Maine Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner

Description

How to fill out Ratification Of Pooled Unit Designation By Overriding Royalty Or Royalty Interest Owner?

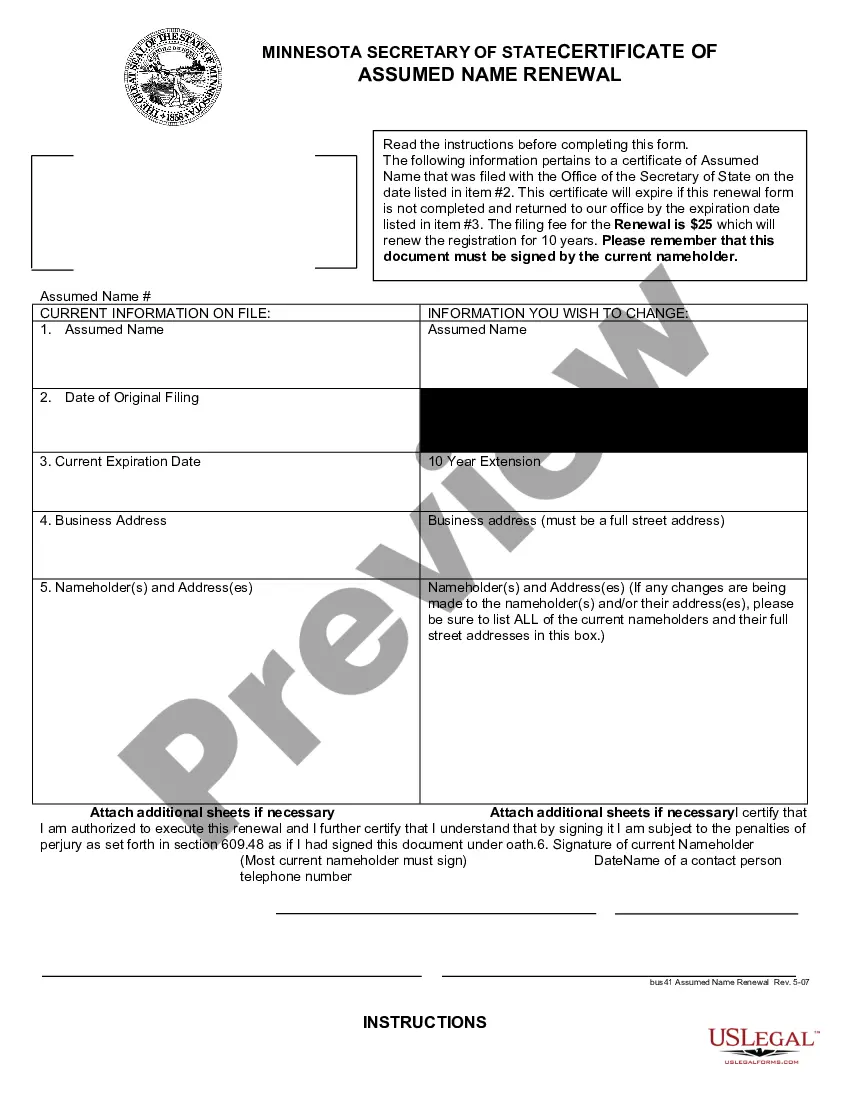

It is possible to invest time on the web searching for the authorized papers format that suits the state and federal demands you want. US Legal Forms offers a huge number of authorized varieties that happen to be analyzed by experts. You can actually acquire or print out the Maine Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner from my assistance.

If you have a US Legal Forms account, it is possible to log in and then click the Download switch. Following that, it is possible to full, change, print out, or indication the Maine Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner. Every authorized papers format you get is your own eternally. To obtain one more version associated with a bought kind, visit the My Forms tab and then click the corresponding switch.

If you are using the US Legal Forms internet site the very first time, keep to the simple instructions below:

- Initial, ensure that you have chosen the right papers format for that area/metropolis of your choice. Read the kind information to ensure you have picked out the correct kind. If accessible, use the Preview switch to appear through the papers format as well.

- If you want to locate one more version of your kind, use the Look for area to get the format that fits your needs and demands.

- After you have found the format you want, click Get now to carry on.

- Pick the pricing program you want, type in your accreditations, and register for a merchant account on US Legal Forms.

- Full the transaction. You may use your bank card or PayPal account to cover the authorized kind.

- Pick the structure of your papers and acquire it in your gadget.

- Make changes in your papers if required. It is possible to full, change and indication and print out Maine Ratification of Pooled Unit Designation by Overriding Royalty Or Royalty Interest Owner.

Download and print out a huge number of papers web templates while using US Legal Forms site, that provides the largest collection of authorized varieties. Use expert and condition-particular web templates to take on your organization or person needs.

Form popularity

FAQ

A royalty interest is a property interest that entitles the owner to receive a share of the production revenue. An individual or company that owns a royalty interest does not have to pay for any of the operational costs required to produce the resource, but they still own a portion of the revenue produced.

An overriding royalty interest (ORRI) is an undivided interest in a mineral lease giving the holder the right to a proportional share (receive revenue) of the sale of oil and gas produced. The ORRI is carved out of the working interest or lease.

: an interest in and royalty on the oil, gas, or minerals extracted from another's land that is carved out of the producer's working interest and is not tied to production costs compare royalty.

An override provision allows for ongoing royalty payment on future albums, sometimes including those not produced by the original producer.

A gross overriding royalty entitles the owner to a share of the market price of the mined product as at the time they are available to be taken less any costs incurred by the operator to bring the product to the point of sale.

An overriding royalty interest (ORRI) is an interest carved out of a working interest. It is: A percentage of gross production that is not charged with any expenses of exploring, developing, producing, and operating a well.