This form documents the daily mileage report for projects. The report consists of the date, location (from/to) and the odometer reading (begin/end), and the total.

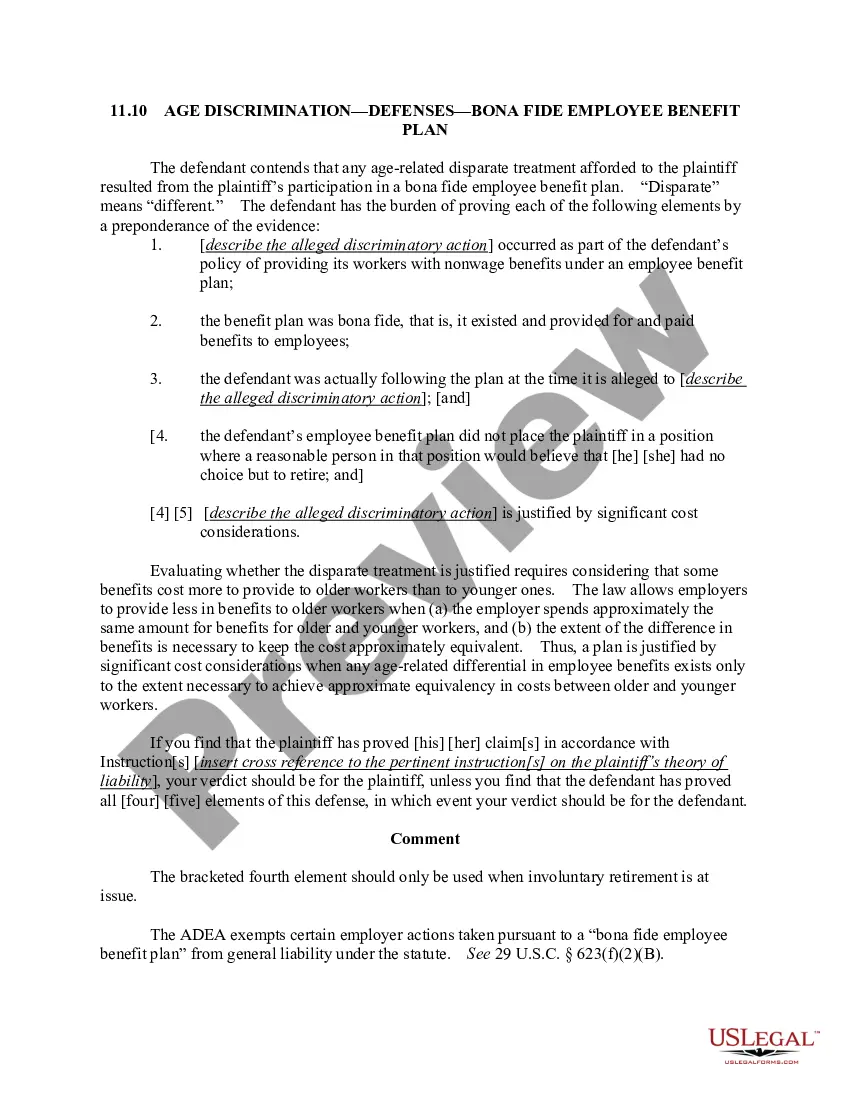

Maine Daily Mileage Report

Description

How to fill out Daily Mileage Report?

Are you presently in a position the place you require paperwork for either enterprise or specific uses virtually every time? There are a lot of legitimate papers web templates available on the net, but getting kinds you can depend on isn`t simple. US Legal Forms offers a huge number of type web templates, like the Maine Daily Mileage Report, which can be written in order to meet federal and state demands.

Should you be previously informed about US Legal Forms web site and have a free account, basically log in. Following that, you can down load the Maine Daily Mileage Report template.

If you do not offer an profile and would like to start using US Legal Forms, adopt these measures:

- Get the type you will need and make sure it is for the right town/county.

- Use the Preview switch to examine the form.

- Look at the outline to actually have selected the proper type.

- When the type isn`t what you are seeking, make use of the Research discipline to obtain the type that suits you and demands.

- Once you find the right type, simply click Get now.

- Select the rates program you want, fill in the specified info to generate your money, and buy an order using your PayPal or credit card.

- Pick a convenient data file formatting and down load your duplicate.

Locate all of the papers web templates you might have bought in the My Forms food selection. You can get a more duplicate of Maine Daily Mileage Report whenever, if required. Just click the required type to down load or printing the papers template.

Use US Legal Forms, probably the most extensive variety of legitimate kinds, to conserve time as well as avoid errors. The assistance offers expertly made legitimate papers web templates that can be used for a selection of uses. Create a free account on US Legal Forms and begin generating your way of life a little easier.

Form popularity

FAQ

58.5 cents per mile driven for business use, up 2.5 cents from the rate for 2021, 18 cents per mile driven for medical, or moving purposes for qualified active-duty members of the Armed Forces, up 2 cents from the rate for 2021 and.

Calculate the Car mileage Calculate your car mileage by dividing the number of kilometers you drove as per the trip meter by the quantity of fuel used.

Get the miles traveled from the trip odometer, or subtract the original odometer reading from the new one. Divide the miles traveled by the amount of gallons it took to refill the tank. The result will be your car's average miles per gallon yield for that driving period.

Mileage is typically calculated from the point of the office, or a net of the total miles driven less the normal round trip daily commute to work for that day. The rate is determined based on pronouncements from the Internal Revenue Service and the Treasury Department.

Beginning on January 1, 2021, the standard mileage rates for the use of a car (also vans, pickups or panel trucks) will be: 56 cents per mile for business miles driven, down 1.5 cents from the 2020 rate. 16 cents per mile driven for medical or moving purposes, down 1 cent from the 2020 rate.

A. Effective July 1, 2007 Employees who are disabled and use their own personal adapted vehicle on State business, shall receive the current mileage reimbursement plus an additional ten cents ($. 10) per mile. The State retains the right to require employees to use State vehicles in lieu of mileage reimbursement.

In 2021, the standard IRS mileage rate is 56 cents per mile for business miles driven, 16 cents per mile for moving or medical purposes and 14 cents per mile for charity miles driven.

For employees and state officers and officials not subject to any such agreement, the State shall pay 36¢ per mile effective January 1, 2006, 38A¢ per mile effective January 1, 2007, 40A¢ per mile effective July 1, 2007, 42A¢ per mile effective July 1, 2008, 44A¢ per mile effective January 1, 2009 and effective July 1,

Calculating mileage reimbursement is relatively simple. To find your reimbursement, multiply the number of business miles driven by the IRS reimbursement rate. So if you drove 1,000 miles and got reimbursed . 56 cents per mile, your reimbursement would be $560 (1,000 miles X $0.56 = $560).