Michigan Sample Letter for Withheld Delivery

Description

How to fill out Sample Letter For Withheld Delivery?

If you require to complete, acquire, or create sanctioned document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Take advantage of the site's user-friendly search to find the documents you require. Numerous templates for commercial and personal purposes are categorized by types and states or keywords.

Utilize US Legal Forms to obtain the Michigan Sample Letter for Withheld Delivery in just a few clicks.

Every legal document format you purchase is yours forever. You have access to every template you downloaded in your account. Select the My documents section and choose a form to print or download again.

Complete and download, and print the Michigan Sample Letter for Withheld Delivery with US Legal Forms. There are many professional and state-specific forms you can utilize for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Download button to retrieve the Michigan Sample Letter for Withheld Delivery.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have selected the form for your specific city/state.

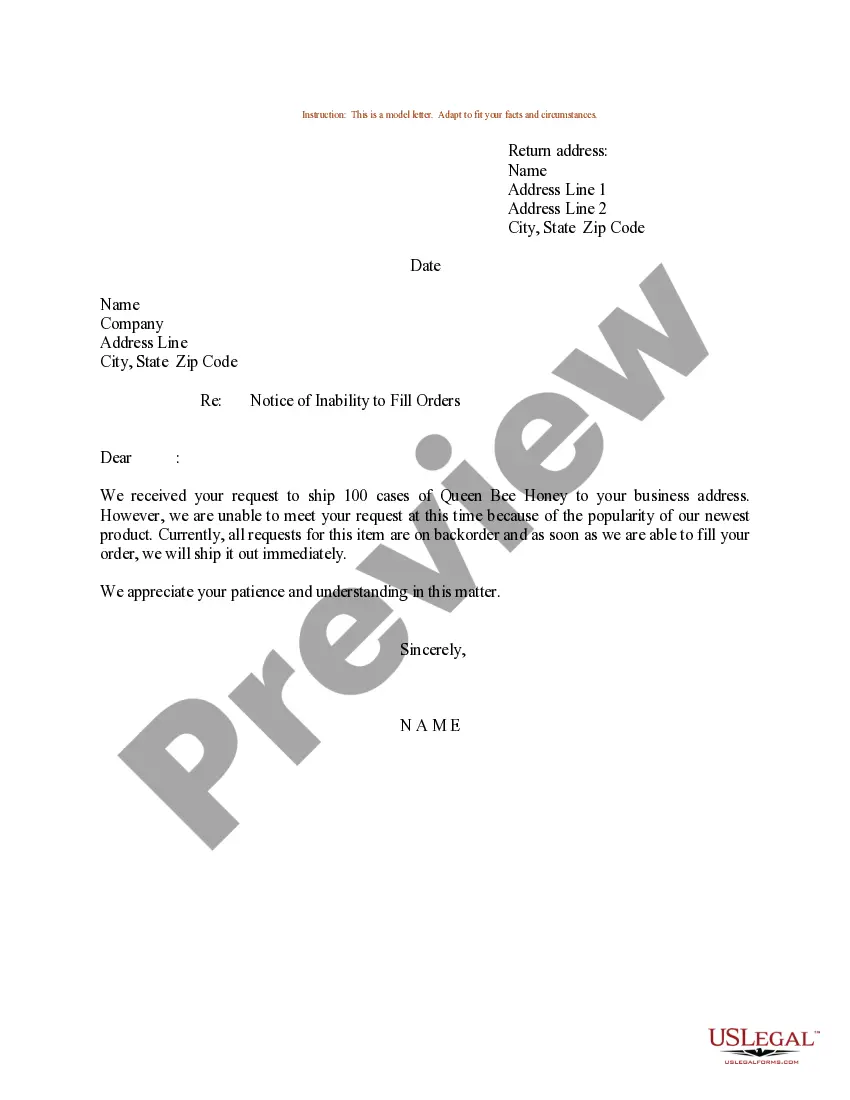

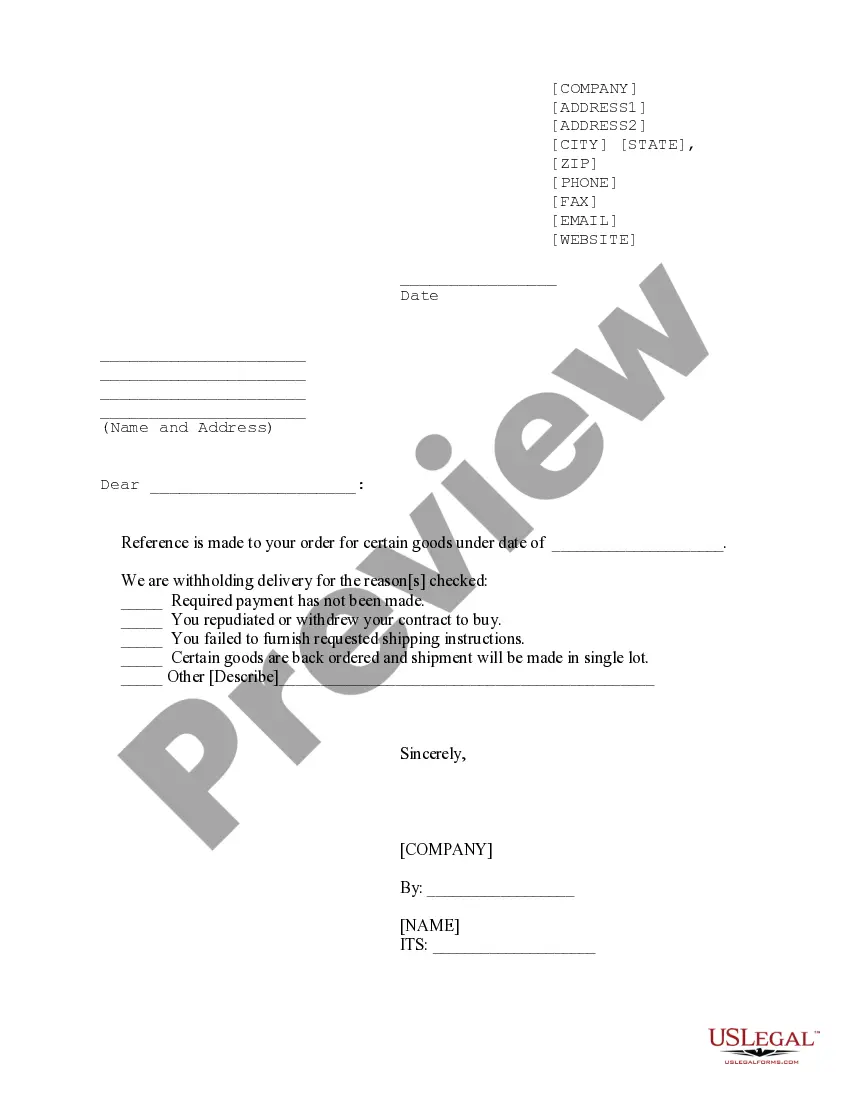

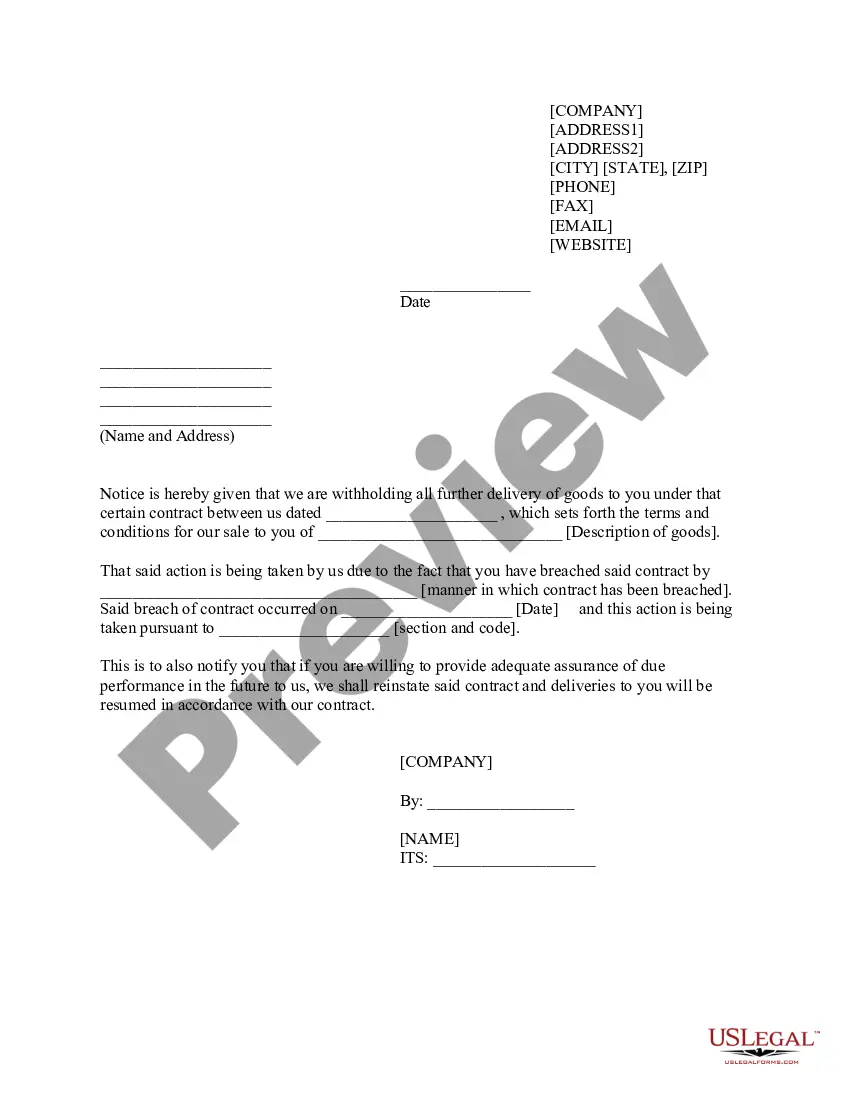

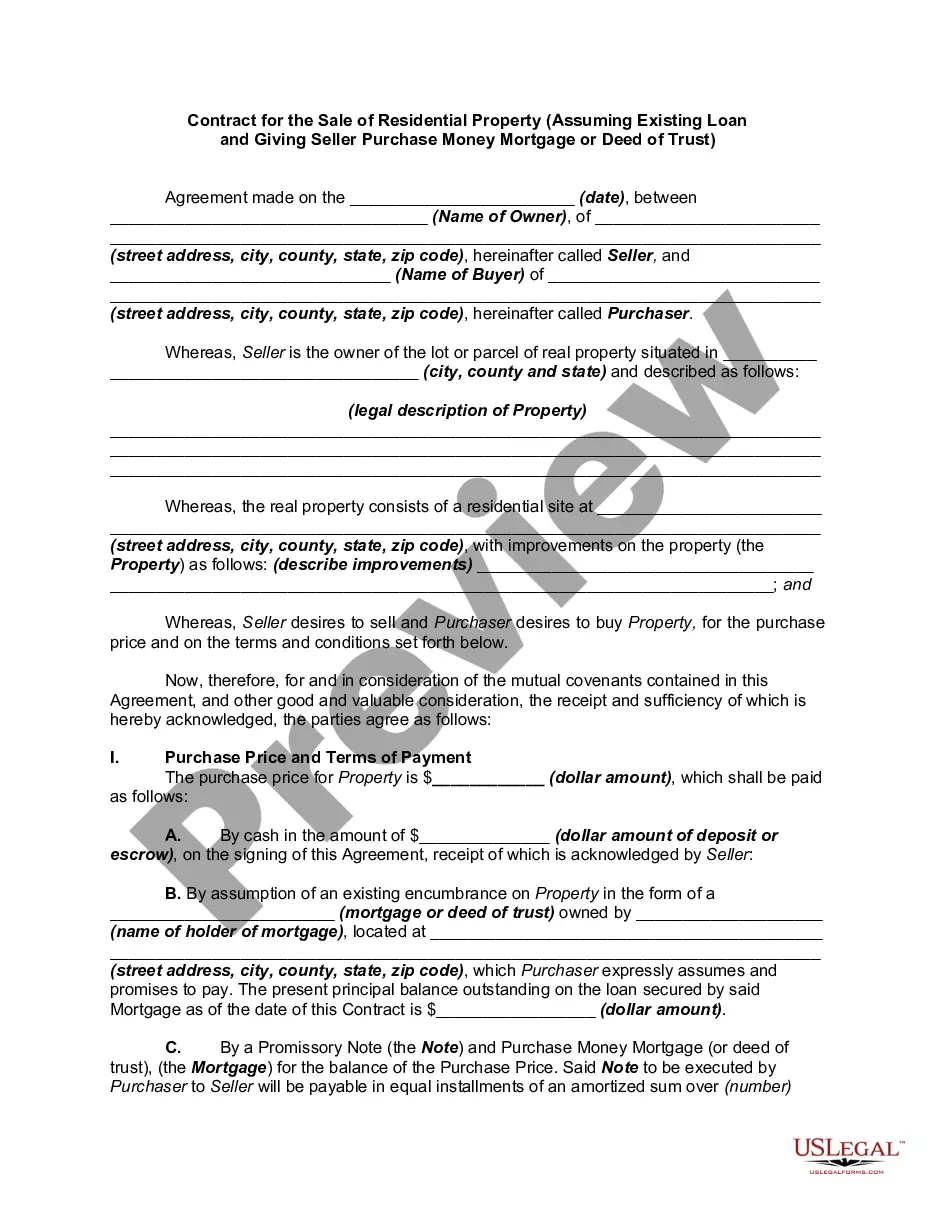

- Step 2. Use the Preview function to review the form's contents. Don’t forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form.

- Step 4. Once you have found the form you need, click the Get now button. Select the payment plan you prefer and enter your details to register for the account.

- Step 5. Complete the payment. You may use your Visa or Mastercard or PayPal account to finalize the transaction.

- Step 6. Choose the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Michigan Sample Letter for Withheld Delivery.

Form popularity

FAQ

You may receive a check from the Michigan Treasury as part of a tax refund or a payment related to unclaimed funds. This compensation could arise due to overpayments or correction of errors in your financial dealings. Understanding the reasons for such payments can help you respond accurately, and using a Michigan Sample Letter for Withheld Delivery can guide you in managing any necessary correspondence.

The Michigan Secretary of State manages a variety of state functions, including overseeing vehicle registrations, administering elections, and licensing business entities. They ensure that state laws are followed and provide services to the public for compliance with these laws. If you are dealing with issues related to state correspondence, knowing how to use resources like a Michigan Sample Letter for Withheld Delivery can be beneficial.

You may receive a letter from the Secretary of State for various reasons, such as confirming your vehicle registration or reminding you about an impending license renewal. These correspondences often require your attention to avoid legal issues or ensure compliance. If you need help drafting a response or a legal document, consider using the Michigan Sample Letter for Withheld Delivery as a template.

Receiving a letter from the Department of Treasury means that they need to notify you about a tax issue or payment you owe. It could also indicate that you have a refund or need to take some action regarding your finances. Understanding these letters is essential, especially if you are preparing any documentation, including a Michigan Sample Letter for Withheld Delivery.

To write a check to the Michigan Department of Treasury, start by entering the date at the top right corner. Next, write the payee as 'Michigan Department of Treasury' on the line provided. In the box, enter the amount in numbers, and in words, write the same amount on the line below. Finally, sign the check and include proper notes in the memo section, especially if it pertains to your Michigan Sample Letter for Withheld Delivery.

Receiving a letter from the IRS in Detroit typically means that there is an issue with your tax filings or accounts that needs clarification. This could be related to missing documents, discrepancies in your records, or updates about your tax status. To navigate such communications effectively, a Michigan Sample Letter for Withheld Delivery from USLegalForms may be exactly what you need.

The voluntary disclosure program in Michigan allows taxpayers to come forward voluntarily to address unreported income or unpaid taxes without facing penalties. This initiative encourages compliance and offers protection for those who disclose their tax situations appropriately. If you’re participating in this program, a Michigan Sample Letter for Withheld Delivery can assist in drafting your correspondence.

A certified mail from the IRS denotes that the correspondence requires proof of delivery and is often related to important tax matters. This type of mail provides you with a tracking number and confirms that you received it, ensuring that you are aware of any critical issues. To respond properly to such letters, a Michigan Sample Letter for Withheld Delivery may help structure your response.

If you received a letter from the IRS, it usually involves a tax-related matter that requires your attention, such as confirming information or addressing discrepancies. This communication may indicate an adjustment to your tax return or request for additional documentation. For effective communication in response, a Michigan Sample Letter for Withheld Delivery can be a practical tool.

The IRS in Detroit manages federal tax matters for residents in the area, including processing tax returns and addressing tax compliance issues. This office also provides support for individuals who have questions about their tax obligations. If you are unsure how to communicate with the IRS effectively, consider using a Michigan Sample Letter for Withheld Delivery for your written responses.