Michigan Financing Statement

Description

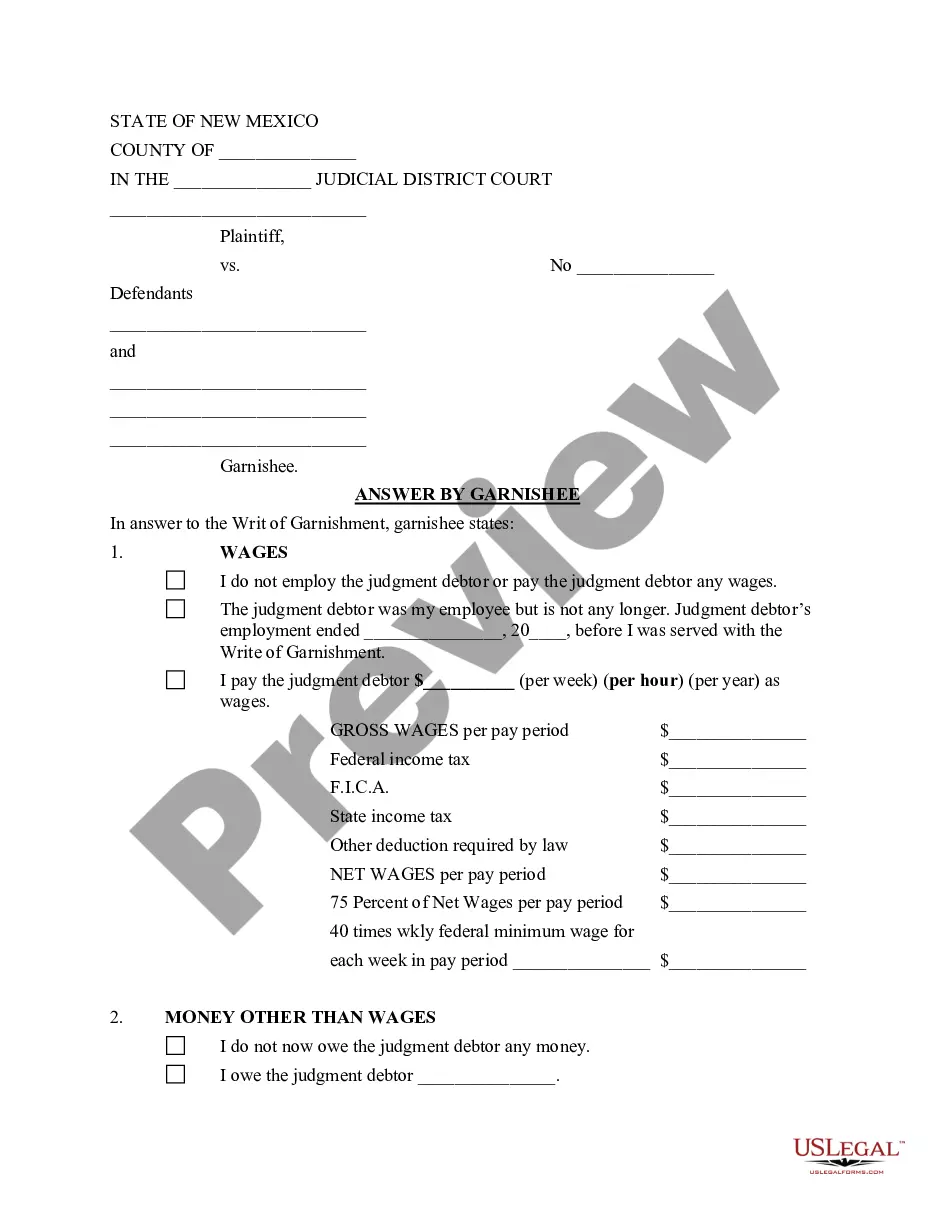

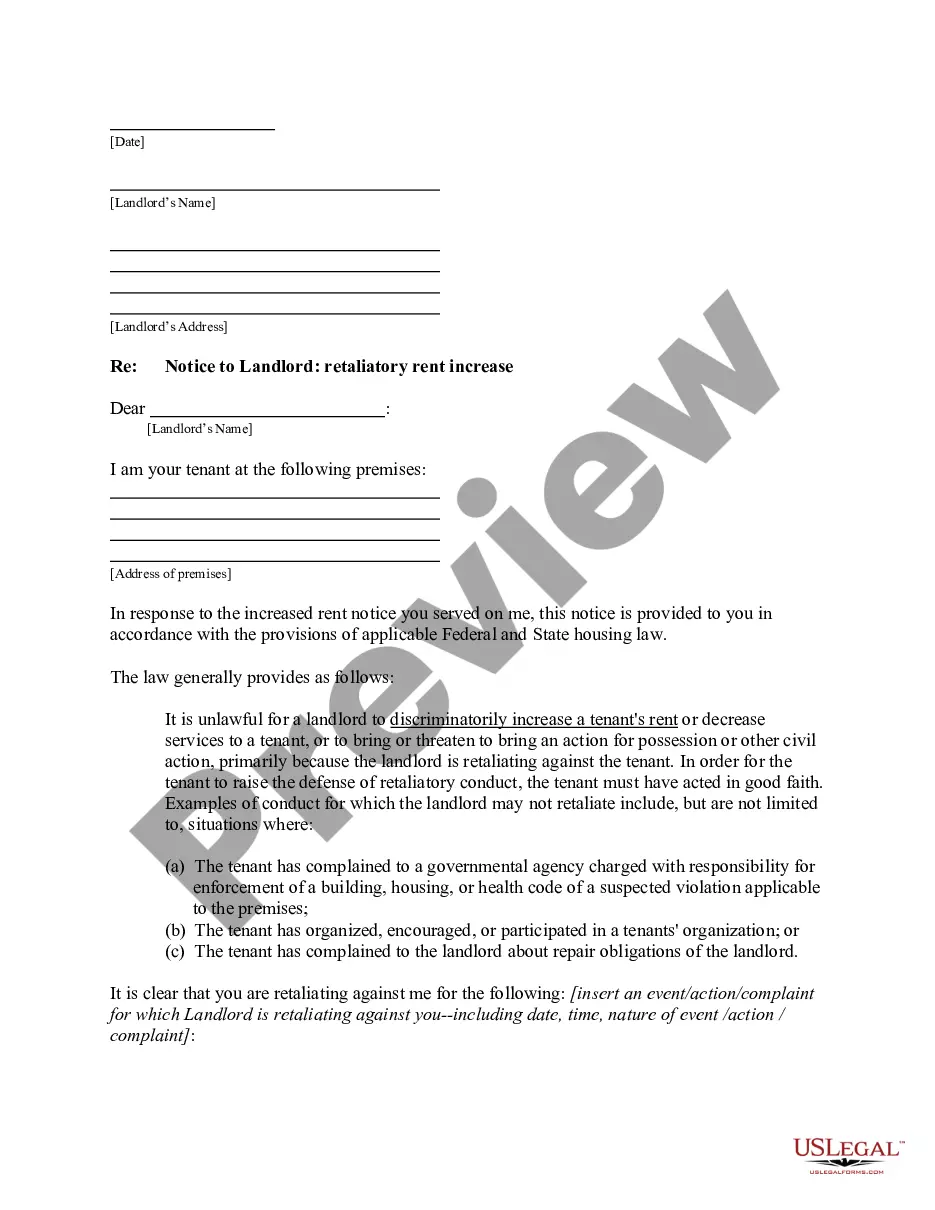

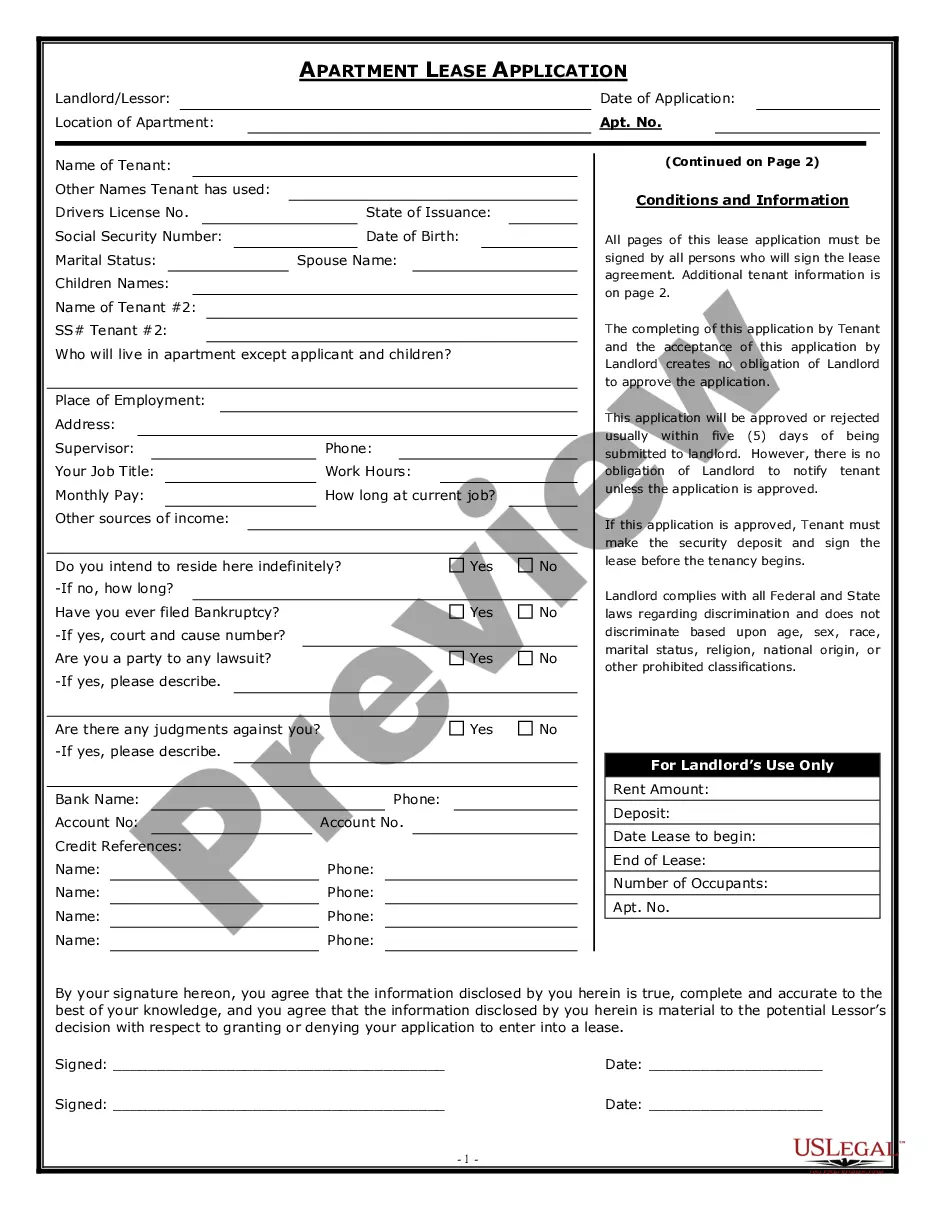

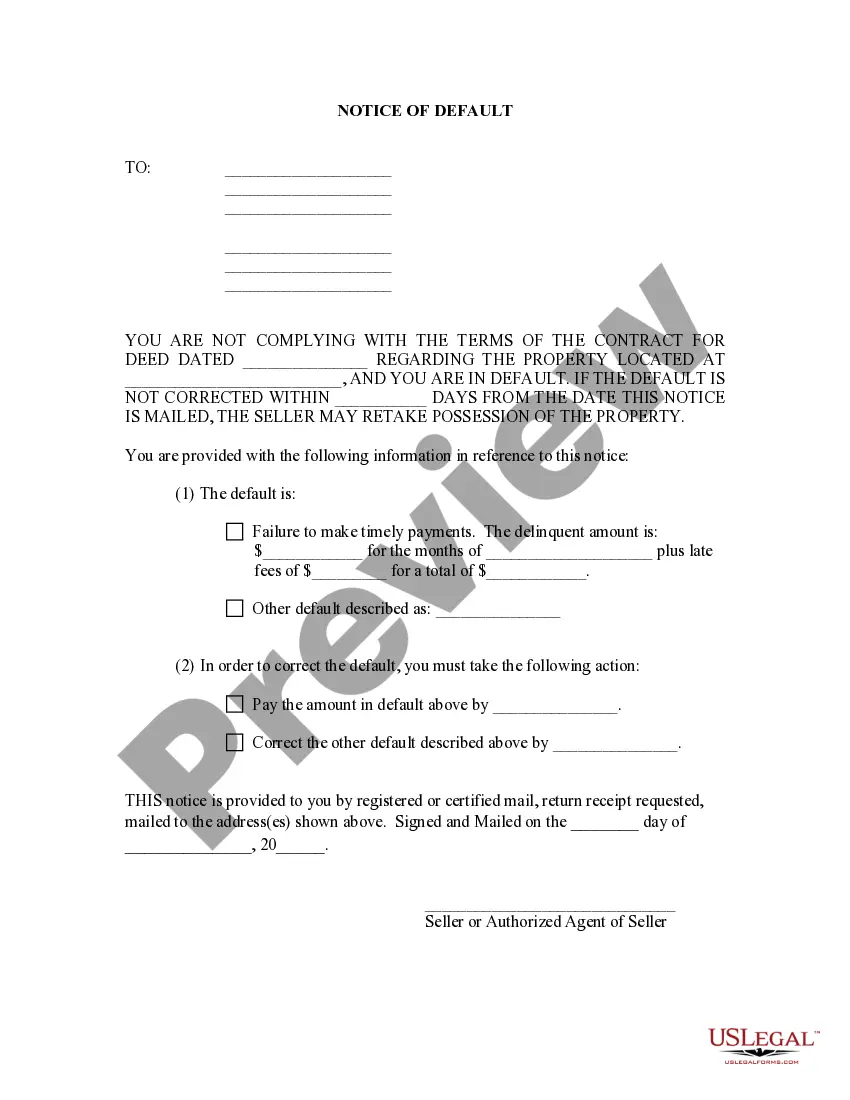

How to fill out Financing Statement?

If you intend to consolidate, obtain, or print authentic document templates, utilize US Legal Forms, the premier collection of legal forms available on the web.

Make use of the site's straightforward and user-friendly search function to locate the documents you need.

An assortment of templates for business and personal purposes is categorized by groups and states or keywords.

Step 4. Once you have found the form you desire, click the Buy now button. Select your preferred pricing plan and enter your details to register for an account.

Step 5. Process the transaction. You may use your credit card or PayPal account to complete the purchase.

- Employ US Legal Forms to find the Michigan Financing Statement in just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to acquire the Michigan Financing Statement.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have chosen the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Don't forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

A financing statement does not require a signature to be effective under Michigan law. However, it must contain the necessary information to identify the parties involved and the collateral described. For further assistance in filing correctly, consider using platforms like US Legal Forms, which simplifies the process for users.

Yes, a financing statement serves as a public notice that a lien exists against certain collateral. This lien is important for creditors as it establishes their legal claim on the property covered by the Michigan Financing Statement. If you seek to protect your interests, filing a financing statement is a critical step.

In Michigan, you file a UCC financing statement with the Michigan Department of Licensing and Regulatory Affairs (LARA). This office maintains public records of filings, providing transparency for interested parties. It's essential to choose the correct filing location to ensure your Michigan Financing Statement is valid and enforceable.

For a Michigan Financing Statement to be valid, it must include specific details such as the names of the debtor and secured party, an adequate description of the collateral, and the filing office's identification. This information ensures that anyone searching public records can easily find the statement and understand the claimed security interest. Always consult legal guidance to ensure compliance with these requirements.

A financing statement is typically filed by a secured party, which can be a lender or a seller, in order to perfect a security interest under the Michigan Financing Statement framework. These parties seek to protect their rights in the collateral provided by a borrower or buyer. By filing, they assert their interest in the property, ensuring it is recognized legally.

Receiving a UCC Financing Statement indicates that a creditor has filed a claim against your property in Michigan. This document serves to inform you of their security interest and may involve your assets. It’s essential to review this statement carefully and, if necessary, consult with a legal professional to understand your situation better.

The financing statement is a form that outlines the details of the secured transaction between a debtor and a creditor. In Michigan, this document typically includes information about the parties involved and the description of the collateral. It acts as a foundational element in the UCC (Uniform Commercial Code) system, safeguarding the interests of creditors.

Filing a Michigan Financing Statement establishes a legal claim over the debtor's assets, ensuring that the creditor’s rights are recognized. This process aids in preventing disputes regarding ownership and rights to the property. Essentially, it solidifies your position as a creditor in any potential bankruptcy or financial difficulties.

Filing a Michigan Financing Statement provides public notice of a creditor's claim against a debtor's collateral. This notice informs other potential creditors about the existing security interest. By filing this statement, you help create transparency in the financial dealings of the debtor.

A financing statement is a legal document that serves as a public notice that a creditor has an interest in a debtor's personal property. This instrument provides essential information about the security interest and protects the creditor's rights. In Michigan, this document is crucial for securing interests in personal property, ensuring clarity in financial transactions.