Michigan Employee Information Form

Description

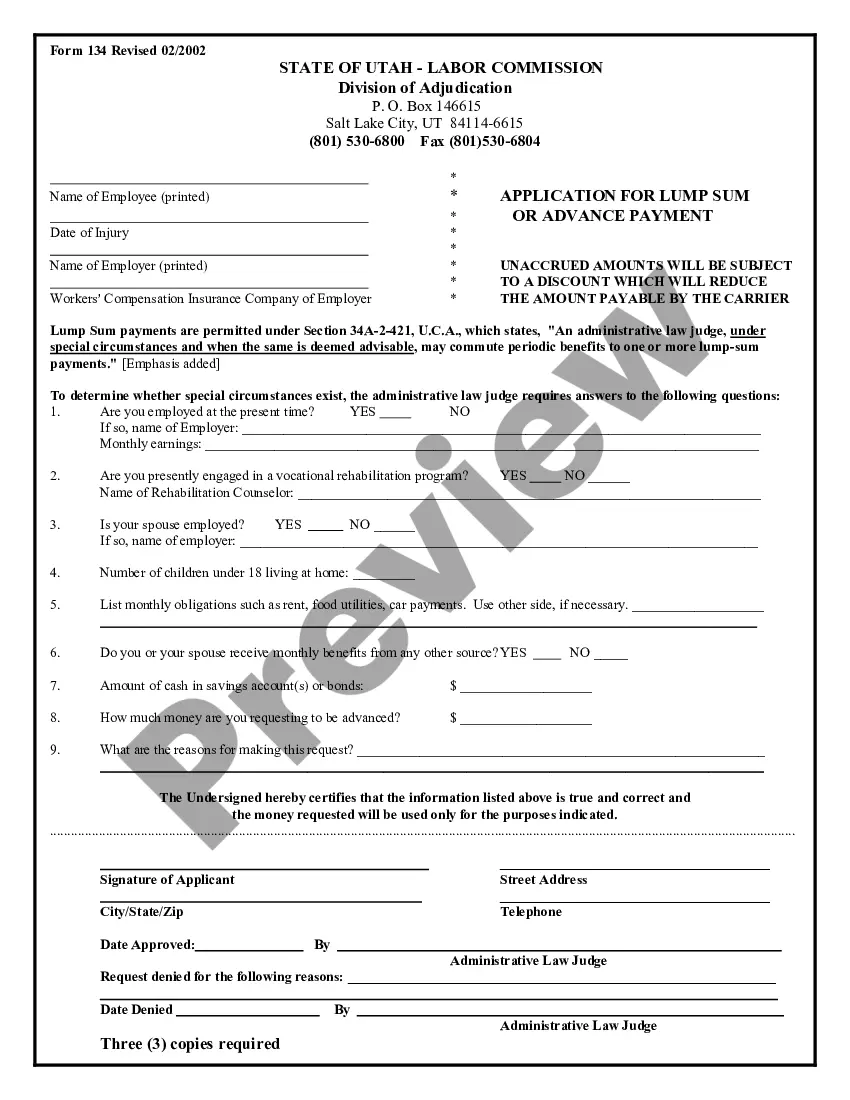

How to fill out Employee Information Form?

Are you in a predicament where you need to possess documents for either business or personal purposes almost every day.

There are numerous legal document templates accessible online, but finding ones you can trust isn't simple.

US Legal Forms offers a vast array of form templates, such as the Michigan Employee Information Form, which can be printed to meet state and federal requirements.

Once you find the correct form, click on Acquire now.

Select the pricing plan you desire, complete the required information to create your account, and make the payment with your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Afterward, you can download the Michigan Employee Information Form template.

- If you do not have an account and wish to begin using US Legal Forms, follow these steps.

- Identify the form you need and ensure it is for the correct state/region.

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the correct form.

- If the form isn't what you are looking for, use the Lookup field to find the form that fits your needs.

Form popularity

FAQ

New employees in Michigan typically need to complete a few essential pieces of paperwork. This includes the Michigan Employee Information Form to provide their personal details and tax withholding preferences. New hires should also complete the I-9 form to verify their identity and work eligibility. Having all necessary documents ready can simplify the hiring process and ensure a smooth onboarding experience.

In Michigan, new employees must complete several important forms. These include the Michigan Employee Information Form, which collects personal and tax information. Additionally, employees may need to submit a Federal W-4 form for tax withholding. Ensuring these forms are filled out correctly helps streamline payroll and maintains compliance with state and federal regulations.

To write employee information, focus on key data such as the employee’s full name, contact details, job position, and relevant tax information. Ensure clarity and accuracy to facilitate smooth communication and processing. Using the Michigan Employee Information Form can help standardize this process and assist you in relaying critical information to your employer.

When filling out an employee availability form, clearly indicate the days and times you are available to work. Be honest about your limitations to help your employer schedule shifts effectively. Including this information alongside your Michigan Employee Information Form ensures that your scheduling preferences align with your overall employment details.

Determining the right level of tax withholding involves assessing your income, filing status, and number of dependents. You can consult the IRS withholding calculator for guidance. Additionally, your Michigan Employee Information Form will outline your preferences and enable employers to apply the appropriate withholding rates.

To complete an employment tax form, begin with entering your income details, followed by the amounts for tax deductions and credits. Ensure that you've collected all necessary tax documents to accurately report your earnings. Utilizing the Michigan Employee Information Form can greatly assist in providing your employer with precise information for tax calculations.

Choosing between 0 or 1 on your W4 depends on your financial situation and preference for tax withholding. If you claim 0, more tax will be withheld, which may lead to a refund later. On the other hand, claiming 1 may result in less withholding, so assess your circumstances carefully to decide, and always refer back to your Michigan Employee Information Form for accurate details.

Filling out an employee information form requires you to provide personal details clearly and accurately. Begin with your full name, contact details, and Social Security number, followed by any pertinent job-related information. The Michigan Employee Information Form serves as a critical document that streamlines your integration into the payroll system.

An employee information form typically includes essential details such as the employee's name, address, Social Security number, and emergency contact information. Additional sections may cover tax withholding preferences, job position, and direct deposit options. Completing the Michigan Employee Information Form accurately ensures that your employer has all requisite details to process payroll and benefits.

To fill out self-employment tax, start by calculating your net earnings from self-employment. You will report this income on Schedule C, then transfer the amount to Schedule SE to determine your self-employment tax. Keep in mind that a correctly filled Michigan Employee Information Form can help you keep track of your earnings and any related taxes.