Michigan Articles of Incorporation, Not for Profit Organization, with Tax Provisions

Description

The proper form and necessary content of articles or certificates of incorporation for a nonprofit corporation depend largely on the requirements of the state nonprofit corporation act in the state of incorporation. Typically nonprofit corporations have no capital stock and therefore have members, not stockholders. Because federal tax-exempt status will be sought for most nonprofit corporations, the articles or certificate of incorporation must be carefully drafted to include specific language designed to ensure qualification for tax-exempt status.

How to fill out Articles Of Incorporation, Not For Profit Organization, With Tax Provisions?

If you wish to comprehensive, acquire, or produce legitimate record web templates, use US Legal Forms, the biggest collection of legitimate forms, that can be found on the web. Use the site`s basic and hassle-free lookup to get the documents you require. Various web templates for company and specific reasons are categorized by types and says, or key phrases. Use US Legal Forms to get the Michigan Articles of Incorporation, Not for Profit Organization, with Tax Provisions in just a number of mouse clicks.

In case you are previously a US Legal Forms buyer, log in to your bank account and click on the Down load switch to find the Michigan Articles of Incorporation, Not for Profit Organization, with Tax Provisions. You may also access forms you in the past downloaded from the My Forms tab of your respective bank account.

Should you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have selected the form for the right city/region.

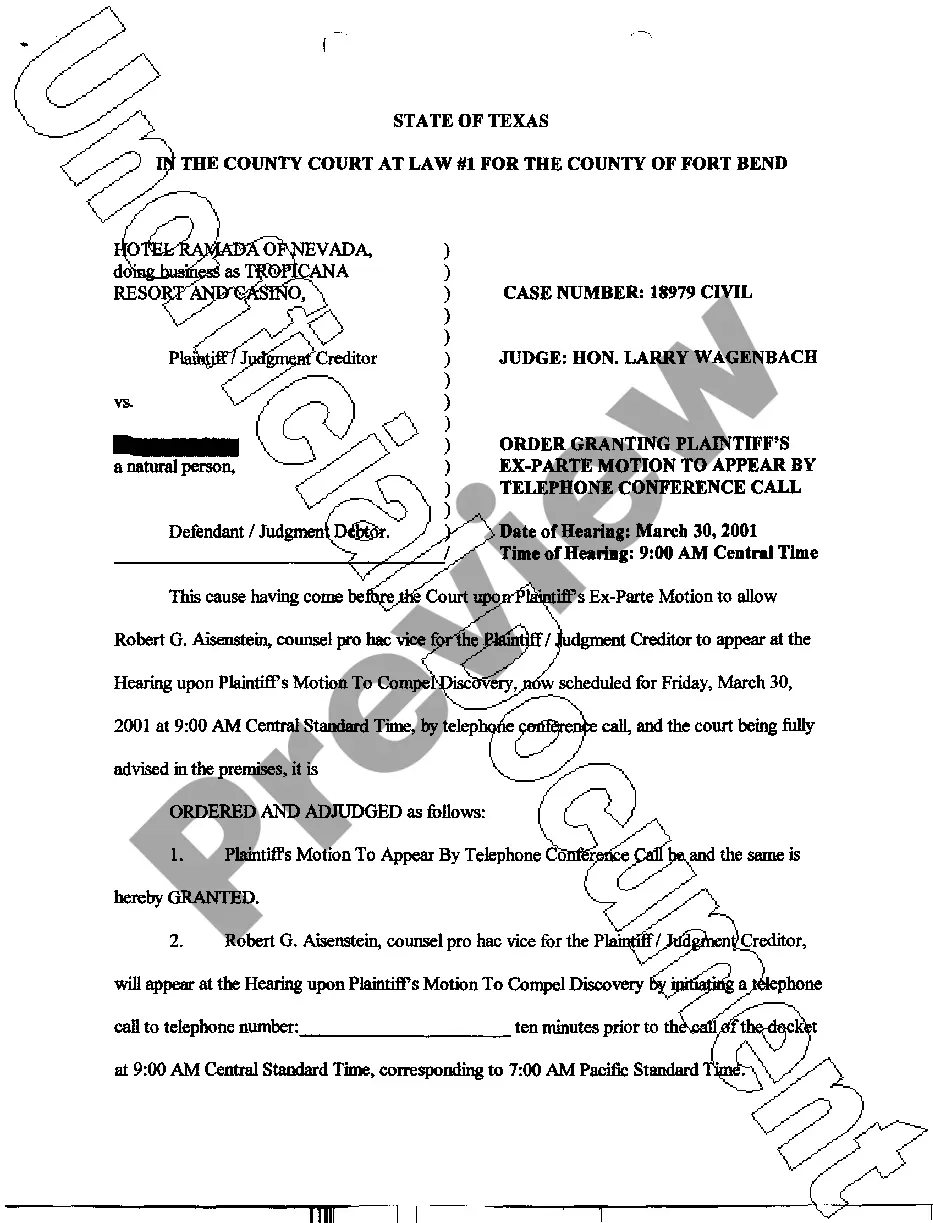

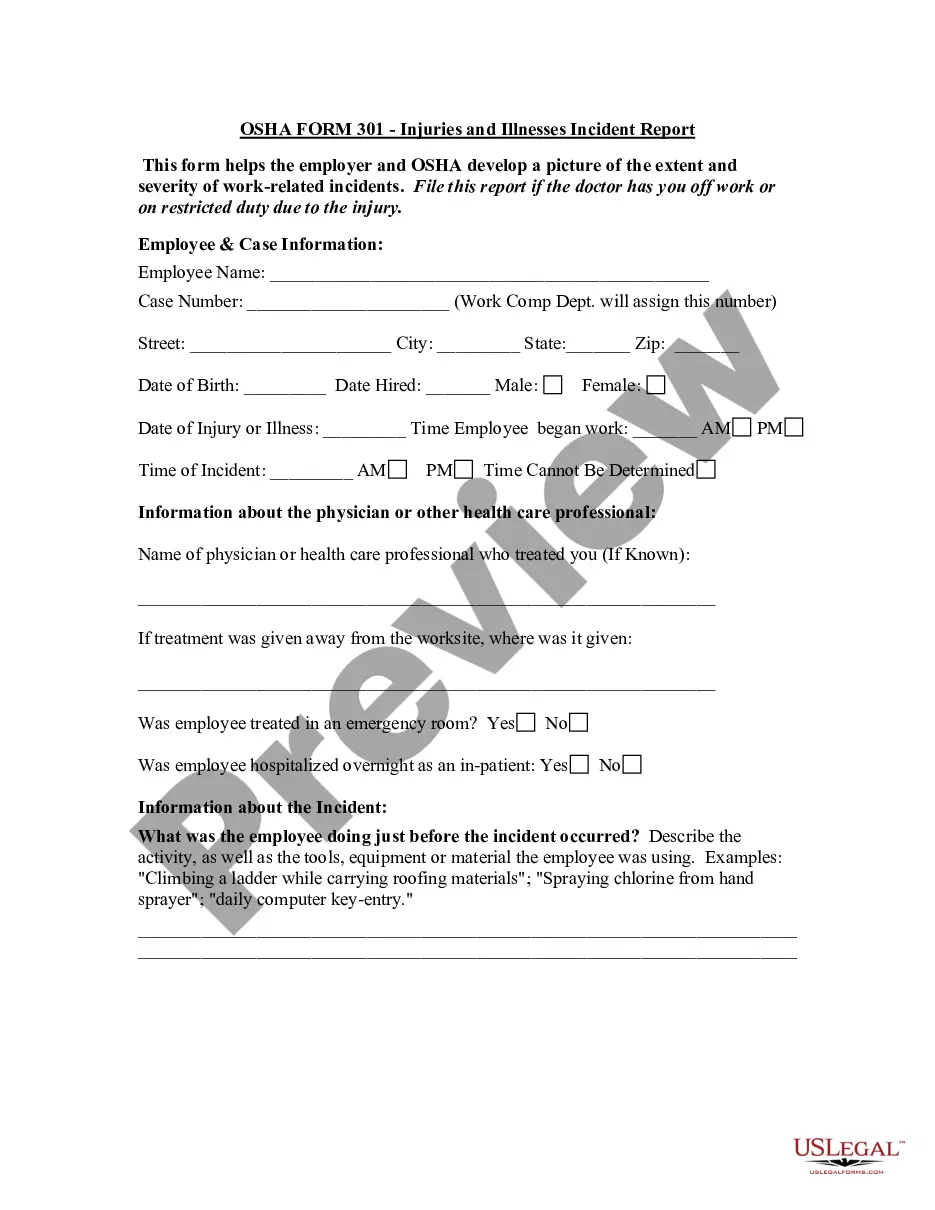

- Step 2. Make use of the Preview choice to look over the form`s articles. Do not neglect to read the explanation.

- Step 3. In case you are unsatisfied with all the type, make use of the Lookup area at the top of the monitor to discover other variations of the legitimate type design.

- Step 4. Upon having discovered the form you require, click on the Acquire now switch. Pick the prices plan you like and include your credentials to register to have an bank account.

- Step 5. Process the purchase. You can utilize your Мisa or Ьastercard or PayPal bank account to accomplish the purchase.

- Step 6. Choose the file format of the legitimate type and acquire it in your device.

- Step 7. Comprehensive, change and produce or indicator the Michigan Articles of Incorporation, Not for Profit Organization, with Tax Provisions.

Every legitimate record design you acquire is yours forever. You have acces to every single type you downloaded with your acccount. Click the My Forms segment and select a type to produce or acquire again.

Contend and acquire, and produce the Michigan Articles of Incorporation, Not for Profit Organization, with Tax Provisions with US Legal Forms. There are thousands of expert and condition-particular forms you can utilize for your company or specific requirements.

Form popularity

FAQ

In California, certain real property and personal property used for nonprofit purposes may be eligible for a property tax exemption. Some common exemptions include the Welfare Exemption, the most general of all exemptions, the Religious Exemption, the Church Exemption, the College Exemption, and the Cemetery Exemption.

The Charitable Nonprofit Housing Property Exemption, Public Act 612 of 2006, MCL 211.7kk, as amended, was created to exempt certain residential property owned by a charitable nonprofit housing organization from property taxes for a maximum period of five years if the property is intended for ultimate occupancy by low- ...

A certified copy of your Articles of Organization or Articles of Incorporation can be ordered by fax, mail, phone, or in person, but we recommend faxing. Normal processing takes up to 10 days, plus additional time for mailing, and costs $16.00 for up to 7 pages, and $1.00 per additional page.

You will have to provide proof that your organization is Michigan non-profit. There is a Michigan Sales and Use Tax Certificate of Exemption form that you may complete and give that form to your vendors, making a claim for exemption from sales or use tax.

Charitable Institution Exemptions Charitable institutions are exempt from property tax in Michigan under MCL 211.7o. The problem is that there is no statutory definition of what a ?charity? is for property tax exemption purposes, and some organizations walk a fine line between not-for-profit and for-profit status.

Are Nonprofits Taxed? Nonprofit organizations are exempt from federal income taxes under subsection 501(c) of the Internal Revenue Service (IRS) tax code. A nonprofit organization is an entity that engages in activities for both public and private interest without pursuing the goal of commercial or monetary profit.

The small business taxpayer personal property exemption provides a complete exemption from personal property tax for industrial or commercial personal property when the combined true cash value of all industrial personal property and commercial personal property owned by, leased by or in the possession of the owner or ...

Yes. Personal Property is a tax on the physical (tangible) assets of the business, not the structure or building itself. Therefore, the owner of the business, not the owner of the building, is assessed a personal property tax.