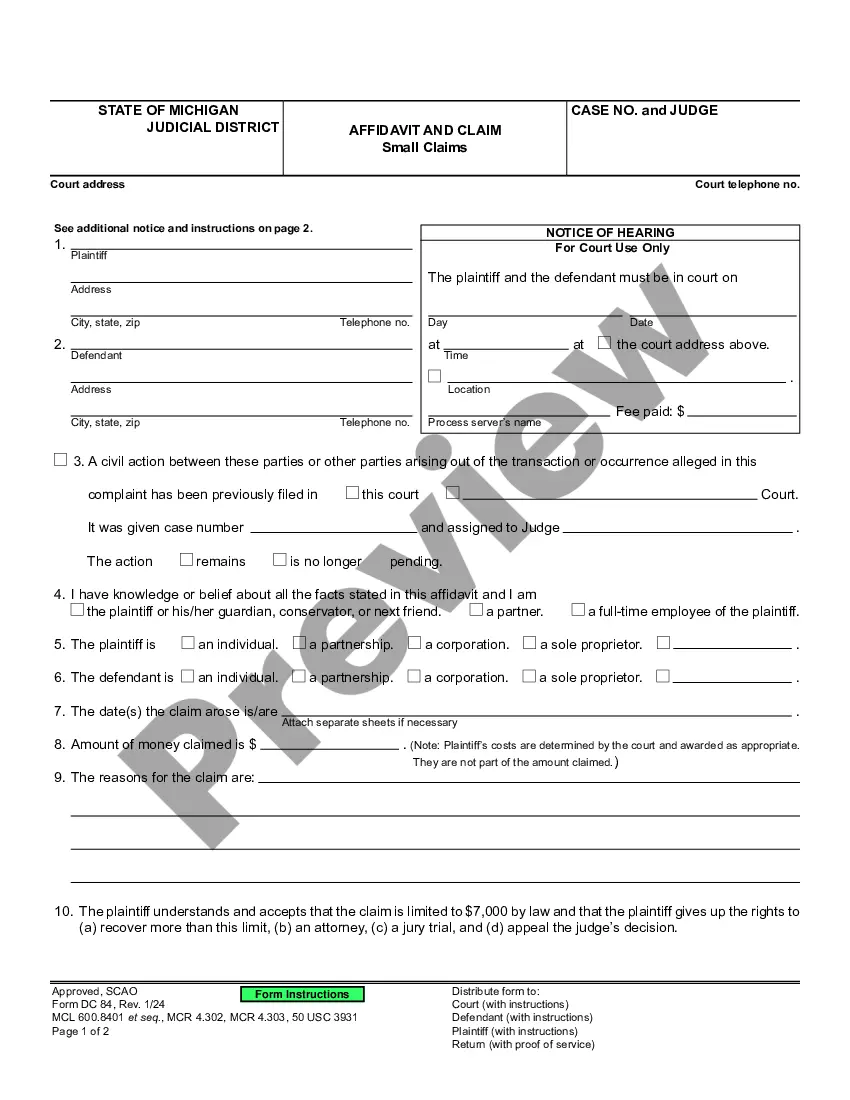

This is an Affidavit of Judgment Debtor to be used in the Small Claims Court in the State of Michigan. A Judgment Debtor will use this form to provide information about himself/herself to the Judgment Creditor.

Michigan Affidavit of Judgment Debtor

Description

How to fill out Michigan Affidavit Of Judgment Debtor?

Obtain any type from 85,000 lawful documents including Michigan Affidavit of Judgment Debtor online with US Legal Forms.

Each template is prepared and updated by state-certified legal experts.

If you have an active subscription, Log In. Once on the form’s page, click on the Download button and go to My documents to access it.

With US Legal Forms, you will always have instant access to the correct downloadable template. The service organizes documents into categories to enhance your search experience. Use US Legal Forms to acquire your Michigan Affidavit of Judgment Debtor swiftly and effortlessly.

- Verify the state-specific requirements for the Michigan Affidavit of Judgment Debtor you need to utilize.

- Review the description and look at the sample.

- Once you are confident that the sample meets your needs, click on Buy Now.

- Select a subscription plan that suits your financial plan.

- Establish a personal account.

- Complete the payment using one of two suitable methods: by credit card or through PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable document is downloaded, print it out or save it to your device.

Form popularity

FAQ

To collect a judgment in Michigan, you can take several steps, such as garnishing wages, seizing bank accounts, or placing a lien on property. It's essential first to complete necessary legal paperwork and obtain a court order. Using a Michigan Affidavit of Judgment Debtor can aid in informing the debtor’s financial situation, enhancing your collection strategy. The US Legal Forms platform streamlines this process, allowing you to compile the needed documents efficiently.

Judgment proof in Michigan means a debtor lacks sufficient income or assets to satisfy a court-ordered judgment. If you are judgment proof, creditors cannot collect from you because you do not own valuable property or earn a significant paycheck. In such cases, a Michigan Affidavit of Judgment Debtor might help identify your financial status. It can clarify whether collection efforts are worthwhile for creditors.

To file a motion to set aside judgment in Michigan, you must prepare a motion along with supporting documents explaining your reasons. This includes demonstrating a legitimate argument, such as newly discovered evidence or an error made during the original trial. Submitting these documents to the court can lead to a reevaluation of the judgment, potentially changing the outcome. Utilizing resources like the Michigan Affidavit of Judgment Debtor can clarify previous judgments.

In Michigan, certain personal property can be seized to satisfy a judgment. This includes assets like bank account funds, vehicles, and valuable collectibles. To avoid complications, utilizing a Michigan Affidavit of Judgment Debtor can guide you through the process, ensuring that all legal protocols are followed during property seizure.

Even after you win a lawsuit, you still have to collect the money awarded in the judgmentthe court won't do it for you. Financially sound individuals or businesses will routinely pay a judgment entered against them. However, not everyone will be as willing. If necessary, legal ways to force payment exist.

If you do not pay the judgment, the judgment creditor can "garnish" your wages.If you make an agreement, the withholding of your wages will stop or be changed to a smaller amount you agree on. This may also avoid a court hearing. If your wages are garnished, the Sheriff will send you information.

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).You may even be able to win the case.

Once the creditor has a money judgment, it can use various methods to collect on that judgment. It can garnish your wages, place a levy on your bank account, or place a lien against any real estate that you own. For a comprehensive guide to dealing with debt, get Solve Your Money Troubles.

A creditor cannot take all of your property. Up to $1,000 worth of certain personal property may be exempt from seizure.

If someone owes you $10,000 or less, then you can sue in a California small claims court. If you are owed more than $10,000, you can still sue in small claims, but you have to waive any additional amount you are owed.You agree to sue for only the $10,000.