Michigan Receipt for Payment of Account

Description

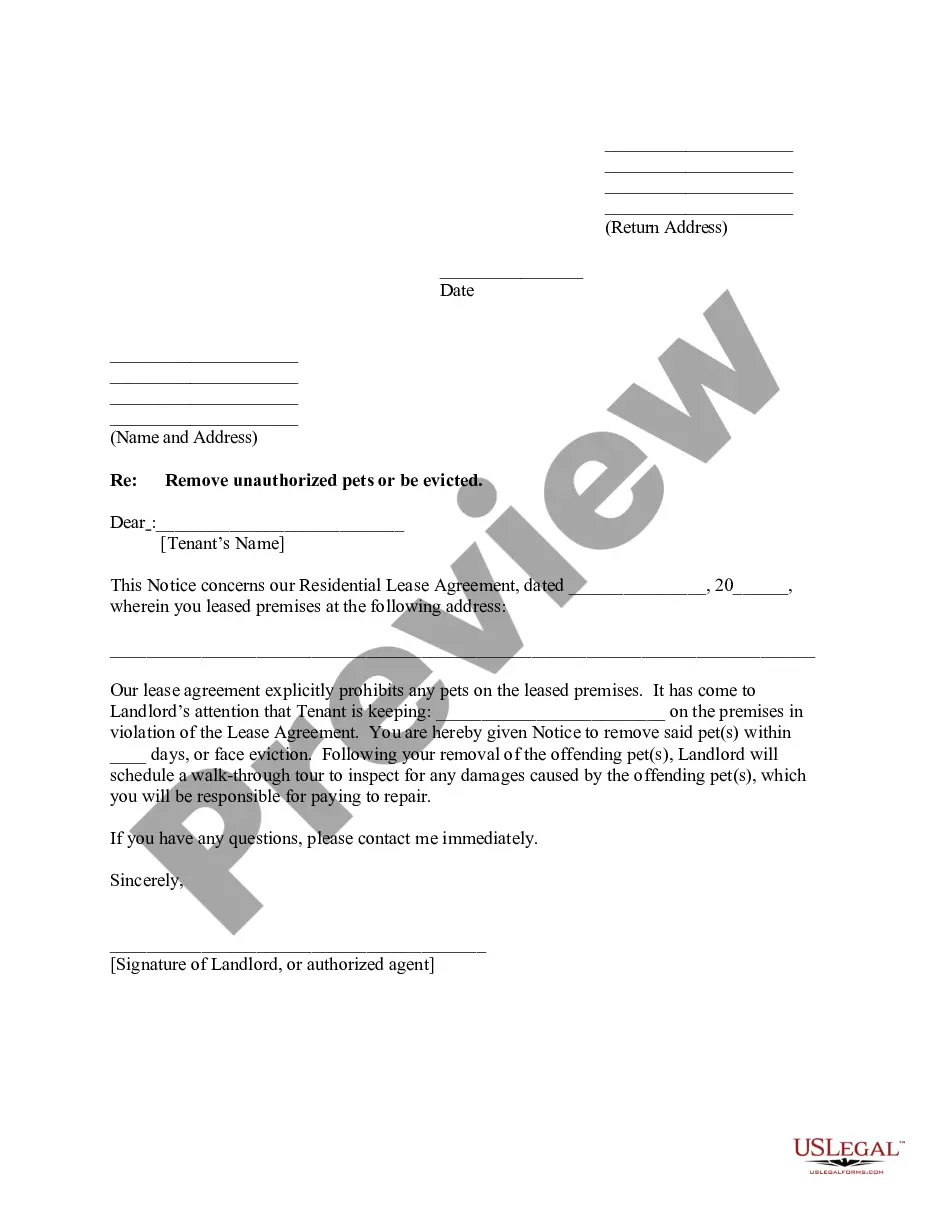

How to fill out Receipt For Payment Of Account?

If you wish to total, down load, or produce lawful papers layouts, use US Legal Forms, the biggest assortment of lawful varieties, which can be found on the Internet. Make use of the site`s basic and practical research to find the documents you require. Different layouts for enterprise and person uses are categorized by types and suggests, or search phrases. Use US Legal Forms to find the Michigan Receipt for Payment of Account within a handful of clicks.

If you are previously a US Legal Forms consumer, log in to the profile and then click the Obtain switch to get the Michigan Receipt for Payment of Account. You can also accessibility varieties you previously acquired in the My Forms tab of your own profile.

Should you use US Legal Forms the very first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form to the appropriate town/country.

- Step 2. Take advantage of the Review solution to look through the form`s articles. Never forget about to see the information.

- Step 3. If you are unsatisfied together with the kind, use the Research area at the top of the display to find other variations of your lawful kind design.

- Step 4. Upon having discovered the form you require, click the Acquire now switch. Select the prices program you prefer and put your accreditations to sign up to have an profile.

- Step 5. Process the transaction. You should use your charge card or PayPal profile to finish the transaction.

- Step 6. Select the structure of your lawful kind and down load it on your own system.

- Step 7. Total, modify and produce or indicator the Michigan Receipt for Payment of Account.

Each and every lawful papers design you buy is your own forever. You possess acces to each and every kind you acquired in your acccount. Click on the My Forms portion and select a kind to produce or down load once again.

Compete and down load, and produce the Michigan Receipt for Payment of Account with US Legal Forms. There are thousands of skilled and express-specific varieties you can use for your enterprise or person requires.

Form popularity

FAQ

You need to enter your Social Security Number and the zip code from your tax return. Anyone can make a credit or debit card payment on their Michigan state income taxes.

Payments can be made prior to receiving a Notice of Intent/Final Bill for Taxes Due by using the Michigan Individual Income Tax e-Payments system. You can also submit any late or partial payments by check or money order to Michigan Department of Treasury, P.O. Box 30774, Lansing MI 48929.

Make your check payable to the "State of Michigan". Always write your unique identifier or federal identification number on your check.

What is included on a payment receipt? The seller's business name/logo. A clear label ('Payment receipt') The original invoice number. The date the payment was received. The amount received. Any remaining amount due.

To pay your debt or other questions about your delinquent account, call Treasury Collection Services Bureau at 517-636-5265. If you are making a payment by electronic withdrawal (EFT), please have your bank account number and the 9 digit bank routing number of your financial institution available.

Payments can be made via Michigan Treasury Online (MTO) using an e-check or credit card (fees are applicable).

To pay your debt or other questions about your delinquent account, call Treasury Collection Services Bureau at 517-636-5265.

A: The Michigan Automated Tax Payment System is the system used to complete payments using Electronic Funds Transfer (EFT). A user identification and password is required. To make an online payment go to .Michigan.gov/biztaxpayments. Touchtone phone payments can be made by calling 1-877-865-2860.