Maine Ratification of Oil and Gas Lease by Party Claiming An Outstanding or Adverse Interest

Description

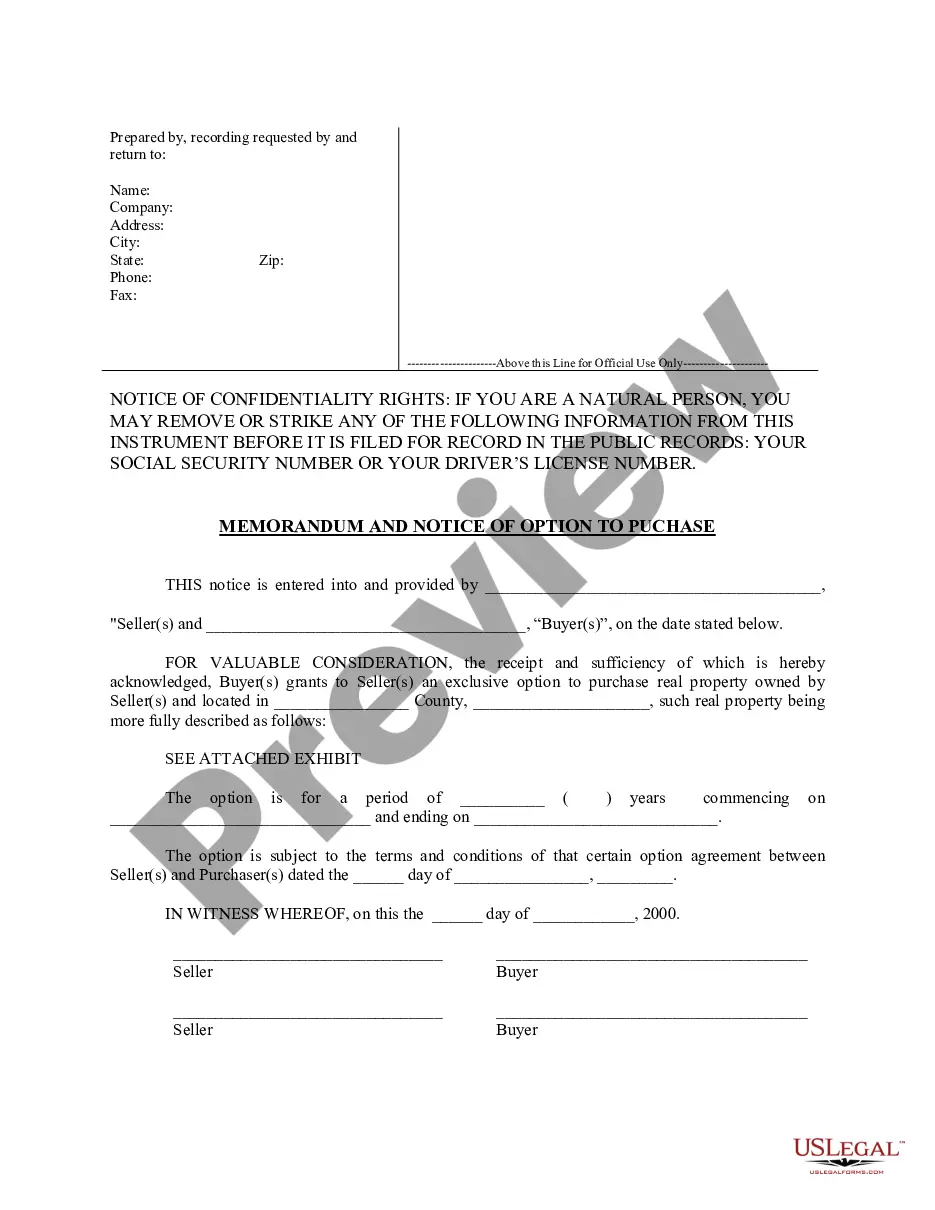

How to fill out Ratification Of Oil And Gas Lease By Party Claiming An Outstanding Or Adverse Interest?

Choosing the right lawful papers format might be a struggle. Naturally, there are a lot of web templates accessible on the Internet, but how do you get the lawful kind you need? Utilize the US Legal Forms web site. The services provides thousands of web templates, for example the Maine Ratification of Oil and Gas Lease by Party Claiming An Outstanding or Adverse Interest, that can be used for business and private demands. Each of the forms are checked by specialists and meet up with state and federal needs.

If you are previously signed up, log in to the account and click the Download option to get the Maine Ratification of Oil and Gas Lease by Party Claiming An Outstanding or Adverse Interest. Make use of your account to check with the lawful forms you may have bought previously. Go to the My Forms tab of your respective account and have another copy from the papers you need.

If you are a brand new user of US Legal Forms, here are straightforward instructions that you can comply with:

- Initial, ensure you have selected the correct kind for the metropolis/area. You are able to examine the form using the Preview option and study the form outline to ensure this is basically the best for you.

- In case the kind will not meet up with your needs, use the Seach field to discover the correct kind.

- Once you are positive that the form is suitable, go through the Buy now option to get the kind.

- Select the rates strategy you desire and enter in the required info. Create your account and pay money for the order utilizing your PayPal account or credit card.

- Pick the file formatting and download the lawful papers format to the system.

- Total, change and print and signal the received Maine Ratification of Oil and Gas Lease by Party Claiming An Outstanding or Adverse Interest.

US Legal Forms is definitely the biggest local library of lawful forms in which you can discover different papers web templates. Utilize the service to download professionally-created files that comply with state needs.

Form popularity

FAQ

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

What is the granting clause? The granting clause is the clause under which the owner of the oil and gas rights leases the oil and gas rights to the oil and gas company along with the right to develop the oil and gas on a specifically described piece of real estate.

ASSIGNMENT: The legal instrument whereby Oil and Gas Leases or Overriding Royalty interests are assigned or conveyed. ASSIGNMENT CLAUSE: A clause in any legal instrument that allows either party to the contract to assign all or part of his or her interest to others.

A percentage of ownership in an oil and gas lease granting its owner the right to explore, drill and produce oil and gas from a tract of property. Working interest owners are obligated to pay a corresponding percentage of the cost of leasing, drilling, producing and operating a well or unit.

The lessee of an oil or gas lease can assign the entire lease or part of it. In other words, the lessee can sell or transfer part of the estate or the entire estate to which they have the working rights. The assignee is assigned the working interest and lease obligations, including override royalty.

Net Revenue Interest is the portion of an oil and gas leaseholder's interest in production that they are entitled to receive as part of their lease. The amount is calculated after deducting all royalty payments, production costs, and other fees.

To ?ratify? a lease means that the landowner and oil & gas producer, as current lessor and lessee of the land, agree (or re-agree) to the terms of the existing lease.