Michigan Transfer under the Uniform Transfers to Minors Act - Multistate Form

Description

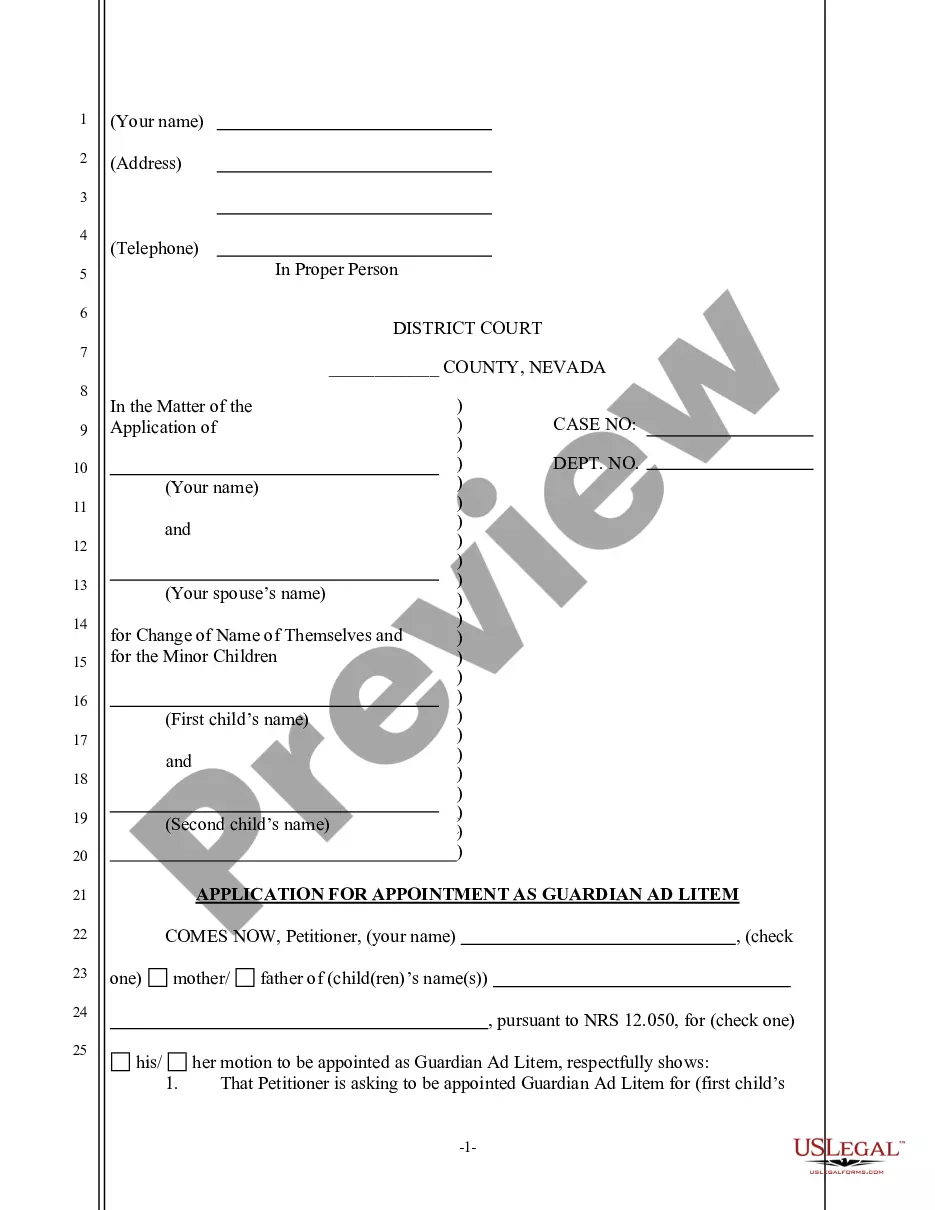

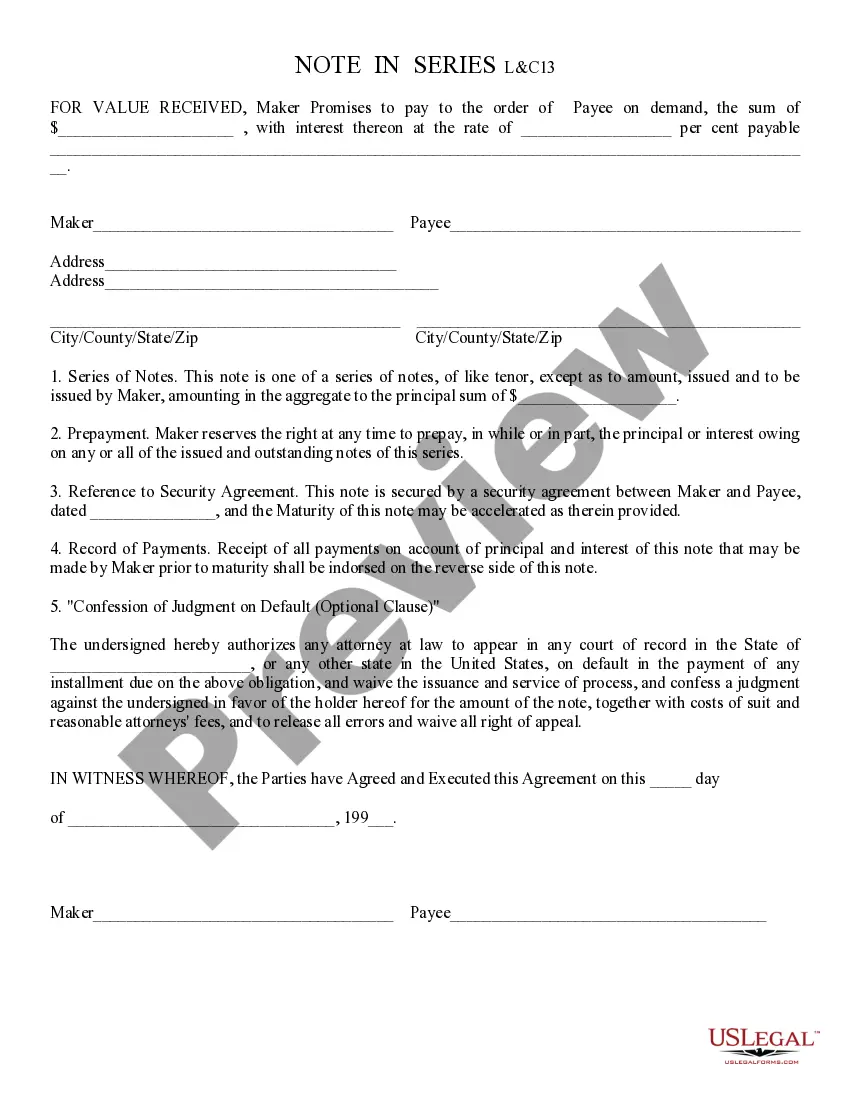

How to fill out Transfer Under The Uniform Transfers To Minors Act - Multistate Form?

US Legal Forms - one of many biggest libraries of legal varieties in the USA - provides a variety of legal record templates you can down load or produce. While using website, you may get a large number of varieties for company and personal purposes, sorted by categories, suggests, or key phrases.You can get the newest versions of varieties such as the Michigan Transfer under the Uniform Transfers to Minors Act - Multistate Form in seconds.

If you have a membership, log in and down load Michigan Transfer under the Uniform Transfers to Minors Act - Multistate Form through the US Legal Forms local library. The Obtain button will show up on each form you see. You have access to all formerly saved varieties in the My Forms tab of your accounts.

If you would like use US Legal Forms the first time, allow me to share basic guidelines to get you started off:

- Ensure you have picked the proper form for your personal metropolis/state. Select the Preview button to check the form`s content material. Browse the form information to actually have selected the proper form.

- In the event the form doesn`t match your needs, take advantage of the Look for industry towards the top of the display screen to get the one that does.

- When you are happy with the shape, verify your decision by clicking the Purchase now button. Then, select the rates program you prefer and give your qualifications to register on an accounts.

- Method the financial transaction. Make use of credit card or PayPal accounts to finish the financial transaction.

- Find the format and down load the shape on your own device.

- Make modifications. Complete, revise and produce and indication the saved Michigan Transfer under the Uniform Transfers to Minors Act - Multistate Form.

Every single design you included in your account does not have an expiration particular date and it is yours forever. So, in order to down load or produce an additional copy, just check out the My Forms area and click around the form you require.

Obtain access to the Michigan Transfer under the Uniform Transfers to Minors Act - Multistate Form with US Legal Forms, probably the most considerable local library of legal record templates. Use a large number of professional and status-certain templates that meet up with your company or personal requires and needs.

Form popularity

FAQ

Can You Withdraw Money From an UTMA Account? It's possible to withdraw money from an UTMA account. However, there's one essential rule you've got to bear in mind ? all withdrawals from a custodial account must be for the direct benefit of the beneficiary.

The Michigan Uniform Transfer to Minors Act allows a person to transfer property, such as bank accounts, securities, life insurance policies, tangible personal property and real estate, to a minor to be held for the benefit of that minor until that individual reaches the age of 18 and in some cases, up to the age of 21 ...

Transferring a UTMA account to a child is simple. You can do so with most financial or investment institutions. You can also consult a tax or business lawyer to help you set up the legal structure, although most financial institutions can do this for you.

Depending on the state a UTMA account is handed over to a child when they reach either age 18 or age 21. In some jurisdictions, at age 18 a UTMA account can only be handed over with the custodian's permission, and at 21 is transferred automatically.

Transfers made to a UGMA or UTMA account are irrevocable and belong to the child in whose name the account is registered; however, the account is controlled by the custodian until the child reaches a certain age, which varies by state (usually 18 or 21).

As the custodian, you can withdraw money from a custodial account if you need to use it to pay for something that will benefit the minor. You can't take the money back yourself, or give it to someone else.

How is an UTMA account taxed? UTMA accounts have a few tax implications. While there are no taxes on withdrawals (since contributions are made with after-tax dollars), there may be taxes on any unearned income. Unearned income includes taxable interest, dividends, and capital gains on any assets in the account.