This form is a general form of a bill of sale for personal property (i.e. goods). It should not be used to convey title to real property or title to a motor vehicle.

Michigan General Form for Bill of Sale of Personal Property from One Individual to another Individual

Description

How to fill out General Form For Bill Of Sale Of Personal Property From One Individual To Another Individual?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a range of legal form templates that you can purchase or print.

By utilizing the website, you can find thousands of forms for both commercial and individual use, categorized by types, states, or keywords. You can access the most recent versions of forms, such as the Michigan General Form for Bill of Sale of Personal Property from One Person to Another, in moments.

If you already have a subscription, Log In and obtain the Michigan General Form for Bill of Sale of Personal Property from One Individual to Another through the US Legal Forms library. The Get button will appear on every form you review. You can access all previously saved forms in the My documents section of your account.

Make edits. Fill out, modify, print, and sign the downloaded Michigan General Form for Bill of Sale of Personal Property from One Individual to Another.

Every template you save in your account has no expiration date and is yours forever. Therefore, if you need to download or print another copy, simply visit the My documents section and click on the form you desire.

- If you are using US Legal Forms for the first time, here are straightforward instructions to get started.

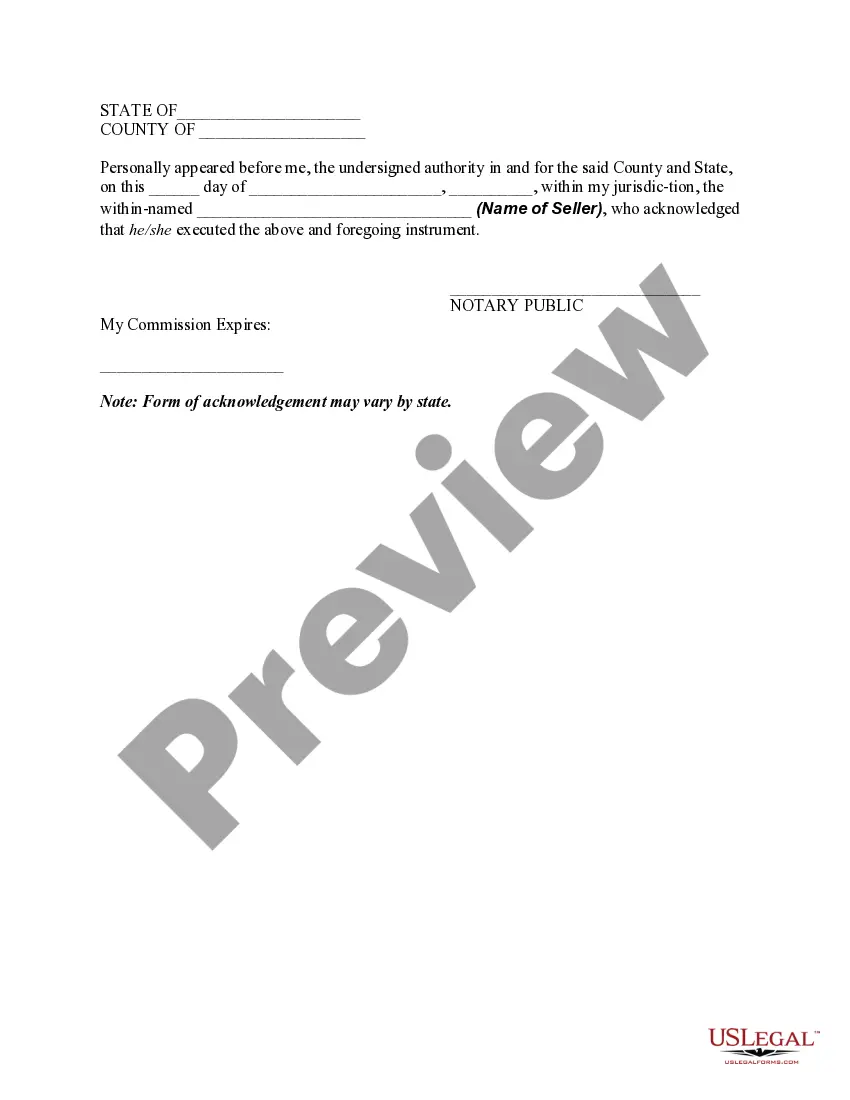

- Make sure you have chosen the correct form for your city/county. Click the Preview button to examine the content of the form. Review the form summary to ensure you have selected the correct one.

- If the form does not meet your requirements, use the Search box at the top of the screen to find one that suits your needs.

- Once you are satisfied with the form, confirm your choice by clicking on the Get now button. Then select the payment plan you prefer and provide your details to register for an account.

- Complete the transaction. Use your credit card or PayPal account to finish the transaction.

- Select the format and download the form to your device.

Form popularity

FAQ

Tax and Title At the time of titling, a $15 title transfer fee will be collected. If a lien is added, the fee is $16. A six-percent use tax will also be collected.

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer.

How to Transfer Michigan Real EstateFind the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

How to Transfer Michigan Real EstateFind the most recent deed to the property. It is helpful to begin by locating the most recent deed to the property (the deed that transferred the property to the current grantor).Create the new deed.Sign and notarize the deed.File the deed in the county land records.

Michigan law requires that a Property Transfer Tax Affidavit (PTA) be filed with the local assessor (city or township) upon the transfer of ownership of real property. As used in the statute transfer of ownership means the conveyance of title 2026

5 Ways to Transfer Property in IndiaSale Deed. The most common way of property transfer is through a sale deed.Gift Deed. Another popular way of transferring property ownership is by 'gifting' the property using a gift deed.Relinquishment Deed.Will.Partition Deed.

In accordance with Michigan State Law, a Property Transfer Affidavit must be filed with the local assessor's office whenever real estate or some types of personal property transfer ownership (a transfer of ownership is generally defined as: a conveyance of title to, or present interest in, a property, including

Gifts of real property in Michigan are subject to this federal gift tax. In accordance with federal law, individuals are permitted an annual exclusion of $15,000 on gifts. This means that gifts valued below $15,000 do not require a federal gift tax return (Form 709).

Affidavit must be filed by the new owner with the assessor for the city or township where the property is located within 45 days of the transfer. The information on this form is NOT CONFIDENTIAL.