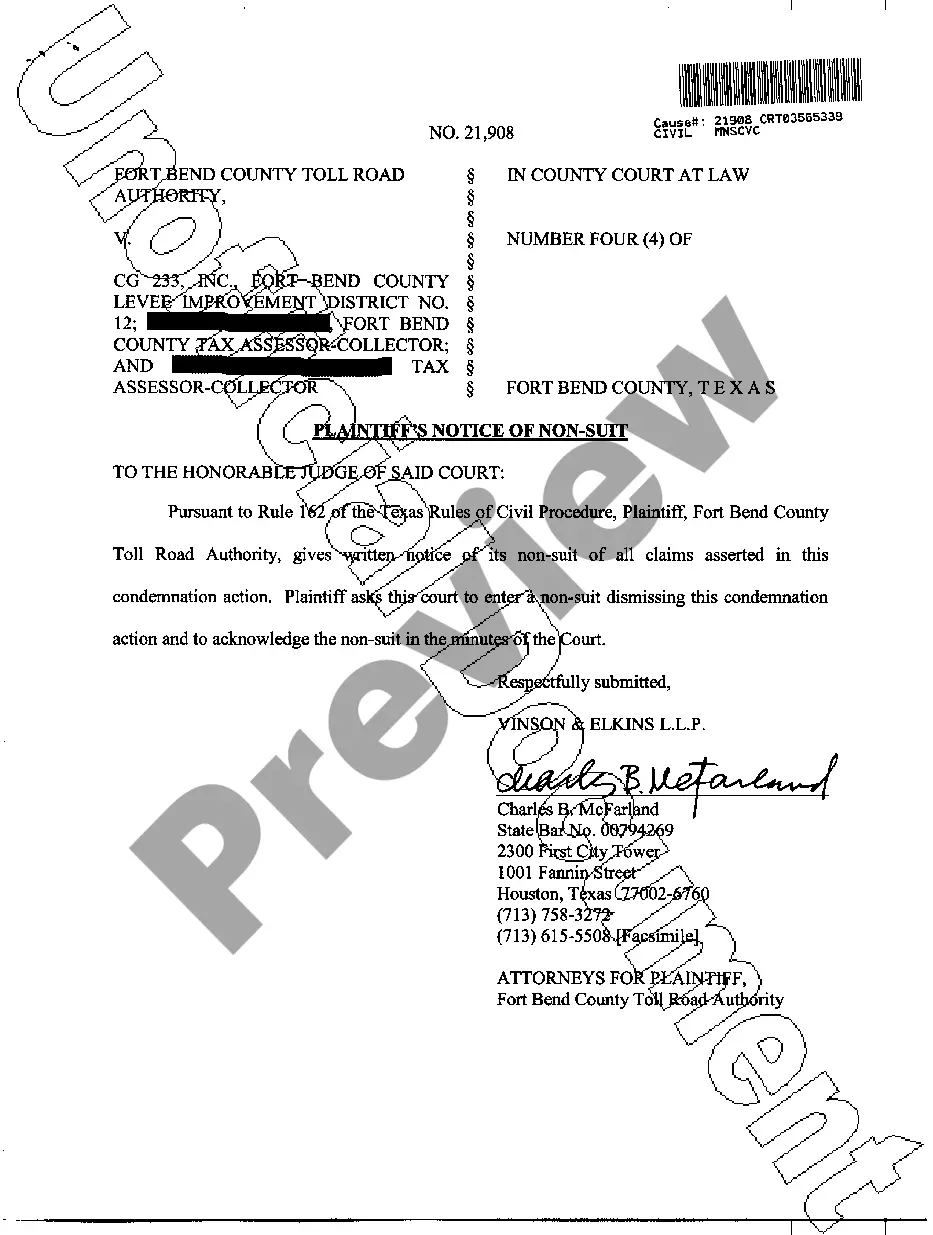

Michigan Employer's Disclosure of Health Insurance and/or Income Information

Description

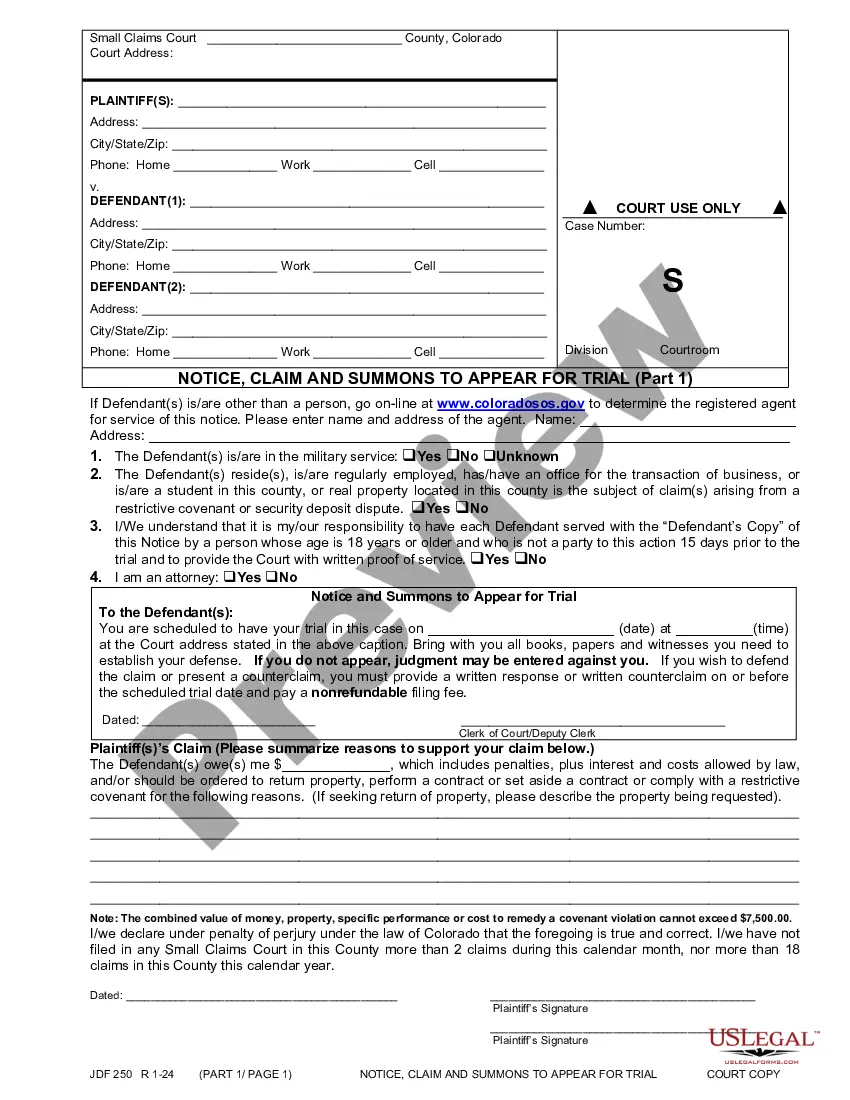

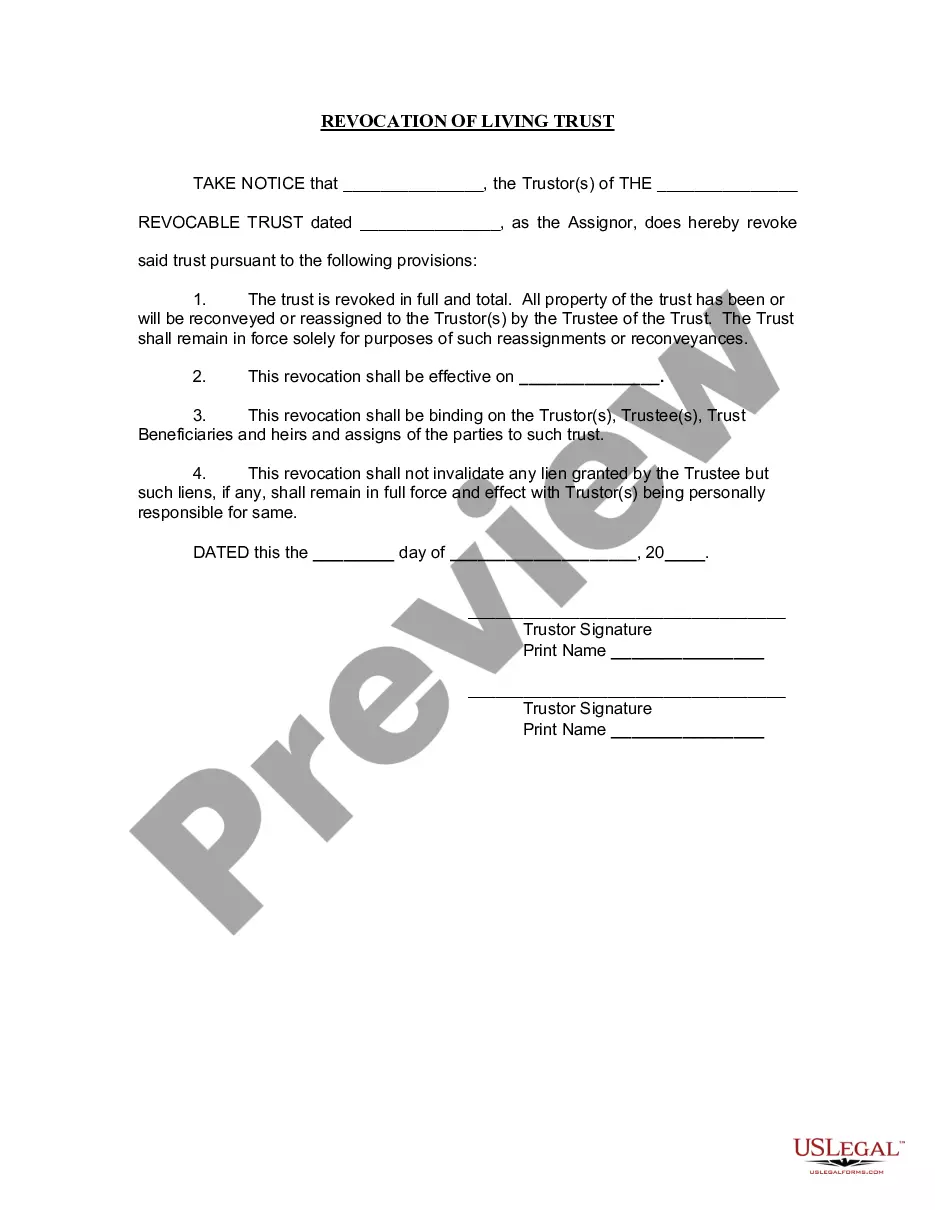

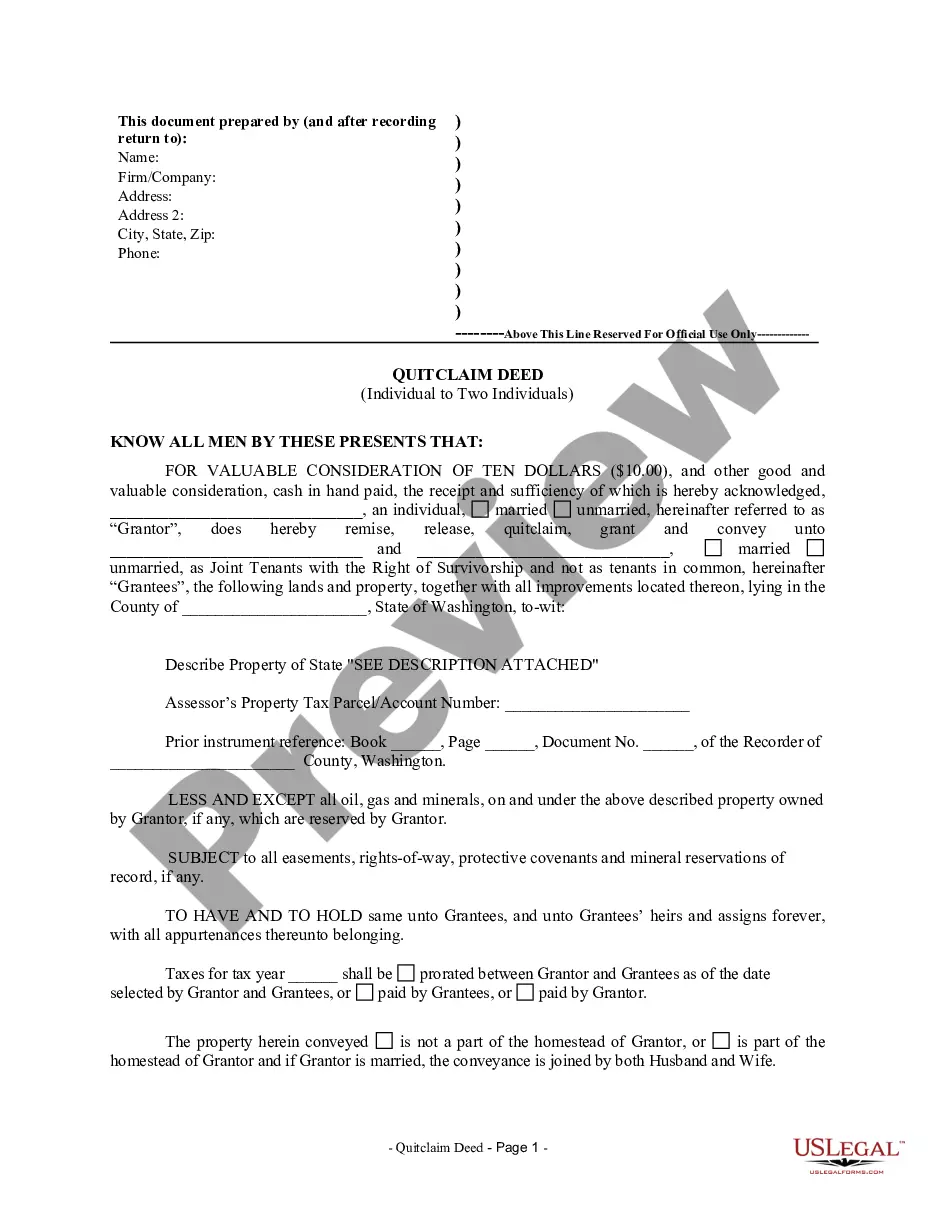

How to fill out Michigan Employer's Disclosure Of Health Insurance And/or Income Information?

Have any template from 85,000 legal documents including Michigan Employer's Disclosure of Income and Health Insurance Information online with US Legal Forms. Every template is drafted and updated by state-licensed lawyers.

If you have already a subscription, log in. When you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you have not subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Michigan Employer's Disclosure of Income and Health Insurance Information you need to use.

- Read description and preview the sample.

- As soon as you’re confident the sample is what you need, simply click Buy Now.

- Choose a subscription plan that works well for your budget.

- Create a personal account.

- Pay out in just one of two appropriate ways: by card or via PayPal.

- Pick a format to download the document in; two options are available (PDF or Word).

- Download the file to the My Forms tab.

- When your reusable form is ready, print it out or save it to your device.

With US Legal Forms, you’ll always have immediate access to the right downloadable template. The service gives you access to documents and divides them into categories to simplify your search. Use US Legal Forms to obtain your Michigan Employer's Disclosure of Income and Health Insurance Information easy and fast.

Form popularity

FAQ

Under New York State law, parents are responsible for supporting their child until the child is 21 years old.

Under the COVID-Related Tax Relief Act, the IRS can't take second-round payments to pay overdue child support. As with second-round checks, third stimulus checks won't be reduced to pay child support arrears.

Child support refers to court-ordered payments made by the non-custodial parent to help the custodial parent with the costs of raising a child.While each case is unique, New Jersey courts calculate how much is paid by the obligor (the person making the payments) by following specific guidelines, or formulas.

Contact the Child Support Division at 1-800-252-8014.