Michigan Balloon Unsecured Promissory Note

Description

How to fill out Balloon Unsecured Promissory Note?

You can spend time online trying to locate the appropriate legal document template that meets the state and federal requirements you have.

US Legal Forms offers a vast array of legal forms that have been reviewed by professionals.

You can easily download or print the Michigan Balloon Unsecured Promissory Note from the service.

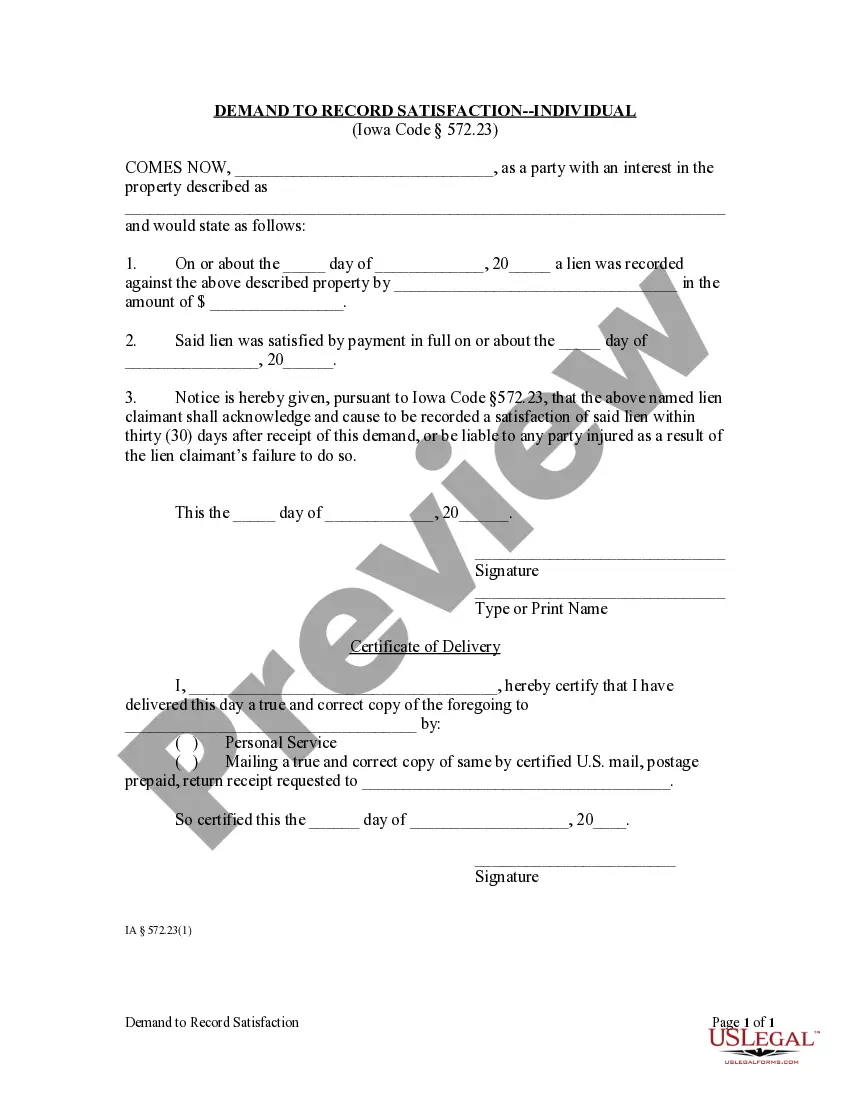

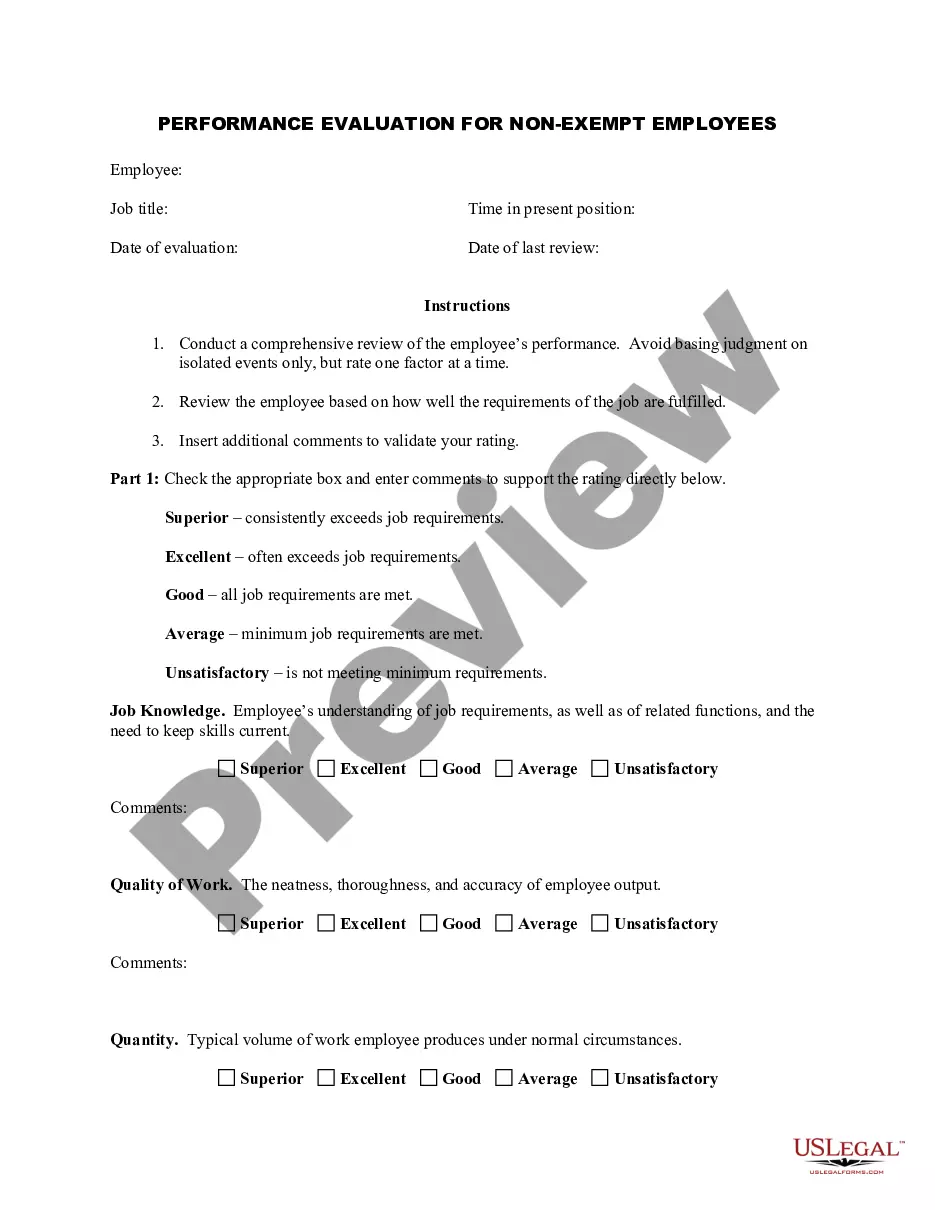

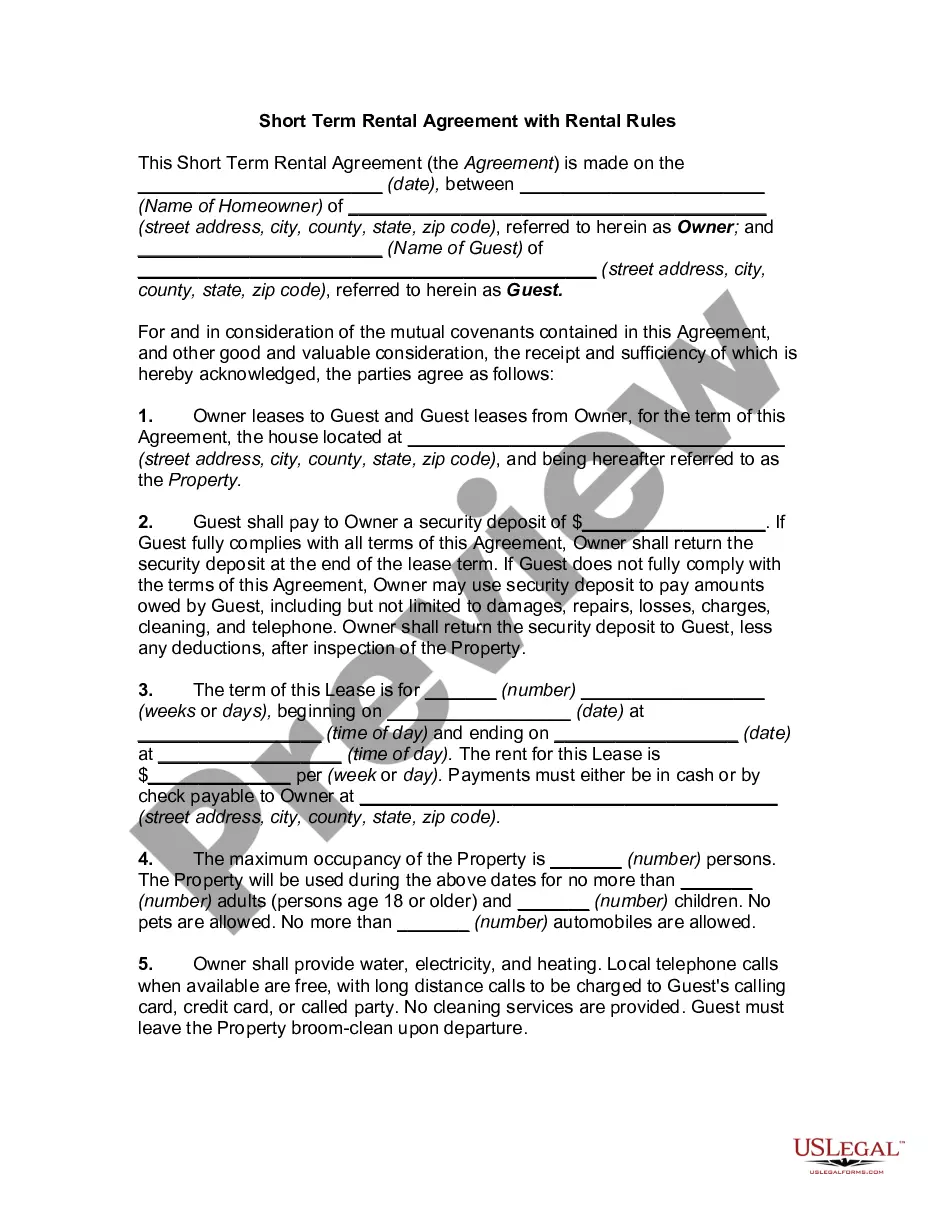

If available, utilize the Review button to examine the document template as well.

- If you already possess a US Legal Forms account, you may sign in and click on the Download button.

- Subsequently, you can fill out, modify, print, or sign the Michigan Balloon Unsecured Promissory Note.

- Each legal document template you acquire is yours permanently.

- To obtain another copy of the purchased form, navigate to the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the straightforward instructions below.

- Firstly, ensure you have chosen the correct document template for the county/city you select.

- Read the form description to confirm you have selected the right one.

Form popularity

FAQ

An unsecured promissory note is not typically classified as a security, because it does not represent an investment in a business or enterprise. Instead, it is a promise to repay a debt without collateral. However, it can still be a crucial instrument in financial transactions, including those involving a Michigan Balloon Unsecured Promissory Note.

The primary difference between secured and unsecured promissory notes lies in collateral. A secured note is backed by specific assets, which the lender can claim if the borrower defaults. Conversely, a Michigan Balloon Unsecured Promissory Note does not involve collateral, which can increase risk for lenders but may provide borrowers with greater flexibility.

Negotiating a balloon payment involves discussing terms with the lender before the payment due date. You can propose a refinancing option to spread the amount over a more extended period, request a lower lump sum, or even suggest an alternative repayment plan. This approach can help ease financial strain when dealing with a Michigan Balloon Unsecured Promissory Note.

Discharging a promissory note involves paying off the amount listed on the note, thereby fulfilling your obligations. In relation to a Michigan Balloon Unsecured Promissory Note, this means completing any specified payments, including the balloon payment, to conclude your financial duty. It's wise to retain proof of payment and discharge for your records, and legal platforms like uslegalforms can provide templates to document this process effectively.

A promissory note can be voided by mutual consent from both the borrower and the lender or by a court ruling in specific circumstances. For a Michigan Balloon Unsecured Promissory Note, make sure you have documentation proving that both parties agree to void it. Consider using platforms like uslegalforms to draft a formal agreement that records the voiding process.

You can terminate a promissory note by making the final payment or reaching an agreement with the lender to cancel the obligation. With a Michigan Balloon Unsecured Promissory Note, it’s essential to obtain confirmation from the lender regarding the termination to prevent any future claims. Engaging with legal resources, such as uslegalforms, can aid in ensuring all steps are correctly followed.

To release a promissory note, the lender must provide a written statement indicating that the debt has been satisfied. For a Michigan Balloon Unsecured Promissory Note, this release should include details like the original note, repayment confirmation, and any relevant dates. Utilizing services from platforms like uslegalforms can simplify this process, ensuring you have the proper documentation.

The discharge of a promissory note occurs when the borrower fully repays the amount owed. In the context of a Michigan Balloon Unsecured Promissory Note, this means that once you make the final payment, the note is no longer valid, and your obligation is fulfilled. This process can help you clear your debts and improve your financial standing.

To retrieve your promissory note, reach out to the lender or financial institution that provided it. They can send you a copy upon request. If necessary, you can also use uslegalforms to draft a new Michigan Balloon Unsecured Promissory Note that aligns with your needs.

If you lose your promissory note, it's important to act quickly. You should notify the lender immediately and request a replacement. By utilizing services like uslegalforms, you can easily access templates to draft a new Michigan Balloon Unsecured Promissory Note and maintain your obligations.