Michigan Resolution Form for Corporation

Description

How to fill out Resolution Form For Corporation?

If you wish to finish, obtain, or generate legal document templates, utilize US Legal Forms, the best collection of legal forms that are accessible online.

Take advantage of the site's straightforward and user-friendly search to find the documents you need.

Numerous templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have located the form you need, click on the Buy Now button. Choose the pricing plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to find the Michigan Resolution Form for Corporation in just a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click on the Download button to obtain the Michigan Resolution Form for Corporation.

- You can also access forms you previously saved in the My documents tab of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

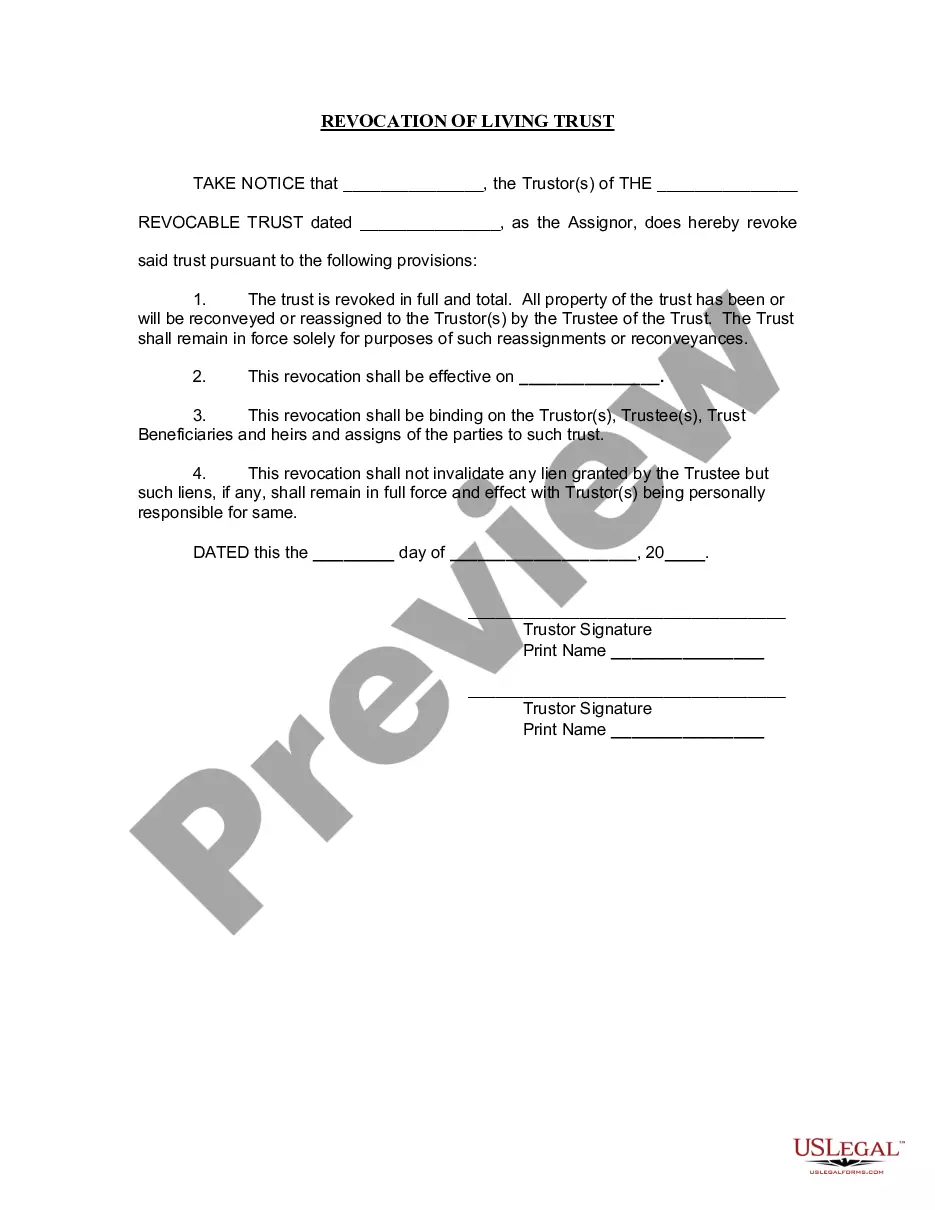

- Step 2. Utilize the Preview option to review the form's contents. Remember to check the details.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

Form popularity

FAQ

Filling out Michigan LLC paperwork starts with gathering the necessary information, such as the LLC name, registered agent, and business purpose. Use the Michigan Resolution Form for Corporation to approve and document the formation of your LLC. Carefully follow the instructions provided for each section, ensuring all information is accurate and complete. Once filled out, submit the paperwork to the appropriate state office for processing.

Writing a corporate resolution example involves outlining key decisions made by the corporation's board of directors. Start by stating the resolution's purpose, followed by details like the date, location, and specifics of the board's decision. Conclude the document with a signature line for the official to sign and date. When using a Michigan Resolution Form for Corporation, ensure the resolution meets Michigan’s legal requirements for corporate governance.

The main difference between an S Corp and a C Corp in Michigan lies in their taxation. An S Corp allows income, losses, deductions, and credits to pass through to shareholders, avoiding double taxation. In contrast, a C Corp is taxed independently, meaning corporate profits are taxed at the corporate level, and dividends are taxed again at the shareholder level. Understanding this difference is essential when filing your Michigan Resolution Form for Corporation, as it affects your business structure and tax obligations.

Filing a Michigan annual report online is straightforward. First, gather your necessary business information, including the Michigan Resolution Form for Corporation if applicable. Next, visit the Michigan Department of Licensing and Regulatory Affairs website to access the online filing portal. The process will guide you through submitting your report while ensuring compliance with state regulations.

To dissolve a corporation in Michigan, you need to file a Michigan Resolution Form for Corporation with the state. This form outlines your decision to dissolve the corporation and must be approved by your board of directors and shareholders. After filing, ensure all debts and obligations are settled before completing the dissolution process. For added convenience, consider using platforms like US Legal Forms to obtain the correct documents quickly.

To dissolve a corporation in Michigan, you must file the Articles of Dissolution with the state and ensure that all tax obligations are met. It is also advisable to hold a meeting and pass a resolution to officially approve the dissolution. Using a Michigan Resolution Form for Corporation during this process can serve as an important record of the decision to dissolve, ensuring legal compliance.

To file for a corporation in Michigan, you need to complete the Articles of Incorporation and submit them to the Michigan Department of Licensing and Regulatory Affairs. Along with this, ensure you have the necessary approvals and resolutions in place. A Michigan Resolution Form for Corporation can help you document your decisions effectively, streamlining the incorporation process.

The purpose of a resolution is to officially document decisions made by a corporation’s board or shareholders, ensuring there is a clear record for legal and compliance reasons. Resolutions provide clarity and protect the interests of the corporation and its stakeholders. Utilizing a Michigan Resolution Form for Corporation contributes to a well-organized decision-making process.

In Michigan, you can form various types of corporations, including C corporations, S corporations, and nonprofit corporations. Each type has its own structure, tax implications, and legal requirements. Regardless of the type you choose, having a Michigan Resolution Form for Corporation can assist you in managing decisions and actions specific to your business structure.

A corporate resolution to sell stock is a written agreement that authorizes the sale or transfer of shares within a corporation. This resolution specifies the terms of the sale and provides legal backing for the transaction. By using a Michigan Resolution Form for Corporation, you can simplify the process and ensure that all parties are informed of the decision.