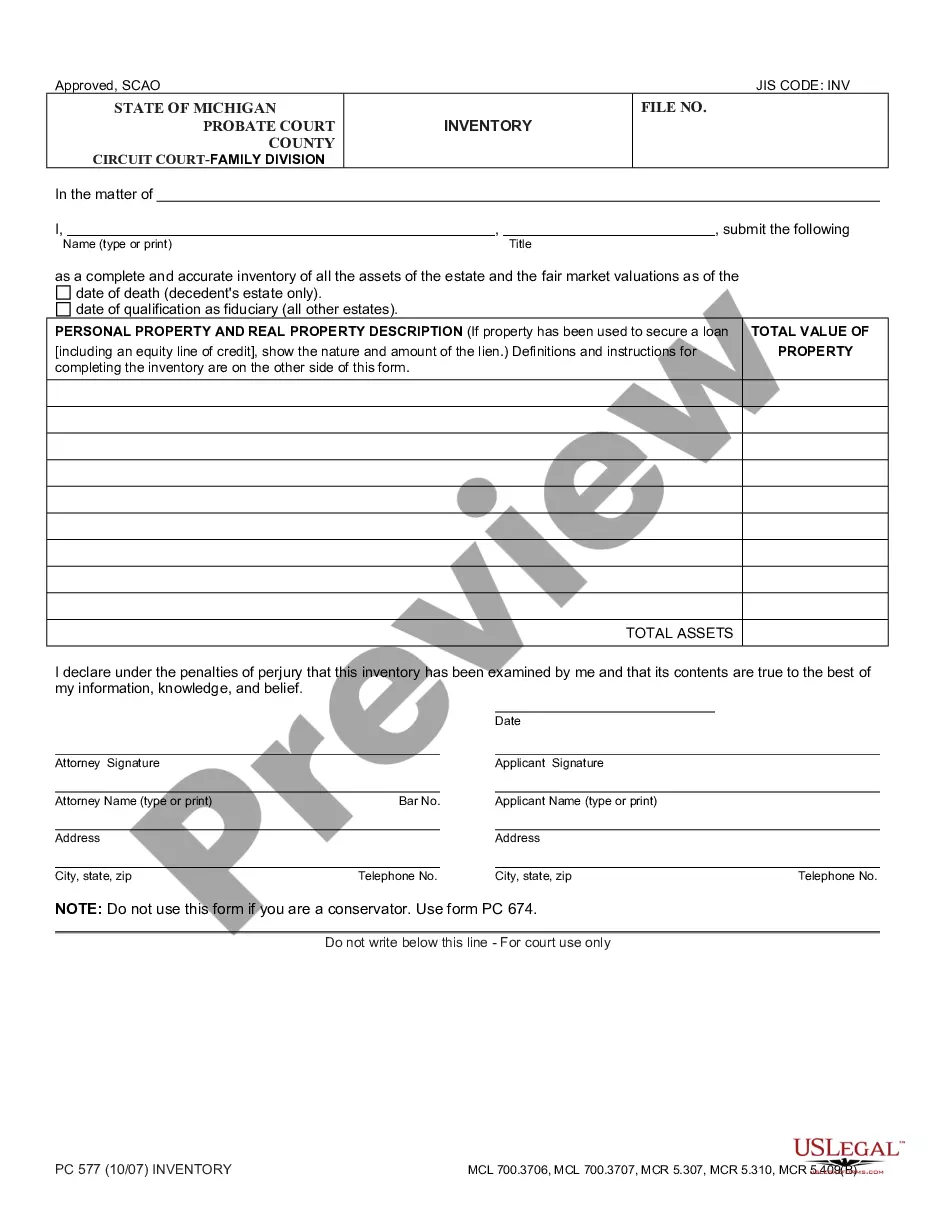

Michigan Inventory (Conservatorship) is a legal process that allows a court-appointed conservator to take control of a person's estate and manage it for their benefit. The conservator is responsible for managing the assets of the estate, including making investments, paying bills, and ensuring that the person's financial affairs are in order. There are two types of Michigan Inventory (Conservatorship): voluntary and involuntary. Voluntary conservatorship is when a person willingly seeks help from a court-appointed conservator to manage their estate. Involuntary conservatorship is when the court appoints a conservator to manage the estate of a person who is unable to do so themselves, such as when an individual is mentally incapacitated or has been declared incompetent. Michigan Inventory (Conservatorship) is an important and necessary legal process that helps ensure individuals are receiving the help they need to manage their financial affairs.

Michigan Inventory (Conservatorship)

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Michigan Inventory (Conservatorship)?

If you're searching for a method to accurately finalize the Michigan Inventory (Conservatorship) without employing a legal advisor, then you're precisely in the correct place.

US Legal Forms has established itself as the most comprehensive and dependable repository of official templates for every personal and business circumstance. Each document you discover on our web service is crafted in accordance with federal and state regulations, ensuring that your paperwork is organized.

Another fantastic aspect of US Legal Forms is that you never misplace the documents you obtained - you can access any of your downloaded templates in the My documents section of your profile whenever you require it.

- Verify that the document displayed on the page aligns with your legal circumstances and state regulations by reviewing its textual description or browsing through the Preview mode.

- Input the document title in the Search tab at the top of the page and select your state from the dropdown menu to find another template in case of any discrepancies.

- Repeat the content verification and click Buy now when you are assured of the paperwork's compliance with all requirements.

- Log in to your account and click Download. Sign up for the service and select a subscription plan if you do not have one yet.

- Utilize your credit card or the PayPal option to settle your US Legal Forms subscription. The blank will be available for download immediately after.

- Choose the format in which you prefer to save your Michigan Inventory (Conservatorship) and download it by clicking the corresponding button.

- Incorporate your template into an online editor to complete and sign it quickly or print it out to prepare a physical copy manually.

Form popularity

FAQ

Yes, a conservator can sell property in Michigan, but they must follow strict legal guidelines. The conservator must act in the best interest of the ward and obtain court approval for significant transactions. Utilizing the proper resources, such as US Legal Forms, can greatly assist in navigating the Michigan Inventory (Conservatorship) process, ensuring compliance with legal requirements.

In Michigan, a conservator manages finances and property, whereas a guardian oversees personal health and welfare decisions. This distinction is important for the Michigan Inventory (Conservatorship) process, as individuals may need one or both types of protection. Understanding these roles helps families make better decisions when considering legal options.

A conservatorship generally manages an individual's financial affairs, while a LPS conservatorship specifically focuses on those unable to care for themselves due to mental health issues. In Michigan Inventory (Conservatorship), understanding this distinction helps in determining the appropriate legal pathway for each situation. Each type of conservatorship addresses unique needs based on the individual's circumstances.

A conservatorship can limit personal freedom, as it places decision-making authority in the hands of the conservator. This might lead to potential conflicts between the conservator's judgment and the individual's wishes. Additionally, the process can be expensive, as it often requires court involvement and legal fees, creating a burden on the Michigan Inventory (Conservatorship) resources.

Household items included in a probate inventory can range from furniture and appliances to collectibles and art. Typically, any personal property owned by the deceased falls within this category. It's important to list these household items accurately to ensure a fair and transparent distribution among heirs.

A Michigan estate inventory should be detailed enough to encompass all aspects of the deceased's assets. This includes providing descriptions, valuations, and the locations of the assets. Clarity in this documentation is crucial as it assists in the probate process and protects the interests of beneficiaries. Using platforms like UsLegalForms can simplify creating this inventory.

An inventory for probate in Michigan includes a comprehensive list of assets owned by the deceased. For example, it may consist of real estate properties, vehicles, jewelry, furniture, and bank accounts. Organizing these details into a structured format is essential for court submission and helps with the distribution of assets to heirs.

Certain assets do not go through probate in Michigan, such as joint-owned properties, life insurance policies, and retirement accounts with designated beneficiaries. Additionally, assets held in trusts avoid probate procedures. Knowing these categories can help streamline the management of an estate and reduce unnecessary delays.

In Michigan, assets that must go through probate include properties solely owned by the deceased, bank accounts without joint owners, and personal belongings not designated to beneficiaries. Additionally, any assets that are not held in a trust or have designated heirs also require probate. Understanding which assets are subject to this process can help in planning an estate effectively.

Filling out a probate inventory in Michigan requires gathering detailed information about the deceased's assets. Start by listing all property, including real estate, bank accounts, and personal belongings. Be sure to use the Michigan Inventory (Conservatorship) form, which outlines specific requirements for submitting this documentation to the court. Accurate inventory preparation can simplify the probate process.