understand the specific reason for the check. If you have further questions, consider reaching out to them directly for clarification.

While escrow accounts can provide security in a real estate transaction, they do have drawbacks. One disadvantage is that you might encounter higher costs due to fees associated with escrow services. Additionally, escrow accounts can create delays in the completion of transactions. Understanding these aspects can help you use the Michigan Escrow Check Receipt Form effectively and keep track of your financial commitments.

To write a check for Michigan taxes, start by filling in the date, followed by the recipient's name, which is generally the local tax authority. Specify the amount and include a memo indicating it is for taxes, like 'Michigan Property Taxes.' Remember to keep a copy of the Michigan Escrow Check Receipt Form for your records, as this will help you track your payments efficiently. Keeping this organized can simplify future tax inquiries.

Property tax in Michigan is assessed at the local level based on the estimated market value of your property. This tax goes toward funding public services such as schools, infrastructure, and emergency services. Understanding this system is crucial, and having the Michigan Escrow Check Receipt Form can help you stay organized. This document details your payments and assists you in navigating your tax responsibilities.

In Michigan, seniors 65 and older may qualify for property tax exemptions under certain conditions. This means that eligible homeowners can significantly reduce their property taxes or even eliminate them entirely. To ensure you maximize your benefits, keep an eye out for the Michigan Escrow Check Receipt Form that can serve as proof of your fulfilled obligations. Using this form can streamline your qualification process.

Summer property taxes in Michigan cover the period from July 1 to December 31 each year. This timeframe helps property owners understand their tax liabilities during the warmer months. When managing these payments, remember to utilize the Michigan Escrow Check Receipt Form for better documentation. Keeping organized records will save you time and stress later on.

In Michigan, summer taxes typically cover the months of July and August. This period allows residents to prepare for their upcoming property tax responsibilities, ensuring they are aware of their obligations. Receiving your Michigan Escrow Check Receipt Form can help you track these payments effectively. This form serves as a receipt for transactions, making your financial recordkeeping easier.