US Legal Forms - one of several largest libraries of legitimate forms in the United States - delivers a wide array of legitimate papers web templates it is possible to acquire or printing. Using the website, you will get 1000s of forms for enterprise and person functions, sorted by groups, states, or keywords.You will discover the latest models of forms much like the Michigan Agreement By Heirs to Substitute New Note for Note of Decedent within minutes.

If you currently have a membership, log in and acquire Michigan Agreement By Heirs to Substitute New Note for Note of Decedent from the US Legal Forms library. The Obtain option will show up on each and every kind you look at. You have access to all formerly downloaded forms within the My Forms tab of the bank account.

If you wish to use US Legal Forms initially, listed here are basic instructions to help you get started:

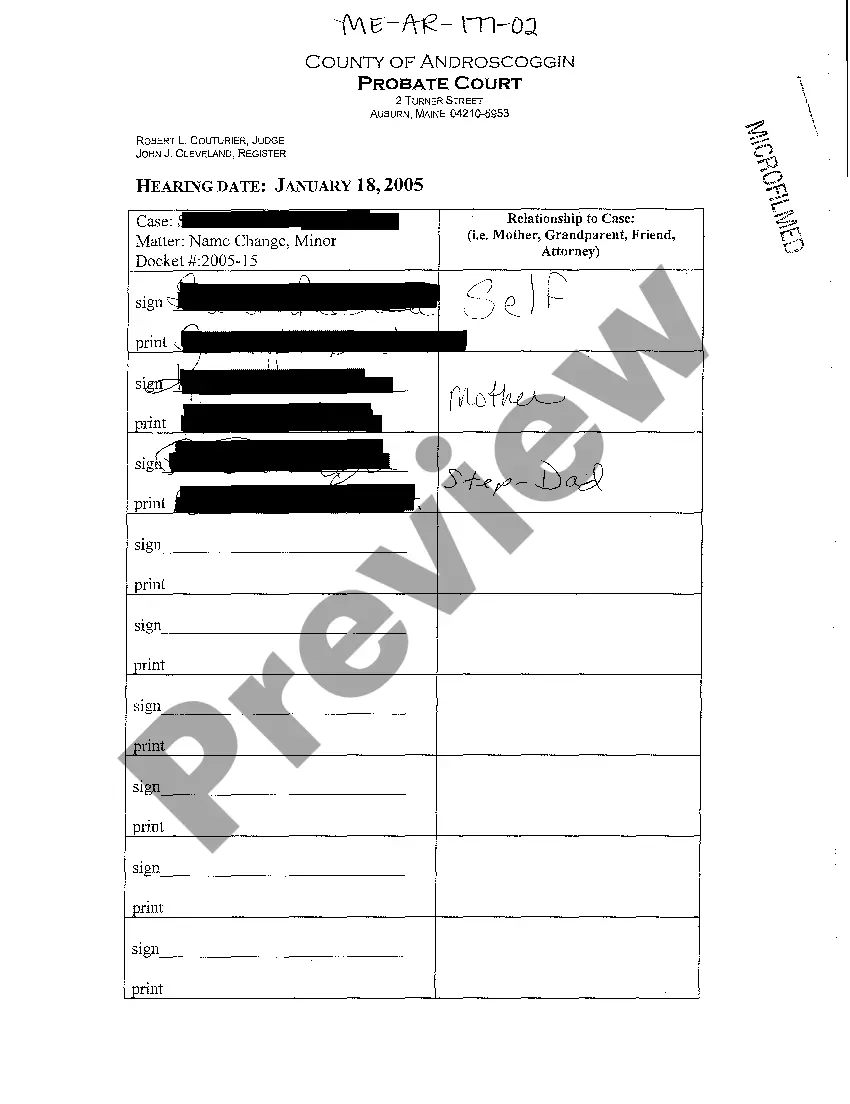

- Be sure you have chosen the correct kind to your city/county. Go through the Review option to analyze the form`s articles. Read the kind outline to actually have selected the correct kind.

- When the kind doesn`t suit your demands, utilize the Search field on top of the monitor to obtain the one which does.

- Should you be pleased with the shape, affirm your selection by clicking the Purchase now option. Then, select the prices plan you favor and give your references to sign up for the bank account.

- Approach the deal. Utilize your charge card or PayPal bank account to perform the deal.

- Choose the formatting and acquire the shape in your system.

- Make modifications. Fill up, edit and printing and sign the downloaded Michigan Agreement By Heirs to Substitute New Note for Note of Decedent.

Every design you put into your bank account lacks an expiration date and is your own forever. So, in order to acquire or printing one more duplicate, just go to the My Forms segment and click on on the kind you want.

Gain access to the Michigan Agreement By Heirs to Substitute New Note for Note of Decedent with US Legal Forms, by far the most comprehensive library of legitimate papers web templates. Use 1000s of professional and state-specific web templates that satisfy your company or person requirements and demands.