Michigan Simple Equipment Lease

Description

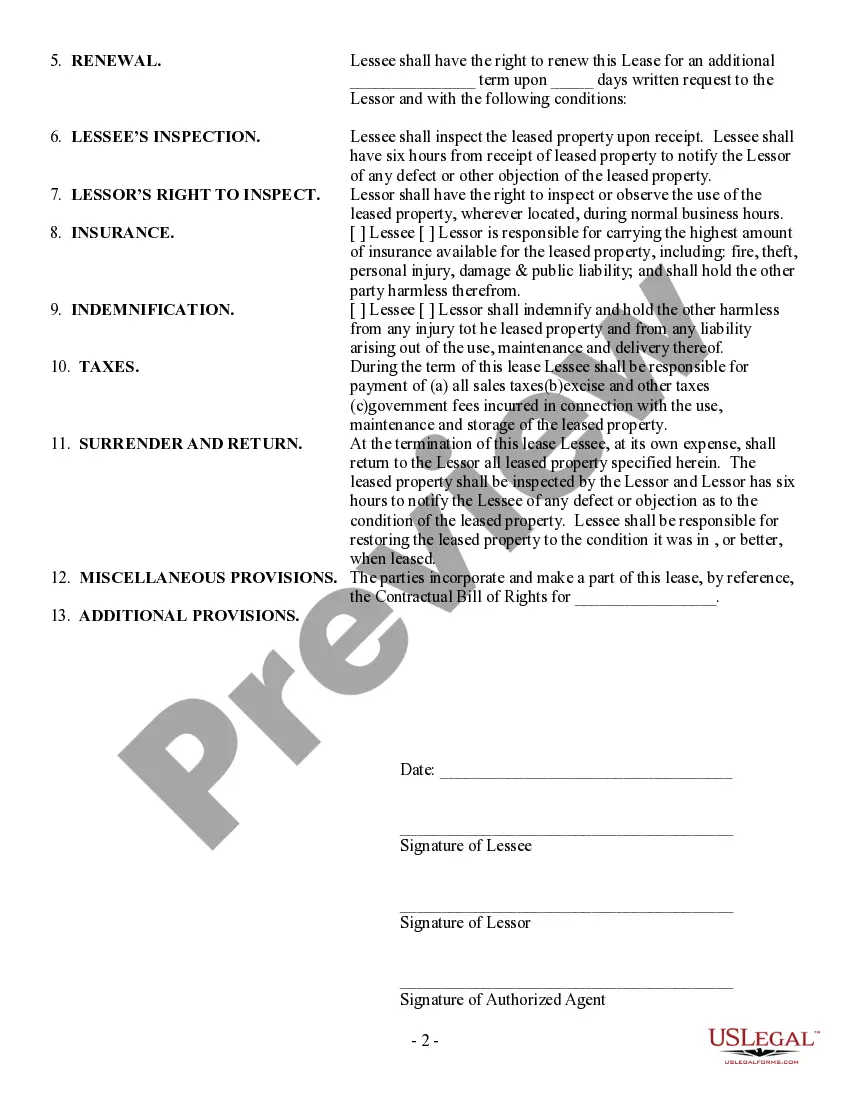

How to fill out Simple Equipment Lease?

US Legal Forms - one of the largest collections of legal documents in the United States - provides a broad selection of legal document templates that you can download or create.

By using the website, you can obtain thousands of forms for professional and personal purposes, categorized by type, state, or keywords. You can find the latest versions of forms like the Michigan Simple Equipment Lease in just moments.

If you already have an account, Log In and download the Michigan Simple Equipment Lease from the US Legal Forms library. The Download button will appear on each form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Edit. Fill out, modify, and print and sign the downloaded Michigan Simple Equipment Lease.

- Make sure you have selected the correct form for your area/state.

- Click the Review button to examine the content of the form.

- Check the form description to confirm that you have chosen the right one.

- If the form does not meet your requirements, use the Search field at the top of the page to find one that does.

- When you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the payment plan you prefer and provide your details to create an account.

Form popularity

FAQ

Determining a good lease rate often depends on the type of equipment and the financing terms offered. Generally, lower lease rates are preferable and can range from 2% to 8% of the equipment value. For a Michigan Simple Equipment Lease, evaluating multiple offers can help find the best deal that meets your budget. Consult professionals for valuable insights on rates.

The interest rate for an equipment lease varies based on factors like the lessee's creditworthiness and the type of equipment. Generally, rates can range from 4% to 12%. It's beneficial to compare rates among various leasing companies before finalizing a Michigan Simple Equipment Lease. Checking with multiple lenders can lead to better financing terms.

For a lease to be valid in Michigan, it must include essential elements such as offers, acceptance, consideration, and a lawful purpose. Additionally, all parties involved must have the legal capacity to enter into the agreement. Ensuring your Michigan Simple Equipment Lease reflects these components will uphold its enforceability. USLegalForms offers resources to help you structure valid leases.

The average interest rate for equipment financing can vary widely but typically ranges from 4% to 15%. Factors influencing this rate include the type and age of equipment, credit score, and lease term. For those seeking finance options through a Michigan Simple Equipment Lease, it's wise to shop around to find competitive rates that suit your needs.

Setting up an equipment lease begins with identifying the equipment you need and the terms of the lease. Draft a lease agreement that details the payment schedule, responsibilities, and conditions for use. In Michigan, following the guidelines for a Michigan Simple Equipment Lease ensures you stay compliant with state laws. Utilizing platforms like USLegalForms can make drafting easier.

A good equipment lease rate can depend on various factors, including the type of equipment, lease duration, and the creditworthiness of the lessee. Generally, a market comparison will help you find a fair rate. In Michigan, a Michigan Simple Equipment Lease typically ranges from 2% to 10% of the equipment's value. Researching rates or getting professional advice can provide clarity.

To create a rental agreement for equipment, start by specifying the parties involved, the equipment details, and the rental duration. You can use templates to ensure you include the necessary terms, like payment schedule and maintenance responsibilities. For a Michigan Simple Equipment Lease, it's crucial to comply with local regulations. Consider using USLegalForms to streamline this process and access legally sound templates.

In Michigan, there is no specific age at which individuals stop paying property taxes entirely. However, some programs offer tax assistance or exemptions for senior citizens. If you are leasing property under a Michigan Simple Equipment Lease, it's wise to stay informed about potential tax relief options available.

In Michigan, there is a personal property tax exemption for small businesses on certain leased property. This exemption can reduce tax burdens significantly, especially for those utilizing a Michigan Simple Equipment Lease. Business owners must file for this exemption to take advantage of savings.

In Michigan, personal property is typically assessed at market value and subject to a local millage rate. Each locality may have different rates, so it’s essential to know how tax laws might affect equipment you lease. Utilizing a Michigan Simple Equipment Lease can help you track your taxable personal property accurately.