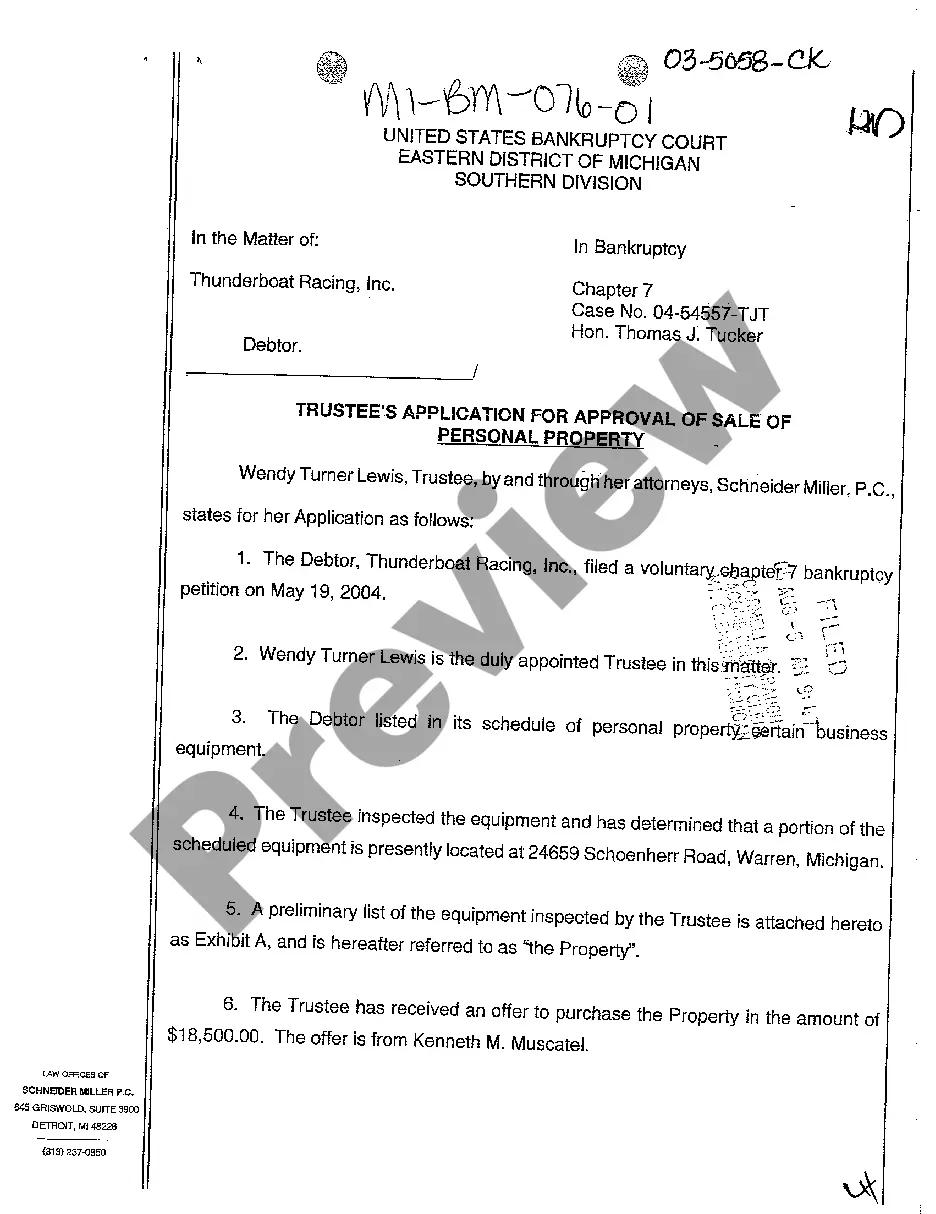

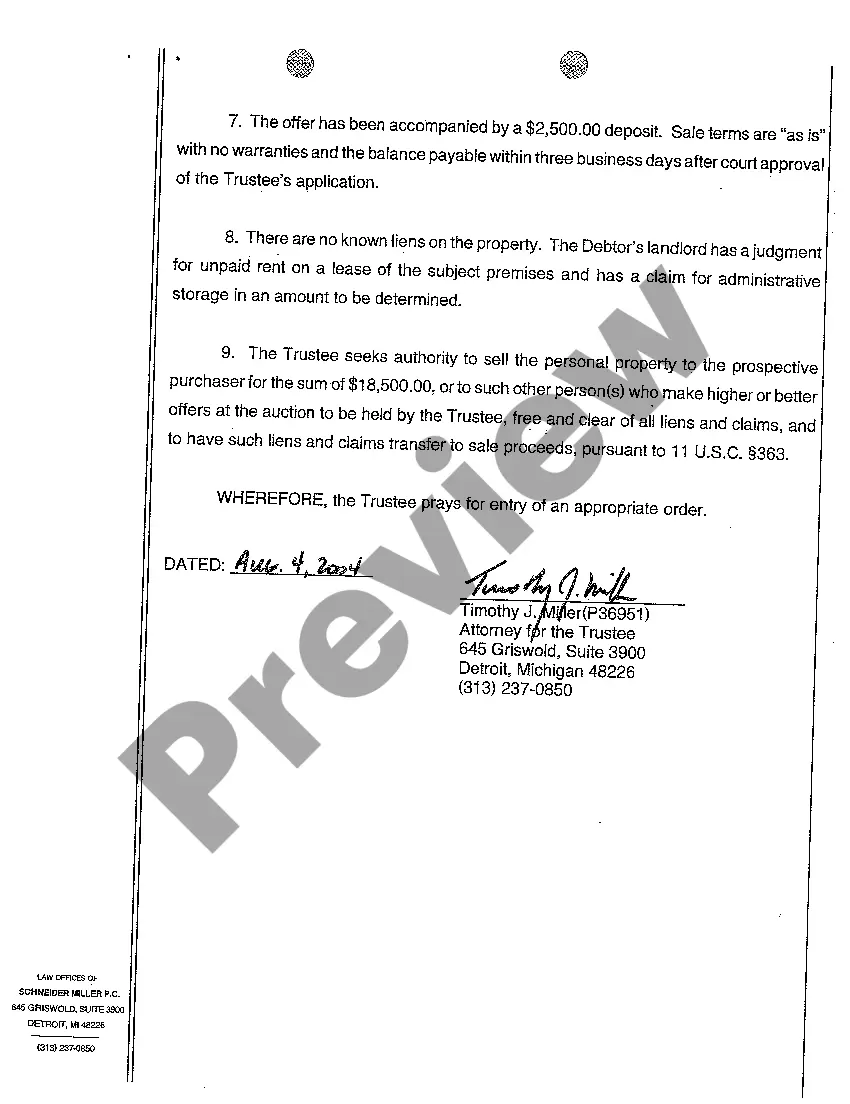

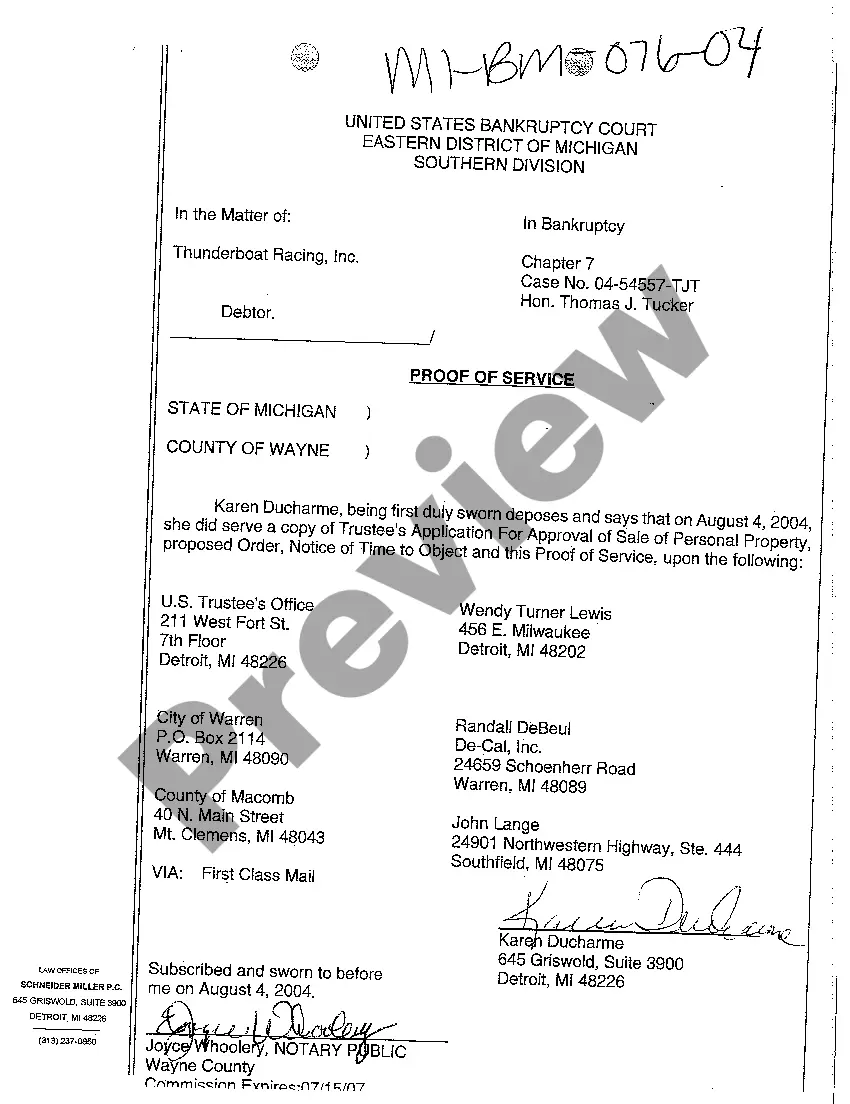

Michigan Trustee's Application for Approval of Sale of Personal Property

Description

How to fill out Michigan Trustee's Application For Approval Of Sale Of Personal Property?

Obtain any variant of 85,000 official documents including the Michigan Trustee's Application for Authorization of Sale of Personal Property online with US Legal Forms.

Each template is crafted and revised by state-certified lawyers.

If you possess a subscription, Log In. Once you’re on the document’s page, hit the Download button and navigate to My documents to access it.

As soon as your reusable document is downloaded, print it out or store it on your device. With US Legal Forms, you’ll always have instant access to the right downloadable template. The service offers forms and organizes them into categories to ease your search. Utilize US Legal Forms to acquire your Michigan Trustee's Application for Authorization of Sale of Personal Property efficiently and swiftly.

- Verify the state-specific prerequisites for the Michigan Trustee's Application for Authorization of Sale of Personal Property you wish to utilize.

- Examine the description and view the sample.

- When you’re confident the sample meets your needs, simply click Buy Now.

- Select a subscription option that fits your finances.

- Establish a personal account.

- Complete the payment using one of two suitable methods: by card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

Form popularity

FAQ

If you fail to receive a trust distribution, you may want to consider filing a petition to remove the trustee. A trust beneficiary has the right to file a petition with the court seeking to remove the trustee. A beneficiary can also ask the court to suspend the trustee pending removal.

Executors have also traditionally set fees as a percentage of the overall estate value. So for example, a $600K estate which required 850 hours of work might generate $22K in executor fees (see calculator below). The executor may pay himself or herself this compensation as earned, without prior court approval.

The trustee acts as the legal owner of trust assets, and is responsible for handling any of the assets held in trust, tax filings for the trust, and distributing the assets according to the terms of the trust. Both roles involve duties that are legally required.

The executor can sell property without getting all of the beneficiaries to approve.Once the executor is named there is a person appointed, called a probate referee, who will appraise the estate assets.

Michigan statutes provide no specific requirements an executor must meet, and you are free to name any adult that you trust as your executor. The court must appoint that person unless someone else challenges your choice of executor and there is clear evidence that he or she is incompetent or unsuitable to serve.

Many executors are able to wrap up an estate themselves, without hiring a probate lawyer.Many executors decide, sometime during the process of winding up an estate, that they could use some legal advice from a lawyer who's familiar with local probate procedure .

Can trustees sell property without the beneficiary's approval? The trustee doesn't need final sign off from beneficiaries to sell trust property.

A beneficiary has the right to seek court intervention to stop a Trustee from selling any asset. Of course, court intervention takes time and money, which the beneficiary must pay in order to stop the sale.Be forewarned, your powers to stop sales or recover assets that are sold can be severely limited.

A trustee may sell real property, subject to the authority granted to them in the trust document. They must act solely in their capacity as trustee, and in the interest of the beneficiaries.