Maine Discounts, Credits & Tubulars

Description

How to fill out Discounts, Credits & Tubulars?

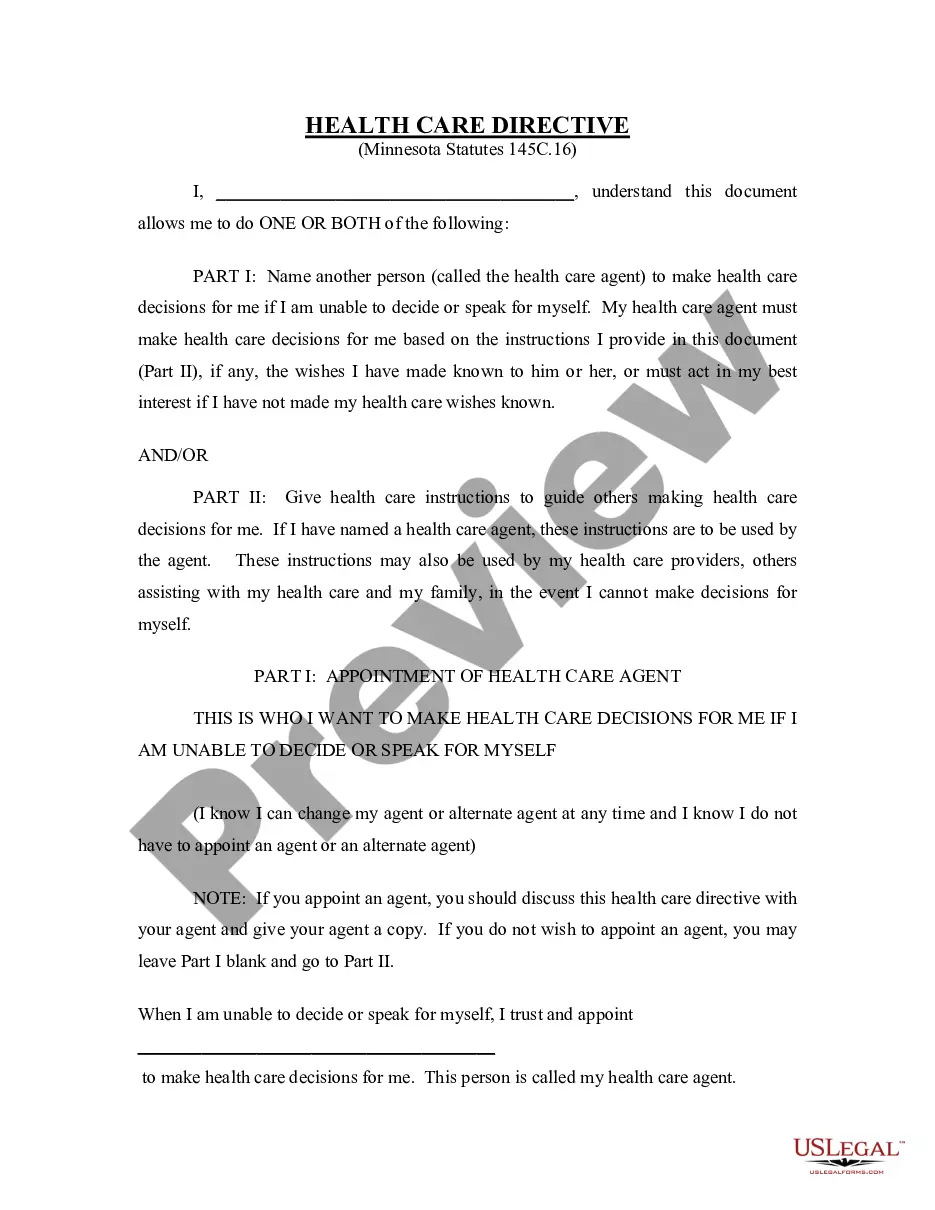

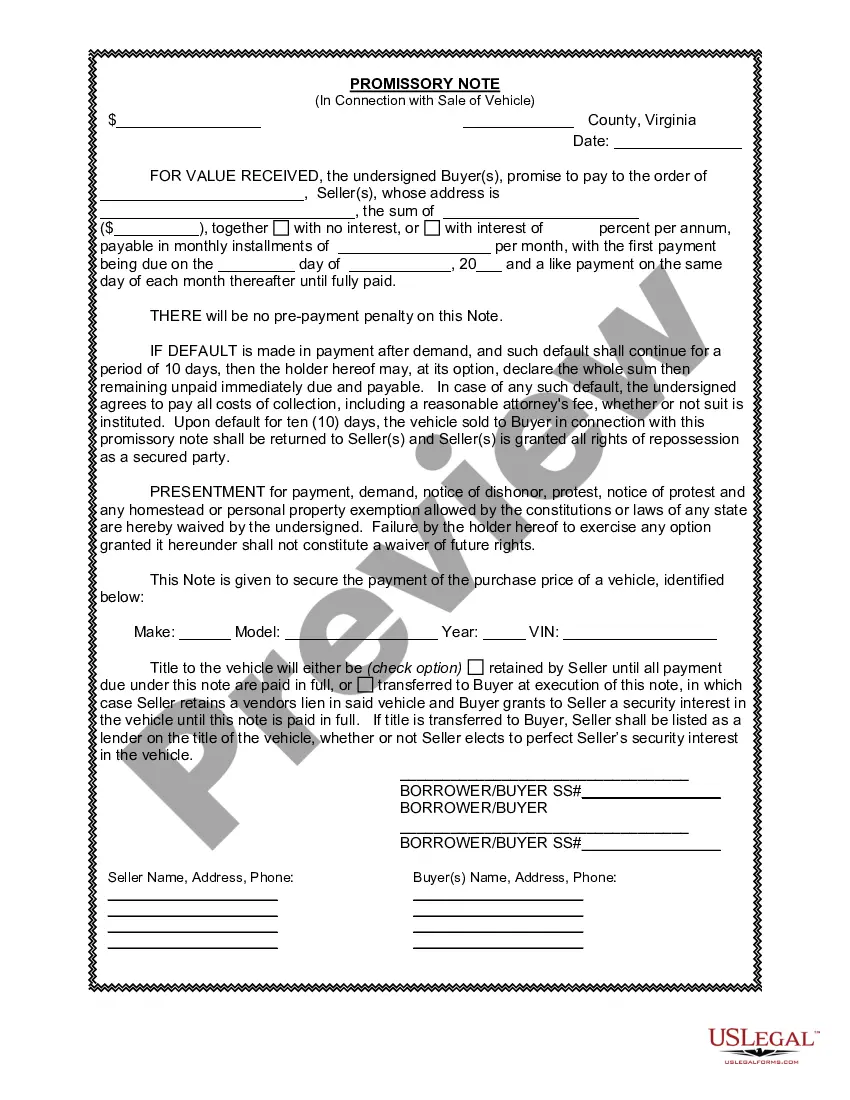

Choosing the right legitimate file template might be a battle. Naturally, there are tons of web templates available online, but how will you get the legitimate form you require? Take advantage of the US Legal Forms site. The services gives 1000s of web templates, such as the Maine Discounts, Credits & Tubulars, which can be used for organization and personal demands. All of the types are examined by pros and fulfill federal and state needs.

Should you be previously registered, log in to the profile and then click the Obtain key to get the Maine Discounts, Credits & Tubulars. Make use of your profile to search through the legitimate types you might have purchased previously. Visit the My Forms tab of your respective profile and acquire one more version of your file you require.

Should you be a fresh end user of US Legal Forms, listed here are easy directions that you should adhere to:

- Very first, make sure you have chosen the proper form for your area/area. You can look over the shape making use of the Preview key and browse the shape information to guarantee this is the right one for you.

- If the form will not fulfill your requirements, take advantage of the Seach industry to obtain the correct form.

- When you are positive that the shape is proper, click on the Get now key to get the form.

- Opt for the prices program you need and enter the essential info. Create your profile and pay for your order making use of your PayPal profile or charge card.

- Select the submit structure and obtain the legitimate file template to the system.

- Complete, change and print and sign the acquired Maine Discounts, Credits & Tubulars.

US Legal Forms is the greatest local library of legitimate types in which you can see numerous file web templates. Take advantage of the service to obtain appropriately-produced paperwork that adhere to status needs.

Form popularity

FAQ

A tax credit of up to $2,600 was put into effect for any projects billed as of January 1, 2023. The criteria for qualifying requires customers to have a tax liability of $2,000 or more, and only certain equipment qualifies for this credit.

Mainers can save hundreds of dollars on their energy bills by electrifying their homes, but may be daunted by the high upfront costs. Through the High-Efficiency Electric Home Rebate Act (HEEHRA) program, the new law allocates $36 million to help low- and moderate-income households reduce their energy bills.

The amount of the credit you can take is a percentage of the total improvement expenses in the year of installation: 2022: 30%, up to a lifetime maximum of $500. 2023 through 2032: 30%, up to a maximum of $1,200 (heat pumps, biomass stoves and boilers have a separate annual credit limit of $2,000), no lifetime limit.

Efficiency Maine Rebates Low-Income Customers: 80% of the cost, up to $8,000 (participants in HEAP, SNAP, TANF, and MaineCare qualify.) See if you are eligible for a low-cost or no-cost heat pump rebate. Moderate Income Customers: 60% of the cost, up to $6,000. Qualification is based on household income.

Maine homeowners can now receive an additional $2,600 back in their income taxes when installing a heat pump in 2023. Learn more about the Energy Efficient Home Improvement Tax Credits here.

2023 Tax Credits Maine homeowners can now receive an additional $2,600 back in their income taxes when installing a heat pump in 2023. Learn more about the Energy Efficient Home Improvement Tax Credits here.

How to Get a Rebate Hire a Residential Registered Vendor. Complete upgrade. Submit rebate claim form. Receive rebate check in mail.