Michigan Affidavit of Domicile for Stock Transer

Description

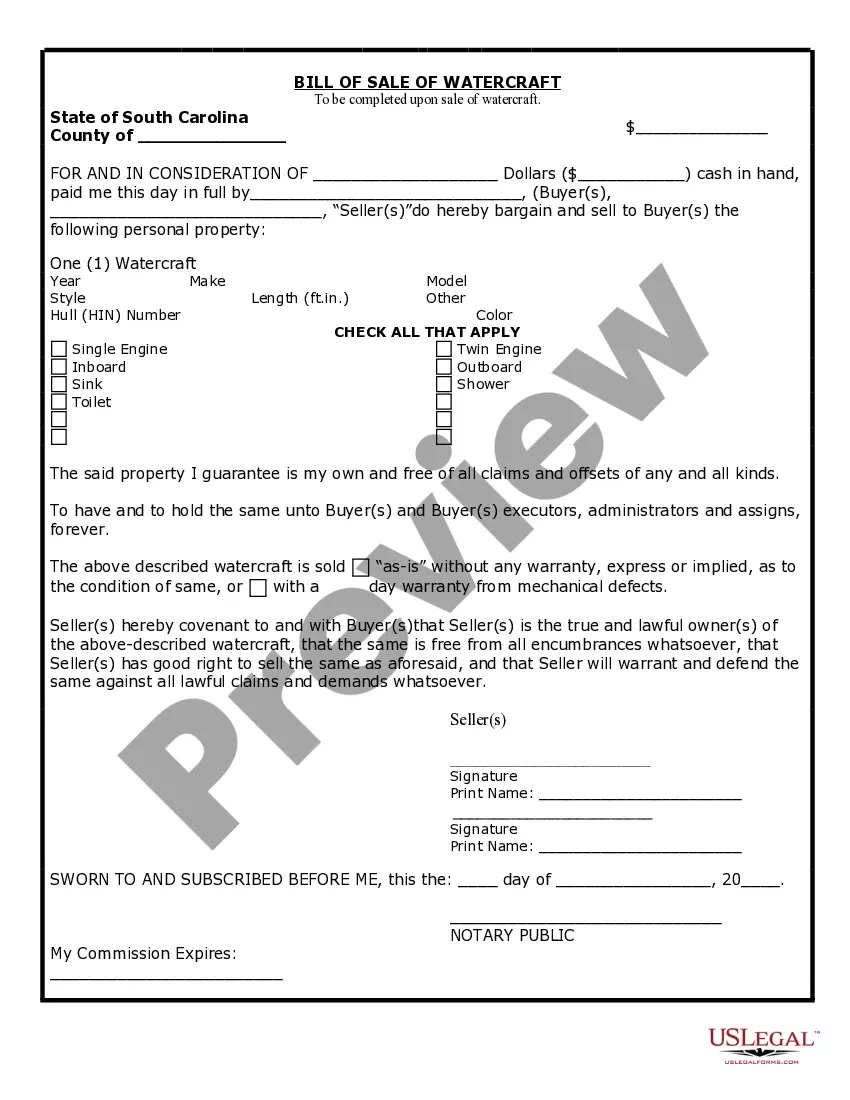

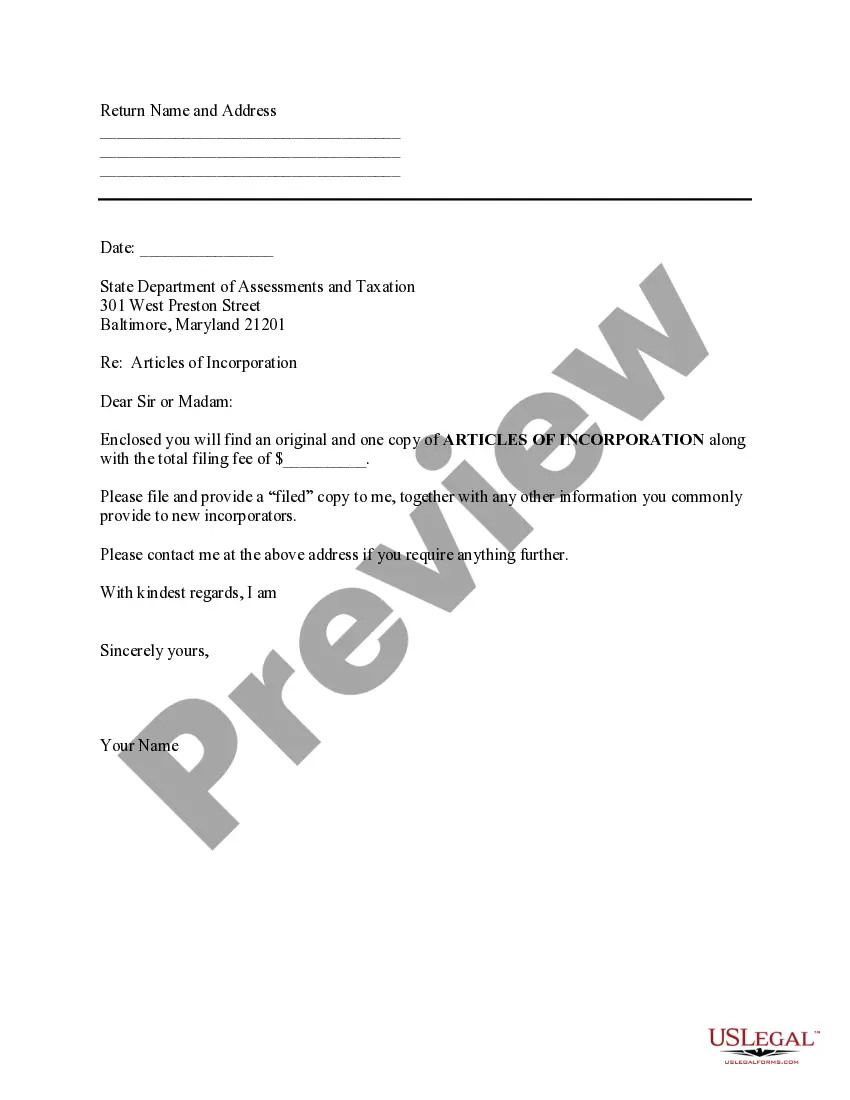

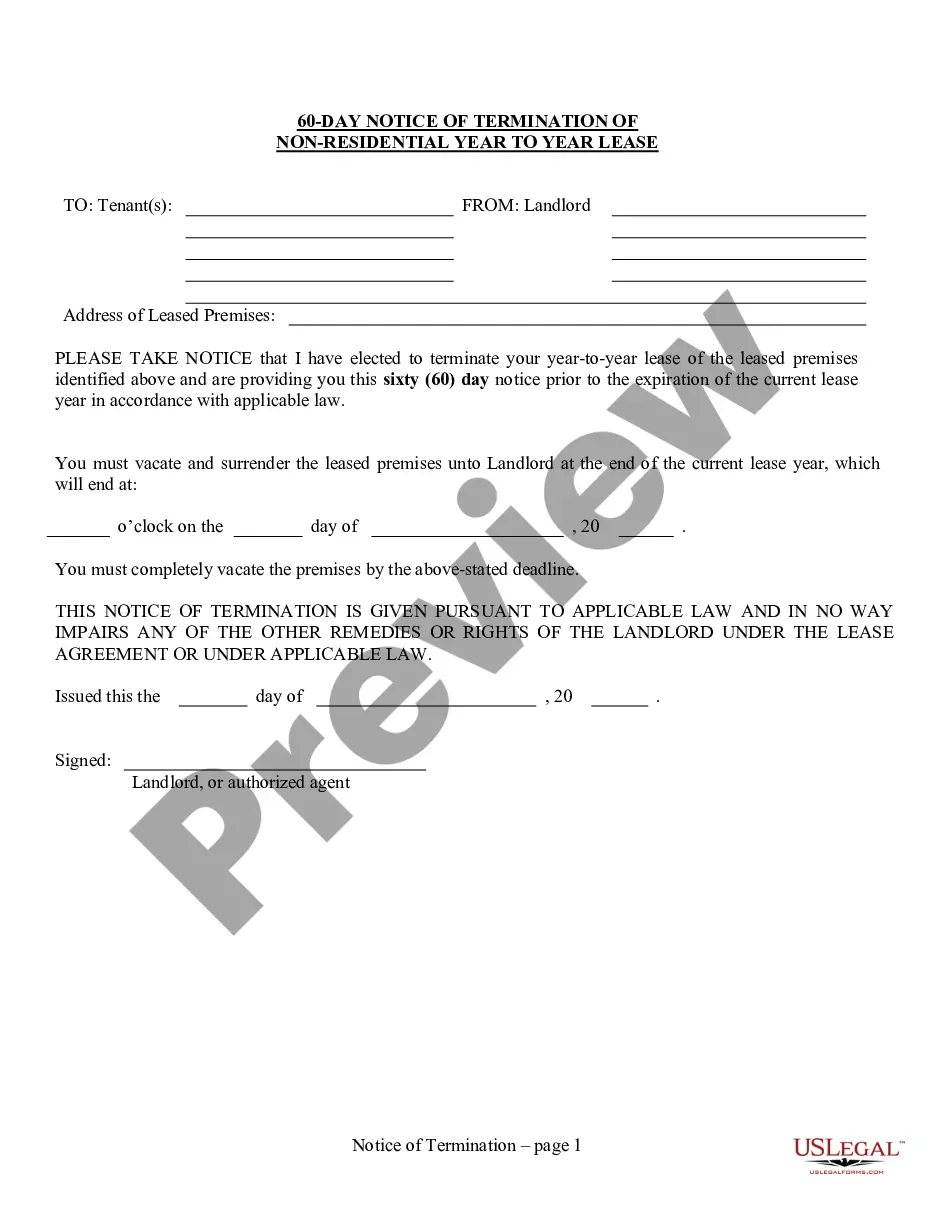

How to fill out Affidavit Of Domicile For Stock Transer?

If you wish to comprehensive, download, or produce legal papers templates, use US Legal Forms, the biggest assortment of legal forms, that can be found on the Internet. Use the site`s simple and convenient search to discover the files you need. Numerous templates for company and person reasons are categorized by classes and suggests, or keywords and phrases. Use US Legal Forms to discover the Michigan Affidavit of Domicile for Stock Transer within a few click throughs.

When you are presently a US Legal Forms consumer, log in to the account and click on the Down load option to get the Michigan Affidavit of Domicile for Stock Transer. You can also accessibility forms you previously saved in the My Forms tab of your account.

If you use US Legal Forms initially, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that appropriate town/country.

- Step 2. Take advantage of the Review choice to look over the form`s articles. Never neglect to read through the outline.

- Step 3. When you are unhappy using the form, utilize the Research area on top of the monitor to discover other types in the legal form design.

- Step 4. After you have located the form you need, go through the Purchase now option. Select the prices prepare you like and add your references to register to have an account.

- Step 5. Method the transaction. You may use your bank card or PayPal account to perform the transaction.

- Step 6. Pick the structure in the legal form and download it in your device.

- Step 7. Complete, change and produce or sign the Michigan Affidavit of Domicile for Stock Transer.

Each legal papers design you buy is your own property permanently. You have acces to every form you saved in your acccount. Click the My Forms portion and choose a form to produce or download once more.

Contend and download, and produce the Michigan Affidavit of Domicile for Stock Transer with US Legal Forms. There are thousands of professional and state-certain forms you can use for the company or person requirements.

Form popularity

FAQ

Real Estate Probate ? If a property is valued below $22,000, a spouse or any surviving heirs can petition a probate court to have the estate probated. For estates valued above $22,000 there is a formal supervised probate process which requires the appointment of a personal representative to distribute the estate.

An Affidavit of Domicile is a legal document that you can use to verify the home address of a person who has died. As the executor or administrator of an estate, you are required to produce an Affidavit of Domicile when transferring or cashing in stocks or other investment assets of a deceased person.

In Michigan, creditors have up to 3 years from the date of death to present claims to the estate. However, if you have followed the Task: Publish Notice of Death correctly, creditors will have only 4 months from the date of the first publication of notice to creditors.

Affidavit of Decedent's Successor for Delivery of Certain Assets Owned by Decedent (PC 598) may be used to affirm the following: More than 28 days have passed since the death of the decedent. The estate does not include real property.

Motor Vehicles. If a decedent dies with no probate assets (i.e., owns nothing in their name alone) except for one or more motor vehicles whose total value is not more than $60,000, title to the vehicles can be transferred by the Secretary of State without opening an estate in the Probate Court.

Knowing where the decedent's domicile (where the decedent had his or her primary residence) was at date of death is key when figuring out where you must probate the assets and what state you must pay taxes to (although real estate is subject to state estate or inheritance tax, if any, in the state in which it's located ...

Whether an estate is small depends on the value of the property in it. The dollar limit can change each year. If a person dies in 2023, an estate must be valued at $27,000 or less to be small. If a person died in 2022, an estate must be valued at $25,000 or less.